Plan before action: Understanding Opportunities and Challenges in the 2025 Automotive Market

After experiencing multiple challenges such as the impact of the pandemic, supply chain adjustments, and changes in consumer habits, the Chinese automobile market in 2025 presents a brand-new development pattern. Based on authoritative insurance registration data, this article comprehensively analyzes the real situation of the new car market in China from January to July 2025 from five dimensions: overall market performance, new energy transition, brand competition landscape, technological development trends, and future outlook.

Market Overall Performance: Resilient Recovery and Structural Optimization

The Chinese automobile market showed a remarkable recovery trend in 2025. According to insurance data, the sales of new cars in July 2025 reached 1.867 million units. Reached a new high for the same period since 2017.Compared to the low point of 1.452 million units in 2020, this represents a 28.6% increase, marking that the market has completely emerged from the impact of the pandemic and entered a new phase. Stable in total, optimal in structureThe new stage of development.

The recovery trajectory shows a clear"V-shaped" featureFrom 2017 to 2019, there was a period of high-level consolidation with sales maintaining between 11.82 million and 12.21 million vehicles. In 2020, due to the impact of the pandemic, sales plummeted to 9.485 million vehicles, a year-on-year decrease of 21.8%. In 2021, there was a strong rebound to 12.064 million vehicles, a year-on-year increase of 27.2%. From 2022 to 2024, the market entered a period of steady recovery, with sales gradually climbing. From January to July 2025, the cumulative sales reached 12.704 million vehicles, a year-on-year increase of 7.4%, indicating that market confidence continues to strengthen.

It is worth noting that this recovery is not merely a simple rebound in numbers, but is accompanied by profound structural changes. Although overall sales have surpassed the levels of 2017, the internal composition of the market has undergone fundamental transformation.The traditional fuel vehicle market continues to shrink, while the new energy vehicle market is rapidly emerging.This "mutual adjustment" structure optimization has allowed the Chinese automobile market to achieve a significant improvement in quality while maintaining stable overall volume.

