Policy Empowers Waste Plastic Recycling, Plastic Market Welcomes Supply and Demand Restructuring

Under the push of the "dual carbon" goals and green development strategy, the recycling of plastics has become a key focus for the industry and policymakers. Recently, the Ministry of Industry and Information Technology has included "waste plastic recycling" as a priority direction in the construction of ministerial-level pilot platforms for the first time, and has clarified the goal of building a national pilot service network by the end of 2027, thus addressing industry bottlenecks from the technical end.

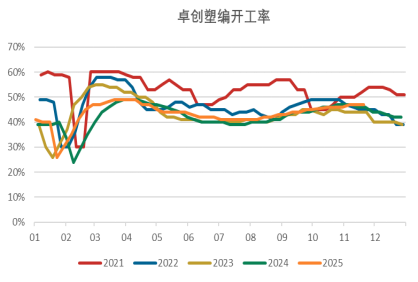

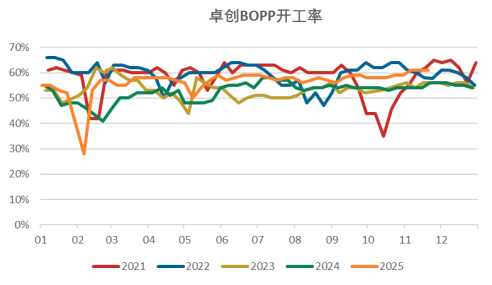

The policy has broken the demand ceiling for recycled plastics, resulting in a structural differentiation characteristic. The polypropylene (PP) market has experienced a "two extremes" situation; e-commerce promotions have driven up orders for packaging materials, while the real estate sector continues to "cool down." This pattern of "overall weakness with localized surges" clearly reveals a deep-seated shift in the PP market from "total volume-driven" to "structural growth." Specifically, there is strong demand for BOPP films used in express delivery packaging and thin-walled injection-molded materials for takeaway containers and milk tea cups, while demand in areas such as pipes, which are affected by the sluggish real estate sector, remains weak. The advancement of recycled plastic policies will further strengthen the acceleration of growth in high-end specialty materials, while traditional plastic weaving demand continues to be suppressed.

In the high-end sector, particularly in the automotive field, the market size for Post-Consumer Recycled (PCR) plastics used in vehicles is steadily growing. According to research by QYResearch, the global market size is expected to be approximately $1.879 billion by 2024 and reach $2.513 billion by 2031, with a compound annual growth rate of 4.3% between 2025 and 2031. The automotive industry is extensively using PCR materials in sustainable development plans and lightweight strategies, while consumers increasingly favor vehicles made with recycled material components. The home appliance industry also demonstrates strong demand for recycled materials. Boosted by national consumption policies, the cumulative year-on-year growth rate of retail sales of home appliances and audio-visual products in China is expected to be 20.1% by October 2025, driving up the demand for modified PP used in appliances. Policy-driven trade-in activities for consumer goods further stimulate the demand for upgrading to green appliances, providing a broader market space for recycled plastics.

In traditional sectors, the rigid demand for takeout and instant retail keeps the price of high melt flow index transparent materials firm, becoming a rare highlight in PP demand. On the other hand, PP-R pipe materials, which also belong to the PP family, are experiencing sluggish demand due to the continuous adjustment of the real estate industry. As the differentiation within varieties will intensify, it is no longer possible to view a particular type of plastic as a homogeneous product; instead, attention needs to be paid to the demand differences between different brands and application fields. Especially with the environmental policies being intensified during the "15th Five-Year Plan" period, the goal of reducing energy consumption per unit of GDP by 3% will compel enterprises to accelerate their transition towards biodegradable materials, recycled plastics, and low-carbon production processes. This trend will further enhance the demand for high-end recycled plastics, while demand in some traditional application fields may remain weak.

From a fundamental perspective, in the short term, policy expectations outweigh substantial impacts, and plastic futures will continue to be dominated by traditional supply and demand factors, although market expectations are starting to diverge. In the medium to long term, as pilot platforms are established and technological breakthroughs occur, the substitution effect of recycled plastics for virgin plastics will gradually become evident, putting downward pressure on the valuation center of the plastic market.

Author: Wang Shiqi, Senior Market Analysis Expert

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage