PLA Market Oversupply, Hisun Biomaterials' Net Profit in the First Half Decreased by Nearly 90% Year-on-Year, Company Fundraising Project Delayed

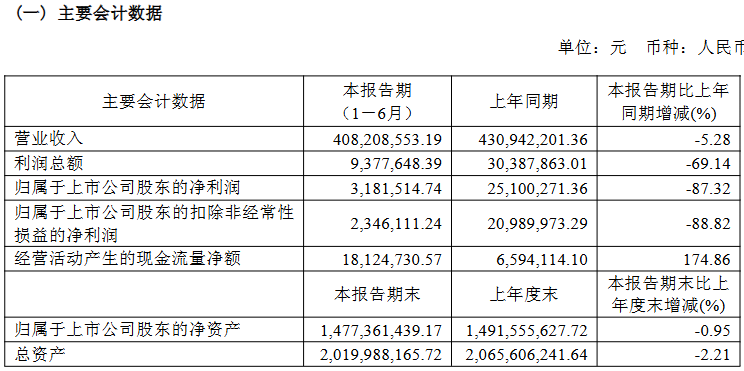

On the evening of August 18,Haizheng BiomaterialsIn the disclosure of the 2025 semi-annual report for (688203), the company achieved a revenue of 408 million yuan in the first half of the year, a decrease of 5.28% year-on-year; the net profit attributable to shareholders was 3.1815 million yuan, a decrease of 87.32% year-on-year.

Hisun BiomaterialsThe company stated that the main reason for the significant decline in net profit was the year-on-year decrease in product prices during the reporting period, which narrowed profit margins, as well as a year-on-year reduction in interest income and government subsidies.

Haizheng BiomaterialsThe gross profit margin has significantly decreased. The semi-annual report shows that the company's gross profit margin is 9.87%, a year-on-year decrease of 3.72 percentage points.

The company is the first in China and the second in the world to commercialize the production of polylactic acid (PLA). Listed on the STAR Market in August 2022, the company’s main products are resin-form polylactic acid, which are used in low-temperature food contact packaging materials, fiber products, heat-resistant household items, disposable tableware, and 3D printing materials.

In the institutional survey conducted in June,Haizheng BiomaterialsThe executive stated that the current polylactic acid market is experiencing an oversupply, with a significant imbalance between supply and demand. In 2024, the global consumption of polylactic acid is expected to be around 260,000 tons, while domestic consumption in China will be about 120,000 tons. Market prices are affected by supply and demand conditions, and both domestic and international companies are expected to introduce new production capacities, which is likely to lead to a further decline in polylactic acid prices in the future. However, the current market price is already close to the cost line, so there won't be much fluctuation in pricing in the future.

Haizheng currently has a pure polylactic acid production capacity of 60,000 tons per year, and the company's existing production lines are operating near full capacity with full sales.

Haizheng BiomaterialsWith the tightening of domestic and international environmental protection policies and the steady advancement of the "plastic restriction and ban" timetable, the domestic polylactic acid (PLA) industry has gradually transitioned from a situation of "external dependency at both ends" to a "dual circulation" pattern of both domestic and international markets. The downstream markets for PLA products at home and abroad have rapidly expanded. Existing competitors of the company all have plans to increase PLA production capacity, and some enterprises have to varying degrees mastered PLA production technology and have already begun constructing new PLA production capacities.

Considering the macro environment, actual implementation of policies, and market conditions in recent years, the company has decided to extend the timeline for its projects funded by raised capital. The completion date for the 150,000-ton annual production capacity polylactic acid project (Phase I) is now extended to before December 2025, while the completion date for the 150,000-ton annual production capacity polylactic acid project (Phase II) is extended to before December 2028. As of the end of the reporting period, the civil engineering works for the 150,000-ton annual production capacity polylactic acid project are basically completed. For Phase I, the equipment installation and commissioning for the 75,000-ton annual production capacity polylactic acid production line, as well as the operation of the production auxiliary building and warehouse system along with personnel deployment, have been completed.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track