Pc prices fall below "floor price"! general materials turn into a red ocean, how to open up high-end tracks?

The average price of 11,333 yuan/ton was like a heavy hammer, shattering the market expectations of PC industry practitioners — this is already the lowest price since the early days of the 2020 pandemic. However, what is more alarming than the price is that under the shadow of an additional 900,000 tons of bisphenol A production capacity, this industry avalanche triggered by homogenized competition may have only just begun.

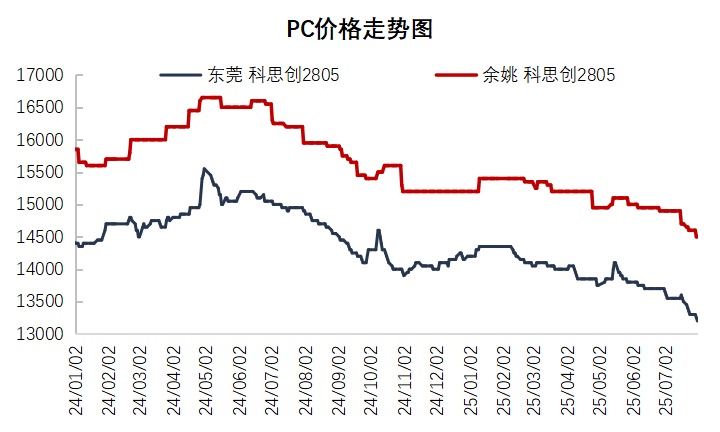

Currently, the polycarbonate (PC) market is experiencing an unprecedented downturn. As one of the five major engineering plastics, PC has long been widely used in electronics, automotive, and construction materials due to its excellent impact resistance, transparency, and heat resistance. However, since 2025, the PC market has been continuously declining, with prices reaching new lows. As of the end of July, the average domestic market price for PC has fallen to 11,333 yuan/ton, marking the second-lowest level since April 2020. In the East China market, the mainstream negotiation price for domestic materials fluctuated between 10,300-11,700 yuan/ton, a decrease of 16.54%-19.72% compared to the same period in 2024.

Cause analysis: Supply-demand imbalance is the core contradiction

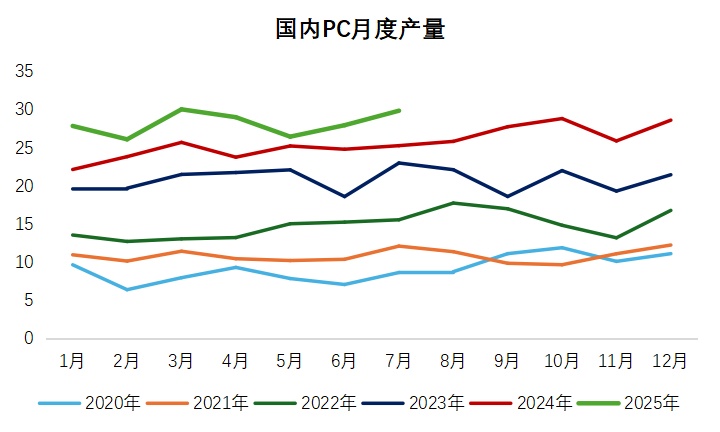

The supply side continues to expand.It is the primary factor leading to the current predicament. In recent years, domestic PC production capacity has rapidly expanded, especially with the concentrated commissioning of new units using the non-phosgene process route. In July 2025, despite multiple units such as those at Cangzhou Dahua and Pingmei Shenma undergoing shutdowns and maintenance, the industry's overall operating rate remained high at around 70%, with production reaching 298,500 tons, representing a month-on-month increase of 6.80% and a year-on-year increase of 13.11%. What is more noteworthy is that domestic PC production is expected to continue growing in August, with only two units scheduled for maintenance, which will have a limited impact on overall supply.

