PE Pipe: Price Hits 5-Year Low! 2025 Market Trend Analysis

[Introduction]:From January to August 2025, the market prices of PE pipes were all lower than the same period in previous years, with the fluctuation range being narrower than in past years, overall showing a trend of weak oscillation. There were also instances of temporary price increases. Under the phased influences of macroeconomic factors, costs, and supply and demand, the price trend in 2025 exhibited phenomena that broke seasonal patterns during multiple time periods, with the pressure from demand noticeably intensifying.

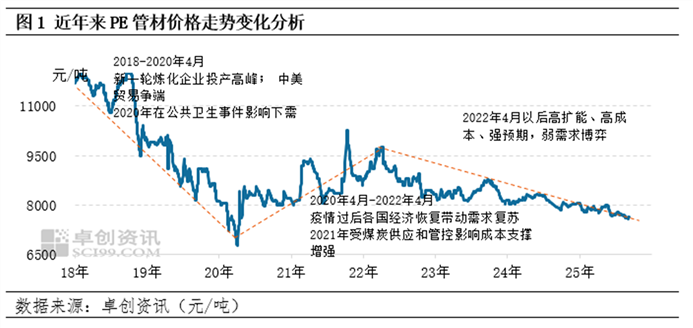

From 2018 to 2025, the market price of PE pipes generally shows an inverted "N" trend. In 2020, due to the impact of public health events, poor recovery in demand, and the sharp drop in crude oil prices, the market price fell to a nearly five-year low of 6,750 yuan/ton in early April 2020. Subsequently, as downstream demand gradually recovered and upstream raw material crude oil prices repeatedly rose, cost support strengthened, reaching a high point of 9,800 yuan/ton in mid-October 2021. Following this, with the gradual release of production from new capacity installations and the slow recovery of demand, PE pipe prices began to decline. From 2023 to 2025, prices are heavily influenced by policy guidance, with strong expectations and weak reality in a long-term state of contention. Additionally, with the commissioning of previous PE pipe installations, pressure on the supply side continues to increase, and prices maintain a low-level oscillation.

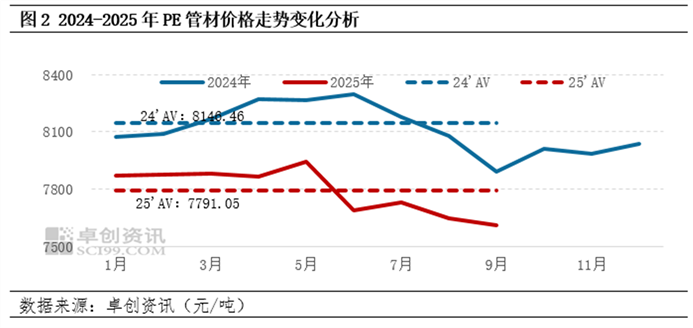

From January to August 2025, the market price of PE pipes remained below the levels of previous years during the same period, with price fluctuations narrowing compared to previous years. Taking the price of YGH041 from Sinopec Shanghai Petrochemical in East China as an example, the average price from January to August 2025 was 7,791.05 yuan/ton, down 4.36% from the same period last year. The price peaked in May and bottomed out in August, with a fluctuation range of 440 yuan/ton, compared to 500 yuan/ton last year, indicating an overall narrowing of price volatility. Overall, the price of PE pipes from January to August 2025 showed a trend of fluctuating weakness, though there were brief periods of price increases. These price rises were mainly driven by the combined effects of three factors: firstly, the sustained implementation of macroeconomic policies provided effective support to the market; secondly, the high international crude oil prices led to a cost-push effect; and thirdly, there were market benefits from periodic supply shortages. On the other hand, price declines were primarily due to two constraining factors: on the one hand, the recovery in demand fell short of expectations, resulting in a gap between actual and anticipated demand; on the other hand, the periodic oversupply in the market led to sluggish inventory reduction, creating supply-side pressure that had a clear suppressive effect on spot market prices.

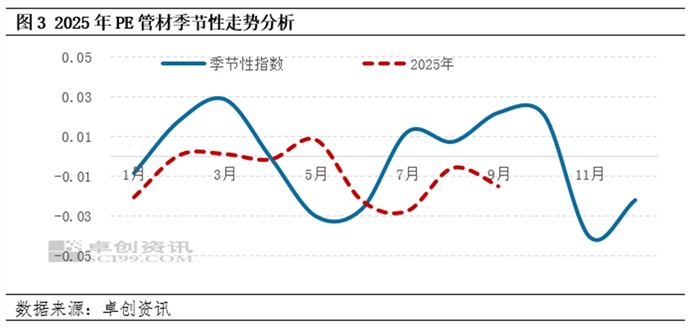

Based on the seasonal patterns over the past five years, the months of February to March and November to December typically experience month-on-month increases, while the months from July to October usually see month-on-month declines. The peaks occur in March and October, and the troughs occur in May to June and November.

In 2025, certain periods within the year broke the seasonal pattern. In May, an off-season price increase occurred, mainly driven by positive macroeconomic news and strengthened support from crude oil costs, along with enhanced supply support. These factors collectively boosted the pipe market, resulting in month-on-month price increases. However, in July and August, as well as early September, the market experienced an off-season price decline. During this period, although the incremental supply was limited and overall pressure was not significant, the traditional demand off-season and weak actual demand recovery caused market participants to adopt a cautious mindset. Downstream buyers maintained low-price, just-needed purchases, and transactions failed to expand, suppressing spot market activity. From July to September, the downward price trend was difficult to reverse, remaining in a continuous decline phase.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track