Overview of the food packaging container industry

This text is extracted from the prospectus of Xintianli Technology Co., Ltd. The company has currently passed the IPO counseling of the Beijing Stock Exchange, with the counseling institution being Guotai Haitong Securities.

Industry Development Status and Trends

Industry Development Overview

01 Overview of the Development of the Food Container Industry

Food containers refer to packaging containers that come into direct contact with food. During food processing, transportation, storage, sales, and consumer use, they can reduce damage from external biological, chemical, and physical factors, thereby maintaining the stability of the food's quality.

In recent years, the food container industry has been in a phase of rapid development.

On the one hand, with the changes in people's lifestyles and the acceleration of life pace, the demand for fast food, canned goods, and other processed and packaged foods continues to increase among consumers.

On the other hand, the rise of e-commerce and the express delivery industry in recent years has also facilitated food delivery orders, creating new growth opportunities for the market size of food containers.

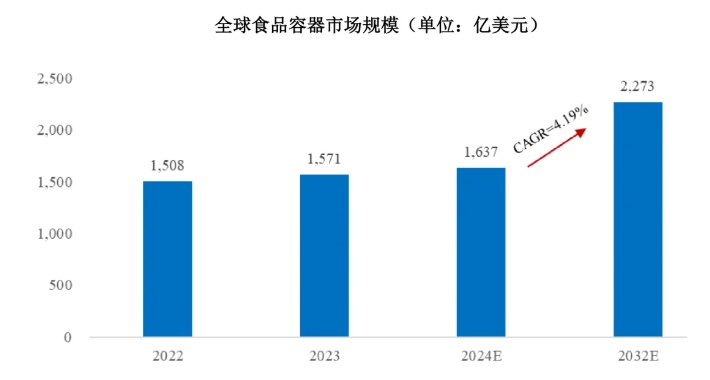

According to MarketResearchFuture statistics, the global food container market size in 2023 is USD 157.1 billion, and food containers are expected to grow from USD 163.7 billion in 2024 to USD 227.3 billion in 2032, with a compound annual growth rate of 4.19%.

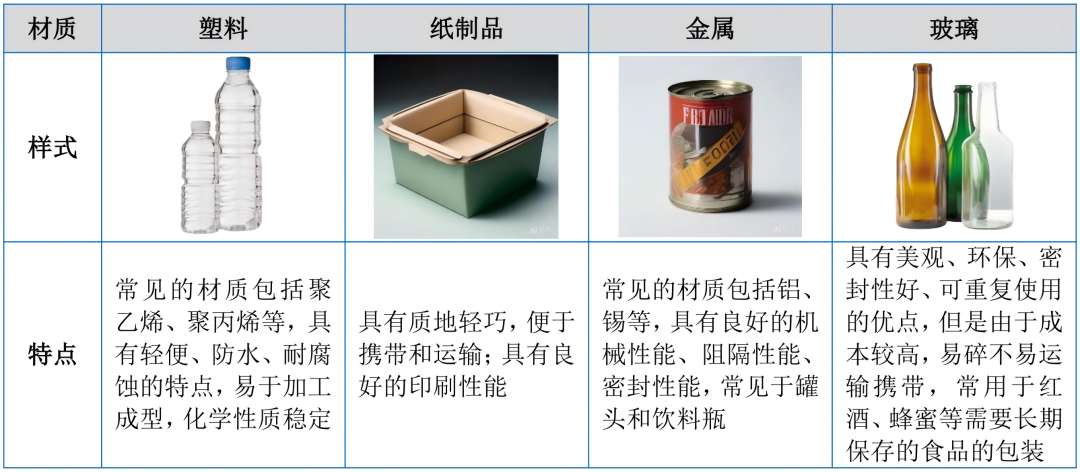

Food containers can be classified by material into plastic, paper products, metal, and glass. Due to their different characteristics, the application fields of different materials also vary. Among them, plastic and paper products have become the most important components of food container materials due to their excellent performance and lower cost. The comparison of food containers made from different materials is as follows:

02 Overview of the Development of the Plastic Food Container Industry

Plastic food containers are storage containers made from various plastic materials. Due to their lightweight nature, ease of processing, chemical stability, and lower cost, they are the fastest-growing and largest market share material in the food container market, accounting for about one-third of the entire food container market size.

