【Plastic Market Morning Update】Oil prices decline! PE and PP fluctuate, while PS and EVA slightly firm up.

Summary: Early morning market update for general plastics on April 2! Market focus shifts from oil-producing country sanctions to U.S. tariff policies, raising concerns about weakened demand prospects, leading to a decline in international oil prices. Limited marginal improvement in supply and demand keeps the PE market fluctuating; weak demand constrains price trends, with PP likely to consolidate within a range. Improved low-price transactions may lead to a slight uptick in PS market prices, while the PVC market remains range-bound. Rising prices in South China keep ABS prices in a narrow consolidation trend. Manufacturers are expected to continue supporting prices, with the EVA market likely to stabilize or consolidate.

PP:

One, Focus Areas

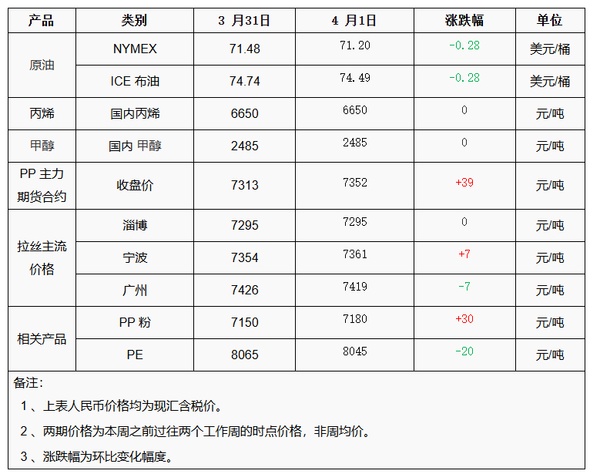

1. On April 1, market attention shifted from oil-producing country sanctions to concerns about US tariff policies, leading to worries about the impact on demand, resulting in a decline in international oil prices. NYMEX crude oil futures contract for May fell by $0.28 per barrel to $71.20, a decrease of -0.39%; ICE Brent crude oil futures contract for June also fell by $0.28 per barrel to $74.49, a decrease of -0.37%. China's INE crude oil futures主力contract for May rose by 11.6 to 549 yuan per barrel, with the night session rising by 4.3 to 553.3 yuan per barrel.

2、April 1: Propylene FOB Korea stabilizes at $800/ton, CFR China stabilizes at $825/ton.

On April 1st, the fifth line (300,000 tons/year) PP unit of Yulong Petrochemical restarted. The PP unit of Yan'an Energy (300,000 tons/year) was shut down for maintenance. The first line (70,000 tons/year) PP unit of Dushanzi Petrochemical was shut down for maintenance. The second line (140,000 tons/year) PP unit of Luoyang Petrochemical was shut down for maintenance. The first line (500,000 tons/year) PP unit of Inner Mongolia Baofeng was shut down for maintenance.

4. According to Lobang Information on April 1st, the two oil polyolefin inventory was 800,000 tons, an increase of 70,000 tons from the previous day.

Core logic:Downstream new orders follow-up is limited, and market action force is insufficient.

Price List

Three, Market Outlook

Recently, international oil prices have been relatively strong, providing ongoing cost support for PP. The number of maintenance shutdowns at upstream production facilities has increased, with the impact of stoppages rising by 18.72%. Coupled with the absence of new capacity additions in the short term, supply-side pressures have temporarily eased. Downstream factories have seen moderate new order follow-ups, with lackluster demand performance constraining price trends. It is expected that the polypropylene market may experience range-bound consolidation today.

PE

1. Points of Interest

1 Cost side:Market attention has shifted from production sanctions on oil-producing countries to the tariffs imposed by the United States, raising concerns that the demand outlook may be affected, leading to a decline in international oil prices. The NYMEX crude oil futures contract for May fell 0.28 USD per barrel to 71.20 USD, a decrease of 0.39%; the ICE Brent crude oil futures contract for June, which is in the process of rollover, fell 0.28 USD per barrel to 74.49 USD, a decrease of 0.37%.

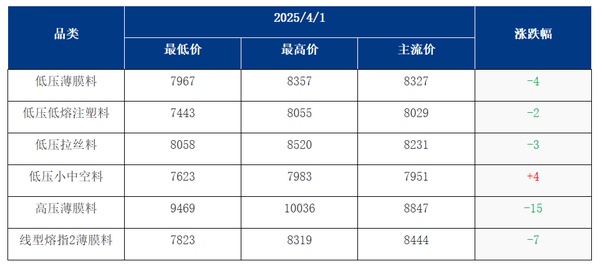

2 Currently, the parking facilities involve 18 polyethylene units, with additional maintenance at Liaoyang Petrochemical, Daqing Petrochemical, and Sichuan Petrochemical units.

3 On the previous day, the domestic polyethylene market mostly declined, with a range of 2-15 yuan/ton. Spot supply was relatively abundant, downstream resistance to high prices persisted, and traders continued to offer slight discounts for shipments, creating a cautious atmosphere.

