Perspective on Polyt’s Semi-Annual Report: 43.94% Net Profit Growth Driven by Production Capacity Expansion

As the domestic modified plastics market moves forward under pressure, industry leader PRET delivered an impressive report card for the first half of 2025.

The secret behind its net profit growth of 43.94% year-on-year has long been hidden in its production bases spread across the globe and newly established factories.

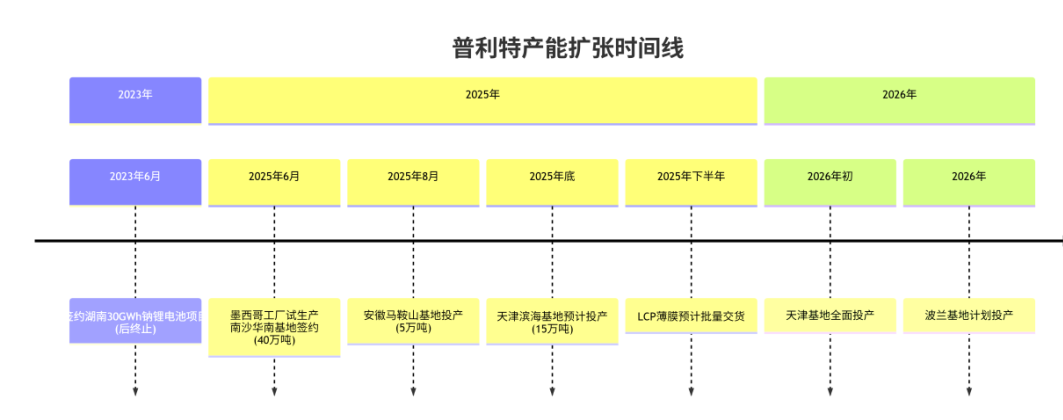

1. Proactive Capacity Deployment Strategy

Recently, Polestar inCapacity expansionFrequent actions in various aspects, the company is...Modified materials fieldContinuously expand production capacity.

