[Plastics Market Weekly Outlook] Oil Prices Fall! Intense Struggle Between Costs and Supply-Demand Ends, PE, PVC Prices Continue to Fluctuate

March 31stGeneral-purpose plastics Market sentiment alert! Market concerns over the increase of US tariffs enhancing trade risks may lead to global economic recession, causing international oil prices to fall. The short-term market is fiercely struggling between cost and supply-demand ends, and it is expected that the PP market will have a weak range-bound fluctuation trend; PE and PVC prices will continue to operate in a volatile manner; in the short term...PS market price The ABS market price may continue to maintain a sluggish decline; the EVA market may continue to move in a sideways consolidation.

PP

1. Points of interest

March 28: Market concerns over increased U.S. tariffs heightening trade risks, potentially leading to a global economic recession, international oil prices fell. NYMEXCrude Oil FuturesThe May contract fell by $0.56 to $69.36 per barrel, down 0.80% month-on-month; ICE Brent crude futures for May fell by $0.40 to $73.63 per barrel, down 0.54% month-on-month. China's INE crude oil futures main contract 2505 dropped by 1.7 to 541.7 yuan per barrel, and fell by 3.7 to 538 yuan per barrel in the night session.

Acrylic FOB Korea is at 800 USD/ton, CFR China is at 825 USD/ton.

3. This week (20250321-0327), the average operating rate of domestic polypropylene downstream industries decreased by 0.01 percentage points compared to last week, reaching 50.43%.

4. March 31st: The polyolefin inventory of the two oil companies was 730,000 tons, an increase of 60,000 tons compared to last week.

Core logic: Slow demand follow-up, easing sales pressure by the end of the month, and faster social inventory destocking.

II. Price List

III. Market Outlook

At the end of the month, tight spot resources combined with intensive maintenance support have led to a clear market sentiment of holding prices and waiting. The imposition of additional overseas tariffs has suppressed some product orders, resulting in a notably cautious market mood. Weak demand is dragging down the market, leading to lower future valuations. However, cost support from PDH production remains, locking in a market floor. In the short term, the market is caught in a fierce struggle between costs and supply-demand dynamics, with expectations of a weak and range-bound trend today. The mainstream transaction range is anticipated to test between 7,260 and 7,430 yuan/ton.

PE

I. Focus Points

1Cost side:Market concerns over U.S. tariff hikes escalating trade risks, potentially leading to a global economic recession, have driven international oil prices lower. NYMEXCrude oil futuresThe May contract fell by $0.56 to $69.36 per barrel, a decrease of 0.80% compared to the previous period; ICE Brent crude oil futures for May fell by $0.40 to $73.63 per barrel, a decrease of 0.54% compared to the previous period.

2Currently, parking device:Currently, the parking facilities involve 22 sets of polyethylene units, with no additional units undergoing maintenance.

3Last Week's Market Review:Yesterday, domestic polyethylene spot market prices fell, with a range of 3-19 yuan/ton. Last week, market demand was limited, and end-users showed obvious resistance to high-priced resources, which restricted further price increases. At the same time, new production capacity is gradually being released, and market sentiment is bearish. Traders are maintaining an active sales strategy, but transactions remain weak.

Core logic:Spot prices are fluctuating.

Price List Note: The provided text "二、价格表单" translates to "Price List" in English. The number "二" indicates it is the second item in a sequence, but for a standalone title, "Price List" is an appropriate translation.

III. Market Outlook

Looking at the raw material trends this week, it is expected that oil-based cost support will weaken while coal-based cost support will remain largely unchanged; it is predicted that the overall operating rate of PE downstream industries this week will decrease by 0.02%. Although the consumer market is driving some short-term new orders, as short-term orders are gradually delivered, the support for production capacity may weaken, and there is a possibility of a decline in operating rates. In combination with supply conditions, this week involves the restart of maintenance facilities at companies such as Sinopec Korea, Liaoyang Petrochemical, Wanhua Chemical, and Yangzi Petrochemical, along with planned maintenance at QiLu Petrochemical and others. It is estimated that the impact of maintenance this week will be around 57,400 tons, a decrease of 47,700 tons compared to last week. It is expected that the total production this week will be around 649,300 tons, an increase of 32,900 tons from last week. Overall, although maintenance activities are increasing on the supply side, new projects are gradually resuming normal operations, while downstream players maintain necessary inventory levels. It is forecasted that polyethylene prices will continue to oscillate in the coming week.

