[pbt daily review] cost support remains stable, pbt market continues to run steadily

1 Today's Summary

The PBT manufacturer's quotation remained stable overall this week.

② There is less maintenance of PBT units this week.

③ The PBT production for this period is 23,800 tons. Increased by 0.12 million tons from the previous period, a growth rate of 5.31%. Capacity utilization rate: 56.11% "compared to the previous period, an increase of 2.97%" 。 The average domestic PBT gross profit this week is -379 yuan/ton, up 88 yuan/ton compared to the previous week. 。

2 Spot Overview

Table 1 Domestic PBT Price Summary (Unit: Yuan/Ton)

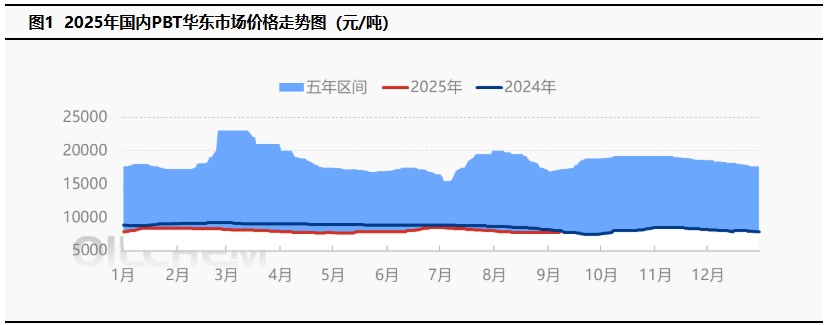

The mainstream price of low to medium viscosity PBT resin in the East China region today is 7,650-7,900 RMB/ton, stable compared to the previous working day. Today, the PBT market continues to operate steadily, the PTA market shows a weak rebound, and the BDO market is in a wait-and-see mode. Raw material support is stable, PBT.MarketThe market continues to operate steadily, with on-the-spot pricing. According to Longzhong Information, the price of low-viscosity PBT pure resin in the East China market is 7,650-7,900 yuan/ton.

3 Production Status

The Blue Mountain Tunhe PBT plant completed maintenance and resumed normal production within the week, increasing the domestic PBT supply.The PBT production for this period is 23,800 tons. Increased by 0.12 million tons from the previous period, a growth rate of 5.31%. Capacity utilization rate is 56.11% "...increased by 2.97% compared to the previous period." 。 The average domestic PBT gross profit this week is -379 yuan/ton, an increase of 88 yuan/ton compared to the previous week. 。

|

Figure 2: Trend Chart of Domestic PBT Capacity Utilization Rate in 2025 |

Figure 3 2025 Domestic PBT Profit and Price Comparison Chart (Yuan/Ton) |

![[PBT日评]:市场消息面清淡 PBT市场企稳运行(20250903) [PBT日评]:市场消息面清淡 PBT市场企稳运行(20250903)](https://oss.plastmatch.com/zx/image/9215395641074350ac9813e639920d9a.png)

|

![[PBT日评]:市场消息面清淡 PBT市场企稳运行(20250903) [PBT日评]:市场消息面清淡 PBT市场企稳运行(20250903)](https://oss.plastmatch.com/zx/image/acecec2eaea142238fc64d54854f4f8b.png)

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

4 Price prediction

The PBT market is expected to continue its stalemate. On the raw material side, PTA is experiencing a traditional peak season, yet the terminal performance is lukewarm, with downstream primarily engaging in just-in-time purchasing. However, the short-term supply and demand remain relatively tight, the balance sheet continues to de-stock, and with low processing fees, oil prices are fluctuating upward, providing strong support on the cost side. In the short term, there is an expectation of a continued rebound in the PTA spot market. Some BDO factories have announced shutdowns for maintenance, which will increase supply-side support, and suppliers continue to stabilize the market. Downstream purchasing is on an as-needed basis, while holders are maintaining a steady and cautious approach, resulting in a stable and calm market scenario. With stable cost support and downstream and terminal sectors following demand, most industry players are maintaining a steady and observant stance. The market focus is expected to remain temporarily stable, and the PBT market may continue with a stalemate arrangement in the short term. Therefore, Longzhong anticipates that tomorrow the East China market for medium to low viscosity PBT resin will be priced at 7650-7900 RMB/ton.

5 Related product information

PTA Market: The current PTA spot price is up by 13 to 4608. The September main port delivery offer is reported as a 01 discount of 55-60, with transactions at a 01 discount of 60-65. The October main port delivery's 01 discount is around 50. The absolute price during the day fluctuates warmly with costs, and the spot basis difference strengthens along with the monthly spread. Market transactions are based on just-in-time demand. (Unit: CNY/ton)

BDO Market: As of the time of writing, the mainstream spot bulk negotiation price in the East China region is 7,300-7,500 RMB/ton, and the barrel negotiation price is 8,300-8,500 RMB/ton (delivered with acceptance). Month-on-month unchanged Today in the East China regionBDO MarketStable operation. Some facilities are reducing load or are expected to shut down, supporting the suppliers to maintain a stable market. Downstream follows up as needed, and holders quote according to the market, with the market focus temporarily stable. 。

6 Data Calendar

Table 2 Domestic PBT Data Overview (Unit: tons, yuan/ton)

|

Data |

Publication Date |

Previous Data |

This issue's trend forecast |

|

PBT Capacity utilization rate |

Thursday 5:00 PM |

56.11 % |

- |

|

PBT Weekly Production |

Thursday 5:00 PM |

2.38 10,000 tons |

- |

|

PBT Weekly Profit |

Thursday 5:00 PM |

-379 yuan/ton |

↘ |

|

Data Source: Longzhong Information Remarks: 1 Consider significant fluctuations as upward or downward movements, highlighting data dimensions with changes exceeding 3%. 2 Regarded as a narrow fluctuation, highlighting data with a range of changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track