PMMA Embraces High-End Integrated Transformation

Polymethyl methacrylate (PMMA), commonly known as acrylic or organic glass, is a high molecular polymer that has high transparency. It can be processed through casting, injection molding, extrusion, thermoforming, and other techniques, and it possesses good post-processing performance. PMMA is widely used in fields such as automotive, medical, communications, and construction. With the growth of production capacity, market competition has become increasingly intense, and future development is showing a trend towards high-end integration.

The annual average growth rate of production capacity reaches 13.2%.

PMMA production technology includes bulk polymerization, suspension polymerization, solution polymerization, etc. Bulk polymerization has advantages such as advanced and reasonable production technology, simple production process, compact equipment, continuous production, high efficiency, and no discharge of the three wastes, making it a technology with development prospects.

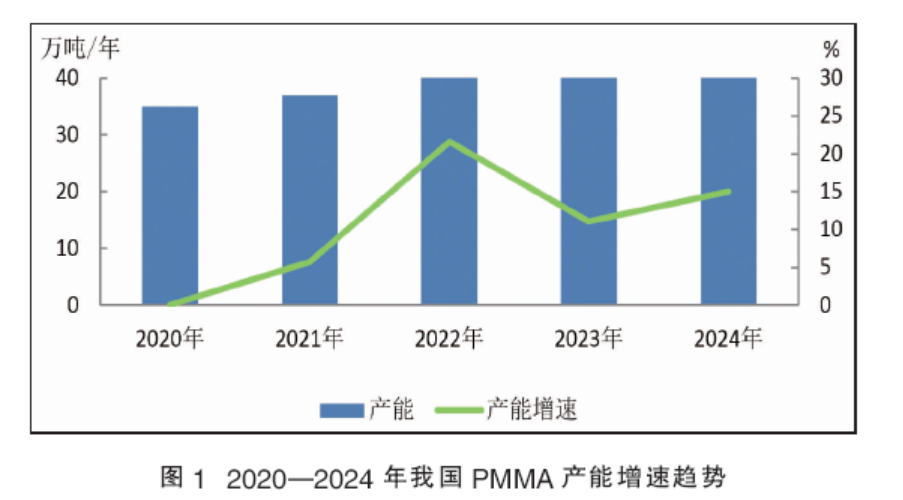

From 2020 to 2024, China's PMMA production capacity has significantly increased, with a total capacity growth of 225,000 tons per year, achieving an average annual growth rate of 13.2%. In 2021, Jiangxi Yiliang Optoelectronic New Materials Co., Ltd. commissioned a 20,000 tons per year PMMA facility; in 2022, Wanhua Chemical Group Co., Ltd. launched the second phase of its PMMA facility with a capacity of 80,000 tons per year; in 2023, Jiangxi Yiliang Optoelectronic New Materials Co., Ltd. expanded its facility capacity to 50,000 tons per year, and Rohm Chemical added a new production line, increasing its capacity to 60,000 tons per year; in 2024, Chongqing Shuangxiang Optical Materials Co., Ltd., a wholly-owned subsidiary of Shuangxiang Co., Ltd., launched the first phase of its 75,000 tons per year PMMA project, filling the capacity gap in the southwest region. By the end of 2024, China's PMMA production capacity will reach 575,000 tons per year, an increase of 15% year-on-year. The growth trend of PMMA production capacity in China from 2020 to 2024 is shown in Figure 1.

