[PE Daily Review] Fluctuation 1-13! There is a trend of increasing supply, and it is expected that the PE market will experience minor fluctuations.

1Today's summary

On March 3rd, the market is worried that the U.S. tariffs will drag down the global economy and demand, and it is uncertain whether OPEC+ can postpone its production increase plan, leading to a decline in international oil prices. NYMEX crude oil futures for April fell by $1.39 to $68.37 per barrel, a decrease of 1.99%; ICE Brent crude futures for May fell by $1.19 to $71.62 per barrel, a decrease of 1.63%. China's INE crude oil futures main contract for 2504 fell by 3.3 to 539.2 yuan per barrel, and in the night session, it fell by 12.7 to 526.5 yuan per barrel.

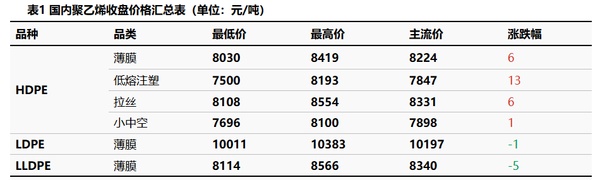

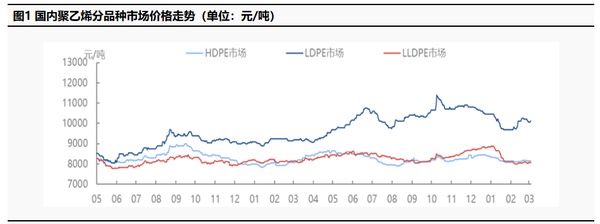

Today, the HDPE market price has increased by 1-13 yuan/ton; the LDPE market price has slightly decreased by 1 yuan/ton; the LLDPE market price has slightly decreased by 5 yuan/ton.

2Spot Overview

Today's domestic polyethylene spot market prices showed mixed trends. The HDPE spot market prices adjusted by 1-13 yuan per ton, with some upward adjustments influenced by news of maintenance and production conversion. However, the increase was limited. The LDPE spot market prices slightly decreased by 1 yuan per ton; although some low-end market resources were reduced, participants were not very enthusiastic about purchasing, leading to only slight fluctuations in overall market prices. The LLDPE spot market prices slightly decreased by 5 yuan per ton; in the short term, there was no new supply pressure, but spot supplies remained relatively abundant. Negative macroeconomic signals were released, resulting in more transactions at lower price points.

3Futures basis

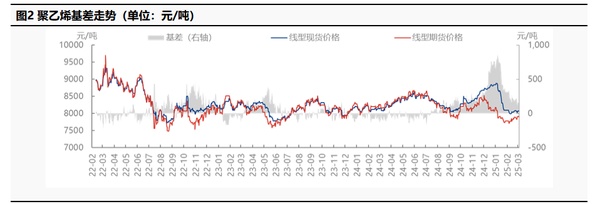

The LL main contract fluctuated downwards, opening at 7,927 yuan/ton, and closing at 7,905 yuan/ton by 15:00, which is 10 yuan/ton lower than the previous settlement price. The trading volume was 251,200 contracts, and the open interest was 496,100 contracts, an increase of 12,300 contracts. Today's futures-spot basis is 165 yuan/ton, an increase of 21 yuan/ton compared to the previous working day's basis.

4Production Dynamics

Polyethylene capacity utilization rate fell from 88.48% to 86.25%, a decrease of 2.23% on a monthly basis. There is no resumption of maintenance equipment today, and there are additional shutdowns at the HDPE Phase II unit of Sino-Korean Petrochemical and HDPE equipment of a certain company in Tianjin. The oil-based cost is 8036 yuan/ton, a decrease of 125 yuan/ton compared to the previous working day; the oil-based profit is 164 yuan/ton, an increase of 125 yuan/ton compared to the previous working day; the coal-based profit is 1861 yuan/ton, unchanged from the previous working day.

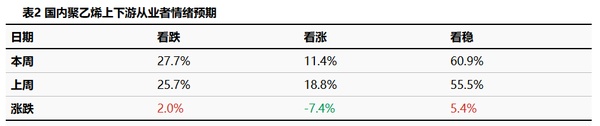

5market sentiment

6Price Prediction

In the short term, although downstream demand is continuously increasing and production enterprises also have a trend of price support, the supply is expected to increase after the middle of the month with the full production of new capacity from Shandong Xinsidai and Inner Mongolia Baofeng. This might negatively impact the price increase. At that time, it is expected that the market price will fluctuate within a narrow range.

7, Related product information

Oil market:In the short term, the main trading logic of the international crude oil market has not changed. The bullish factors come from the continued production cut by OPEC+, the U.S. strengthening sanctions on Iran, and the improved demand outlook in Asia, while the bearish factors are Trump's tariff policies, a strong U.S. dollar, and easing geopolitical tensions. The U.S. has begun implementing tariff increases on multiple countries, raising concerns about demand, and the potential easing of sanctions on Russia could reduce supply risks. It is expected that international crude oil prices will fall today.

8Data Calendar

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track