Summary: Morning market update for general plastics on March 24! The market believes that the Asian economy and demand are expected to improve, coupled with the instability in the Middle East still bringing potential supply risks, leading to an increase in international oil prices. Intense friction between supply and demand over territory, PP prices may slightly rise; with demand below expectations, PE prices may fluctuate at the bottom, PS market may weaken and consolidate, ABS maintains a downward trend; cost side remains firm in the short term, PVC market continues to fluctuate within a range; photovoltaic demand remains positive, EVA maintains a trend of consolidation.

PP

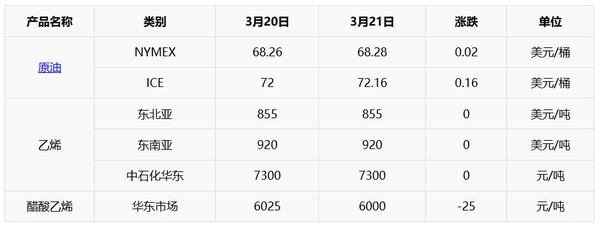

1, 3/21: The market believes that the Asian economy and demand are expected to improve, coupled with the instability in the Middle East still bringing potential supply risks, leading to an increase in international oil prices. NYMEX May contract rose by $0.21 per barrel to $68.28, up 0.31% month-over-month; ICE Brent May futures increased by $0.16 per barrel to $72.16, up 0.22% month-over-month. China's INE crude oil futures main contract 2505 rose by 9.3 to 531.3 yuan per barrel, and during the night session, it increased by 4.4 to 535.7 yuan per barrel.

2, Propylene FOB Korea at 810 USD/ton, CFR China at 830 USD/ton.

3, This week (20250314-0320) the average operating rate of domestic polypropylene downstream industries increased by 0.46 percentage points to 50.44%.

4, March 24: The inventory of the two oil polyolefins is 795,000 tons, an increase of 30,000 tons from last week.

Core logic: enhanced support on the cost side, gradual recovery of downstream rigid demand, and high difficulty in cost transfer.

II. Price List

Three,market outlook

Cost and demand fundamentals support, market confidence slightly rises. Intensive maintenance on the supply side provides a positive push, alleviating the bearish impact brought by market supply and demand pressures. The main reason for the demand side is the slow recovery of rigid demand, with frequent national policies assisting in increasing demand. Bearish drags come from overseas tariff hikes, restricting some downstream product export orders. In the short term, there is intense friction between supply and demand, with the expectation that today's market prices may see a slight increase, mainly ranging from 7260 to 7420 yuan/ton for transactions.

PE

I. Focus Points

1、cost end:The market believes that the Asian economy and demand are expected to improve, and the instability in the Middle East still brings potential supply risks, leading to an increase in international oil prices. The NYMEX May contract rose by $0.21 per barrel to $68.28, a month-on-month increase of 0.31%; the ICE Brent crude futures May contract increased by $0.16 per barrel to $72.16, a month-on-month increase of 0.22%.

2current parking equipment:Currently, the parking equipment involves 25 sets of polyethylene equipment, with no new equipment maintenance added.

3last week's market review:The domestic polyethylene spot market price fell on the previous day, with a decline of 6-17 yuan/ton. The imbalance in supply and demand in the market continued last week, with a slow recovery in demand, making it difficult to effectively absorb the pressure from the supply side. Some producers lowered their ex-factory prices, further eroding market confidence. Traders generally faced pressure and offered discounts for sales, leading to a mainly downward trend in market prices.

core logicSpot price fluctuates.

II. Price List

Market Outlook

This week, in terms of raw material trends, it is expected that the cost support for oil-based production will strengthen, while the cost support for coal-based production will remain largely unchanged; it is estimated that the overall operating rate of various downstream industries for PE will increase by 0.88%. The demand from downstream polyethylene slightly follows up, and at the same time, large-scale enterprises' regular finished product inventory stocking for production needs may still lead to an increase in operations. Considering the supply situation, this week, maintenance facilities such as Wanhua Chemical, Yanshan Petrochemical, Guangdong Petrochemical, and Yangzi Petrochemical will be restarted, with new short-term planned maintenance facilities including Zhong'an United and Shanghai Petrochemical. It is estimated that the impact of maintenance on production this week will be 68,600 tons, a decrease of 44,000 tons compared to last week. The total estimated production for this week is 586,300 tons, a reduction of 16,400 tons compared to last week. In summary, although the growth rate of supply is below expectations, the recovery of downstream demand is slow, and inventory digestion is sluggish, it is predicted that the price of polyethylene may fluctuate at the bottom this week.