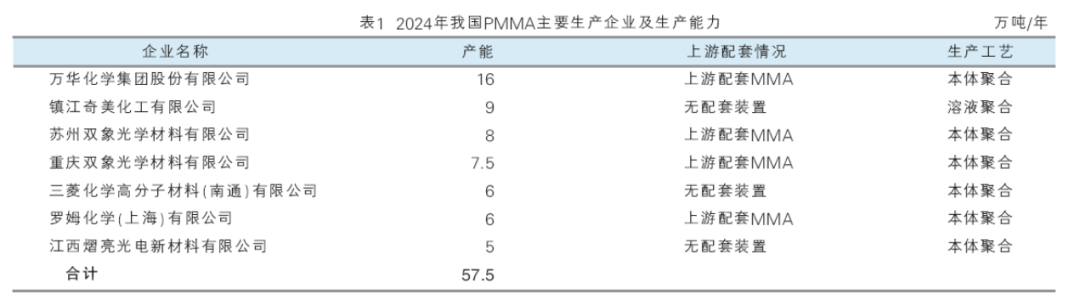

Currently, there are seven main PMMA manufacturers in China: Wanhua Chemical, Rom Chemical, Suzhou Shuangxiang, Zhenjiang Chi Mei, and Mitsubishi Chemical, all concentrated in the East China region; Jiangxi Yiliang in the Central China region; and Chongqing Shuangxiang in the Southwest region. The major PMMA production enterprises and production capacities in China for 2024 are shown in Table 1.

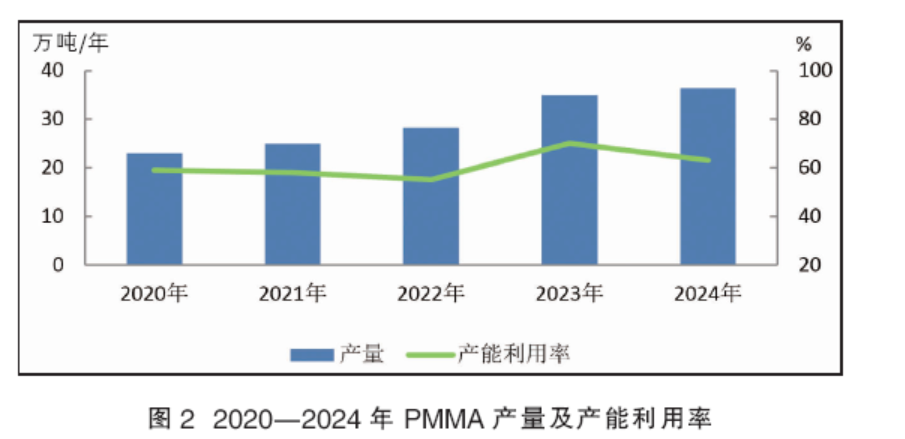

The increase in production capacity has driven the growth in output, with China's PMMA production in 2024 reaching 363,000 tons, an increase of 3.7% year-on-year. Due to high costs, production enterprises operated at low load during certain periods, coupled with the growth in the capacity base and the gradual release of new capacity, the capacity utilization rate declined to 63%, down 7 percentage points from 2023. The PMMA production and capacity utilization rate from 2020 to 2024 are shown in Figure 2.

