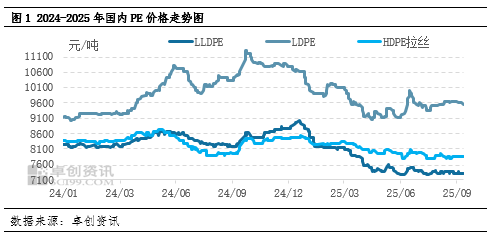

[PE Weekly Review] Demand Falls Short of Expectations, Purchasing Enthusiasm Remains Low

1Market Review: Slight Downward Shift in Price Focus

1.1Domestic closing price

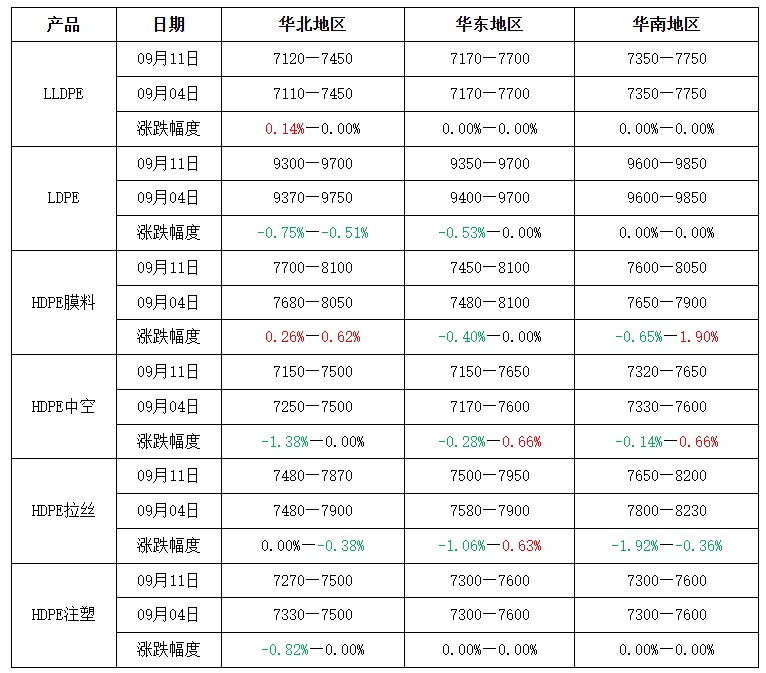

This week, the domestic PE market price has slightly declined.Crude oil prices fluctuated significantly during the week. Although there were several consecutive days of increases, the boost to the polyethylene market was limited. During the week, production lines such as Wanhua Chemical and Shanghai Petrochemical resumed operations, but new shutdowns occurred at facilities including Yangzi Petrochemical, Sinochem Quanzhou, and Dushanzi Petrochemical. As a result, weekly maintenance losses remained at a high level for the year, and petrochemical inventories were at relatively low levels for the year, so overall supply pressure was not significant. Downstream agricultural film industry operating rates continued to rise, with major manufacturers maintaining high operating levels, but purchasing enthusiasm in the market was not high. Operating rates in other downstream sectors fluctuated only slightly. At present, the "Golden September" peak demand season has not met expectations, market participants are cautious, and spot prices have fallen slightly within a narrow range. Currently, mainstream linear polyethylene prices are between 7,120 and 7,750 yuan/ton, with some small increases and fluctuations of around 10 yuan/ton. Mainstream high-pressure polyethylene prices are between 9,300 and 9,850 yuan/ton, with some prices softening and fluctuations ranging from 50 to 70 yuan/ton. Prices for various low-pressure polyethylene products have seen both increases and decreases, with fluctuations ranging from 20 to 150 yuan/ton.

Table 1: Overview of PE Market Prices in Various Regions of the Country

Unit: yuan/ton

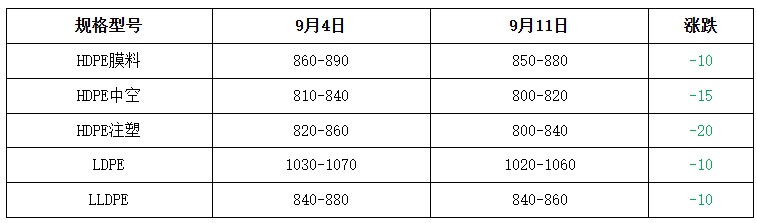

1.2 U.S. dollar market price

The US dollar PE market declined this week.In the linear segment, the weekly quotation dropped by 10 USD/ton, with intended transaction prices ranging from 840 to 860 USD/ton. In the high-pressure segment, the weekly quotation also fell by 10 USD/ton, with intended transaction prices between 1020 and 1060 USD/ton. In the low-pressure film segment, the weekly quotation declined by 10 USD/ton, with intended transaction prices at 850 to 880 USD/ton, accompanied by forward letters of credit. Zhuo Chuang Information believes that overall oil prices are experiencing significant volatility, but this has limited impact on market sentiment. Regarding imports, although some shipments from a Middle Eastern country have arrived at the port, the arrival of near-ocean resources has decreased, resulting in little change in total import volume. From the domestic supply perspective, the domestic PE maintenance loss volume stands at 151,900 tons, an increase of 2.85 tons compared to the previous period, with weekly maintenance losses reaching the highest point of the year, leading to a slight reduction in overall supply. On the demand side, downstream demand remains weak, with limited follow-up on new factory orders; mostly small, necessity-driven purchases dominate, exerting bearish pressure on raw material prices. Looking at both domestic and international markets, although some product import windows have opened, considering shipping schedules, domestic traders are generally cautious and hesitant to take the lead, resulting in limited market transaction volumes.

Table 2 Domestic PE USD Market Price Statistics

Unit: USD/ton

2.Driving factors:This week, the operating rate of downstream has partially increased.

This week, the operating rate of some downstream PE sectors has increased.This week, the operating rate of agricultural film increased by 5 percentage points to 45%, and the operating rate of pipe materials increased by 1 percentage point to 33%. Other operating rates remained stable, with mainstream operating rates across various downstream industries currently ranging from 33% to 53%. This week marks the traditional peak demand season of "Golden September" for agricultural films, with further follow-up on greenhouse film orders. Some factories have accumulated orders, maintaining a high operating rate. In North China, the demand for garlic mulch film is following up, significantly boosting the operating rates of mulch film factories, leading to a further increase in overall operating rates. Regarding pipe materials, downstream demand has not improved as expected, with most factories operating at a limited recovery rate of around 20% to 40%. Those with better order follow-ups can reach 40% to 50%. The order cycle is shorter compared to previous years, and with cautious demand expectations, factories are not inclined to engage in speculative stocking. Instead, they primarily procure as needed based on order situations.

3Market Outlook: Spot market prices are expected to fluctuate within a narrow range.

Zhuo Chuang Information expects that the domestic PE market prices will fluctuate and consolidate next week, with mainstream LLDPE prices ranging from 7,120 to 7,750 yuan/ton.Next week, uncertainties will lead to wide fluctuations in oil prices, providing limited support to spot market prices. From the perspective of domestic supply, it is expected that PE planned maintenance losses next week will be 126,600 tons, a decrease of 25,300 tons week-on-week. Among them, LLDPE maintenance losses will be 24,300 tons, down 11,000 tons week-on-week, indicating an increase in domestic supply. In terms of demand, although the agricultural film industry is in the peak season and purchase frequency has increased, order follow-up is slow, mostly limited to just-in-time procurement. The packaging film industry may have some support from new orders, but end-user purchasing has slowed down, resulting in insufficient overall demand growth. In summary, downstream industries have insufficient follow-up on new orders in the short term, limiting upward price momentum. It is expected that next week the LLDPE market price will mainly fluctuate and consolidate.

Supply:The preliminary estimate for the domestic PE maintenance loss in the next period is 126,600 tons, a decrease of 25,300 tons compared to this period. Among them, the loss for LLDPE is 24,300 tons, LDPE is 16,500 tons, and HDPE is 85,800 tons. On the import side, ocean-going shipments are gradually arriving at ports, with a slight increase in the supply of some products, leading to overall increased supply pressure.

Demand: Translate the above content into English and output the translation directly without any explanations.The agricultural film industry is experiencing its traditional peak demand season, and orders for film manufacturers may continue to follow suit. Overall operations are expected to further improve with the increase in orders, and factories are increasingly demanding raw materials, showing a significantly higher enthusiasm for market procurement. Demand in the foaming industry is improving to a reasonable extent, with some stockpiling. For other downstream industries, demand growth is relatively limited, primarily maintaining production with on-demand procurement. Overall, the demand side provides some support to the market.

Cost:Next week, the key to oil price trends will be whether the Russia-Ukraine issue and the Middle East issue gradually cool down or further escalate. The uncertainty factors will lead to wide fluctuations in oil prices, with the average price of US crude oil at $63 per barrel, and a fluctuation range between $60 and $65 per barrel. If the situation further escalates, crude oil prices will rise further, and attention should be paid to the resistance situation at the key $65 level for US crude oil. Otherwise, if the US requests a conversation with Putin and mediates with Israel, leading to a cooling of the situation, crude oil prices will fall. Therefore, geopolitics will dominate the oil price trend next week, and the Fed's interest rate cuts have been largely priced in, so they will not cause significant disturbances to oil prices. Wide fluctuations in oil prices will be the main trend. In terms of risks, one is the smooth progress of Russia-Ukraine negotiations; the other is the Fed increasing interest rate cuts.

Macro aspect:In August, the consumer market operated steadily overall, with the Consumer Price Index (CPI) remaining flat month-on-month and decreasing by 0.4% year-on-year. The core CPI, excluding food and energy prices, rose by 0.9% year-on-year, with the growth rate expanding for the fourth consecutive month. The domestic market competition order continued to optimize, and supply-demand relationships in some industries improved. The Producer Price Index (PPI) for industrial producers shifted from a 0.2% decline in the previous month to being flat month-on-month; it decreased by 2.9% year-on-year, with the decline narrowing by 0.7 percentage points compared to the previous month.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track