[PET Daily Review] Polyester Bottle Chip Market Prices Rise

1 Today's Summary

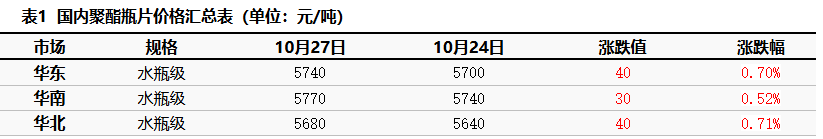

Mainstream factory prices increased by 50-70, while other factories remained stable. Unit: Yuan/Ton

②. Today's domestic polyester bottle chip capacity utilization rate is 73.37%.

2 Spot Overview

Based on the East China region, today's polyester bottle-grade spot price is 5740, unchanged from the previous working day, basically in line with the morning expectations.

Market reports suggest that raw material PTA and bottle chip companies are about to start anti-involution efforts, benefiting the supply side. Raw material prices have surged significantly, with polyester bottle chip factories following the increase by 50-70, and the market focus has subsequently moved upwards. However, downstream and traders are struggling to keep up with the price hikes, with heard morning transactions at 5650-5700, and an afternoon increase of 50, resulting in a large difference in reported and bid prices, leading to sparse transactions. (Unit: Yuan/ton)

|

Figure 1: 2025 Domestic Polyester Bottle Chip Price Trend Chart (Yuan/Ton) |

Figure 2 Price Trend Chart of Domestic Polyester Bottle Chips in 2025 (Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3. Production Dynamics

Today, the capacity utilization rate of polyester bottle flakes has reached 73.37%. In terms of profit, the price of raw material PTA has risen to 4490, MEG price remains stable at 4183, polymerization cost has increased by 34.36 to 5258.22, and the profit for polyester bottle flakes is a loss of 18.22 yuan/ton.

|

Figure 3: Trend Chart of Domestic Polyester Bottle Chip Capacity Utilization Rate for 2024-2025 |

Figure 4: Comparison of Profit and Price of Domestic Polyester Bottle Chips in 2025 (CNY/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data source: Longzhong Information |

4. Market Sentiment

Table 2 Domestic Polyester Bottle Chip Upstream and Downstream Practitioners' Sentiment Expectations (Updated on Monday)

|

Viewpoint |

Quantity |

Proportion |

Month-on-month |

|

Bullish |

5 |

20% |

8% |

|

Bearish |

12 |

48% |

-12% |

|

Flat |

8 |

32% |

4% |

5. Price Forecast

From the supply perspective, new installations are about to start production, contributing effective output in November, but increasing pressure on the supply side. From the demand perspective, entering the off-season, downstream performance is weak, and the consumption of raw materials is slow. Temporarily supported by news, the polyester bottle chip market may maintain a relatively strong pattern. It is expected that tomorrow the spot price of polyester bottle chip water bottle material in the East China region will run within the range of 5700-5800 yuan/ton.

6. Relevant Product Information

PTA Market: East China market PTA prices are organized, with negotiation reference around 4450. This week and next week, main port delivery offers are 01 at a discount of 75-80, with counter-offers at a discount of 80-82 for negotiated transactions. For mid to late November, offers are 01 at a discount of 65-70, with counter-offers at a discount of 70-75 for negotiated transactions. The sentiment in the sector is weak, with absolute prices showing a weak adjustment in the morning. The increase in supply is putting pressure on the market, and insufficient maintenance due to low processing fees is also a factor. As a result, market participants are feeling pressure, leading to limited actual negotiations. (Unit: yuan/ton)

MEG marketToday, the ethylene glycol market showed signs of strengthening. In the morning, the spot price in Zhangjiagang opened around 4155. During the day, the price slightly improved due to some companies announcing maintenance plans for November. In the afternoon, macroeconomic factors boosted a general rebound in commodities, pushing the ethylene glycol spot price above 4200. However, there was insufficient buying interest to follow the rise, and by the afternoon close, the spot price fell back to the 4183-4185 range for negotiations, with the spot basis weakening. In the morning, it was in the 01+80 to 01+83 range. The South China market saw a stalemate between buyers and sellers with low transaction volume.

7. Data Calendar

Table 3 Overview of Domestic Polyester Bottle Chip Data (Unit: 10,000 tons, %)

|

Data |

Release Date |

Last period data |

This period's trend forecast. |

|

Capacity Utilization Rate |

Weekday 17:00 |

73.37% |

→ |

|

Weekly Production |

Thursday 5:00 PM |

33.51 |

→ |

|

Weekly Capacity Utilization Rate |

Thursday 5:00 PM |

73.37% |

→ |

|

Data source: Longzhong Information Remarks: 1 Consider significant fluctuations as those with changes greater than 3%, highlighting the data dimensions with such increases or decreases. 2 Consider narrow fluctuations as those with a price change within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[聚酯瓶片日评]:聚酯瓶片市场价格上扬(20251027)](https://oss.plastmatch.com/zx/image/17447b3134034b8ba424b014ed4e05a5.png)

![[聚酯瓶片日评]:聚酯瓶片市场价格上扬(20251027)](https://oss.plastmatch.com/zx/image/61c337afc7ba40f9b0eaf72e0bf2a245.png)

![[聚酯瓶片日评]:聚酯瓶片市场震荡偏弱(20251013)](https://oss.plastmatch.com/zx/image/5a44178bd7644b5ca7a4d921e93ce724.png)

![[聚酯瓶片日评]:聚酯瓶片市场价格上扬(20251027)](https://oss.plastmatch.com/zx/image/652f1ef3bbf54251ac646f1950b20004.png)