PE Daily Review: Enterprises Reduce Prices to Deplete Inventory, Downstream Demand for Essential Purchases

1. Today's Summary

1. The Israeli-Palestinian sides have reached a ceasefire agreement, and the instability of the geopolitical situation has eased, leading to a decline in international oil prices. NYMEX crude oil futures for November are at $61.51, down $1.04 per barrel, a decrease of 1.66%; ICE Brent crude futures for December are at $65.22, down $1.03 per barrel, a decrease of 1.55%.

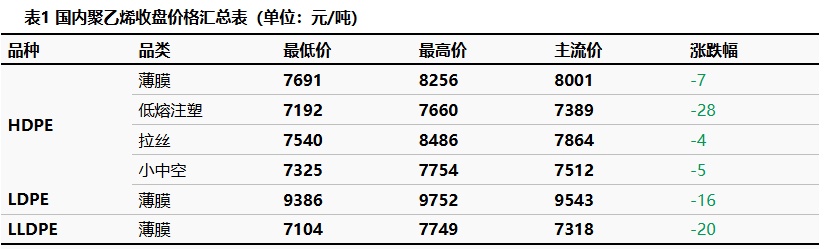

②、 The price fluctuation range for the HDPE market is -28 to 4 yuan/ton, the LDPE market price is -16 yuan/ton, and the LLDPE market price is -20 yuan/ton.

2. Spot Overview

Recently, the arrival of imported resources has increased, leading to an accumulation of domestic inventory. Orders are maintained on a just-needed basis, and industry insiders hold a rather pessimistic view of the market outlook. The focus is primarily on offering discounts to reduce inventory. The price fluctuation range for the HDPE market is -28 to 4 yuan/ton, the market price for LDPE is -16 yuan/ton, and the market price for LLDPE is -20 yuan/ton.

3

The main LL contract fluctuated downward, opening at 7,075 yuan/ton. As of 15:00, the closing price was 7,037 yuan/ton, down 36 yuan/ton compared to the previous settlement price. The trading volume was 225,100 lots, and the open interest was 557,900 lots. Today's futures-spot basis was -17 yuan/ton, up 10 yuan/ton from the previous working day.

4 Production Dynamics

Capacity utilization is The change from 75.37% to 74.44%. The cost of oil production is 7,387 yuan/ton; the oil production profit is -237 yuan/ton; the coal production profit is 602 yuan/ton.

|

Figure 3 Domestic polyethylene capacity utilization trend |

Figure 4 Domestic polyethylene profit and price comparison (yuan) /ton) |

![[PE日评]:库存累积,商家让利去库为主(20251009)](https://oss.plastmatch.com/zx/image/715c3af87b2a45aea7ee67c31c11472e.png) |

![[PE日评]:库存累积,商家让利去库为主(20251009)](https://oss.plastmatch.com/zx/image/5960a3fe2dc34271b69d6a259493f50f.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

5 Market sentiment

Table 2. Sentiment Expectations of Domestic Polyethylene Upstream and Downstream Practitioners

|

Date |

Bearish |

Bullish |

Steady watching |

|

This week |

25.7% |

5.9% |

68.3% |

|

Last week |

20.3% |

9.4% |

70.3% |

|

Rise and Fall |

5.4% |

-3.5% |

-2.0% |

|

Data Source: Longzhong Information |

|||

|

Note: The above data is updated every Thursday. |

|||

6. Price Prediction

In the short term, the cost support of crude oil for polyethylene is limited. On the supply side, both imported resources and domestic production show an increasing trend, leading to greater supply pressure. On the demand side, downstream orders mainly maintain just-in-time inventory replenishment. Overall, it is expected that in the short term, the polyethylene market price may undergo a weak adjustment, with a magnitude of... 10-50 yuan/ton.

7. Related Product Information

Crude Oil Market: In the short term, the main trading logic of the international crude oil market has not changed. The positives come from the continuation of U.S. sanctions policies against oil-producing countries and geopolitical uncertainties, while the negatives are OPEC+ maintains its stance on increasing production amid poor global economic conditions. The easing situation between Israel and Palestine is still a market focus, and coupled with OPEC+'s firm position on production increases, international oil prices are expected to show a downward trend tomorrow.

8. Data Calendar

Table 3 Domestic Polyethylene Data Overview Table (Unit: 10,000 tons)

|

Data |

Publication Date |

Previous Data |

Current Trend Forecast |

|

PE Production Enterprises Total Inventory (10,000 tons) |

Wednesday 17:00PM |

45.83 |

↘ |

|

PE social sample warehouse inventory |

Tuesday 17:00PM |

-2.17% |

↘ |

|

PE Weekly Production (10,000 tons) |

Thursday 17:00PM |

64.26 |

↗ |

|

PE maintenance impact volume (ten thousand tons) |

Thursday 17:00PM |

11.37 |

↘ |

|

PE Weekly Capacity Utilization Rate |

Thursday 17:00PM |

81.84% |

↗ |

|

PE downstream industry capacity utilization rate |

Thursday 17:00PM |

1.21% |

↗ |

|

PE Mindset Survey |

Thursday 12:00AM |

-13.36% |

↗ |

|

Data Source: Longzhong Information Note: 1. ↓↑ are considered significant fluctuations, highlighting data dimensions with a change of more than 3%. 2. ↗↘ is considered a narrow fluctuation, highlighting data with a rise or fall within the range of 0-3%. The above data is updated every Thursday. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track