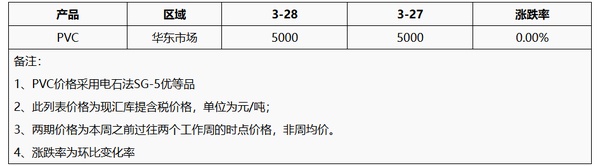

PVC

I. Focus Points

1. On March 28, market concerns over the potential for increased tariffs by the U.S. to heighten trade risks and lead to a global economic recession caused international oil prices to decline. NYMEXCrude oil futuresThe May contract fell by $0.56 to $69.36 per barrel, a decrease of 0.80%环比; the ICE Brent crude futures for May fell by $0.40 to $73.63 per barrel, a decrease of 0.54%. The main contract for China's INE crude oil futures for May fell by 1.7 to 541.7 yuan per barrel, and during the overnight session, it fell by 3.7 to 538 yuan per barrel.

2. Calcium carbide: As of last Friday, the mainstream trade price in the Wuhai area has stabilized at 2,700 yuan/ton, and production enterprises are shipping smoothly. With the gradual recovery of procurement in the Sichuan region, regional demand is increasing. Rain and snow weather in the Ulanqab region has led to transportation difficulties, exacerbating regional supply shortages. It is expected that today...Calcium carbide marketSteady consolidation running, regional performance strengthening.

3. PVC: Last week, domesticPVC marketThe trend shows a rise followed by a回落, with the price increase mainly driven by the macro atmosphere. However, the fundamentals of PVC have seen limited improvement, and the market lacks sustained upward momentum, leading to a consolidation phase after the price hike. Within the week, production volume changes due to upstream enterprise maintenance and load fluctuations were minimal. Domestic demand remained平淡, while the atmosphere for foreign trade export inquiries improved slightly, with concentrated delivery of market export orders. As of March 28, the spot cash warehouse delivery price for ethylene dichloride five-type in the华东region was in the range of 4900-5050元/ton, and for ethylene method, it was in the range of 5000-5200元/ton.

II. Price List

III. Market Outlook

This week, the number of PVC production enterprises undergoing maintenance remains low. With the resumption of operations by companies that were under maintenance last week, market supply is expected to increase. Domestic downstream demand is primarily driven by essential needs, putting pressure on domestic trade supply and demand. Foreign trade is mainly focused on fulfilling previous orders, which somewhat alleviates industry inventory pressure. Macroeconomic expectations are highly uncertain, especially concerning global tariff policies. It is anticipated that the market will maintain a weak and fluctuating trend today.

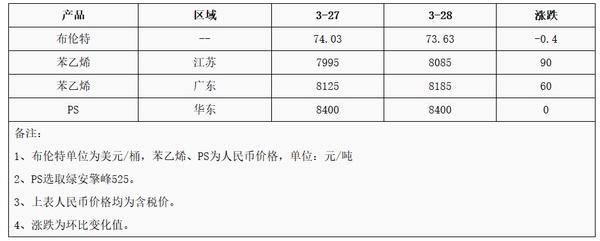

PS

1. Focus Points

1. On March 28, concerns in the market over the potential escalation of trade risks due to additional US tariffs could lead to a global economic downturn, causing international oil prices to fall. NYMEXcrude oil futuresThe May contract fell by $0.56 to $69.36 per barrel, a decrease of 0.80% compared to the previous period; ICE Brent crude futures for May fell by $0.40 to $73.63 per barrel, a decrease of 0.54% compared to the previous period. China's INE crude oil futures main contract for May fell by 1.7 to 541.7 yuan per barrel, and during the night session, it fell by 3.7 to 538 yuan per barrel.

