[pa66 daily review] downstream procurement based on demand, market stabilizes operations

1 Today's Summary

①、 On December 9th, the market continued to focus on the latest progress in Russia-Ukraine peace talks, coupled with the ongoing atmosphere of OPEC+ increasing production, leading to a drop in international oil prices. NYMEX crude oil futures for the January contract fell by $0.63 per barrel to $58.25, a decrease of 1.07% compared to the previous day. ICE Brent crude futures for the February contract fell by $0.55 per barrel to $61.94, a decrease of 0.88% compared to the previous day. China's INE crude oil futures for the 2601 contract fell by 7.1 to 449.3 yuan per barrel, with a further decline of 5.9 in the night session to 443.4 yuan per barrel.

The current domestic operating rate of PA66 is 66%, with a daily output of approximately 2,650 tons. The capacity utilization rate is relatively stable, downstream demand is average, and the domestic PA66 industry has sufficient supply.

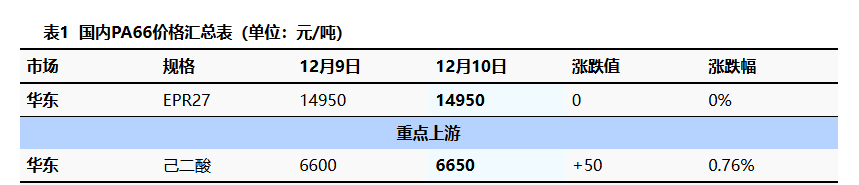

2 Spot Overview

Based on the Yuyao market in the East China region, today's EPR27 market price is referenced at 14,900-15,000 RMB/ton, stable compared to the previous trading day. 。 The market spot supply is stable. The pressure on costs is relatively high, and the trend against involution is deepening. There is a strong sentiment of reluctance to sell at low prices in the market, but downstream buyers are cautious about following high prices, leading to a consolidation in the market.

|

Figure 1: 2025 Domestic PA66 Price Trend Chart (Yuan/Ton) |

Figure 2: Eastern China PA66 Price Trend Chart in 2025 (Yuan/Ton) |

![[聚酰胺66日评]:下游按需采购 市场整理运行(20251124)](https://oss.plastmatch.com/zx/image/3c2c7fc9408b4110b6cbc389b4bd6fa8.png) |

![[聚酰胺66日评]:下游按需采购 市场整理运行(20251124)](https://oss.plastmatch.com/zx/image/a5c0dd0257e844f48cf1316d2c372ec6.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

3 Production Dynamics

Today, the capacity utilization rate of domestic polymerization 66 enterprises is approximately 66%, with ample supply in the industry. In terms of profit, raw material prices have not fluctuated significantly, leading to considerable cost pressure. Suppliers show a tendency to raise prices, and there is an expectation of reduced losses.

|

Figure 3: Trend Chart of Domestic PA66 Capacity Utilization Rate in 2025 |

Figure 4: Comparison of Domestic PA66 Profit and Price in 2025 (Yuan/Ton) |

![[聚酰胺66日评]:下游按需采购 市场整理运行(20251121)](https://oss.plastmatch.com/zx/image/8ec9a4aeca5a4e8c9effe829975d9e3c.png) |

![[聚酰胺66日评]:下游按需采购 市场整理运行(20251114)](https://oss.plastmatch.com/zx/image/2beeeb5094424fa2b161412c184d5e10.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4 Price Forecast

When Previous domestic PA66 cost pressures and anti-involution provide strong price support, while the cautious attitude of downstream limits the room for increase. It is expected that the domestic PA66 market in the short term will...Presenting a narrow fluctuation trend.

5 Relevant product information

Adipic Acid Market: Taking the East China market as the benchmark, adipic acid closed at 6,500-6,800 yuan/ton today, which is an increase compared to previous prices and in line with the morning expectations. Today, the domestic adipic acid market has slightly moved upwards. The fluctuations in the raw materials are limited, providing general support to the current market. Suppliers still have the intention to maintain market stability, and the cautious atmosphere in the market has increased. Some intermediaries, fearing losses, have tentatively increased their offers. Downstream buyers are entering the market as needed. Holders are offering limited concessions, resulting in a slight upward shift in negotiation focus, with flexible follow-up on spot orders and occasional small high-price transactions waiting for digestion. East China reference price is 6500-6800 RMB/ton, delivered with acceptance, actual orders are negotiable.

6 Data Calendar

Table 2 Overview of Domestic PA66 Data (Unit: 10,000 tons)

|

Data |

Publication Date |

Previous Data |

Current Trend Forecast |

|

Capacity Utilization Rate |

Thursday 11:30 AM |

66% |

→ |

|

Weekly Production |

Thursday 4:00 PM |

1.86 |

→ |

|

Data Source: Longzhong Information Note: 1. Consider ↓↑ as significant fluctuations, highlighting data dimensions with a change exceeding 3%. 2. ↗↘ is considered a narrow fluctuation, highlighting data with a rise or fall within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage