Passenger car exports surpass 500,000 units for the first time, chery sets new record surpassing byd to reclaim top spot

In the context of increasingly fierce competition in the global automotive market, China's automobile export market continued to demonstrate strong resilience in August.

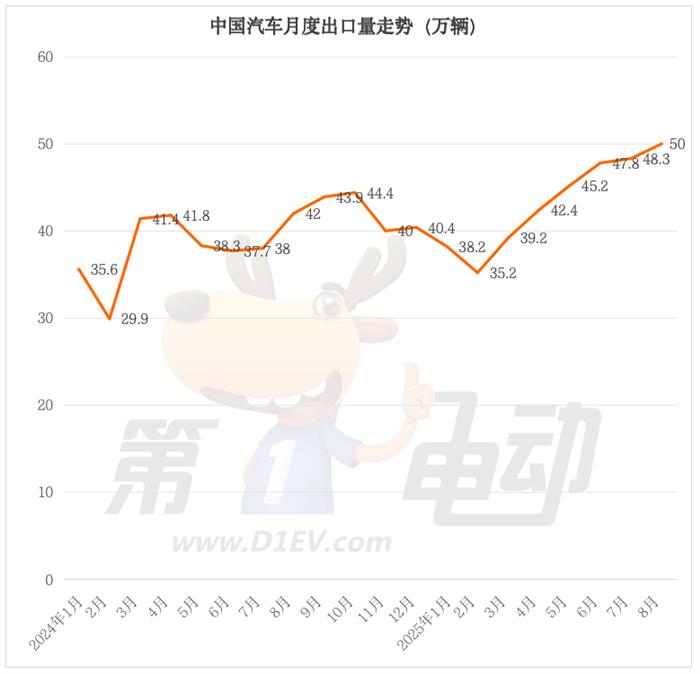

According to data from the China Passenger Car Association, in August, China's passenger car exports surpassed the 500,000 mark for the first time, a month-on-month increase of 3.5% and a year-on-year surge of 19%, setting a new historical record.

Among them, the export volume of new energy vehicles reached 199,000 units, a month-on-month decrease of 7.2%, but a year-on-year surge of over 100%. The export volume of pure electric vehicles reached 130,000 units, a month-on-month decrease of 6%, but a year-on-year increase of 62.8%. The export volume of plug-in hybrid vehicles reached 64,000 units, a month-on-month decrease of 8.7%, but a year-on-year surge of over 200%. This also indicates that fuel vehicles achieved a strong rebound in August, with a month-on-month increase of 12.3%, becoming a key force driving overall exports.

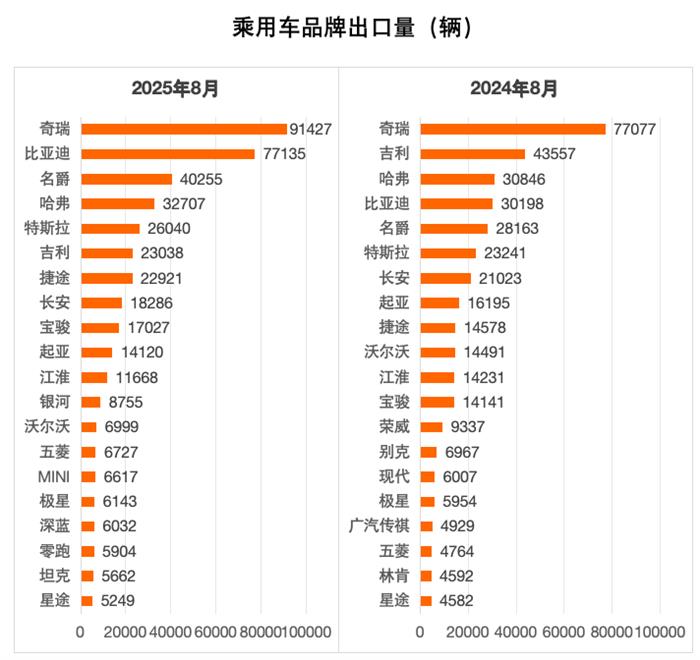

In August, the most significant change came from the leading group—Chery regained the top position in export volume thanks to its strong product performance. Data shows that in August, Chery's brand exports (excluding Jetta, Exeed, etc.) exceeded 90,000 units, setting a new historical high for the brand's own exports and successfully surpassing BYD to reclaim the top spot among Chinese car export brands.

Chery's ascent to the top this time is inseparable from the strong support of its main models. Among them, the export volumes of the Explorer 06, Tiggo 7, and Omoda have all seen significant increases, becoming the core drivers of Chery's overall export growth.

In contrast to Chery's strong rise, BYD's exports in August experienced a phase of adjustment, ultimately ranking second in the export list with a slight month-on-month decrease of 0.6%. Although BYD remains a leading exporter of China's new energy vehicles in the long term, the fluctuation in August's export volume is directly related to the decline in sales of its two core export models, the Song PLUS and the Haishi 07.

