Policy-Driven Helmet Rapidly Popularizes, Plastics Content Extremely High, Industry Chain Accelerates Layout Across All Links

Specialized Plastic VisionOn August 8th, it was observed that the helmet industry within the traditional protective equipment sector has become a focal point for the capital market due to favorable policies and a surge in market demand. Companies such as Nanjing Julong and Chunfeng Power have seen their stock prices rise sharply in a short period, with Nanjing Julong's stock increasing by over 25% in two days. Behind this phenomenon are policy drivers like the revision of Beijing's non-motor vehicle management regulations, as well as new dynamics in the helmet industry chain involving material innovation and market expansion.

The helmet market is booming, presenting opportunities for plastic materials.

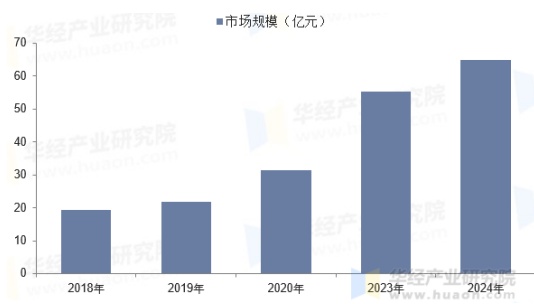

The market size of helmets in China has already increased from...From 12.76 billion yuan in 2015 to 65 billion yuan in 2024, the riding helmet market accounts for 85.3% of the market size, while the police helmet market accounts for 3.5%.

In addition,In 2024, China's helmet industry production exceeded 80.1 million units. It is worth noting that this figure was less than 25 million units ten years ago.

Source: Huaon Industrial Research Institute

Behind the growth of market size, on one hand, the rise of the food delivery economy in recent years has become the biggest factor.As of the end of 2024, the number of online food delivery users in China has reached 545 million, accounting for about half of the overall internet users. Consequently, the size of the food delivery riders has further expanded, which to some extent has stimulated the growth in demand for helmets.

The data speaks volumes, as ofBy the end of 2024, the number of electric bicycles in use in China has reached 400 million.

On the other hand, from the policy perspective, promotion began a few years ago.The "One Helmet, One Belt" safety protection campaign has seen officials repeatedly introduce relevant policies and regulations requiring riders to wear safety helmets.

Plastic materials upstream in the industrial chain have become key beneficiaries.ABS and PC, which represent engineering plastics, along with carbon fiber composites, occupy a core position in helmet manufacturing due to their lightweight and impact-resistant properties. According to analysis, the density of carbon fiber is only one-third of traditional materials, with impact resistance strength increased by more than 40%, making it the preferred material for high-end helmets.

Analysis of Helmet Material Applications and Plasticizer Contentextremely high

The helmet has a complex structure, and the various components have different requirements for material properties. The application of plastic materials also shows trends of diversification and specialization.

Shell material:

ABS plastic: As a common choice for mid- to low-end helmets, ABS plastic is widely used in electric vehicle helmets due to its impact resistance and wear resistance. Its relatively low cost and ease of processing make it suitable for mass production. For example, the outer shells of many helmets used for daily commuting are made of ABS plastic, which can effectively withstand minor scratches and collisions during everyday riding.

PC Plastic: In the high-end helmet sector, PC plastic is favored for its lightweight and high impact resistance. It can effectively absorb impact forces, providing stable protection for the head, especially suitable for complex road conditions. Some professional mountain bike helmets or high-end motorcycle helmets use PC plastic shells to cope with more intense riding environments.

Carbon fiber composites: as the preferred material for high-end helmets, carbon fiber composites have a density only...One-third the weight of ABS/PC, with impact resistance increased by over 40%. It enables helmets to be lightweight while providing exceptional protection. In high-risk fields such as racing and extreme sports, carbon fiber helmets have almost become standard, offering reliable safety assurance for professional athletes.

Fiberglass: Although it has relatively high strength, it is relatively brittle and prone to cracking. Therefore, it is often used in scenarios where high material strength is required but the budget is limited. Some entry-level sports helmets may use fiberglass-reinforced shells to ensure a certain level of strength while controlling costs.

Buffer layer material:

EPS (Expanded Polystyrene): As a popular choice for mass-market helmets, EPS is lightweight and has excellent cushioning properties, effectively absorbing impact forces. It is currently the primary material used in the cushioning layers of most helmets, capable of efficiently dispersing impact energy during collisions to protect head safety.

