【PBT Daily Review】The Supply and Demand Struggle in the PBT Market Continues

1today's summary

PBT manufacturer's quotations are stable.

②This week, the PBT plant is operating normally.

③This week, China's PBT industry production reached 21,175 tons, with an industry capacity utilization rate of 49.85%, remaining flat from last week. The average gross profit of domestic PBT this week was -401 yuan/ton, a decrease of 27 yuan/ton compared to last week.

2spot overview

Table 1 Domestic PBT Price Summary (Unit: yuan/ton)

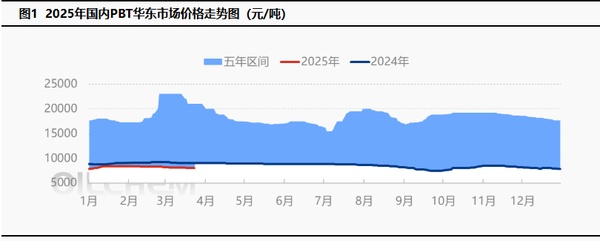

in order toEast China region as the benchmarkToday, the mainstream price of medium to low viscosity PBT resin is 7900-8200 yuan/ton.remained flat compared to yesterday。Today, the PBT market is in a wait-and-see mode, the PTA market is operating weakly, and the BDO market is in a weak stalemate. The cost support is relatively weak, the sentiment in the PBT market is bearish, and there is a psychological game between supply and demand within the market, leading to a wait-and-see attitude. According to Longzhong Information, in the East China market, the price of low to medium viscosity PBT pure resin is 7900-8200 yuan/ton.

3production dynamics

This week, China's PBT industry production reached 21,175 tons, with an industry capacity utilization rate of 49.85%, remaining flat from last week, and a decrease of 1.53% compared to the same period last year. In terms of facility operations this cycle, there were no significant changes in PBT facilities. The average gross profit of domestic PBT this week was -401 yuan/ton, a drop of 27 yuan/ton on a week-on-week basis.

4price prediction

It is expected that the PBT market will fluctuate within a range. In terms of costs, the PTA balance sheet maintains the expectation of inventory reduction, with no significant supply and demand contradictions, and the overall valuation is relatively low. However, there are many unstable external factors, and commodities lack sustained drivers. Downstream operations are cautious, and in the short term, the domestic PTA spot market will maintain a volatile pattern; at the beginning of the new trading cycle for BDO, the market continues to adopt a wait-and-see attitude. The actual demand from the terminal downstream is sluggish, and negotiations upon entering the market occur, with holding vendors having moderate confidence in the future market. Mainstream offers are stable, and actual transactions are negotiated based on the market, with the market center oscillating weakly. The cost support is average, and the PBT market mostly adopts a wait-and-see mentality. The market lacks clear bullish or bearish drivers, leading to fluctuations within a range. Therefore, Longzhong expects that tomorrow's East China market for medium to low viscosity PBT resin will be in the range of 7900-8200 yuan/ton.

5related product situation

PTAmarketEast China market PTA spot market prices declined, with negotiations around 4840. For this week and next week, main port delivery, warehouse receipts for May at a discount of about 15, transactions discussed between 15-22. April main port delivery offers May at par to a premium of 15, bids discussed at May par to a discount of 5. Intraday absolute prices recovered after falling with costs, the spot basis showed some loosening, and overall negotiations were moderate. (Unit: yuan/ton)

BDOmarket:As of the time of writing, the mainstream negotiation for spot bulk water in East China is 7900-8000 yuan/ton, and the negotiation for drum-packed goods is 8900-9000 yuan/ton (cash on delivery), remaining unchanged from yesterday. Today, the BDO market in East China is operating with a wait-and-see attitude. At the beginning of the week, there is little news in the market, and traders are observing before entering. The actual demand downstream is weak, and there is bargaining; cargo holders are cautious in their operations, negotiating deals based on the current market, and the overall market situation remains weak and stagnant.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track