[PE Daily Review] Narrow Price Fluctuations Supported by Downstream Rigid Demand

1. Today's Summary

OPEC+'s planned production increase for October is relatively moderate, and the risk of U.S. sanctions against some oil-producing countries remains, leading to a rise in international oil prices. NYMEX crude oil futures for October settled at $62.26 per barrel, up $0.39 or 0.63% week-on-week; ICE Brent crude oil futures for November settled at $66.02 per barrel, up $0.52 or 0.79% week-on-week.

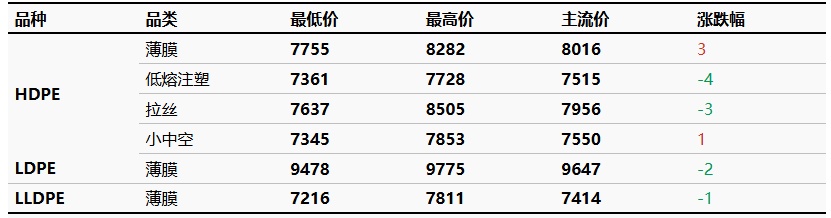

②、 The price change range in the HDPE market is -4 to 3 yuan/ton, in the LDPE market -2 yuan/ton, and in the LLDPE market -1 yuan/ton.

2. Spot Market Overview

Table 1 Domestic Polyethylene Closing Price Summary Table (Unit: Yuan) /ton)

Support from the raw material side remains, and production enterprises have increased maintenance of equipment, resulting in a reduction in output. However, downstream peak season orders have not been fulfilled, leading to weakened market confidence. Today's transactions are maintained at just-needed levels. The market price change for HDPE is -4 to 3 yuan/ton, for LDPE is -2 yuan/ton, and for LLDPE is -1 yuan/ton.

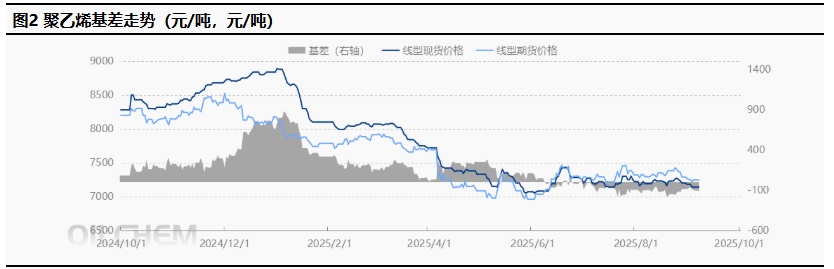

3 translates to "spot-futures basis" in English.

The LL main contract fluctuated downward, opening at 7,248 yuan/ton and closing at 7,229 yuan/ton by 15:00, remaining stable compared to the previous settlement price. The trading volume was 165,800 lots, and the open interest was 518,000 lots. Today's futures-spot basis was 7,150 yuan/ton, compared to the previous working day's +7,261 yuan/ton.

4 Production Dynamics

Capacity utilization rate from The percentage changed from 78.25% to 78.17%. The cost of oil-based production is 7,452 yuan/ton; the oil-based profit is -202 yuan/ton; the coal-based profit is 962 yuan/ton.

|

Graph 3 Domestic Polyethylene Capacity Utilization Trend |

Figure 4 Comparison of Domestic Polyethylene Profit and Price (Yuan) /ton) |

![[PE日评]:下游刚需支撑,价格窄幅波动(20250909) [PE日评]:下游刚需支撑,价格窄幅波动(20250909)](https://oss.plastmatch.com/zx/image/484eb1e880c44d41998e32179a510a95.png) |

![[PE日评]:下游刚需支撑,价格窄幅波动(20250909) [PE日评]:下游刚需支撑,价格窄幅波动(20250909)](https://oss.plastmatch.com/zx/image/d2adea9bf09b4e558422c21988d18a99.png) |

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

5 Market sentiment

Table 2 Domestic Polyethylene Upstream and Downstream Industry Participants' Sentiment and Expectations

|

Date |

Bearish |

Bullish |

Steady look |

|

This week |

16.8% |

16.3% |

66.8% |

|

Last week |

17.8% |

18.8% |

63.4% |

|

Rise and fall |

-1.0% |

-2.5% |

3.5% |

|

Data source: Longzhong Information |

|||

|

Note: The above data is updated every Thursday. |

|||

6. Price Prediction

In the short term, On the supply side, inventory pressure is easing. On the demand side, downstream gradually enters the traditional peak season, but downstream enterprises still have certain inventory, and order growth is not significant, mainly maintaining rigid demand. Therefore, it is expected that the polyethylene market will experience narrow fluctuations tomorrow. 。

7. Relevant Product Information

Crude Oil Market: The main trading logic of the international crude oil market has not changed. The bullish factors include the continuation of U.S. sanctions policy on oil-producing countries and uncertainties in geopolitical situations, while the bearish factors are OPEC+ maintains its stance on production increases, and the global economy remains weak. The production increase by OPEC+ is smaller than expected, providing limited suppression to oil prices. Currently, the situation between the United States and Venezuela, as well as the Russia-Ukraine and Israel-Palestine conflicts, remains unstable. Geopolitical tensions have strengthened support for oil prices, and it is expected that... Bright International oil prices are expected to show a slight upward trend.

8. Data Calendar

Table 3 Domestic Polyethylene Data Overview Table (Unit: Ten Thousand Tons)

|

Data |

Publication Date |

Previous period data |

This period's trend is expected |

|

Total Inventory of PE Production Enterprises (10,000 tons) |

Wednesday 17:00PM |

45.08 |

↘ |

|

PE Social Sample Warehouse Inventory |

Tuesday 17:00PM |

-0.27% |

↘ |

|

Weekly PE Production (10,000 tons) |

Thursday 17:00PM |

63.25 |

↗ |

|

PE maintenance impact volume (10,000 tons) |

Thursday 17:00PM |

12.33 |

↘ |

|

PE Weekly Capacity Utilization Rate |

Thursday 17:00PM |

80.55% |

↗ |

|

Capacity Utilization Rate of Downstream Industries in PE |

Thursday 17:00PM |

0.80% |

↗ |

|

PE Mentality Survey |

Thursday 12:00AM |

-0.99% |

↘ |

|

Data Source: Longzhong Information Remarks: 1. ↓↑ are regarded as significant fluctuations, highlighting data dimensions with a price change exceeding 3%. 2. ↗↘ are regarded as narrow fluctuations, highlighting data with changes within the range of 0-3%. The above data is updated every Thursday. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track