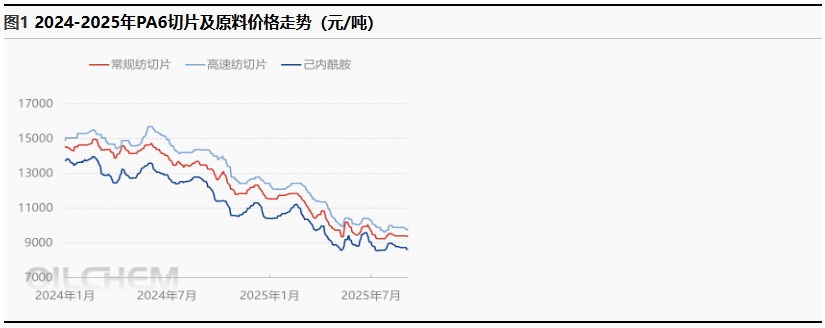

[PA6 Weekly Review] Market Bulls and Bears Coexist, PA6 Market Slightly Weakening

1. Market Focus This Week

1) The price of Sinopec's pure benzene in East China and South China refineries is reduced by 100 yuan/ton, to be implemented at 5900 yuan/ton, effective from September 4th. The monthly settlement price for Sinopec's caprolactam is 9330, Shenyuan's weekly listed price is 9200, and the spot price for caprolactam in East China is 8650. (Unit: yuan/ton)

2) Regular spinning PA6 chips in East and Central China are priced at 9,200-9,550 RMB/ton for cash with short delivery, and some high-end chips are priced at 9,300-9,600 RMB/ton for cash self-pickup. High-speed spinning PA6 regular chips are priced at 9,100-9,300 RMB/ton for cash ex-factory, and premium chips are priced at 9,600-9,900 RMB/ton for acceptance delivery. (Unit: RMB/ton)

Supply and demand situation: According to Longzhong's statistics, this week's caprolactam production is 131,100 tons, and nylon 6 chip production is 125,600 tons. The operating rate of nylon filament is 78%. This week, the operating rate of the domestic weaving industry is 62.42%, an increase of 0.44% compared to last week.

2. This Week's Market Analysis

The PA6 chip market operated slightly weakly this cycle, with mainstream prices at 9375-9400 yuan/ton for spot delivery. From the cost side, the price of raw material caprolactam has declined, and polymerization enterprises continue to incur losses, so cost pressure remains. However, downstream demand is average, and limited end orders have restrained downstream purchasing, mainly just restocking out of necessity. Some low-priced chip producers have temporarily stabilized their quotations, while chips at slightly higher prices are being negotiated for shipment with modest sales. Market transactions are flat. This cycle, the PA6 high-speed spinning chip market declined, with mainstream prices at 9750-9900 yuan/ton for spot delivery. Raw material prices dropped, coupled with average downstream demand, polymerization enterprises have slow sales and are negotiating shipments. Multiple negative factors from cost and demand have led to a decline in market transaction prices.

3. Market Impact Factors Analysis

1 Raw materials: The current spot market for caprolactam in East China is slightly weak, with prices ranging from 8,650 to 8,700 yuan/ton. Upstream benzene prices have been lowered by 100 yuan to 5,900 yuan/ton, weakening cost support for the caprolactam market. Coupled with a lack of improvement momentum in terminal demand, some downstream PA6 enterprises continue to reduce operating rates, pressing prices during raw material procurement. The supply pattern of caprolactam is slightly loose, market confidence is weak, and the focus of spot negotiations has slightly shifted lower. As of Thursday, the spot price of caprolactam in the East China market is around 8,650 yuan/ton, with payment on acceptance and delivery.

2) As of September 4, 2025, the price of liquid caprolactam is 8,650 RMB/ton (delivered with acceptance), and the price of conventional PA6 spinning ordinary chips is 9,200-9,550 RMB/ton cash ex-factory. Based on this, the weekly average profit of conventional PA6 spinning chips is calculated to be -88 RMB/ton. As of September 4, 2025, the spot price of caprolactam is 8,650 RMB/ton delivered to East China, and the monthly settlement price of Sinopec caprolactam is 9,330 RMB/ton. The quoted price for PA6 high-speed spinning premium chips is 9,600-9,900 RMB/ton on an acceptance basis delivered to East China. Based on this, the weekly average profit for PA6 high-speed spinning premium chips is -381 RMB/ton.

4. Next Week Forecast:

The PA6 market is expected to undergo a slight consolidation in the next cycle. The mainstream price of conventional spun cutting chips is likely to remain in the range of 9,300-9,350 RMB/ton for spot cash short delivery consolidation, while the mainstream price of high-speed spun cutting chips of superior grade is expected to consolidate in the range of 9,650-9,750 RMB/ton for acceptance delivery. 。 Key Focus Areas: 1. Supply Side. Overall supply is expected to increase in the next cycle, mainly due to the increase in load in western Shandong during this cycle, resulting in an overall increase in supply for the next cycle. 2. Demand Side. Downstream manufacturers have limited orders, and raw material procurement is primarily based on periodic just-in-time replenishment. 3. Cost Side. The caprolactam market is expected to undergo minor adjustments in the next cycle, with cost pressure from chip losses still present. Further attention should be paid to the impact of costs and supply-demand dynamics on market sentiment.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track