Price List

Three, Market Outlook

The increase in maintenance operations has led to continued price support upstream in the short term; downstream players are restocking based on pre-holiday essential demand, with market sentiment remaining cautious. In the short term, marginal improvements in supply and demand are limited, and the polyethylene market is expected to fluctuate.

PVC

ABS

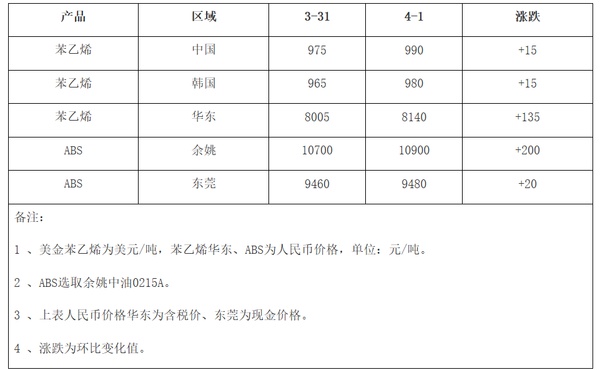

One, Focus Areas

1 、 On April 1st, market attention shifted from oil-producing country sanctions to the U.S. tariff policy, raising concerns that demand prospects would be dragged down, leading to a decline in international oil prices. NYMEX crude oil futures for May contracts fell by $0.28 to $71.20 per barrel, a decrease of 0.39%; ICE Brent oil futures for June contracts fell by $0.28 to $74.49 per barrel, a decrease of 0.37%. In China, the INE crude oil futures main contract for May rose by 11.6 to 549 yuan per barrel, with a night session increase of 4.3 to 553.3 yuan per barrel.

III. Market Outlook

Yesterday, prices in the South China market rose, and prices in the East China market also increased. Terminal demand remained decent, with overall transactions booming. It is expected that today's market prices will maintain a narrow consolidation trend.

PS

One, Focus Areas

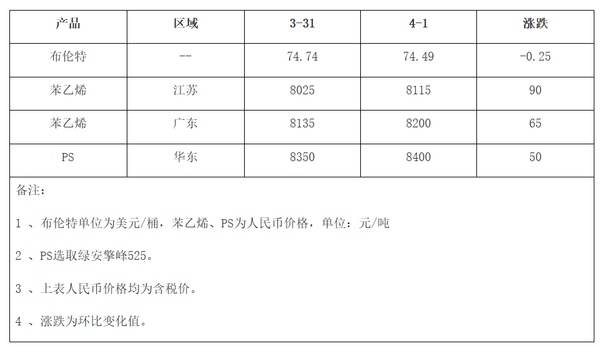

Raw material styrene has experienced a volatile rise, with stronger cost support. However, supply remains at a high level, and demand is not meeting expectations, resulting in an improvement in market sales at lower levels.

II. Price List

3. Market Outlook

The price of raw styrene has been volatile and increased, providing stronger cost support. However, with high supply levels and demand falling short of expectations, there has been some improvement in sales at lower price points. In the short term, the PS market prices may firm slightly. It is expected that the transparent改苯price in the East China market will be between 8,400 to 9,800 RMB per ton. (Note: "透明改苯" might refer to modified transparent polystyrene or another specific product; I've kept it as "transparent改苯" due to uncertainty about the exact context or product name.)

EVA

On April 1st, the market focus shifted from sanctions on oil-producing countries to the US tariff hike policy, with concerns that the demand outlook would be dragged down, leading to a fall in international oil prices. The NYMEX crude oil futures 05 contract dropped by $0.28 per barrel to 71.20, a decrease of 0.39% from the previous day. The ICE Brent crude oil futures switched to the 06 contract, falling by $0.28 per barrel to 74.49, a decrease of 0.37%. China's INE crude oil futures主力contract 2505 rose by 11.6 to 549 yuan per barrel, and the night session increased by 4.3 to 553.3 yuan per barrel.

Core Logic:On the cost side, ethylene and vinyl acetate are weak, reducing the support from the cost side. Some factories have switched to producing EVA foam material, which may add to the supply. Downstream foam demand is following a刚需 (mandatory) pattern, and market sentiment is becoming more relaxed. It is expected that the EVA market will likely remain weak.

Three, Market Outlook

In the short term, the domestic EVA market is expected to remain stable with some consolidation. The supply side is mostly focused on photovoltaic orders, and with the strong support from photovoltaic demand, EVA manufacturers will continue to maintain price stability. Downstream foaming demand remains steady, but transaction volumes are unlikely to increase significantly. Market participants are slightly panicked. It is expected that the domestic EVA market will mainly undergo weak consolidation. Mainstream market prices: hard materials will fluctuate between 11,200-11,600 yuan/ton, soft materials may fluctuate between 11,400-11,700 yuan/ton, and photovoltaic materials will fluctuate between 11,500-11,900 yuan/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track