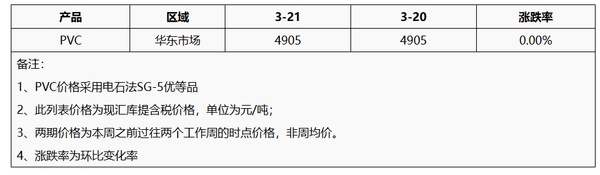

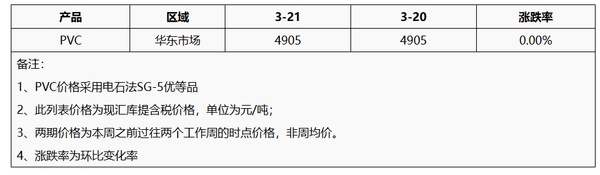

PVC

I. Focus Points

3/21: The market believes that the Asian economy and demand are expected to improve, and the instability in the Middle East still brings potential supply risks, leading to an increase in international oil prices. NYMEX crude oil futures May contract rose by $0.21 to $68.28 per barrel, a month-on-month increase of +0.31%; ICE Brent crude oil futures May contract increased by $0.16 to $72.16 per barrel, a month-on-month increase of +0.22%. China's INE crude oil futures main contract 2505 rose by 9.3 to 531.3 yuan per barrel, and the night session rose by 4.4 to 535.7 yuan per barrel.

2, calcium carbide: As of last Friday, the domestic calcium carbide market remained stable. The mainstream trading price in the Wuhai area stabilized at 2700 yuan/ton, with smooth sales from production enterprises. A price difference of 50 yuan/ton was formed compared to the Wuhai area, increasing market观望sentiment. Downstream regional arrivals were uneven, with active procurement. Demand in the southwest region began to decline today, alleviating the tightness of regional arrivals. It is expected that the domestic calcium carbide market will remain stable over the weekend.

Note: "观望" is a Chinese term that typically means 'wait-and-see' or 'watching', but in this context, it seems to refer to a cautious or uncertain market sentiment. If you prefer a more direct translation, you can use "cautious sentiment" or "uncertainty."

3, PVC: Last week, the domestic PVC market price maintained a range-bound fluctuation, with resistance to price increases. The supply and demand pattern of PVC showed weakness. The market trading atmosphere was flat, the industry inventory reduction was slow, and downstream orders were poor, leading to low enthusiasm for purchasing. Spot transaction prices saw some adjustments downward. As of March 21, the warehouse withdrawal price for calcium carbide process type five in the East China region was 4800-4950 yuan/ton, while for ethylene process it was 4950-5200 yuan/ton.

II. Price List

III. Market Outlook

The domestic PVC market fundamentals have not shown significant improvement, with production still maintaining high levels; foreign trade exports are currently focused on delivery, and due to unstable policies, new orders are cautiously seen as weak, with domestic demand slowing down; the price of raw material calcium carbide is stable, and cost aspects remain firm in the short term. Currently, there are no major factors affecting the PVC market, which continues to fluctuate within a range. It is expected that today's mainstream price of PVC SG-5 in East China will be in the range of 4850-5000 yuan/ton.

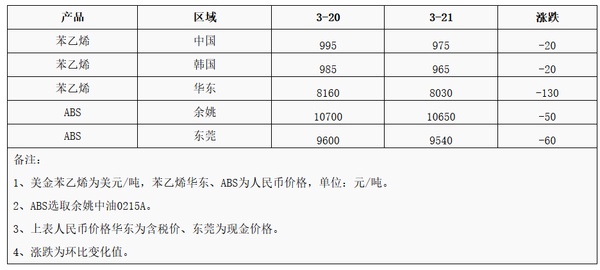

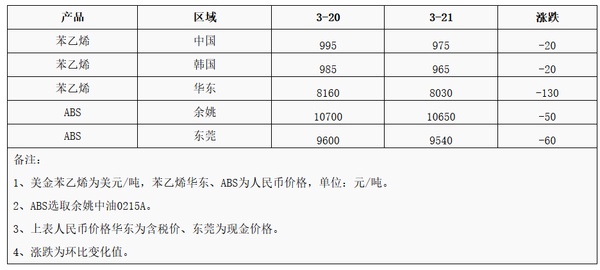

ABS

I. Focus Points

1、crude oil3/21: The market believes that the Asian economy and demand are expected to improve, and the instability in the Middle East still brings potential supply risks, leading to an increase in international oil prices. NYMEX crude oil futures May contract rose by $0.21 per barrel to $68.28, up 0.31% month-over-month; ICE Brent crude oil futures May contract increased by $0.16 per barrel to $72.16, up 0.22% month-over-month. China's INE crude oil futures main contract 2505 rose by 9.3 to 531.3 yuan per barrel, and the night session increased by 4.4 to 535.7 yuan per barrel.

