[PBT Daily Review] Market News Confused, PBT Market Fluctuates Narrowly

1 Today's Summary

①This week, PBT manufacturers have lowered their prices.

There were fewer PBT unit maintenance activities this week.

③ In this period, the PBT production was 22,200 tons, an increase of 900 tons from the previous period, with a growth rate of 4.23%. The capacity utilization rate was 52.30%, an increase of 2.12% from the previous period. 。 The average domestic PBT gross profit this week is -441 yuan/ton, a decrease of 4 yuan/ton compared to the previous week. 。

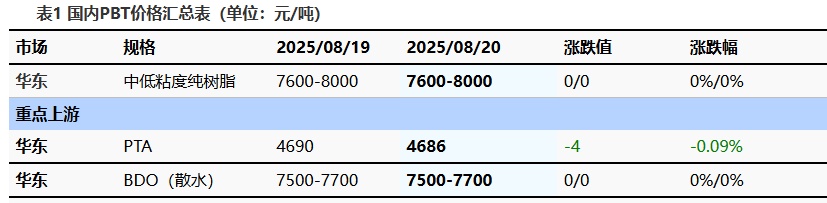

2 Spot Market Overview

Based on the East China region, today's mainstream price for low to medium viscosity PBT resin is between 7,600 and 8,000 yuan per ton, remaining stable compared to the previous working day. Today, the PBT market is chaotic and stalemated. The PTA market is showing a strong consolidation, while the BDO market is running weakly. Raw material support remains temporarily stable. Information in the PBT market is rather confusing, leading to uncertain sentiment among industry players. Occasional low prices have been heard, but mainstream quotations remain within a certain range. According to Longzhong Information, the price of medium- and low-viscosity pure PBT resin in the East China market is 7,600-8,000 yuan/ton.

3 Production Dynamics

The maintenance of Nantong Xingchen's PBT plant was completed during the week, resulting in an increase in domestic PBT supply. This period's PBT output was 22,200 tons, an increase of 900 tons compared to the previous period, up by 4.23%. The capacity utilization rate was 52.30%, up by 2.12% from the previous period. 。 This week, the average gross profit of domestic PBT is -441 yuan/ton, down 4 yuan/ton from the previous week. 。

|

Figure 2 Domestic PBT Capacity Utilization Rate Trend in 2025 |

Figure 3 Year 2025 Domestic PBT Profit and Price Comparison Chart (Yuan/Ton) |

![[PBT日评]:原料延续走跌 PBT市场观望运行(20250814) [PBT日评]:原料延续走跌 PBT市场观望运行(20250814)](https://oss.plastmatch.com/zx/image/365f66169cc84d098ff1dcb0b9f0fb9e.png)

|

![[PBT日评]:原料延续走跌 PBT市场观望运行(20250814) [PBT日评]:原料延续走跌 PBT市场观望运行(20250814)](https://oss.plastmatch.com/zx/image/ce1cfaff002a45ff99c7aa24285153bc.png)

|

|

Data source: Longzhong Information |

Data source: Longzhong Information |

4 Price Prediction

The PBT market is expected to remain stable. The supply and demand for raw material PTA maintain a tight pattern, with macro sentiments driving an overall strong trend in commodities. With low valuations, cost support remains solid, and there is an expectation of a continued rebound in the short-term PTA spot market. The BDO market is in a period of transition between old and new cycles, with market participants maintaining a wait-and-see attitude, awaiting new monthly policy guidance. Although there are downstream inquiries, actual transactions are currently limited. Changes in raw materials and fundamentals are temporarily limited, and the PBT market remains cautious, with the supply and demand standoff persisting. The market is expected to fluctuate within a range. Therefore, Longzhong predicts that tomorrow, the price for medium to low viscosity PBT resin in the East China market will be between 7,600-8,000 yuan/ton.

5 Relevant Product Information

PTA Market: Today's PTA spot price decreased by 4 to 4686. August main port delivery for September traded at a discount of 0-5, with slightly lower warehouse receipts, while September main port delivery for September traded at a premium of 10-18. Macro expectations drove improved sentiment, with absolute prices weakening and consolidating with costs intraday before rebounding. The spot and forward basis continued to improve, buying sentiment was acceptable, and market negotiations were average. (Unit: RMB/ton)

BDO Market: As of the time of writing, the mainstream spot bulk negotiations in the East China region are at 7500-7700 yuan/ton, with packaged negotiations at 8500-8700 yuan/ton (delivered on acceptance), remaining unchanged from yesterday. Today, the BDO market in East China fluctuated within a range. At the end of the trading cycle, industry participants are observing with a strong sense of caution. Downstream just-in-demand purchasing continues, with holders' quotations stable, and the market remains weakly stagnant, awaiting new cycle policy guidance.

6 Data Calendar

Table 2 Overview of Domestic PBT Data (Unit: ton, RMB/ton)

|

Data |

Release Date |

Previous period data |

This period's trend forecast |

|

PBT Capacity utilization rate |

Thursday 5:00 PM |

52.30 % |

↗ |

|

PBT Weekly Output |

Thursday 5:00 PM |

2.22 10,000 tons |

↗ |

|

PBT Weekly Profit |

Thursday 5:00 PM |

-441 yuan/ton |

↘ |

|

Data source: Longzhong Information Remarks: 1 Treat "↓↑" as significant fluctuations, highlighting data dimensions with a price change exceeding 3%. 2 Regarded as narrow fluctuations, highlighting data with price changes within the range of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track