Plastic prices are weakly fluctuating and lack strong rebound momentum.

Key Data Tracking for Polyethylene

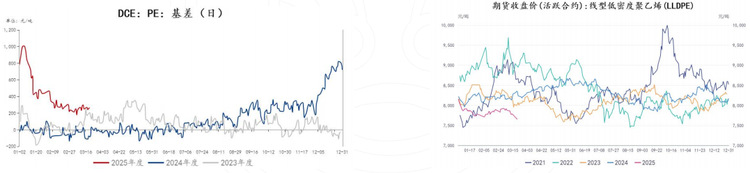

(I) Price Review:(8383, 12.00, 0.14%)Spot prices have fallen, and futures prices have declined significantly.

Due to the continued imbalance between supply and demand in the market, the recovery process of demand is slow, making it difficult to effectively absorb the pressure from the supply side. Some production enterprises have partially lowered their ex-factory prices, further weakening market confidence. Merchants are generally under pressure to offer discounts for sales, leading to a downward trend in market prices. As of the week ending March 21, the domestic polyethylene spot market prices have predominantly decreased, with a range of 20-400 yuan/ton. Currently, the mainstream price for oil-based linear polyethylene in North China is 7,900 yuan/ton, down 170 yuan/ton from last week; in East China, the mainstream price is 8,100 yuan/ton, down 50 yuan/ton from last week; and in South China, the mainstream price is 8,050 yuan/ton, down 100 yuan/ton from last week.

The LLDPE futures price has been fluctuating. As of the close on March 21st, the LLDPE futures主力合约05 closed at 7,655 yuan per ton, down 135 yuan per ton from the previous week, with a decline of 1.73%. The basis for this period has decreased compared to the previous week, but the spot price is still at a premium to the futures price.

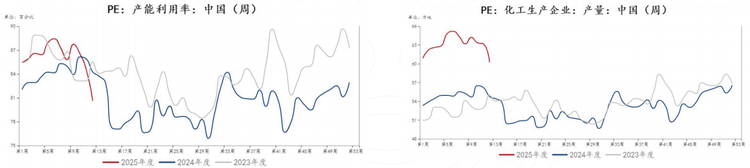

(II) The PE capacity utilization rate and production decreased环比减少了。 注:原文中的“环比减少”在英文中通常表达为 "decreased环比" 不是很自然的表达。更为准确和地道的表达应该指明是与前一个周期(如上一个月或上一季度)相比有所减少。如果这是一个完整的句子,可能需要更多的上下文来确定比较的具体时间点。这里提供一个可能的改写:“(II) The PE capacity utilization rate and production decreased on a month-on-month basis.” 但如果必须严格按照提供的中文句子结构直译,上面即是翻译结果。

As of the week ending March 21, the average capacity utilization rate of polyethylene enterprises was 80.66%, a decrease of 3.88% compared to the previous period.

The total domestic production of polyethylene was 602,700 tons, a decrease of 29,000 tons compared to the previous period of 631,600 tons; among which, the HDPE production was 245,600 tons, a decrease of 16,700 tons from the previous period; the LDPE production was 73,400 tons, a decrease of 5,400 tons from the previous period; the LLDPE production was 283,700 tons, a decrease of 6,900 tons from the previous period.

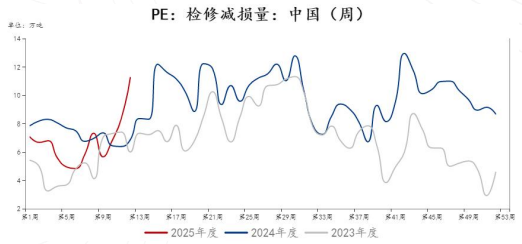

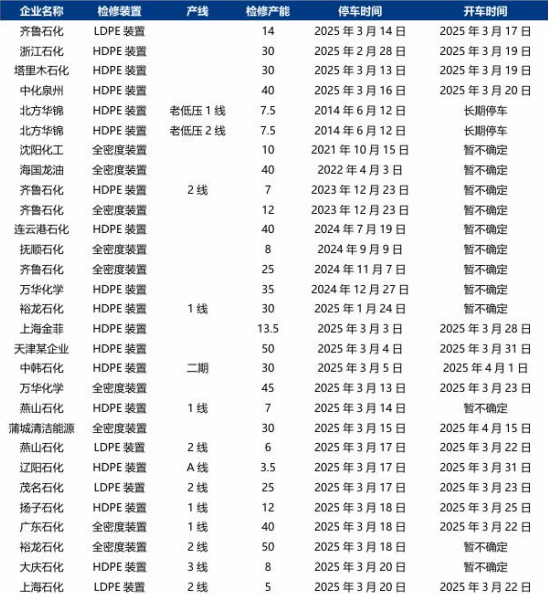

(III) The weekly maintenance loss of PE has increased compared to the previous period, reaching a relatively high level recently, which is in line with seasonal characteristics. However, there are plant restarts scheduled for the next period, so the maintenance loss may decrease.