Source of the image: Baidu Youjia

EPP foam polypropylene: Compared to EPS, EPP foam polypropylene not only has excellent cushioning performance but also outstanding resilience, capable of withstanding multiple impacts. It is suitable for riders with higher safety requirements. Some high-end helmets or helmets designed for special environments (such as mountain bike downhill helmets) use EPP foam layers to provide more durable and reliable protection.

Other component materials:

Lining and accessories: Soft fabric and sponge enhance wearing comfort, the mask usesPC materials ensure clear vision, while the nylon straps and plastic buckle form a fastening system. The helmet lining is usually made of breathable fabric, with added sweat-absorbing foam to enhance comfort during long periods of wear. The visor should be made of high-transparency PC material to ensure the rider has a clear view and also provide some impact resistance to protect facial safety.

Seizing the blue ocean, various segments of the industrial chain accelerate their entry.

The booming helmet industry has attracted the attention and participation of numerous enterprises throughout the industrial chain. From raw material supply and product manufacturing to equipment production, each segment is experiencing vigorous development, while also facing its own opportunities and challenges.

Upstream raw material enterprises:

Kingfa Sci. & Tech.: As a leading modified plastics company in China, Kingfa Sci. & Tech. saw its net profit increase by more than [percentage] year-on-year in the first half of the year.45%, overseas base expansion boosts market share. The company is actively expanding into international markets, with its bases in Vietnam and Spain already in operation. Overseas bases in Poland, Mexico, Indonesia, and other locations are under accelerated construction. Amid intensified domestic competition, going global has become an important development strategy for the company.

Nanjing Julong: Although the company's polymer-modified material products can be used in helmets, its performance growth mainly relies on the expansion of overseas business and entering the drone component sector. Related products have already entered the supply chains of multiple domestic OEMs, with a relatively low correlation to the helmet industry.

Other raw material suppliers: Woter New Materials, Jushi Chemical, Jessie, Zhonglan Chenguang, Wanhua Chemical, Shunwei Co., Chi Mei, Hangzhou Zhongju, and other enterprises are also important suppliers of helmet-specific materials and equipment solutions. They possess strong technical capabilities and market influence in the fields of modified plastics and composite materials, providing diversified material options for the helmet industry.

Midstream manufacturers:

Pengcheng Helmets: Annual production exceedsWith an output of 3 million units, products are exported to over 100 countries, with continuous growth in the European market. The brand LS2 sponsors various international events such as Moto GP and the Winter Olympics. Through intelligent manufacturing, it enhances production efficiency and quality. The products meet global safety standards and have strong competitiveness in the international market.

Foshan Wenjin: ownsAR, GP, and MY are three major helmet brands with products covering the motorcycle and cycling fields. The AR brand is publicly listed, while the MY brand focuses on overseas markets. Its products are certified by the European ECE and the American DOT, emphasizing design and technological innovation. The brand continuously launches new products that meet market demands.

Image source: Southern+

Chengxiang Emergency Equipment: Specializing in the research and production of firefighting helmets, launching a full series of carbon fiber firefighting helmets featuring smart communication and thermal imaging functions, supporting customization services, and possessingWith over 50 patents, it is a national high-tech enterprise and a leader in the field of special helmets such as those used in firefighting.

Other well-known brands: Eternal HelmetsIn the 2025 helmet brand rankings, brands such as YOHE, SHOEI, AGV, Arai, HJC, Tanked Racing, YEMA Helmets, MTHELMETS, and ZEUS are among the top. They possess comprehensive research and development, manufacturing, and marketing systems. Their products cover multiple areas including motorcycles, electric vehicles, bicycles, and skiing, meeting the needs of different consumers.

Equipment Supplier:

Topstar: Although the company has manipulators+Injection molding machines+ and auxiliary equipment for injection molding machines provide a complete helmet production line solution, but revenue declined by 36.92% last year and there was a net loss of 245 million yuan, indicating fierce competition in the equipment sector and significant market pressure faced by the company.

The helmet industry, driven by both policy and demand, is experiencing rapid development and transformation.

Innovations in upstream materials, upgrades in midstream manufacturing, and equipment intelligence have become breakthroughs. Although domestic enterprises are gradually entering the high-end market, the industry concentration remains relatively low. Export and technological innovation are still the keys to breaking the deadlock.

In the future, those who can accurately penetrate the high end of the value chain will seize the initiative in this unexpectedly booming market and share in the dividends of industry development.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track