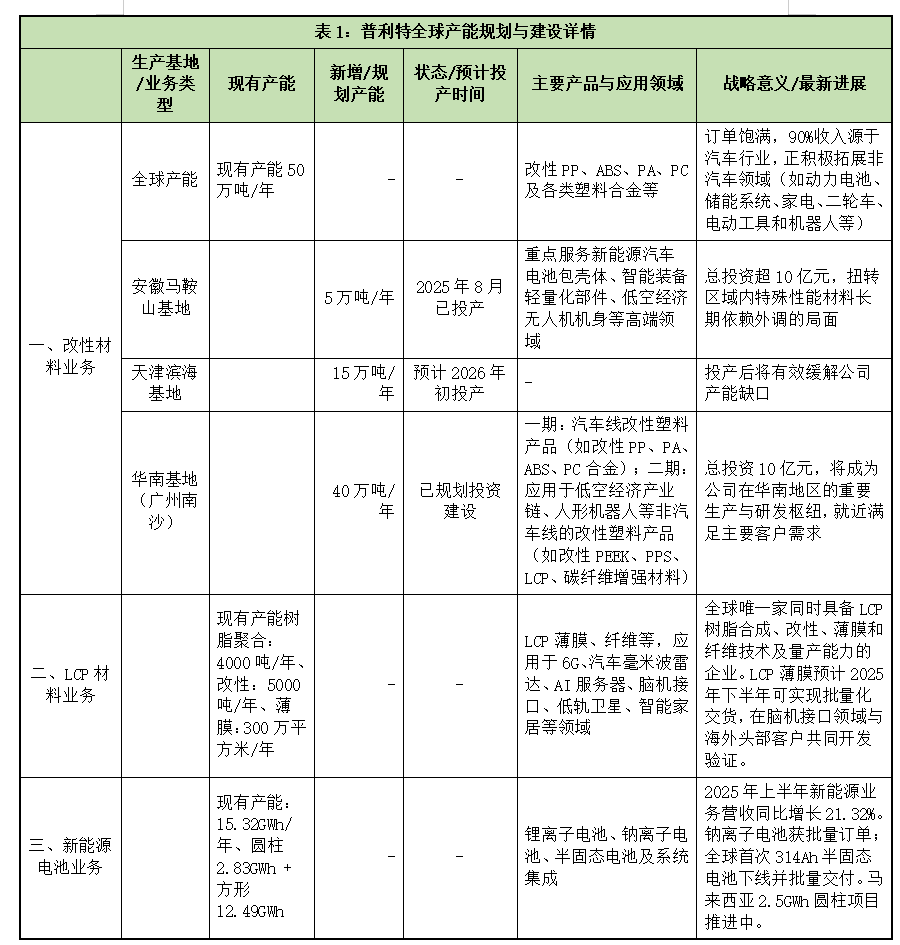

It is reported that there are currently ... established worldwide.12 new material production and manufacturing basesIncluding3 under construction Distributed in Qingpu, Shanghai; Jinshan, Shanghai; Jiaxing, Zhejiang; Tongliang, Chongqing; Wuhan, Hubei; Foshan, Guangdong; Binhai, Tianjin; South Carolina, USA; Chonburi, Thailand; and Monterrey, Mexico.

Current companyExisting production capacity is 500,000 tons.The ongoing projects include the Prett South China Headquarters and R&D Production and Manufacturing Base Project with an expected annual capacity of 400,000 tons, and a new materials factory in Ma'anshan, Anhui, with an expected capacity of 50,000 tons, which is about to start production. The new materials factory in Binhai, Tianjin, with an expected capacity of 150,000 tons, is expected to start production in early 2026.The expected future annual production capacity will exceed 1 million tons.。

2. Overview of Performance in the First Half of 2025

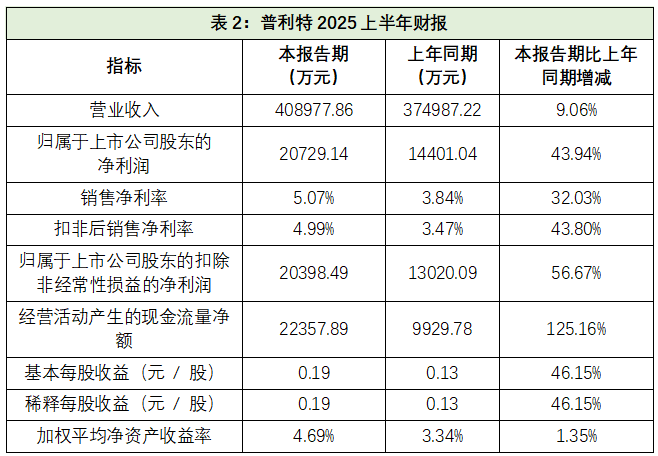

Based on the financial data released by Pret for the first half of 2025, it is not difficult to identify the logic behind its active efforts to expand global production capacity.

Pritt achieves in the first half of 2025.Total operating income: 4,089.7786 million RMB,Year-on-year growth of 9.06%ImplementNet profit attributable to shareholders is 207.29 million yuan.,Increased by 43.94% compared to the same period last year.

Overall, the financial data for the first half of 2025 shows thatThe overall positive trend.

