【PE Daily Review】Downstream buyers purchase on low prices, polyethylene prices generally decline.

1Today's Summary

① On March 25, peace talks between Russia and Ukraine continue to progress, but the situation in the Middle East remains uncertain, causing fluctuations in international oil prices. NYMEXThe May contract for WTI crude oil fell by $0.11 to $69.00 per barrel, a decrease of 0.16%; the May contract for ICE Brent crude oil rose by $0.02 to $73.02 per barrel, an increase of 0.03%. The main contract for China's INE crude oil futures, 2505, rose by 4.0 to 537.3 yuan per barrel, and increased by 1.3 to 538.6 yuan per barrel in the night session.

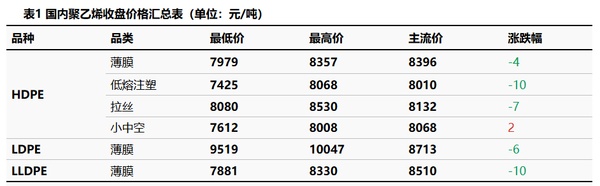

2. Today HDPrice adjustment, range from 2 to 10 yuan per ton; LDPE market price decreases by 6 yuan per ton.The price has fallen by 10 yuan per ton.

2Spot Overview

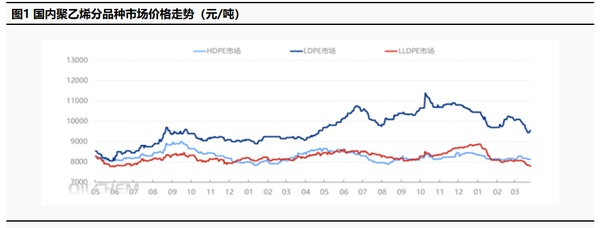

Today's domestic polyethylene spot market prices were mainly down. Although some companies had maintenance plans, which alleviated supply-side pressure to some extent, demand follow-up was limited and downstream procurement enthusiasm was not high, leading to merchants lowering prices to sell. At the same time, some resources saw price increases due to tight supplies, but overall market sentiment remained bearish, lacking strong positive factors to boost market confidence, resulting in a still sluggish overall trading atmosphere. HDPE market prices adjusted by 2-10 yuan/ton; LDPE market prices fell by 6 yuan/ton; LLDPE market prices fell by 10 yuan/ton.

3Spot-Futures Basis

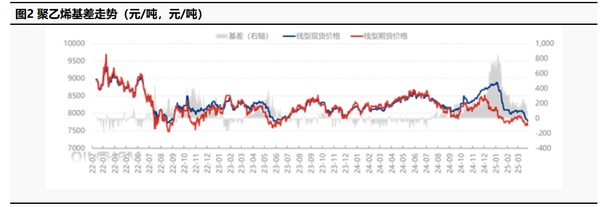

The LL main contract fluctuated downward, opening at 7696 yuan/ton. As of 15:00, the closing price was 7677 yuan/ton, a decrease of 35 yuan/ton from the previous settlement price. The trading volume was 294,300 lots, and the open interest was 464,000 lots, an increase of 10,700 lots. Today's spot-futures basis was 103 yuan/ton, a decrease of 4 yuan/ton compared to the previous working day's basis.

4Production Dynamics

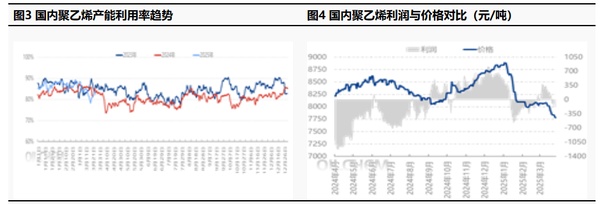

The polyethylene capacity utilization rate fell from 82.38% to 82.20%, a decrease of 0.18% month-on-month. Today, the HDPE line 1 facility at Yulong Petrochemical restarted after maintenance, while the old low-density polyethylene facility at Lanzhou Petrochemical and the LDPE facility at Wanhua Chemical are undergoing maintenance. The cost of oil-based production is 8121 yuan/ton, an increase of 1 yuan/ton compared to the previous working day; the oil-based profit is -171 yuan/ton, a decrease of 1 yuan/ton compared to the previous working day; the coal-based profit is 1743 yuan/ton, a decrease of 20 yuan/ton compared to the previous working day.

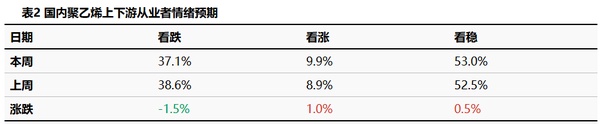

5Market sentiment

6Price prediction

LLDPE and HDPE are adjusting in the same trend, while LDPE products are boosted by low-level replenishment from end users. As the April maintenance season approaches, market confidence is recovering, and prices are running on the high side. In the short term, inventory levels are decreasing at the end of the month, the bearish impact of new production is being digested, and the benefits of maintenance will also be realized. There is support at the market bottom, while the demand side is balancing costs and purchasing on dips. It is expected that polyethylene prices will maintain today's situation tomorrow.

7Product Information

Crude Oil Market:In the short term, the main trading logic in the international crude oil market remains unchanged. The利好来自OPEC+减产氛围3月仍在、美国加强制裁伊朗和地缘局势不稳定性增强,而利空则是Trump关税新政拖累需求预期及美元强势。Tonight, the EIA inventory to be released is important data. Currently, there are signs of decline in both crude oil and refined product inventories. It is expected that the price of international crude oil will show an upward trend today. Note: Some parts in the original text were in Chinese, which I kept as-is since they require translation context or could not be accurately translated without more information. For a fully English translation, these segments need clarification.

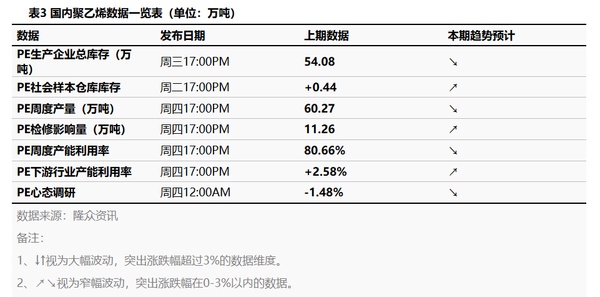

8Data Calendar

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track