Plasticizer Industry Chain September Market Review and October Outlook

Part 1: Brief Description

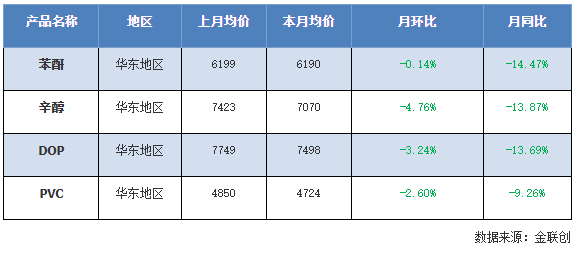

In September 2025, phthalic anhydride, octanol, and DOP all experienced a month-on-month decline, and from a year-on-year perspective, the decrease remained significant.

Unit: Yuan

Part Two: Market Analysis of Various Products

Octanol: In September 2025, the octanol market in China exhibited a weak downward trend. Taking the Shandong market as an example, the market price fluctuated within the range of 6600-7200 yuan/ton. The highest point of the month occurred at the beginning, while the lowest point occurred at the end of the month.

Specifically, in September, domestic n-butanol production enterprises in China maintained high operating rates, with ample supply of spot goods. However, due to weak demand from end-users, the sale of plasticizers was hindered. As a result, the procurement of n-butanol raw materials was mostly postponed, and mainstream manufacturers faced pressure to sell. To alleviate inventory pressure, mainstream manufacturers offered discounts. After the discounts, downstream buyers only made small-scale, just-in-time replenishments at low prices, and the market did not show significant improvement in transactions. Mainstream manufacturers continued to offer discounts. During certain periods, staged concentrated replenishment by downstream buyers temporarily stabilized the market. However, the market lacked substantial positive support, and under the logic of pre-holiday inventory clearance, further discounts were offered again in the latter part of the month. Due to cost pressure, the extent of discounts was limited, with a focus on gradual discounting.

Phthalic anhydrideIn September 2025, the domestic phthalic anhydride market prices showed a narrow oscillation trend, stabilizing initially before weakening. At the beginning of the month, with strong support from the firm prices of raw materials ortho-xylene and industrial naphthalene, producers were inclined to hold prices high, and quotations remained elevated. However, the persistent weakness in demand from downstream plasticizers and end-user industries led to strong resistance to high-priced raw materials, with purchases only made on a just-needed basis. This resulted in a lackluster trading atmosphere and difficulty in increasing transaction volumes. By mid-month, the cost support logic remained solid, and some regions experienced low inventory levels due to plant maintenance, prompting phthalic anhydride manufacturers to have an inclination to raise prices. Yet, the weak demand fundamentals continued to be the core factor restricting the market, with a lack of new orders making it difficult to effectively break through high-end prices, rendering the market with insufficient upward momentum, and mainstream prices primarily exhibiting a sideways consolidation. Approaching the end of the month, as the National Day holiday neared, market sentiment turned cautious, and some holders offered discounts to ease pre-holiday inventory pressure, leading to slight softening in negotiation focus. However, the widespread deep losses in the industry limited the room for price cuts, with a clear bottom support in the market. Throughout the month, the phthalic anhydride market trends showed little regional differentiation, with markets in East China, South China, and North China displaying some resistance to decline, while also lacking upward strength, resulting in a narrowing of overall price fluctuations. As of the close on September 29, the East China ortho-xylene phthalic anhydride market was referenced at 5800-5850 yuan/ton for self-pickup.

DOP:This month, the domestic DOP market has mainly experienced range-bound fluctuations. Whether it's a downward or upward trend, the market's volatility has been limited. Downstream purchasing remains demand-driven, with a cautious and wait-and-see attitude prevailing. Although the traditional peak season has begun, it hasn't significantly boosted demand. The terminal industry's weak production and sales status persists, negatively impacting the demand outlook for DOP. The cost support for DOP is also limited, with raw material 2-ethylhexanol operating at low levels, continuously reaching new annual low prices. Throughout the month, the DOP market faces weak cost and demand conditions. Additionally, the DOP industry has an ample supply of spot goods, especially with major factories operating normally. The industry's overall capacity utilization is at a mid-to-high level, leading to a sufficient supply of DOP in the market. Therefore, DOP merchants primarily focus on routine shipments throughout the month, with the supply-demand pattern remaining imbalanced. In the early to mid-month stages, the DOP market showed a downward trend, mainly due to the decline in 2-ethylhexanol. In the mid-month period, there was a temporary rebound in the DOP market, but the duration and extent of the improvement were limited. The rebound was mainly driven by relatively concentrated restocking by downstream buyers after a prolonged decline, and merchants testing price support amidst long-term losses. However, due to a lack of sustained transaction support, the rebound effect was modest. Entering the late month phase, the DOP market operated within a low range, with its focus shifting to the lower end, although the overall amplitude was limited. As the National Day holiday approached, pre-holiday stocking was not evident, but near the holiday, the resistance for DOP merchants to clear inventories remained, coupled with the continued decline of 2-ethylhexanol, leading to further downward pressure on DOP prices. As of the close on September 29, the prices were 7100-7200 yuan/ton ex-works in Shandong and North China, 7250-7350 yuan/ton ex-works in East China, and 7450-7500 yuan/ton delivered in South China.