At the same time,The demand side remains consistently weak.It constitutes the other side of the contradiction. In traditional downstream applications, the electronics and electrical industry is affected by the decline in consumer electronics demand, resulting in weak willingness to purchase PCs; although the automotive industry shows signs of recovery, its growth rate is below expectations; the building materials industry remains sluggish due to adjustments in the real estate market. July, being a traditional off-season for consumption, sees generally low operating rates among downstream factories. Even though PC prices have approached historical lows, it is still difficult to stimulate bulk purchases. Market trading volume continues to shrink, and traders face immense pressure to clear inventory.

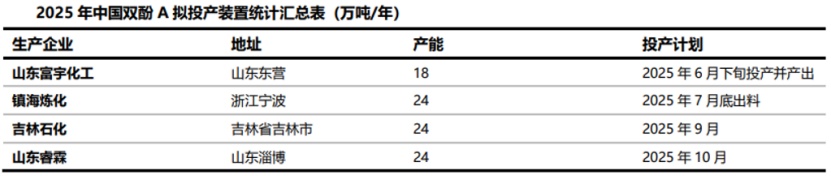

Raw material cost support is weakening.This further exacerbates the downward pressure on the market. Bisphenol A, a primary raw material for PC, has been fluctuating at a low level for a long time, with recent prices in the East China market maintaining at 7800-7900 yuan/ton, mainly based on real orders negotiations. The bisphenol A market itself is also facing an oversupply issue, with an additional 900,000 tons of production capacity expected to be released in the second half of the year, making it difficult to support PC costs. It is worth noting that although there is a theoretical cost transmission relationship between bisphenol A and PC, in actual market operations, PC prices are increasingly determined by their own supply and demand fundamentals.

Industry Dilemma: Homogenized Competition and Structural Contradictions

The core issue currently facing the PC industry is severe homogeneous competition. In recent years, new production capacity has mostly adopted non-phosgene processes, with a single product structure primarily focused on general-purpose materials with a melt index of around 10. Downstream applications are mostly concentrated in traditional fields such as injection molding, water buckets, and sheets. According to industry research, apart from a few companies like Wanhua Chemical and CSPC Tianjin, most PC manufacturers can only produce 3-5 types of specifications, with low differentiation and high substitutability. This has led to a continuous narrowing of price differences between brands and increasing sales difficulties.

Structural overcapacityThe problem is becoming increasingly prominent. On one hand, there is a severe oversupply of general-grade PC; on the other hand, a large amount of high-end specialized materials still need to be imported. Particularly in high-end application fields such as automotive lighting, optical lenses, and films, domestic production capacity remains insufficient. Data shows that the increase in domestic phosgene-based PC production capacity is significantly low, while non-phosgene-based production capacity is growing rapidly; however, the latter has technical limitations in producing high-end grades.

Inventory pressureContinuous accumulation remains an industry pain point. Due to demand consistently falling short of expectations, PC social inventory remains high. Manufacturers and traders are both facing significant pressure to reduce inventory, which further intensifies market price competition. Even during the traditionally strong "Golden September and Silver October" season, market participants remain cautious about inventory clearance.

Future Outlook: Differentiated Development and Industrial Chain Synergy

In the short term, the PC market will continue to face severe challenges. It is expected that the market will remain under pressure and decline in August, but since the absolute prices are already at historically low levels, the extent of the decline may be limited. The traditional seasonal "Golden September and Silver October" may bring a temporary recovery, but prices are likely to fall again in the fourth quarter as the off-season arrives. The raw material bisphenol A is expected to maintain a narrow range of fluctuations, with limited direct impact on the PC market.

In the medium to long term,Differentiated developmentThe key to breaking the deadlock lies ahead. The case of Wanhua Chemical is worth learning from, as it can produce hundreds of PC specifications, covering general grades and various special materials, and has made breakthroughs in high-end applications such as automotive lighting and optics. The industry needs more companies to transition to high value-added products to avoid vicious competition in the general materials market.

Author: Zhao Hongyan, Expert in Market Research at Focus on Plastics

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track