The New Energy Revolution: From Marginal to Mainstream Leapfrog Development

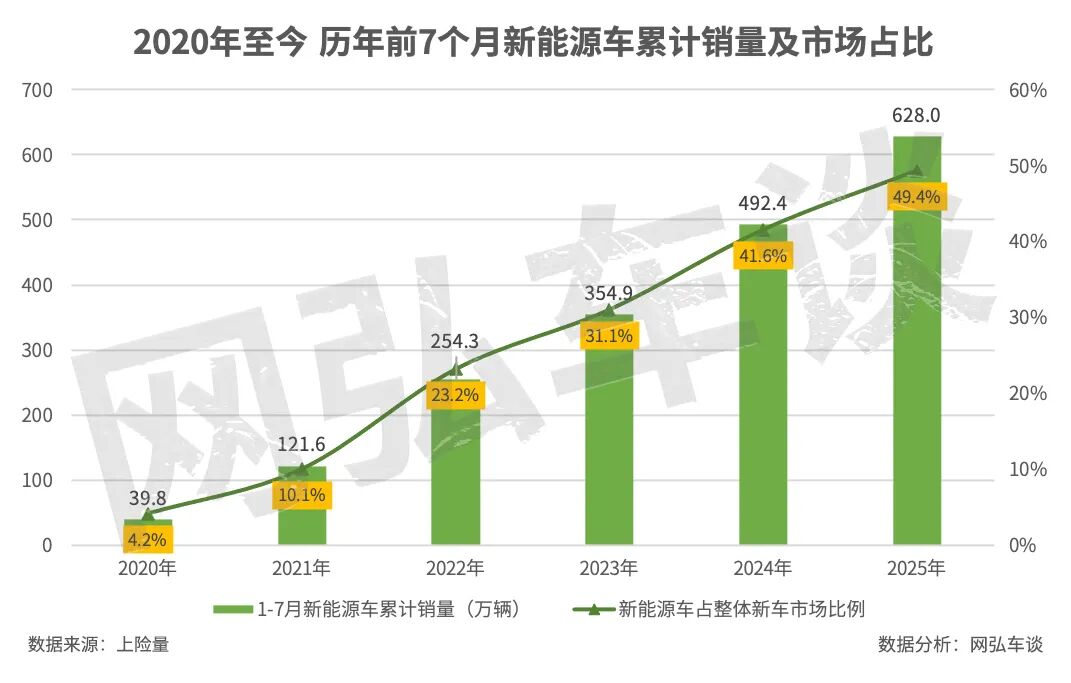

New energy vehicles have become the core engine driving the growth of the Chinese automobile market. From January to July 2025, the cumulative sales of new energy vehicles reached 6.28 million, with the market share rising to 49.4%, nearly occupying half of the market. This figure represents a nearly 16-fold increase compared to the 398,000 units sold in the same period in 2020, with a compound annual growth rate exceeding 60%, demonstrating an astonishing development speed.

From the penetration rate curve, the Chinese new energy vehicle market has experiencedThree key development stages:

From 2020 to 2021: The penetration rate increased from 4.2% to 10.1%, achieving a breakthrough from the nascent stage to initial popularization.

2022-2023: The penetration rate surpassed 20% and exceeded 30%, entering a rapid development phase.

2024-2025: Penetration rate jumps from 41.6% to 49.4%, about to become the market's dominant force.

The explosive growth behind this isThe dual drive of policy and marketOn the policy side, measures such as the dual credit policy, purchase subsidies, and exemption from purchase tax continue to be effective. On the market side, consumer acceptance has increased, product strength has significantly improved, and the cost advantage of usage is becoming increasingly evident. In particular, breakthroughs in battery technology—such as increased energy density and reduced costs—have extended the range of mainstream models from 300km+ to 600km+, greatly alleviating range anxiety.

The improvement of charging infrastructure has also provided strong support for the popularization of new energy vehicles. By July 2025, the number of charging stations nationwide has increased nearly tenfold compared to 2020, the exploration of battery swapping models has made positive progress, and an intelligent charging network has begun to take shape. The improvement of these supporting measures has fundamentally changed the consumer experience.