PVC:In September, the domestic PVC market price rebound remained weak, primarily showing low-level fluctuations. Throughout the month, the supply and demand fundamentals continued to be weak, coupled with a lackluster market trading atmosphere. The PVC futures rebounded sluggishly, with spot prices following futures adjustments, resulting in narrow-range fluctuations. Traders mainly focused on pricing for sales, engaging in actual transaction discussions. Regarding PVC production enterprises, the number of maintenance shutdowns in September decreased and was relatively scattered, leading to a month-on-month increase in production rates. Furthermore, the release of new production capacities continued to exert supply pressure. During the month, PVC producers adjusted their prices based on their own circumstances, with limited room for adjustments. On the downstream demand side, affected by the poor economic situation and weak demand, orders from downstream product manufacturers were unsatisfactory, and overall operating rates remained at a low level, primarily focusing on low-price essential stock replenishment. In other aspects, although export volumes declined, demand from regions like India, Southeast Asia, and Africa remained, keeping export volumes considerable. In summary, the domestic PVC market price rebound in September remained weak, primarily exhibiting low-level fluctuations.

Part Three: Plasticizer Industry Chain Forecast

OctanolIt is expected that the octanol market in China will continue to be weak in October. On the supply side, domestic enterprises will maintain high operating rates, with the Ningxia Jiuhong facility expected to undergo maintenance after the holiday, and some new production capacity waiting to be released, resulting in an overall ample supply. On the demand side, the operation rate of downstream plasticizers will remain around 60-70%, with no significant improvement, exacerbating the supply-demand conflict. In terms of sentiment, the impact of new production capacity will be released in advance, intensifying bearish sentiment among industry players. Overall, under the influence of supply-demand conflicts and the release of new production capacity, the octanol market is expected to remain weak. The East China octanol market is expected to operate within the range of 6,700-7,000 yuan/ton.

Phthalic Anhydride:In October, the domestic phthalic anhydride market is expected to continue its volatile pattern under the dual influence of cost support and weak demand, with the overall trend being stable initially and then under pressure. During the National Day holiday, market trading activities will slow down, with some downstream factories shutting down for the holiday, leading to a temporary contraction in demand. However, since industry inventories were already depleted to low levels by the end of September, and the prices of upstream raw materials such as ortho-xylene and industrial naphthalene remain firm, the cost-side support is strong. Phthalic anhydride producers have a strong willingness to maintain prices, and it is expected that market prices will mainly consolidate sideways during the holiday. After the holiday, the market focus will shift to actual changes in supply and demand. On the supply side, previously shut down facilities are gradually resuming operations, and the industry operating rate is expected to improve slightly, increasing the supply of spot goods. However, demand from downstream plasticizers and end-user industries is unlikely to see substantial improvement, with purchasing of phthalic anhydride remaining primarily on a just-needed basis, making it difficult to effectively absorb the supply increment. By mid to late October, if the cost side shows signs of easing, the cost support for phthalic anhydride may weaken. Meanwhile, downstream resistance to high-priced sources may intensify, leading to a risk of declining market negotiation focus. Nevertheless, considering that the naphthalene-based phthalic anhydride industry has long been in a loss-making state, companies have little inclination to sell low, which may limit the downward price space to some extent. Overall, the phthalic anhydride market in October lacks demand-driven upward momentum and is supported by costs on the downside. It is expected to show a stable to slightly weaker volatile trend. The price of ortho-xylene-based phthalic anhydride in East China is expected to range between 6000-6300 yuan/ton, and the price of naphthalene-based phthalic anhydride in North China is expected to range between 5700-6000 yuan/ton.

DOP:In the DOP market for October, it is expected that the market will mainly experience range-bound fluctuations, with limited room for upward or downward movement. Market participants are likely to maintain a cautious outlook. Firstly, from the supply and demand perspective, the contradiction of ample supply and weak demand in the DOP industry is expected to continue in October. It is anticipated that after the small holiday, there will inevitably be some accumulation of supply in the DOP industry. Thus, after the holiday, the active selling by merchants will continue. Along with the end of the holiday, the operating levels of the DOP industry are also expected to increase, so the overall supply in October will remain at a relatively high level. On the demand side, there is little hope for improvement. End-user production and sales are not strong, and DOP is purchased as needed, which is the norm. However, during periods of long-term low prices, there may be instances of relatively concentrated restocking, but the sustainability of transactions is limited, and the overall transaction atmosphere is subdued. In terms of costs, the planned new capacity for raw material octanol is gradually being put on the agenda, negatively impacting market sentiment. With the expected increase in octanol supply, the risk of weak prices persists, so the cost transmission to DOP in October is expected to be average. The DOP industry in October is likely to continue facing multiple bearish pressures, with an overall weak tone, but there may be occasional rebound scenarios with limited impact. Taking the East China market as an example, it is expected that the DOP East China market will operate in the range of 7200-7600 yuan/ton in October.

PVC:It is expected that the PVC market price will rebound after fluctuations in October 2025, but the extent of the rebound will be limited. On the supply side, there are still some domestic PVC production enterprises with maintenance plans in October, including Lutai Chemical, Shandong Xinfeng, Inner Mongolia Junzheng, Xinjiang Zhongtai, and Xinjiang Tianye, among others. Many of these are significant enterprises, which can alleviate supply pressure to some extent. However, the newly released capacity from new installations will result in a large capacity base, coupled with ample inventory, which limits the space for relief from supply pressure. Regarding downstream demand, as the weather gradually cools, some downstream enterprises have slightly increased their operating rates. However, the current economic situation and the real estate industry are unlikely to see significant improvement, which restricts overall growth. Additionally, the poor profitability of downstream enterprises means that purchases are primarily focused on low-priced essential restocking, providing limited support for prices. On the export side, demand from India and Southeast Asia remains, and the industry is actively expanding into emerging markets such as Africa and the Middle East. It is expected that the export volume in October will still maintain a relatively considerable level, which will have a certain diversion effect on the domestic market. In summary, it is anticipated that the PVC market price will rebound after fluctuations in October 2025, but the extent of the rebound will be limited.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track