Polypropylene: Plant Maintenance Approaches, PP Market May Encounter a New Turning Point for a "Comeback"

Compared with the PP market after the Spring Festival in previous years, the market performance in 2025 after the Spring Festival is a bit "cool." Entering March, there is an increase in the number of maintenance operations at production facilities, and the short-term market outlook may be cautiously optimistic.

Compared to the PP market after the Spring Festival in previous years, the market performance after the Spring Festival in 2025 is a bit "cool". The February market was like "boiling a frog in lukewarm water" in a range of shocks, but as we entered March, there was an increase in concentrated maintenance equipment on the supply side, which may provide some support for the market.

PP weakened as it was difficult to find support in the February venue.

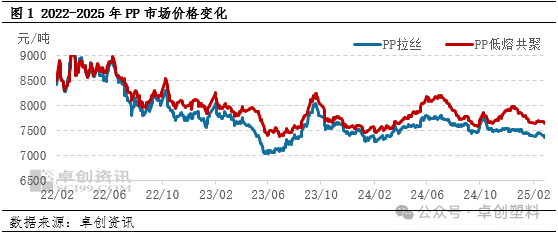

As of February 26, the average price of domestic PP (polypropylene) in the East China region was 7,405.29 yuan/ton, a decrease of 0.41% month-on-month, and the average market price for copolymer was 7,667.65 yuan/ton, a decrease of 0.86% month-on-month. After the holiday, downstream factories mainly purchased raw materials on demand, which provided limited support to the market. At the same time, with some installations resuming operation, the supply pressure in the front-end market increased. In addition, the recovery pace of the downstream PP sectors was slow, and even though the operating load gradually increased, it mainly consumed the stock from the previous period, and the actual demand was limited, which did not significantly drive the market situation. Some stockholders faced significant inventory pressure and actively reduced their offers to facilitate transactions. Moreover, the continuous decline in PP futures in the middle and lower reaches also had a noticeable impact on market sentiment, causing PP prices to drop and market transactions to be weak. The market fundamentals continued to drag on the market, and the market urgently needed a "stimulant" to relieve pressure.

The delay in new production capacity combined with concentrated equipment maintenance alleviates supply pressure.

Despite a large number of new installations planned to start production in 2025, there is not much pressure for the first quarter. The production start-up of Jincheng Petrochemical and Inner Mongolia Baofeng Petrochemical's new installations is not yet clear, and in April, only the ExxonMobil Huizhou ethylene project is planned for trial operations. Overall, the capacity release is limited and will not have a significant impact on the market. However, since the Spring Festival until the end of February, the daily shutdown rate of PP filament is around 15.07%. The main reason for the alleviation of the basic pressure is the increasing number of maintenance installations in upstream production enterprises.

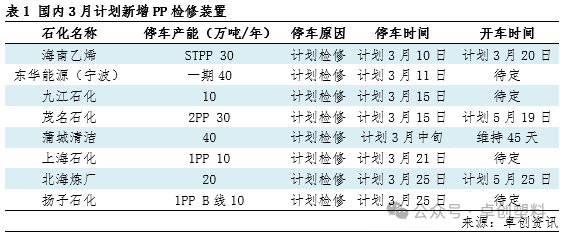

Starting in March, the concentrated maintenance season for the first half of the year is approaching, and the favorable factors on the supply side will continue. The number of maintenance facilities is expected to increase. It is estimated that the production loss from PP facilities in March will be 581,000 tons, an increase of 17.37% month-on-month. In addition to existing maintenance facilities, it is anticipated that 8 petrochemical companies will enter planned maintenance. Among them,********, Hainan Refinery, and Pucheng Clean Energy are expected to conduct long-term maintenance of over 45 days on their PP facilities. This will not only reduce the operating load of polypropylene facilities but may also alleviate some of the pressure on the supply side of the market.

In the short term, although the confidence in the demand side among industry insiders is weaker than in previous years, expectations remain for the first demand point. Starting from March, planned maintenance of equipment is expected to increase, and the mass production of new capacities is uncertain, which may lead to a reduction in domestic market supply. From a macro perspective, the convening of the "Two Sessions" may provide a more positive signal for the market, and the short-term market outlook is cautiously optimistic. It is expected that after a period of fluctuating consolidation, PP may face a rise again.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track