Brand Competition Landscape: Rise of Independents and Market Restructuring

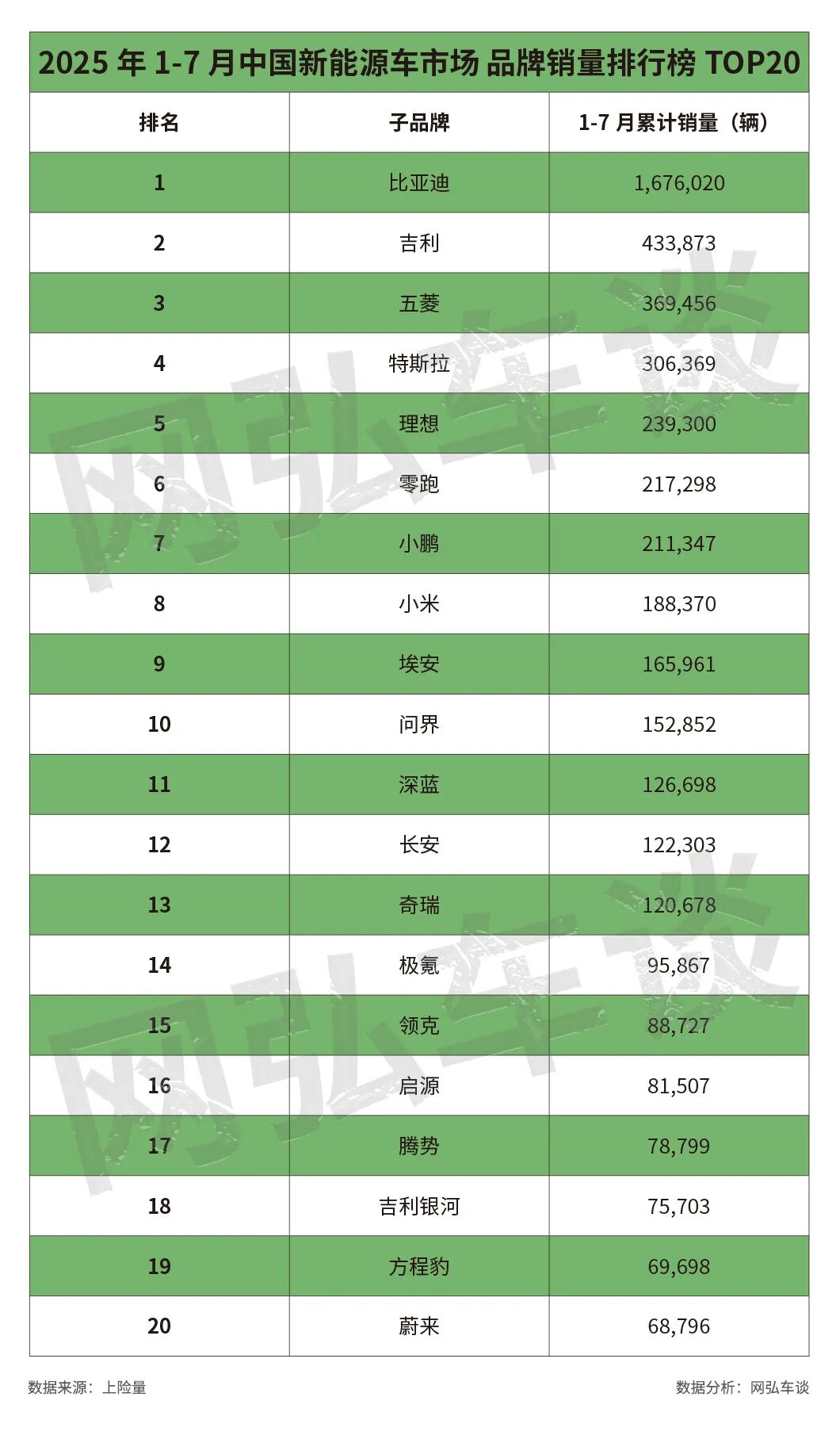

In 2025, the Chinese new energy vehicle market presents a "One superpower, many strong powersBYD leads the competitive landscape with an absolute advantage of 1,676,020 vehicles, surpassing the second-place Geely (433,873 vehicles) by nearly four times, equivalent to the total sales of the 2nd to 10th positions combined, capturing a market share of over 40%, demonstrating unprecedented dominance.