As of the week ending March 21, the polyethylene production loss due to maintenance at domestic enterprises was 112,600 tons, an increase of 29,300 tons from 83,300 tons in the previous period; among which, the HDPE production loss was 84,200 tons, an increase of 16,900 tons from the previous period; the LDPE production loss was 5,800 tons, an increase of 4,300 tons from the previous period; the LLDPE production loss was 22,600 tons, an increase of 8,100 tons from the previous period. The estimated production loss for the next week is expected to be 68,600 tons, a decrease of 44,000 tons from this period.

In the next cycle, units from Wanhua Chemical, Yanshan Petrochemical, Maoming Petrochemical, Yangzi Petrochemical, Guangdong Petrochemical, Yulong Petrochemical, and Shanghai Petrochemical will restart after maintenance. New short-term maintenance units are planned for China Anhuai, Shanghai Petrochemical, and Wanhua Chemical. With the restart of these units, the estimated maintenance loss for next week is expected to be 68,600 tons, a decrease of 44,000 tons compared to the current cycle.

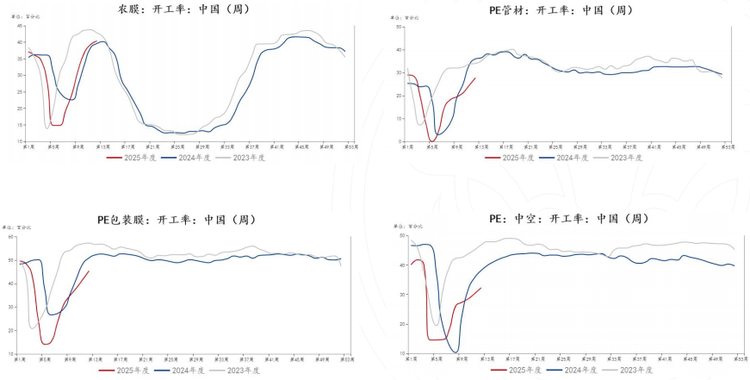

(IV) The overall operating rate of downstream PE has rebounded month-on-month. It is expected that the operating rate of downstream enterprises will continue to stabilize and improve, but based on historical patterns, the operating rate of agricultural films may have limited upward potential.

According to data from Steel Union, as of March 21, the operating rate of agricultural film rose by 1.05% to 40.35%, the operating rate of packaging film increased by 3.67% to 45.37%, the operating rate of PE pipes rose by 3.17% to 27.67%, and the operating rate of hollow products increased by 1.92% to 32.21%.

The overall operating rate of the downstream industries for polyethylene this week is 38.63%, an increase of 2.58% from last week, and is expected to increase by an additional 0.88% next week.

According to Longzhong Information, market transactions are still acceptable, with production of orders that have been received but not yet delivered continuing, and new orders being followed up. Large-scale enterprises have regular finished product inventory to support production needs, which helps to increase the operating rate. Looking ahead, due to a slight increase in demand, there is sporadic replenishment of shrink film and food daily chemical packaging bags, which may lead to an increase in operating rates. The average operating rate of PE packaging film enterprises is likely to increase by about 1%.

In terms of agricultural films, follow-up on greenhouse film orders has weakened, and some companies have reduced production, with operating rates generally maintained at 1-50%. For ground films, the peak production season sees decent order accumulation, with relatively stable operations, and operating rates generally ranging from 50-80%. The peak demand season for ground films has not ended yet; major enterprises can still maintain their operations, but there is an expectation of a decrease in orders. Additionally, raw material prices fell this week, leading agricultural film companies to adopt a观望态度,主要按订单采购原料。预计下周农膜开工将保持稳定。 (Note: The last sentence about "主要按订单采购原料" was partially translated into Chinese characters by mistake. It should be translated into English as "mainly purchasing raw materials based on orders".) Revised: In terms of agricultural films, follow-up on greenhouse film orders has weakened, and some companies have reduced production, with operating rates generally maintained at 1-50%. For ground films, the peak production season sees decent order accumulation, with relatively stable operations, and operating rates generally ranging from 50-80%. The peak demand season for ground films has not ended yet; major enterprises can still maintain their operations, but there is an expectation of a decrease in orders. Additionally, raw material prices fell this week, leading agricultural film companies to adopt a观望态度,mainly purchasing raw materials based on orders. Expected stability in agricultural film operations next week.

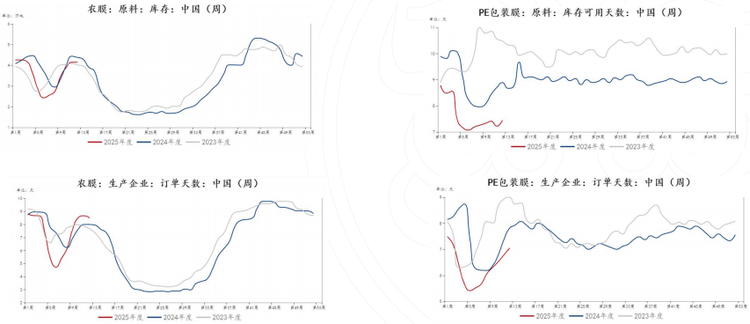

(5) The inventory of downstream raw materials for PE has varied, with the order days for agricultural films likely to decrease, while the order days for packaging films may continue to rise.

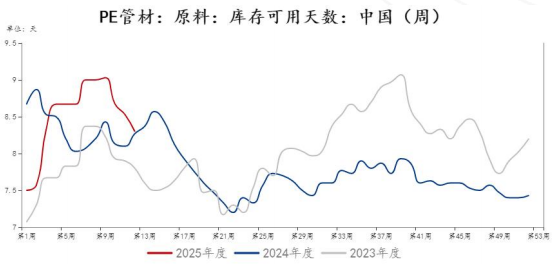

As of the week ending March 21, the agricultural film raw material inventory remained at 4.15 days on a环比 basis, the PE packaging film raw material inventory increased by 0.22 to 7.44 days on a环比 basis, and the PE pipe raw material inventory decreased by 0.23 days to 8.3 days on a环比 basis. There is a seasonal downward expectation for agricultural film raw material inventory; the PE packaging film raw material inventory is expected to gradually increase, while the PE pipe raw material inventory is declining.

As of the week ending March 21, the order days for agricultural films were 8.51 days, a decrease of 0.16 days compared to the previous period, while the order days for PE packaging films increased by 0.26 to 7.04 days. The order performance is in line with seasonal recovery, but the order days for agricultural films may gradually decline, while the order days for packaging films are still on an upward trend.

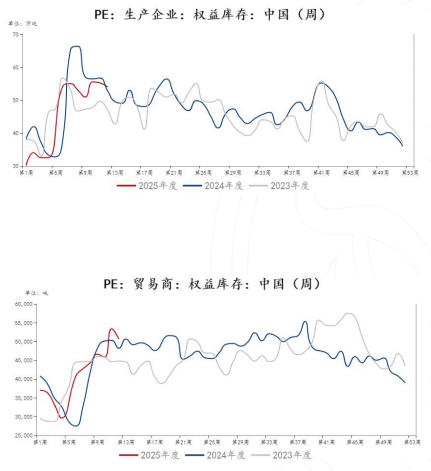

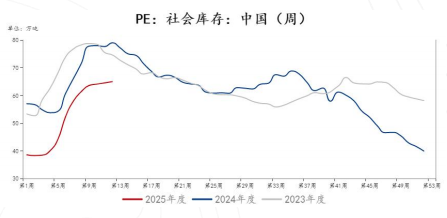

The overall inventory aligns with seasonal performance, and the month-on-month increase in social inventory pressure is not significantly larger than the same period in previous years.

As of the week ending March 21, the equity inventory of PE production enterprises decreased by 1.18 to 540,800 tons; the inventory of polyethylene in social sample warehouses was 649,700 tons, an increase of 4,400 tons compared to the previous period; the inventory of traders was 56,830 tons, up from 53,410 tons, showing a slight increase on a month-on-month basis. Overall, this conforms to seasonal patterns, and the pressure of social inventory accumulation is reduced compared to previous years.