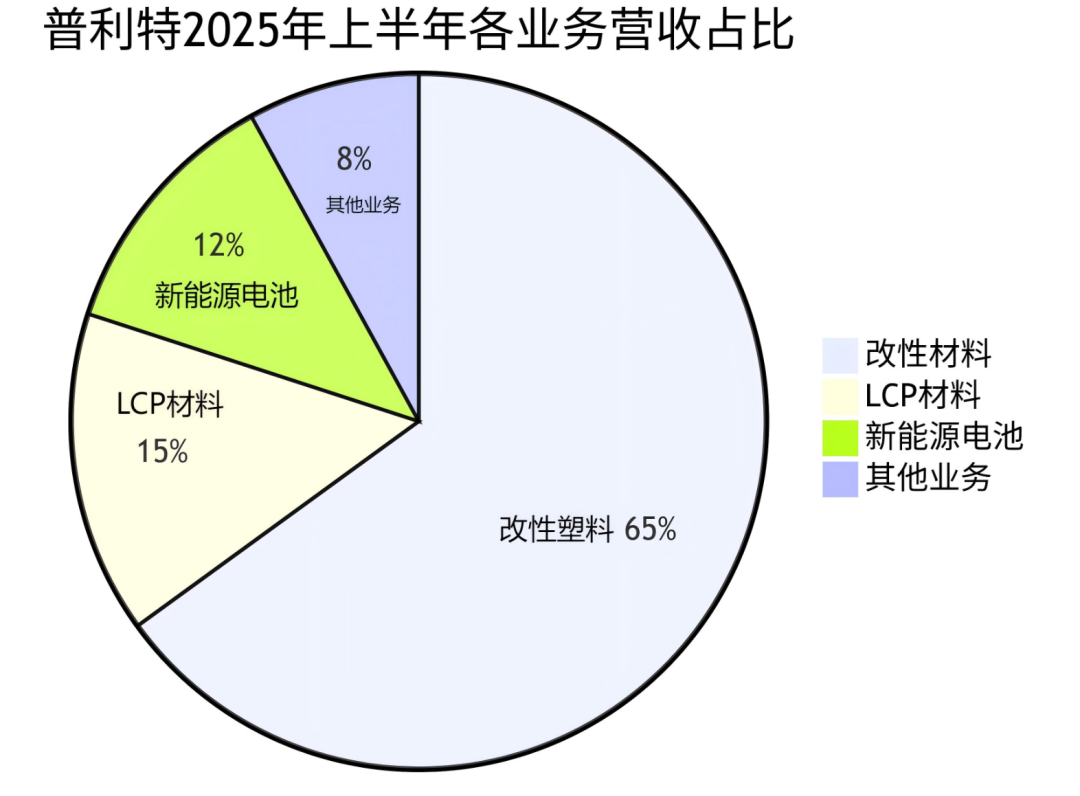

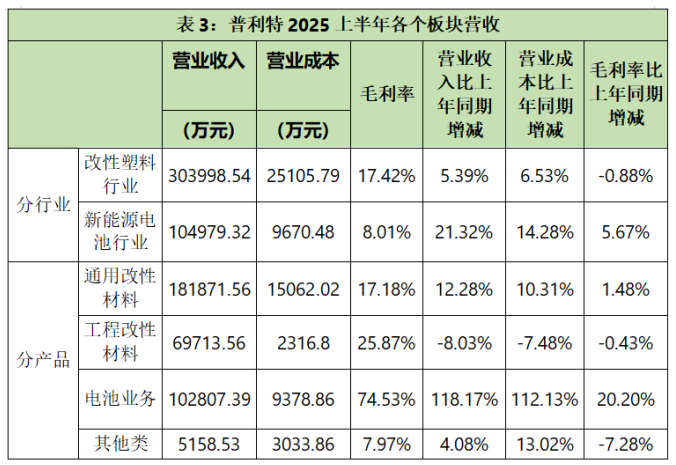

It is worth noting that the net profit in the first half of 2025 has increased year-on-year.43.94%The main growth drivers are attributed to the coordinated growth across various sectors, as can be seen from the following two charts:

It can be clearly seen from the figure:

Modified materials are the company's foundation and ballast.With the highest revenue contribution (about 65%), its stable double-digit growth has provided a solid foundation for overall profits.

New Energy Battery BusinessWith a considerable revenue proportion (about 25%) and a rapid growth rate, it is an important incremental contributor.

LCP materialsAlthough the current revenue share is small, it is growing at an astonishing rate (about 50%) and is a new growth pole with great potential.

3. Cause Analysis

Pret’s rapid development in recent years is closely linked to its long-standing commitment to the strategy of “internal and external improvement, dual-wheel drive.” Now, the company has gradually...The transformation of traditional modified plastics enterprises follows a development path of "deep modification—functional materials—platform technology."The evolution trend.

In the short term, the successive commissioning of new production capacities in Anhui, Tianjin, and other regions is expected to further strengthen their advantages in the field of modified materials, providing stable support for overall performance.

In the medium term, the application of LCP films in consumer electronics (such as AI smartphone antennas) is gradually expanding, while the promotion of sodium batteries and semi-solid-state batteries in the energy storage market is expected to create new growth drivers.

In terms of long-term planning, the company is also conducting materials research and validation in cutting-edge technology fields such as brain-computer interfaces and low Earth orbit satellites, gradually building platform capabilities to provide material solutions for high-tech applications.

4. Future Prospects

By steadily advancing global capacity layout and optimizing product structure, Polynt is expected to achieve more balanced development in terms of profitability and growth potential.

In the context of the current industry transformation, the company is gradually expanding by leveraging strategic patience and technological accumulation."New Materials + New Energy"This path also reflects that manufacturing enterprises need to continuously drive technological innovation and enhance their position in the value chain in order to better seize future growth opportunities.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track