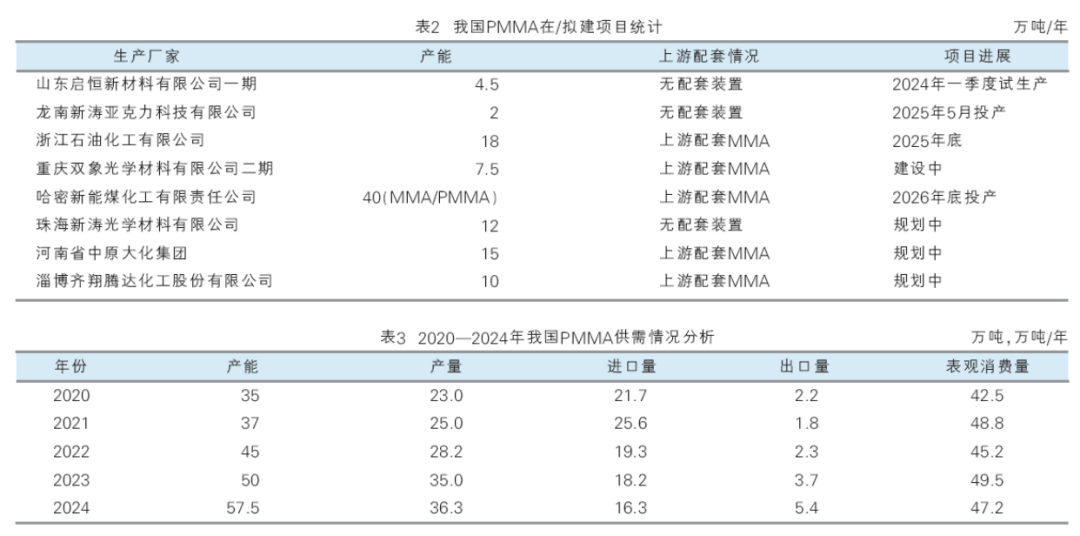

In the coming years, China's PMMA production capacity will continue to grow, with new capacities mainly concentrated in the East China and Southwest regions. The under-construction/planned projects include Rike Chemical's Shandong Qiheng New Materials Co., Ltd. 330,000 tons/year polymer new materials project, with a planned capacity of 140,000 tons/year PMMA, of which the Phase I capacity of 45,000 tons/year has entered the trial production stage in the first quarter of 2024. Chongqing Shuangxiang Optical Materials Co., Ltd.'s 300,000 tons/year PMMA/methyl methacrylate-styrene copolymer (MS) and 40,000 tons/year special ester project, with a planned capacity of 150,000 tons/year PMMA, of which the Phase I Stage 1 PMMA project with 75,000 tons/year capacity was put into operation in April 2024. There are also several projects in the planning stage. Five companies have upstream methyl methacrylate (MMA) supporting facilities, which can better achieve integrated industrial development. Table 2 shows the statistics of China's planned/under-construction PMMA projects.

High-end consumption is steadily increasing.

Downstream factories of PMMA are mainly concentrated in Jiangsu, Jiangxi, Zhejiang, and Guangdong provinces, with the primary trade flow directed towards the East China and South China markets. In recent years, domestic PMMA has increasingly replaced imports, with companies like Wanhua Chemical and Suzhou Double Elephant breaking through technical bottlenecks in light guide plate-grade PMMA products. The acceleration of domestic production has somewhat suppressed PMMA imports from Korea and Japan. Additionally, as the "Belt and Road" initiative continues to advance, the export of PMMA to Southeast Asia, the Middle East, and Africa has gradually increased. The contraction of import scale and the continuous increase in export scale have caused a slight decline in the apparent consumption of PMMA. In 2024, China's apparent consumption of PMMA is projected to be 472,000 tons, a decrease of 7.39% compared to the previous year. The supply and demand situation of PMMA in China from 2020 to 2024 is detailed in Table 3.

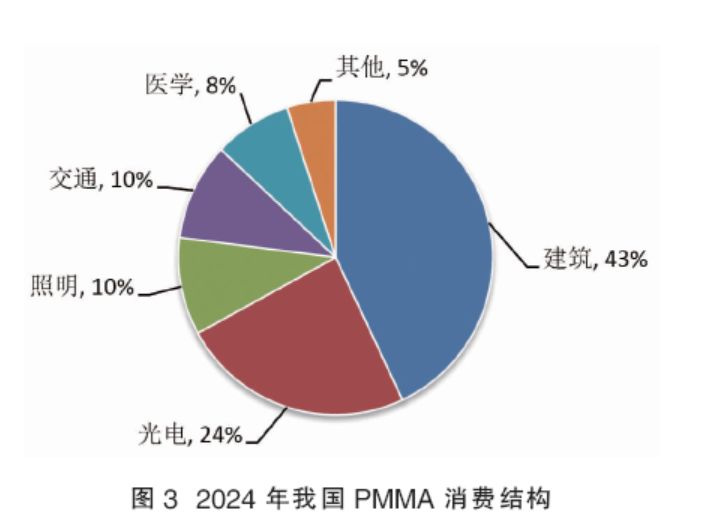

PMMA can be processed using casting, injection molding, extrusion, thermoforming, and other techniques. It has excellent post-processing performance and can be used to manufacture various lamps, lighting equipment, optical glass, advertising showcases, billboards, and other products. Its downstream applications involve fields such as construction, optoelectronics, lighting, transportation, and medicine. Influenced by digital screens replacing traditional advertising boards, PMMA's consumption share in the construction sector is expected to decline to 43% in 2024. However, the consumption of high-end PMMA products in the optoelectronic materials and medical fields is steadily increasing, while the consumption share in other areas remains basically stable. The PMMA consumption structure in China for 2024 is shown in Figure 3.

