POE Production Capacity Soars! 95 Million Tons Expected to Be Released This Year

On one side is technological breakthroughs and soaring production capacity, on the other side is price plummeting and the looming threat of overcapacity. The Chinese POE industry is experiencing a tale of two extremes.

In September 2025, Shenghong Petrochemical announced the successful startup and mass production of its 100,000-ton/year POE project in Lianyungang, Jiangsu, with the first batch of 320 tons of premium products being delivered simultaneously. Almost at the same time, the first shipment of 4,887 tons of ethylene was successfully received by Dingjide, marking the countdown to the feedstock startup of its 200,000-ton/year high-end POE new material project.

The year 2025 will be the "year of mass production explosion" for China's POE (polyolefin elastomer) industry.

In April, the 50,000-ton-per-year unit at Maoming Petrochemical successfully completed trial operations in one go, utilizing domestically developed metallocene catalysts and solution polymerization technology, filling a technical gap in the country. The second phase of Wanhua Chemical's 400,000-ton project in Penglai is accelerating, expected to reach a total capacity of 600,000 tons by the end of the year, with an accompanying alpha-olefin unit to achieve a core raw material self-sufficiency rate of over 80%. In June, the 100,000-ton unit at Jiangsu Hongjing began trial production, with products already certified by BYD and CATL. More notably, companies like Ningxia Baofeng and Kaixin Energy are planning a 500,000-ton capacity based on a coal-based route, while Fuhai Tangshan Petrochemical is supporting a 100,000-ton unit through methanol-naphtha coupling technology. The proposed domestic capacity under construction has exceeded 6 million tons.

The development history of China's polyolefin elastomer (POE) industry is a typical one.History of Breakthroughs in the Localization of Advanced MaterialsIt has gone through the complete process from being completely reliant on imports to technological breakthroughs and then to industrialization breakthroughs. Based on the characteristics of industry development, it can be divided into three key stages.

1. Stage of technological gap and complete reliance on imports (1998-2020)The POE market in China has long been dominated by international chemical giants. In 1998, Dow Chemical first entered the Chinese market with its "ENGAGE" brand POE, primarily used in the TPO modification field, replacing EPDM, which was previously used for PP modification. In 2003, Japan's Mitsui Chemicals introduced its "TAFMER" brand POE into the EVA shoe material modification market using a low-price strategy. In 2009, after LG Chem started producing POE, it also used a low-price strategy to penetrate the Chinese market. During this period,The import dependency is as high as 100%.In the U.S., companies (mainly Dow) hold over 50% of the market share in China, while Korean companies increased their share from 20.8% in 2017 to 38% in 2022. In 2022, the domestic POE import volume reached711,000 tons, a year-on-year increase of 11%, mainly used in high-end fields such as photovoltaic adhesive films and automotive modifications.

Phase 2: Technical Tackling and Pilot Test Breakthrough Stage (2021-2023)Faced with the "bottleneck" predicament, domestic companies have begun to focus on overcoming the three major technical barriers of POE.High carbon α-olefin (especially 1-octene) preparation technology、Research and development of noble metal catalysts Solution polymerization processIn 2021, Wanhua Chemical took the lead in completing the POE pilot test and launched several application grades. In September 2022, Maoming Petrochemical (using North China Institute of Technology's technology) and Oriental Shenghong (800 tons/year pilot plant) successively achieved successful pilot tests. At the same time, Beoy Company completed construction in December 2023.The first domestic industrialized POE unit.This marks the transition of domestic POE from the laboratory to industrialization with a production capacity of 30,000 tons/year. At this stage, the planned domestic production capacity has exceeded 2 million tons/year, but the actual industrial production scale is still less than 40,000 tons/year.

Capacity Expansion Wave

The current POE industry in China is experiencing an unprecedented wave of capacity expansion. According to the latest statistics, the total planned capacity of POE projects under construction in China has exceeded 6 million tons per year, covering more than 40 companies including Wanhua Chemical, Satellite Chemical, Zhejiang Petrochemical, and Dingjide.

The scale has already far exceeded the current global total production capacity (approximately 1.985 million tons) and is also much higher than the forecasted global POE demand for 2025 (approximately 1.2 million tons), indicating a potential risk of serious overcapacity in the future.

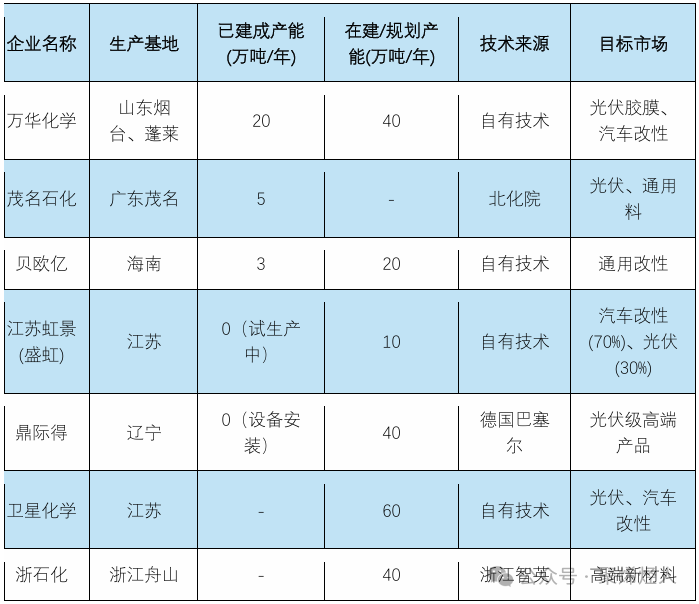

Table: Capacity Layout of Major POE Production Enterprises in China in 2025

China's POE industry is at a historical turning point. On one hand, companies like Wanhua, Shenghong, and Maoming Petrochemical have achieved large-scale breakthroughs, demonstrating China's technological strength in the high-end chemical sector. On the other hand, behind the 6 million tons capacity planning lies the severe risk of overcapacity and technological bottlenecks. The next five years will be a critical period of reshuffling in the industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track