Plit, Soars By 80.8%!

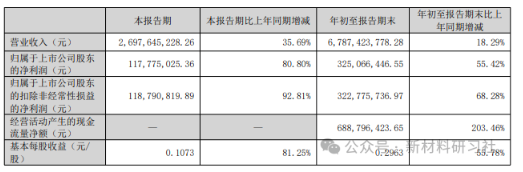

On October 27, Preet released its third quarter 2025 performance report. During the reporting period, the company's operating revenue was 6.79 billion yuan, an increase of 18.3% year-on-year; the net profit attributable to the parent company was 325 million yuan, an increase of 55.4% year-on-year; the net profit attributable to the parent company, excluding non-recurring items, was 323 million yuan, an increase of 68.3% year-on-year.

In the third quarter, the company's operating income was 2.70 billion yuan, an increase of 35.7% year-on-year; net profit attributable to shareholders was 118 million yuan, an increase of 80.8% year-on-year; net profit attributable to shareholders excluding non-recurring items was 119 million yuan, an increase of 92.8% year-on-year.

The company is mainly engaged in the research and development, production, sales, and service of polymer new materials and their composites, as well as lithium-ion batteries, sodium-ion batteries, solid-state batteries, and system integration. The company's business segments are primarily divided into three major directions: modified materials business, ICT materials business, and new energy business. In the new energy sector, the company focuses on lithium batteries as the foundation and considers sodium-ion batteries and solid-state batteries as key strategic development directions for the future.

In terms of business division, in the modified materials sector, the company has established a global production network in this field. It has set up 12 new material production bases (including 3 under construction) in Qingpu and Jinshan of Shanghai, Jiaxing of Zhejiang, Tongliang of Chongqing, Wuhan of Hubei, Foshan of Guangdong, Binhai of Tianjin, as well as overseas locations such as South Carolina in the USA, Chonburi in Thailand, and Monterrey in Mexico.

The current annual production capacity is 500,000 tons. Under construction projects include a 400,000-ton Pritch South China headquarters and R&D production base, a 50,000-ton factory in Ma'anshan, Anhui, set to be operational in the fourth quarter of 2025, and a 150,000-ton factory in Tianjin Binhai, scheduled to start production in early 2026. The future annual production capacity is expected to exceed 1 million tons.

In the ICT materials business, a large-scale production capacity has been established: an annual capacity of 4,000 tons of LCP resin polymerization, 5,000 tons of LCP blending modification, 3 million square meters of LCP film, and 1,000 tons (1000D) of LCP fiber.

The product will be widely used in the future in fields such as 6G, consumer electronics, automotive millimeter-wave radar, AI servers, brain-computer interfaces, and low-orbit satellites, with a broad demand space.

In the new energy business, the subsidiary Haidars leads the new energy sector, with a current annual lithium battery production capacity of 15.32GWh (2.83GWh cylindrical + 12.49GWh prismatic). During the reporting period, a 2.5GWh cylindrical battery project was initiated in Malaysia.

In the field of sodium-ion batteries, the subsidiary Guangdong Haisida Sodium Star Technology has achieved bulk shipments of the 46145-15AH and 71173208-160AH products, while the 50160118-50AH has entered small-scale applications. The signed orders exceed 200 million yuan, and they have also received overseas orders for no less than 1GWh of sodium-ion battery modules, with applications covering energy storage, backup power, start-stop systems, and special vehicles.

In terms of solid-state batteries, the company plans to establish a pilot line for all-solid-state batteries. In the first half of 2025, it aims to achieve mass production of 314Ah large-capacity semi-solid-state batteries at the Haida Zhuhai base (filling a domestic gap) and will also initiate the development of solid-state sodium-ion batteries. Currently, semi-solid-state batteries are in the mass production stage.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track