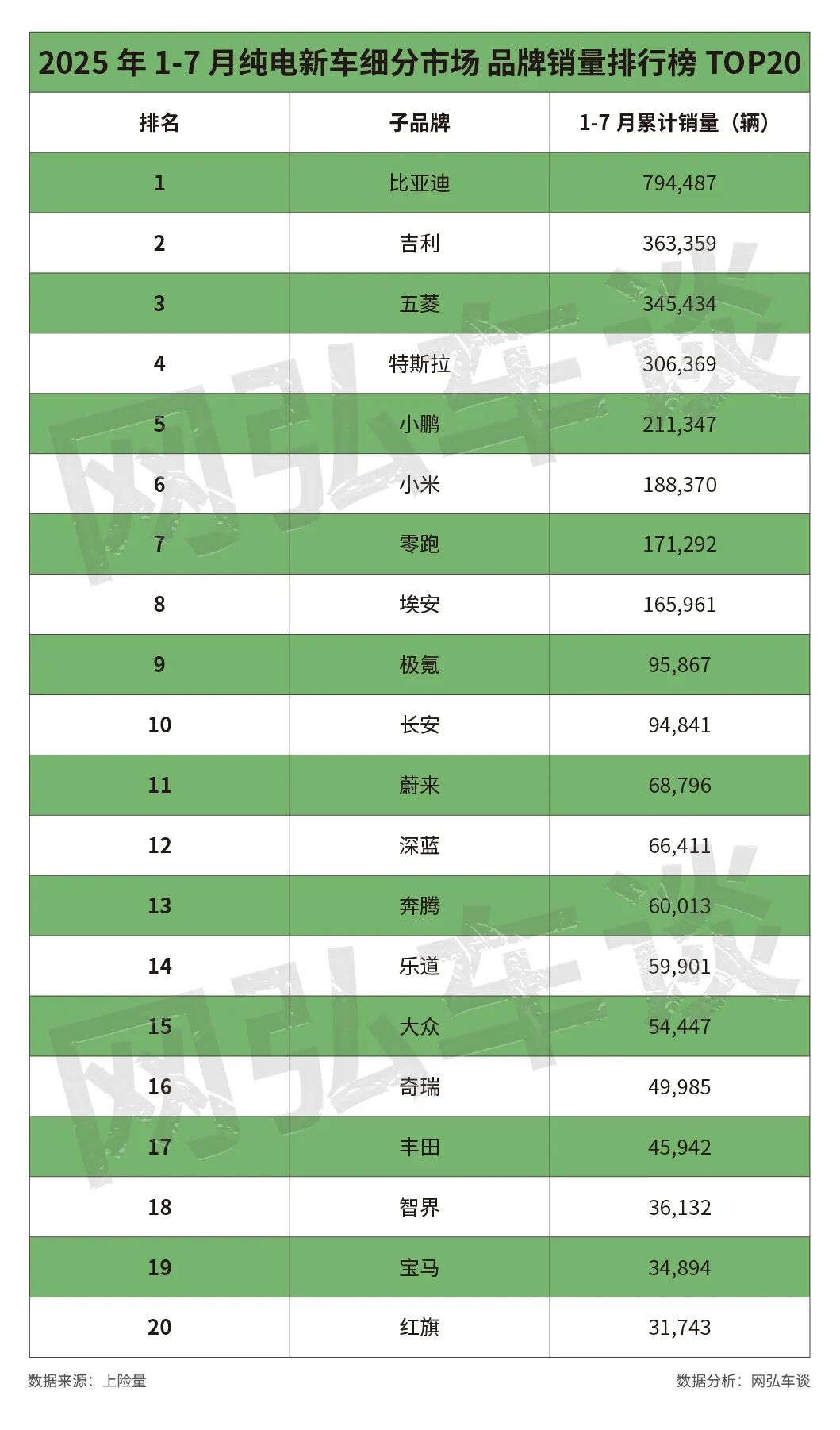

In the pure electric vehicle segment, BYD also leads the way with sales of 794,487 units, more than twice that of second-place Geely (363,359 units). The combined sales of the top five brands account for over 60%, indicating a significant increase in market concentration. Notably, eight out of the top ten are domestic brands, with traditional car manufacturers and new forces advancing side by side, reflecting the comprehensive improvement of Chinese brands in terms of technological accumulation and market recognition.

The division within the new power camp is evident.Ideal (239,300 vehicles), Leapmotor (217,298 vehicles), and XPeng (211,347 vehicles) have shown stable performance, while NIO (68,796 vehicles) is only ranked 20th, reflecting that the differences in product positioning, technical routes, and business models among different companies have begun to show results.

Traditional car companies have shown significant results in their transformation.Geely (including Zeekr, Galaxy) and Changan (including Deep Blue, Qiyuan) have successfully achieved electrification transformation through sub-brand strategies, with multiple sub-brands entering the sales rankings. In contrast, international traditional giants show varied performance. Tesla ranks 4th with 306,369 units, being the only international brand in the top 5, while Volkswagen (15th), Toyota (17th), and BMW (19th) are relatively behind, indicating significant challenges in the transition to pure electric.

Xiaomi Auto, as a new entrant, has performed remarkably, achieving sales of 188,370 units in just seven months, ranking 8th and becoming the biggest dark horse. This phenomenon indicates that in the current market environment, only companies with strong resource integration capabilities and brand influence can successfully break through.

Technological Development Trends: Escalation of Competition from Electrification to Intelligence

As the new energy vehicle market gradually matures, the focus of competition is shifting from...Electrification IntelligentizationIn the early stages, market competition primarily revolved around basic metrics such as range and charging speed. However, by 2025, differentiated competition has fully shifted towards high-tech features like intelligent assisted driving and smart cockpits.

High voltage platform technologyBecoming the standard for leading enterprises. Compared to the traditional 400V system, the 800V high-voltage platform can achieve faster charging speeds and higher energy efficiency, and is penetrating from high-end models to the mainstream market. By the end of 2025, it is expected that over 30% of models will support the 800V high-voltage platform.

Solid-state battery technologyAchieving a breakthrough. Compared to traditional liquid lithium batteries, solid-state batteries offer higher energy density, faster charging speeds, and better safety performance, and are seen as the solution for next-generation power batteries. Several automakers have announced plans to achieve mass production and installation of solid-state batteries in 2026-2027, which may redefine the competitive landscape of the market.