II. Price List:

Three, Market Outlook

Last week, the market prices in Dongguan and Yuyao continued to decline. The recovery of terminal demand was slow, and merchants continued to offer discounts on sales. Overall market demand was average, and it is expected that the domestic ABS market prices will continue to maintain a downward trend this week.

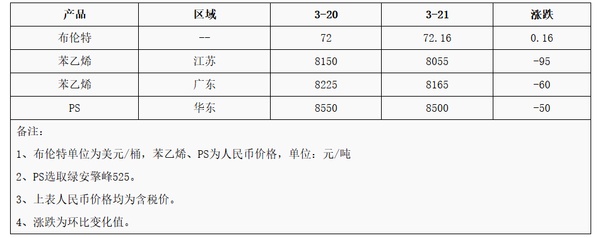

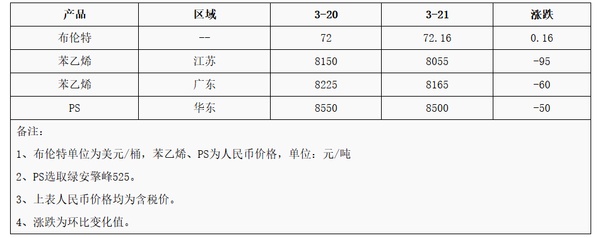

PS

I. Focus Points

3/21: The market believes that the Asian economy and demand are expected to improve, and the instability in the Middle East still brings potential supply risks, leading to an increase in international oil prices. NYMEX crude oil futures for May contract 68.28 rose by $0.21 per barrel, a month-on-month increase of +0.31%; ICE Brent crude oil futures for May contract 72.16 rose by $0.16 per barrel, a month-on-month increase of +0.22%. China's INE crude oil futures main contract 2505 increased by 9.3 to 531.3 yuan per barrel, and the night session increased by 4.4 to 535.7 yuan per barrel.

core logicRaw material styrene is weakly organized, and cost support is hard to improve.

II. Price List

Market Outlook

Raw material styrene is in a weak consolidation, and cost support is hard to improve. Under the influence of high supply, shipping pressure, and demand falling short of expectations, the PS market may trend towards weakness and consolidation in the short term. It is expected that the transparent modified benzene in the East China market will be 8500-10300 yuan/ton.

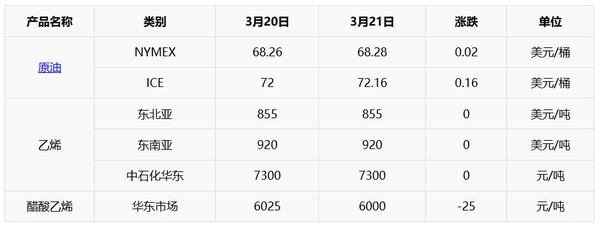

EVA

I. Focus Points

3/21: The market believes that the Asian economy and demand are expected to improve, and the instability in the Middle East still brings potential supply risks, leading to an increase in international oil prices. NYMEX crude oil futures May contract rose by $0.21 per barrel to $68.28, up 0.31% month-over-month; ICE Brent crude oil futures May contract increased by $0.16 per barrel to $72.16, up 0.22% month-over-month. China's INE crude oil futures main contract 2505 rose by 9.3 to 531.3 yuan per barrel, and the night session increased by 4.4 to 535.7 yuan per barrel.

2, Ethylene: The low-priced supply for March has been largely pre-sold, but poor performance downstream and at the terminal level continues to foster a pessimistic market sentiment. It is expected that the transaction range will be narrowly adjusted between 6950-7350 yuan/ton; the US dollar market is expected to remain between 840-860 USD/ton.

Vinyl acetate: Intermediate dealers of vinyl acetate and some downstream users are digesting their previous stock. The market sees limited new order negotiations, with some lower quotations, intensifying the bearish sentiment. It is expected that in the short term, there may be a narrow downward space for market prices.

core logicCost-wise, the market expectations for ethylene and vinyl acetate are weak, leading to a decrease in cost support. Strong photovoltaic demand provides support, while the petrochemical supply side remains under no pressure and continues to prop up the market. The foam market's rigid demand follows suit without change, and the market may continue to operate in a sideways consolidation.

II. Price List

Three,market outlook

In the short term, the domestic EVA market may continue to show a mid-session consolidation trend. The favorable demand from the photovoltaic sector remains unchanged, and EVA producers continue to maintain their price stance. The supply of foam spot goods is still tight, and downstream foam end-users are resistant to high-price purchases. The situation of weak supply and demand remains in a stalemate, and it is expected that the domestic EVA market will maintain a fluctuating consolidation trend this week. It is forecasted: soft material prices at 11,500-11,800 yuan/ton, hard material prices at 11,300-11,700 yuan/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.