Core logic:The raw material styrene has stopped falling and experienced a slight increase, with the negative cost atmosphere easing slightly.

Price List

Market Outlook

Raw material styrene has stopped declining and slightly increased, with the cost's bearish atmosphere easing somewhat. Supply remains at a high level, demand is not as expected, and the market still faces pressure for sales; in the short term,PS Market PriceIt may stop falling and trade narrowly. East China's transparent modified benzene is expected to be at 8,400-9,500 yuan/ton.

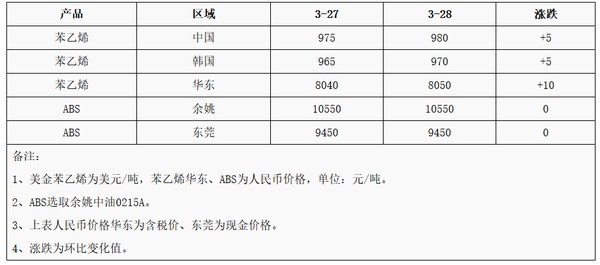

ABS

One, Focus Areas

1、Crude oilOn March 28, the market is concerned that the U.S. will impose additional tariffs, which may increase the risk of trade and lead to a global economic recession, causing international oil prices to fall. NYMEXCrude oil futuresMay contract: $69.36, down $0.56 per barrel, a decrease of 0.80% month-on-month; ICE Brent crude futures May contract: $73.63, down $0.40 per barrel, a decrease of 0.54% month-on-month. China INE crude oil futures main contract 2505: down 1.7 to 541.7 yuan per barrel, night session down 3.7 to 538 yuan per barrel.

II. Price List:

III. Market Outlook

Last week, market prices fell across the board, with market transactions being very sluggish. Petrochemical plants lowered their ex-factory prices across the board, and market prices followed suit. It is expected that domestic ABS market prices will continue to maintain a downward trend this week.

EVA

1. Points of Attention

On March 28th: Market concerns over increased U.S. tariffs heightened trade risks, potentially leading to a global economic recession, causing international oil prices to drop. NYMEXCrude oil futuresThe May contract fell to $69.36, down $0.56 per barrel, with a sequential decrease of -0.80%; ICE Brent crude oil futures for May fell to $73.63, down $0.40 per barrel, with a sequential decrease of -0.54%. China's INE crude oil futures主力contract for May fell by 1.7 to 541.7 yuan per barrel, and during the overnight session, it fell by 3.7 to 538 yuan per barrel.

2. Ethylene: Market supply is exceptionally abundant, and downstream consumption ability is insufficient. The bearish fundamentals in the market still persist, and prices are expected to continue to decline. The expected trading range is estimated to remain between 6,900-7,150 yuan/ton; the USD market is expected to remain between 840-860 dollars/ton.

Vinyl acetate: The supply side production enterprises of vinyl acetate have orders and shipments, while the demand side follows the pace of needs steadily. Intermediaries report prices according to the market, new orders are limited in negotiations, and the focus of negotiations continues to be on the lower end. With the end of the month settlement, industry players pay more attention to the downstream material flow and changes in the supply side's operating load. Market fluctuations are limited, and it is expected that the price of vinyl acetate will remain stable in the coming days.Ethylene MarketWeak and steady, watching and consolidating.

Core logic:The ethylene and vinyl acetate markets are expected to weaken on the cost side, with reduced support from cost factors. Strong photovoltaic demand provides support, while the petrochemical supply side maintains firm market conditions without pressure. Amid weak supply and demand dynamics, the market is likely to continue sideways consolidation.

Price List

Three,Market Outlook

In the short term, the domestic EVA market is expected to remain in a stalemate. Photovoltaic demand is temporarily favorable, providing support, while EVA producers continue to maintain firm pricing. Supply remains relatively tight, but downstream foam terminal factories are resistant to high-priced procurement. Industry players are cautious and follow market trends, maintaining a weak balance between supply and demand. It is anticipated that the domestic EVA market this week may stabilize with a consolidation trend. Forecast: soft material is referenced at 11,400-11,700 yuan/ton, and hard material at 11,200-11,600 yuan/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track