The PMMA market in China faces structural shortages, with domestic PMMA products mainly consisting of general-purpose and heat-resistant grades. High-end products such as optical-grade and impact-resistant grades have a smaller market share and are characterized by lower technological content and added value, leading to structural supply and demand imbalances. The import dependency for high-end products fluctuates between 40% and 55%. The future growth of the low-end sheet market is limited, with development opportunities primarily in optical-grade PMMA, which has broad application prospects. High-performance optical-grade PMMA liquid crystal materials are mainly used in high-end markets such as light guide plates for LCDs, optical fiber materials, and solar photovoltaic cells. In recent years, the localization and substitution of high-end PMMA markets have accelerated, and there is a significant supply gap.

It is expected that the demand market for PMMA will show an upward trend in the coming years. By 2026, the apparent consumption of PMMA in China is expected to reach 520,000 tons, with an average annual growth rate of 3.8% from 2022 to 2026.

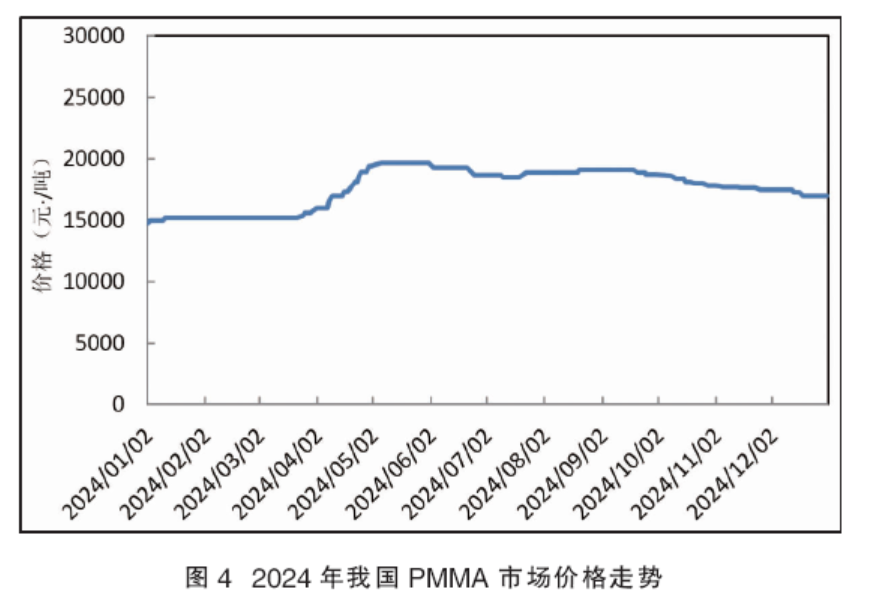

In 2024, the average annual price of PMMA in China is 18,314 yuan/ton, showing a significant year-on-year increase of 26.9%. The lowest price is 15,950 yuan/ton, and the highest price is 20,150 yuan/ton. In the first and second quarters, due to the impact of international geopolitical conflicts, the supply of upstream crude oil and MMA raw materials was tight, leading to a substantial increase in prices. The cost support strengthened, and PMMA prices rose rapidly. In the third quarter, affected by the market off-season and the high PMMA prices, the downstream stocking intention was weak, and PMMA prices basically remained flat. In the fourth quarter, the price of upstream raw material MMA declined, weakening the support from raw material prices, and the PMMA market weakened. The trend of PMMA market prices in China in 2024 is shown in Figure 4.

The advantages of import arbitrage have weakened, while exports have increased.