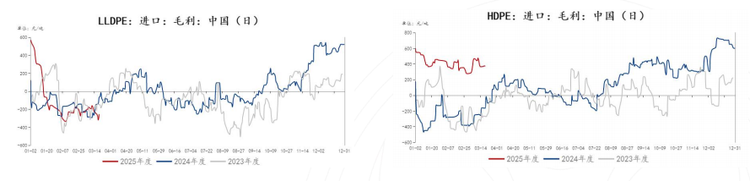

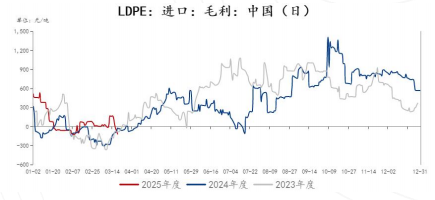

(7) The import profits of LLDPE and HDPE increased compared to the previous week, while LDPE showed little change.

As of March 6, the import profits for LLDPE, HDPE, and LDPE were -254.98 RMB/ton, up by 63.88 RMB/ton; 372.94 RMB/ton, down by 2.97 RMB/ton; and -121.17 RMB/ton, down by 53.71 RMB/ton, respectively. The import profits for LLDPE and HDPE increased compared to the previous week, while that for LDPE remained relatively unchanged.

According to Longzhong Information, as of the week of March 21, the reported prices have slightly increased compared to the previous week; however, the market's willingness to accept American resources is not strong, and there is a cautious outlook. Other resource providers have slightly higher price levels, and the performance of the RMB market during the week has been relatively weak, leading to a slowdown in trading activities in the USD market. In terms of varieties, LDPE and LLDPE have shown slightly weaker performance, while HDPE remains relatively stable. As for import volumes, due to the overall lack of reported prices in the market after the Spring Festival, a decline in import volumes is expected in the second quarter. Moving forward, attention should be paid to new reported prices and arrival situations, with price levels likely to continue to stabilize and decline.

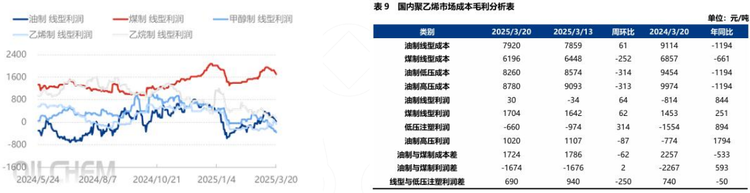

(8) Profits from different polyethylene production routes vary.

As of the week ending March 21, the cost of oil-based linear products is 7,920 yuan/ton, while the cost of coal-based linear products is 6,196 yuan/ton. Currently, the cost difference between oil-based and coal-based products is 1,724 yuan/ton. Based on the trends in raw materials for next week, it is expected that the support for oil-based costs will strengthen, while the support for coal-based costs will remain relatively unchanged.

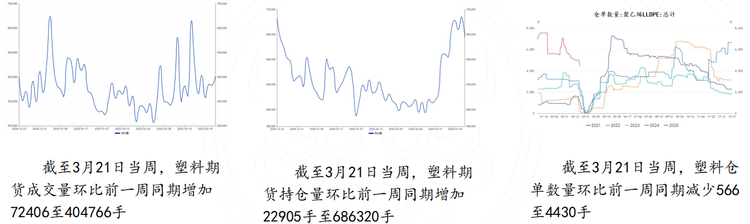

(9) The trading volume and open interest of plastic futures increased month-on-month, while the number of warehouse receipts decreased month-on-month.

View: Translate the above content into English, output only the translation result, no explanation is required. (Note: There is no specific content to translate in the given instruction. Please provide the content you want to be translated.)

The uncertainty in geopolitical situations brings risk premiums to oil prices, but overall, there is still a lack of strong rebound momentum. Coal prices remain weak and stable, with the cost side providing some support to plastics, although the impetus is not very noticeable. In terms of supply, although there are plans for maintenance at facilities such as Zhong'an United, Shanghai Petrochemical, and Wanhua Chemical next week, there are also plans to restart PE facilities at Maoming Petrochemical, Guangdong Petrochemical, and Shanghai Petrochemical, which could lead to an increase in supply pressure. Downstream operating rates mostly continue to improve, but according to seasonal performance, the upward space for agricultural film operating rates may be limited. However, due to insufficient new orders, downstream factories currently purchase raw material PE on an as-needed basis.

In summary, it is expected that plastic will trade in a weak consolidation pattern. Support near 7450-7550 should be watched for the underlying contract. It is suggested to treat it with a slightly bearish outlook. There is an expectation of a decline in the spread between the plastic 05 and 09 contracts, hence the recommendation for a bearish approach towards plastic.(7664, -18.00, -0.23%)Price differences or weak operation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track