[PBT Daily Review] PBT market sentiment is cautious and watchful.

1Today's Summary

① PBT manufacturers' quotations remain stable.

② PBT facilities operated normally this week.

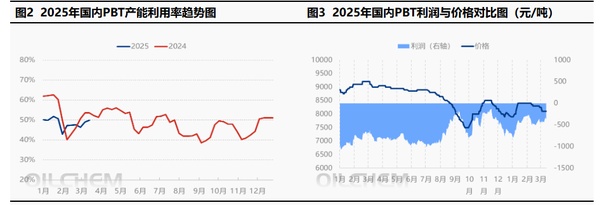

This week, China's PBT industry production reached 21,175 tons, with an industry capacity utilization rate of 49.85%, remaining flat compared to last week. The average gross profit of PBT in the domestic market this week was -401 yuan/ton, a decrease of 27 yuan/ton compared to the previous week.

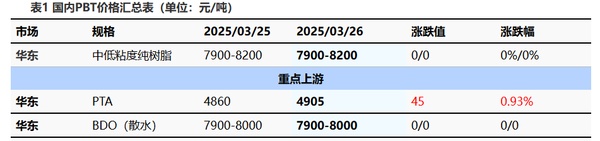

2Spot Overview

Based on the East China regionToday, the mainstream price of medium and low viscosity PBT resin is between 7900-8200 yuan/ton.The same as yesterday。Today's PBT market is operating with观望运行. 【注】:后半句"观望运行"似乎不完整或表述有误,正常的中文应为“观望运行情况”或“保持观望状态”。若按照字面翻译则为 "is operating with观望", 这在英文中不通顺。请提供完整的句子以便更准确地翻译。The BDO market continues to strengthen, with fluctuations within a range. The cost support is still decent, but it has limited support for the PBT market. The market atmosphere is quite cautious, with a bearish sentiment. According to statistics, the price of low to medium viscosity PBT pure resin in the East China market ranges from 7900 to 8200 yuan/ton.

3Production Dynamics

This week, China's PBT industry production reached 21,175 tons, with an industry capacity utilization rate of 49.85%, remaining stable compared to last week and down 1.53% year-on-year. In terms of operational changes, PBT facilities remained largely unchanged this week. The average gross profit for domestic PBT this week was -401 yuan/ton, a decrease of 27 yuan/ton compared to the previous period.

4Price Forecast

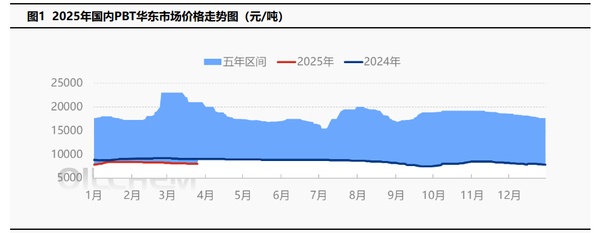

The PBT market is expected to fluctuate within a certain range. On the cost side, the PTA balance sheet maintains expectations for inventory reduction, and with low valuations, cost support remains strong. However, downstream performance is lackluster, and the market lacks continuous driving forces, resulting in insufficient upward momentum for the domestic PTA spot market in the short term. Recently, there have been significant fluctuations in BDO production facilities, and downstream contract orders are following up slowly; spot purchases are scarce and negotiations are ongoing. Suppliers are actively stabilizing the market, while holding manufacturers have a poor operating mindset, leading to more negotiations in the market. Cost trends are relatively stable, and the market sentiment for PBT is cautious and slightly bearish. The market focus may primarily be on range fluctuations, and attention should be paid to the prevalence of low prices. Therefore, Longzhong expects that tomorrow in the East China market, the price for medium and low viscosity PBT resin will be around 7900-8200 yuan/ton.

5Related product information

PTAMarket:Today's PTA spot price increased by 45 to 4905 yuan/ton. This week and next week, the futures delivery and warehouse receipts at the main ports were traded near parity or at a discount of 5 yuan/ton for the May contract. For deliveries in late April, the May contract was traded at a premium of around 10 yuan/ton. The expectation of reduced supply from suppliers boosted sentiment, leading to stronger absolute prices and spot basis on the day. Market participants remained观望 (观望 means观望 in Chinese, which translates to "观望" in English but is often used idiomatically as "cautious观望" or "watchful" in financial contexts). Overall trading activity was moderate.

BDOMarket:As of the time of publication, the mainstream negotiation for spot loose water in the East China region is 7900-8000 yuan/ton, and for packaged water, it is 8900-9000 yuan/ton (delivered on acceptance), which is stable compared to yesterday. Today, in the East China region...Observation of operations. Some facilities have released maintenance-related news, which may increase support on the supply side. Downstream follows demand, negotiations continue, and the market is experiencing weak fluctuations.

6Data Calendar

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track