Notably, the Galaxy brand experienced explosive growth in the export market in August, with export volumes doubling month-on-month, making it the most eye-catching presence on that month's export volume list. Several models under the brand contributed to this success: both the Galaxy E5 and the Starship 7 saw their export volumes exceed 3,000 units. In particular, the Star Wish model not only surpassed 1,000 units exported for the first time, reaching 1,954 units, but also set a new record for itself with a 161-fold month-on-month increase, becoming a crucial force driving the brand's export boom.

#01

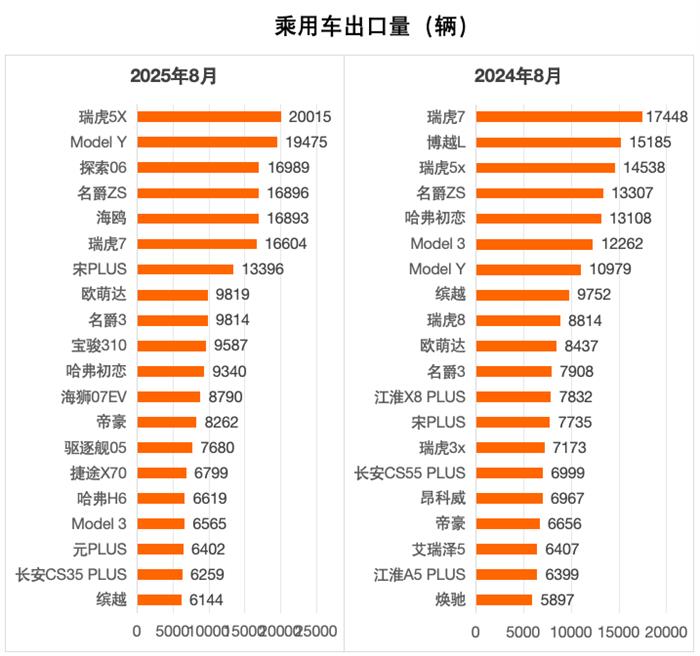

5x has consecutively held the championship for 2 months, while Song PLUS has dropped by 30% and fallen out of the top five.

After surpassing 20,000 units in July, the export volume of Tiggo 5x once again exceeded 20,000 units. Although there was a 7.5% month-on-month decline, it still firmly holds the top position in China's car export volume rankings.

In terms of month-on-month growth, several "dark horses" emerged in the Chinese automobile export market in August. CS35 PLUSAstonishingly1453.1%The month-on-month growth has once again made the list, becoming the biggest highlight of this month's export market. Behind this explosive growth are not only the comprehensive advantages of the model in terms of design, intelligent configuration, and cost-effectiveness, but also possibly the further improvement in channel layout in overseas target markets and the precise efforts in localized marketing, successfully capturing the demand pain points of local consumers.

Following closely is 06The month-on-month increase was as high as126.1%As a highly anticipated model, the Discovery 06 achieved a leap in growth in August, despite having a relatively low export volume base in July.Omoda(95.7%)、 3(58.5%)、 310Models such as (40.3%) also performed well, with month-on-month growth exceeding 40%. The strong performance of these models injected strong momentum into the Chinese car export market in August.

On the contrary,Model 3The export volume decreased significantly month-on-month.46% PLUS(-30.2%)、 07EV(-26.8%)、 Some models, which saw a decrease of 21.5%, are also facing considerable month-on-month pressure. This may be related to some models concentrating on order delivery in July and entering an order digestion period in August. It may also be influenced by fluctuations in overseas market demand and short-term adjustments in the supply chain.

In terms of year-on-year growth, China's automobile export market in August also achieved remarkable results, with several models experiencing double or even multiple times growth.

07 EVNot only does it perform well domestically, but it is also popular in international markets.8 1256.5%The year-on-year growth has redefined market expectations. As a significant representative model in the new energy vehicle sector, its outstanding range and advanced intelligent driving assistance system have quickly established its position in overseas markets.

The performance is also impressive, with a year-on-year increase reaching303.7%This small new energy vehicle is highly competitive in the overseas urban mobility market due to its compact and agile body, affordable price, and range that meets daily commuting needs. It is particularly favored by young consumers and users looking for a second family car.

Furthermore, CS35 PLUS(294.6%)、Model Y(77.4%)、 PLUSThe year-on-year growth rates of models such as the Destroyer 05, which had an export volume exceeding 7,000 units, reaching a historical high, also remained at a high level, entering the TOP15 of the rankings for the first time.

The export volumes of Model 3, Tiggo 7, Haval Chulian, and Bin Yue have declined year-on-year, with Model 3 experiencing a particularly sharp month-on-month decrease of 46.5% in export volume.