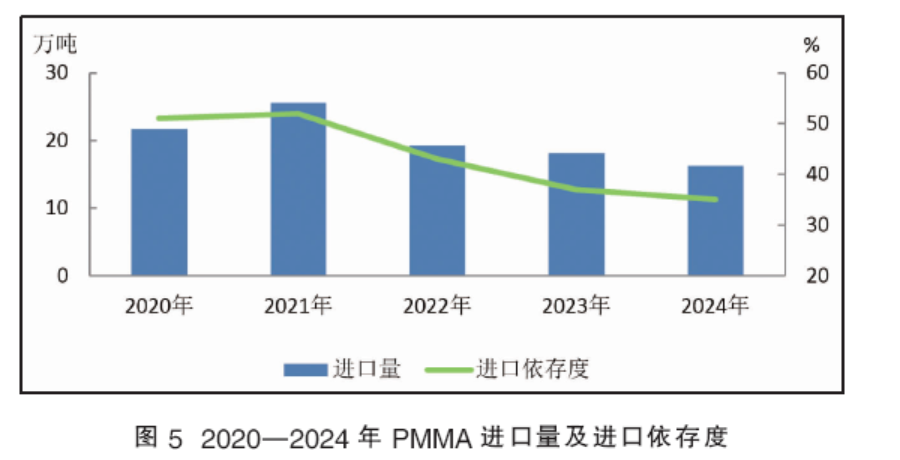

From 2020 to 2024, influenced by the accelerated promotion of domestic substitution, the import volume of PMMA in primary forms (tariff code: 39061000) in China showed a decreasing trend, dropping from 217,000 tons to 163,000 tons, with the import dependency ratio declining annually. In 2024, the import volume of PMMA was 163,000 tons, a year-on-year decrease of 10.4%; the import value was 361.799 million USD, a year-on-year increase of 5.4%. The export volume of PMMA was 54,000 tons, a year-on-year increase of 45.9%. China's net import volume of PMMA shrank to 109,000 tons, a year-on-year decrease of 24.8%. The import volume and import dependency ratio of PMMA from 2020 to 2024 are shown in Figure 5.

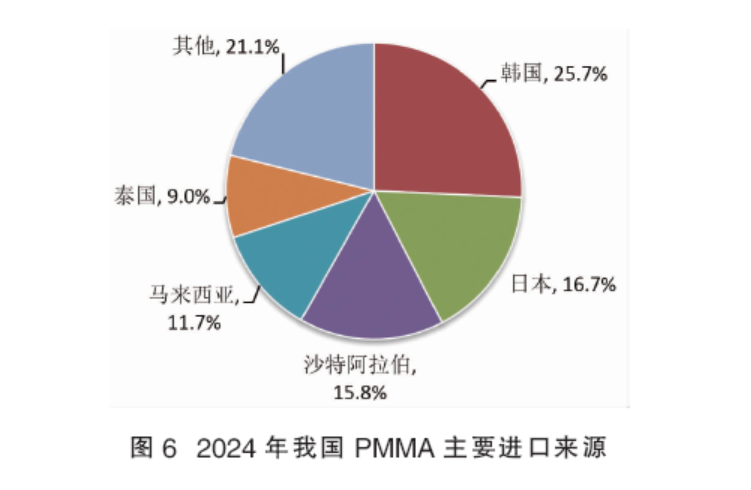

In 2024, China's PMMA imports mainly come from countries or regions such as South Korea, Japan, and Saudi Arabia. Among them, imports from South Korea amount to 42,000 tons, accounting for 25.7% of the total imports; imports from Japan total 27,000 tons, making up 16.7% of the total; and imports from Saudi Arabia reach 26,000 tons, representing 15.8% of the total. The combined import volume from these three countries accounts for 58.2% of China's total PMMA imports. The main sources of PMMA imports in China for 2024 are shown in Figure 6.

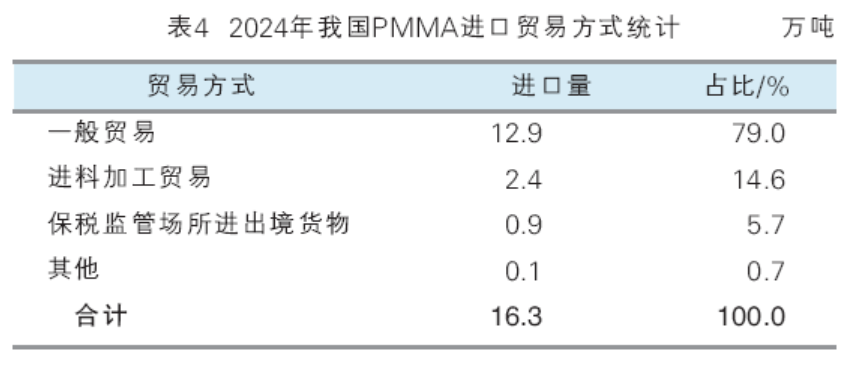

In 2024, the import of PMMA in China is primarily registered in Guangdong, Zhejiang, Jiangsu, Shanghai, and Fujian, accounting for 46.4%, 18.9%, 15.4%, 10.0%, and 3.1% respectively. The main trade methods include general trade, processing trade with imported materials, and goods entering and exiting bonded supervision sites, while other methods are relatively less common. General trade is the primary import trade method, accounting for 79%. Specific trade methods are shown in Table 4.

With the increase in domestic production, China's PMMA export volume shows an overall upward trend from 2020 to 2024, growing from 22,000 tons to 54,000 tons. In 2024, China's PMMA export volume is 54,000 tons, with the top five destinations being Russia, Taiwan, Israel, Bulgaria, and South Korea, accounting for a total of 53.4% of the export volume.

With breakthroughs in transparency, impact resistance, heat resistance, and wear resistance of PMMA products in China, along with a year-on-year increase in production, the advantages of importing PMMA have diminished. It is expected that the import volume of PMMA particles will show a downward trend in the coming years. As new production capacity continues to be released, China's PMMA production and technology are improving, and price advantages are becoming apparent. Multiple factors will drive an ongoing increase in PMMA export volume.

Increased competitive pressure and the trend towards high-end integration.

1. Products moving towards high-end.

The PMMA industry is developing towards high performance, high added value, and high intelligence. The development and utilization of energy-saving and environmentally friendly technologies, as well as new product research and development, structural improvements, and performance optimization, will become the focus of future PMMA industry development. With technological advancements and changes in market demand, the performance and functionality of PMMA materials are continuously improving, such as enhancing the wear resistance, scratch resistance, UV resistance, antibacterial properties, and self-cleaning capabilities of PMMA. At the same time, new applications for PMMA materials are being developed, such as color-changing PMMA, conductive PMMA, luminescent PMMA, and biodegradable PMMA.

2. MMA-PMMA Industry Chain Integration

The collaborative development advantages based on the industrial chain are significant and have become a global trend. Major PMMA production companies worldwide have the capability to self-supply MMA raw materials. In China, companies like Wanhua Chemical, Mitsubishi Chemical, Rohm, and Shuangxiang Co. all have supporting MMA production facilities. In the context of structural supply-demand contradictions and an oversupply situation in the upstream MMA market, establishing a complete MMA-PMMA industrial chain is beneficial for leveraging the cost advantages of integrated industrial chains and enhancing the core competitiveness of enterprises.

3. Increasing industry competition pressure

In 2025-2026, PMMA is expected to add more than 500,000 tons of new capacity, most of which will be supported by upstream MMA facilities, with production areas expanding from the East China market to the Central and Southwest markets. As industry capacity continues to increase, competitive pressure within the industry is becoming increasingly apparent.

In the next five years, the main development directions for PMMA will continue to be technological breakthroughs, the research and promotion of high-end products. With continuous innovation in optical materials and the widespread adoption of 5G communication technology, there will be a sustained strong demand for optical-grade PMMA materials in high-tech industries such as liquid crystal displays, LED lighting, virtual reality (VR), augmented reality (AR), and smart homes. Especially driven by new display technologies and the development of automotive lightweighting, the application of optical-grade PMMA in fields such as light guide plates, display panels, and automotive headlight lenses will further expand, thereby bringing tremendous market growth opportunities to the industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track