Autonomous driving technologyEntering the commercialization phase of Level 3. By 2025, multiple car manufacturers will launch Level 3 autonomous driving models capable of "hands-off and eyes-off" operation under specific conditions, and the City NOA (Navigate on Autopilot) feature will gradually become widespread. The level of intelligence has become an important consideration for consumers when choosing a vehicle and is also a key source of premium pricing for car manufacturers' products.

Smart cockpit experienceContinual upgrades in multimodal interaction, AR-HUD, and integrated cabin-driving technologies have significantly enhanced the driving experience, with cars evolving from mere transportation tools to becoming a "third living space." Technology companies, leveraging their expertise in artificial intelligence and human-computer interaction, have an inherent advantage in this arena.

Future Prospects: Coexistence of Opportunities and Challenges

Looking ahead, the Chinese automobile market will exhibit the following development trends:

Market penetration continues to improve.It is expected that in the second half of 2025, the market share of new energy vehicles will exceed 50%, officially becoming the market mainstream. By 2030, the penetration rate of new energy vehicles is expected to reach 70-80%, completing the replacement of fuel vehicles.

Technology iteration acceleratesNew technologies such as the 800V high-voltage platform, solid-state batteries, and intelligent driver assistance will reshape the industry landscape. Automakers need to continuously increase R&D investment to maintain a competitive edge at the technological forefront. Meanwhile, the ability to integrate the industry chain will become a core competency, as the full-chain layout from battery materials to intelligent chips will determine the long-term development potential of enterprises.

Global expansion acceleratesChinese new energy brands, while consolidating their domestic market, are accelerating their overseas expansion. Europe, Southeast Asia, and the Middle East are becoming the preferred choices for Chinese car manufacturers looking to go global. It is expected that by the end of 2025, China's export volume of new energy vehicles will exceed 2 million units, making them significant players in the global market.

Business model innovationBattery leasing, vehicle-to-grid separation, and battery swapping models will create more value growth points. Automakers need to transform from mere product providers to mobility service providers, building a full life-cycle service system.

However, the industry development also faces numerous challenges:

Sustainable development after subsidy reductionWith the full withdrawal of new energy vehicle purchase subsidies, the market will need to rely on product strength and cost advantages in use to achieve natural growth. Balancing R&D investment with profitability will become the primary challenge faced by car companies.

Supply chain security riskThe supply and price fluctuations of key raw materials such as lithium, cobalt, and nickel, as well as the issue of independent control over core components like chips, may all impact the stability of industry development. Building a secure and resilient supply chain system is crucial.

Infrastructure development is uneven.Although the charging network is rapidly expanding, the coverage in third- and fourth-tier cities and rural areas is still inadequate, limiting the adoption of new energy vehicles in lower-tier markets. The convenience and reliability of charging and swapping facilities still need to be improved.

Profitability ChallengesExcept for a few companies like BYD and Tesla, most new energy vehicle companies have not yet achieved stable profitability. In the fiercely competitive market environment, quickly reaching the breakeven point and achieving a commercial closed loop is crucial for the survival and development of enterprises.

Conclusion: Strategic Choices in an Era of Transformation

In 2025, China's automotive market is undergoing profound changes. New energy vehicles are about to become the mainstream of the market, the competition in smart technology is increasingly intense, and the industrial landscape is rapidly restructuring. For car companies, this is both a challenge and an opportunity.

Traditional automakersAccelerate the electrification transition, activate existing resources, and achieve a smooth transition for the fuel vehicle business.New emerging automakersIt is necessary to quickly cross the scale threshold and build a sustainable business model.For supply chain companiesStrengthen technological innovation and enhance the autonomous controllability of key components.To consumersThere will be more high-quality and cost-effective new energy vehicle models to choose from, and the driving experience will continue to upgrade.

In this era of transformation, only companies that accurately grasp technological trends, deeply understand consumer needs, and continuously innovate business models can remain invincible in future market competition. China's automotive industry is moving from "following" to "leading," providing Chinese solutions for the transformation and upgrading of the global automotive industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track