In the TOP20 export list, new energy vehicles occupy a considerable proportion, which fully proves that the recognition and penetration rate of Chinese new energy vehicles in the global market are continuously improving. At the same time, traditional fuel vehicles are also maintaining strong market competitiveness through technological upgrades and product iterations.

#02

Chery surpasses BYD again to win the championship, Galaxy makes its first appearance on the list.

In August, Chery with91427 The export volume once again surpassed BYD, reaching a new historical high, undoubtedly occupying the top position on the list. Compared to the 86,919 units in July, there was a month-on-month increase of 5.2% and a year-on-year solid growth of 18.8%.

This achievement not only demonstrates Chery's deep foundation in overseas markets but also reflects the competitiveness of its products and the effectiveness of its market layout. For a long time, Chery has consistently emphasized the expansion of overseas markets, continuously consolidating its advantageous position in the export sector by leveraging a diversified product matrix and precisely understanding the demands of different markets. Leading the way once again further solidifies its position at the forefront of China's automobile export sector.

Following closely behind is BYD, with exports reaching 77,135 units in August, a month-on-month decrease of 0.6%. However, in terms of year-on-year data, BYD has demonstrated strong growth momentum as a new energy vehicle giant with a remarkable increase of 155.4%.

MG and Haval ranked third and fourth in export volume, with 40,255 and 32,707 vehicles, respectively. Among them, MG's performance was particularly impressive, with a significant month-on-month export volume increase of 15.7% in August and a year-on-year increase of 42.9%, demonstrating strong growth momentum. Haval also achieved a month-on-month growth of 12.6% and a year-on-year growth of 6.0%, maintaining a stable advantage in the overseas competition within the SUV segment.

In the recently released rankings, the month-on-month growth data of several brands stood out, becoming a major highlight of China's automobile export market in August. Among them, the Galaxy brand performed the most outstandingly, with an export volume of 8,755 units in August, compared to 3,265 units in July, achieving a month-on-month increase of 168.1%. It entered the rankings for the first time and ranked 12th.

As a relatively new brand, Galaxy has quickly made a breakthrough in overseas markets with its unique product positioning and differentiated competitive strategy. In just one month, it achieved a significant increase in export volume, injecting new vitality into the Chinese automobile export market.

The JAC brand also showed explosive growth, with exports of 11,668 units in August, a month-on-month increase of 65.3%. Although there is still an 18.0% decline year-on-year, such a significant month-on-month growth indicates that JAC's adjustments in overseas markets have begun to show results, and product competitiveness and market channel development are expected to further improve.

In addition, the month-on-month increases for Wuling and Xingtu are also considerable, reaching 52.6% and 52.0% respectively. Wuling's exports in August were 6,727 units, a year-on-year increase of 41.2%, with its economical and practical models being well-received in some emerging overseas markets. Xingtu's exports in August were 5,249 units, a year-on-year increase of 14.6%, making some progress in the expansion of the mid-to-high-end overseas market.

Leapmotor is also not to be outdone, with exports of 5,904 units in August, a month-on-month increase of 28.2%. As an emerging force in the new energy vehicle sector, Leapmotor is gradually making its mark in overseas markets by leveraging its advantages in smart technology and cost-effectiveness.

In contrast to the aforementioned brands with strong growth, some brands faced significant growth pressures in August, particularly with unsatisfactory year-on-year performance. Volvo's exports in August amounted to 6,999 units. Although there was a 7.8% increase compared to the previous month, there was a substantial year-on-year decline of 51.7%, making it one of the brands with the largest year-on-year drop on the list. This data reflects that Volvo may be facing multiple challenges in overseas markets, such as insufficient product competitiveness, changes in market demand, or impacts from competitors. It is necessary for Volvo to promptly adjust its market strategy to reverse the downturn.

Geely's performance is also not optimistic, with exports in August at 23,038 units, a month-on-month decrease of 11.8% and a significant year-on-year decline of 47.1%. As a well-known brand in the Chinese automotive industry, Geely's double decline in export figures is noteworthy, which may be related to adjustments in its overseas market layout, product iteration cycles, or fluctuations in some regional markets.

Additionally, the year-on-year performance of Changan and Kia was also relatively weak, with declines of 12.7% and 12.8%, respectively. Although Changan achieved a 16.5% month-on-month increase, turning the year-on-year growth positive remains a key issue that it needs to address.

In August, Polestar's export volume was 6,143 vehicles, a month-on-month decline of 17.5%. Although it achieved a slight year-on-year increase of 3.2%, its growth momentum seems insufficient compared to the high growth of other new energy brands, facing significant pressure in the fierce market competition.

In summary, in August, leading brands represented by Chery, BYD, and MG, as well as emerging brands like Galaxy, Deepal, and Leapmotor, demonstrated strong growth momentum, becoming significant forces driving the growth of China's automobile exports. Meanwhile, some traditional and luxury brands are facing pressures of year-on-year decline and need to promptly adjust their product strategies and market layouts to adapt to changes in the global automotive market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track