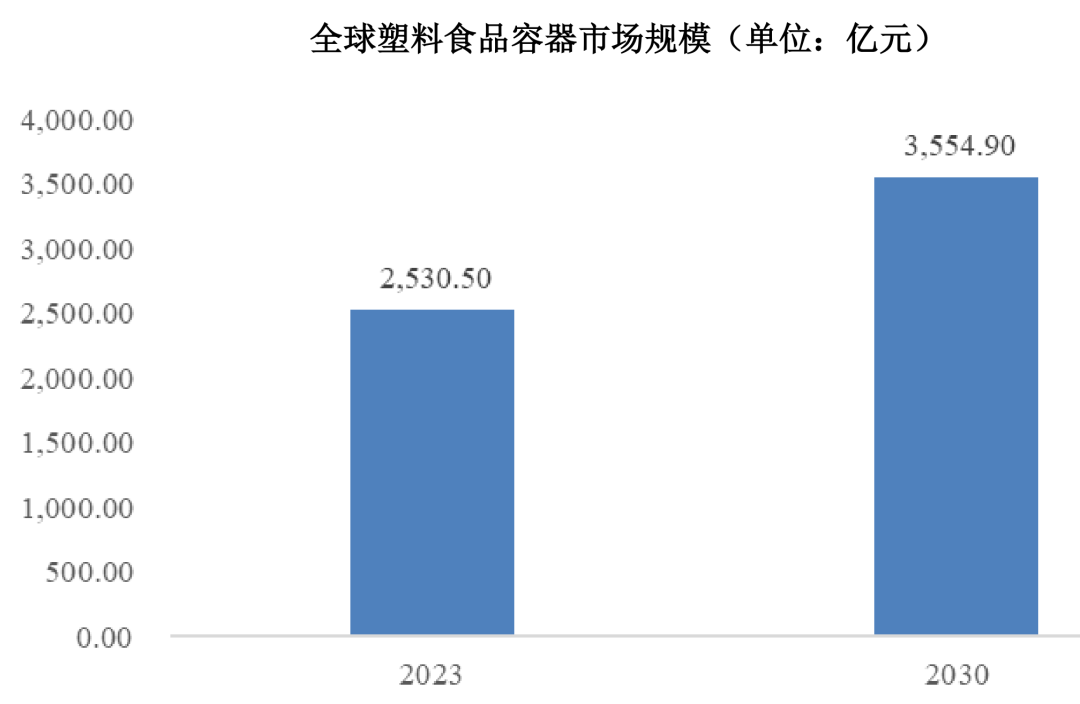

According to the research statistics of Baijian Strategies, the global plastic food container market is showing a steady expansion trend. In 2023, the global plastic food container market size is 253.05 billion yuan, and it is expected to reach 355.49 billion yuan by 2030, with a compound annual growth rate of 4.98%.

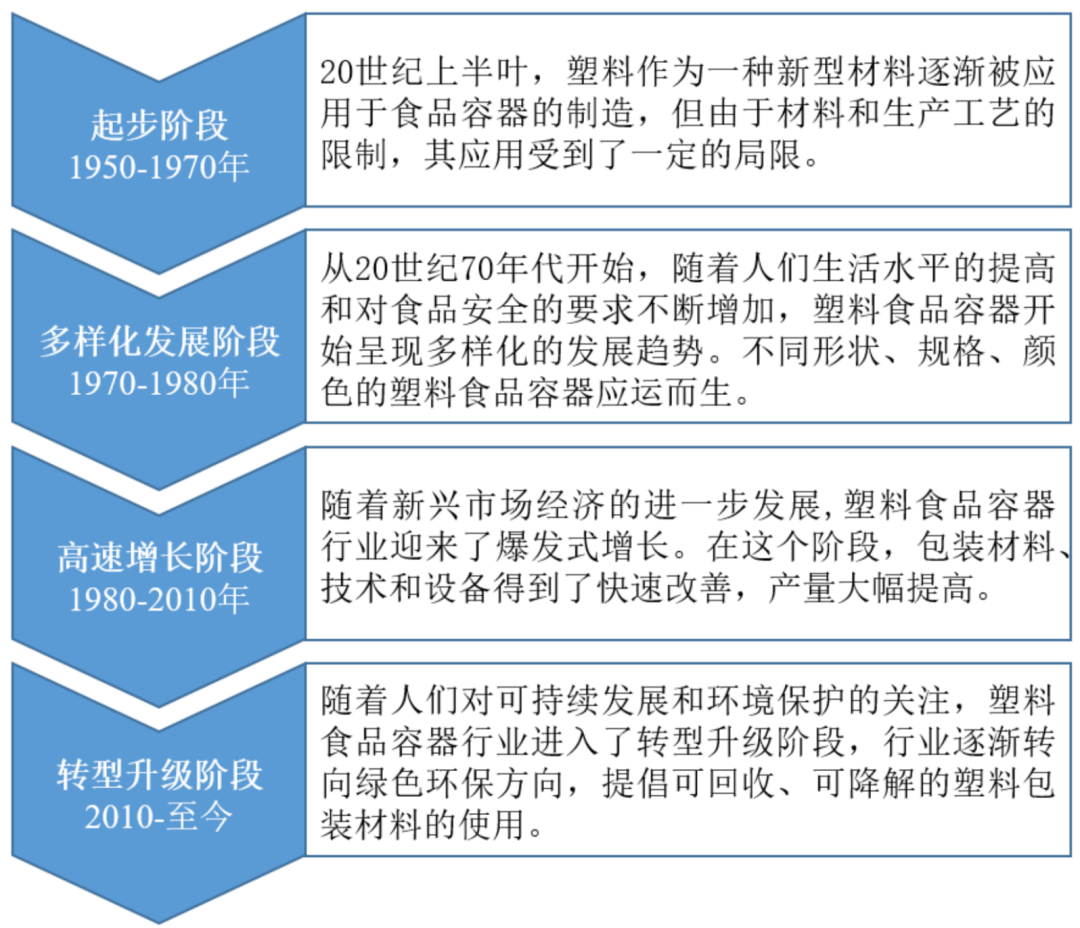

The plastic food container industry can be traced back to around the 1950s, having gone through the initial stage, diversification stage, rapid growth stage, and now the transformation and upgrading stage. In the current context of increasing environmental awareness, the plastic food container industry is gradually transitioning towards sustainable and environmentally friendly directions, seeking new development models and business opportunities.

Downstream Industry Development Overview

01 Food Industry

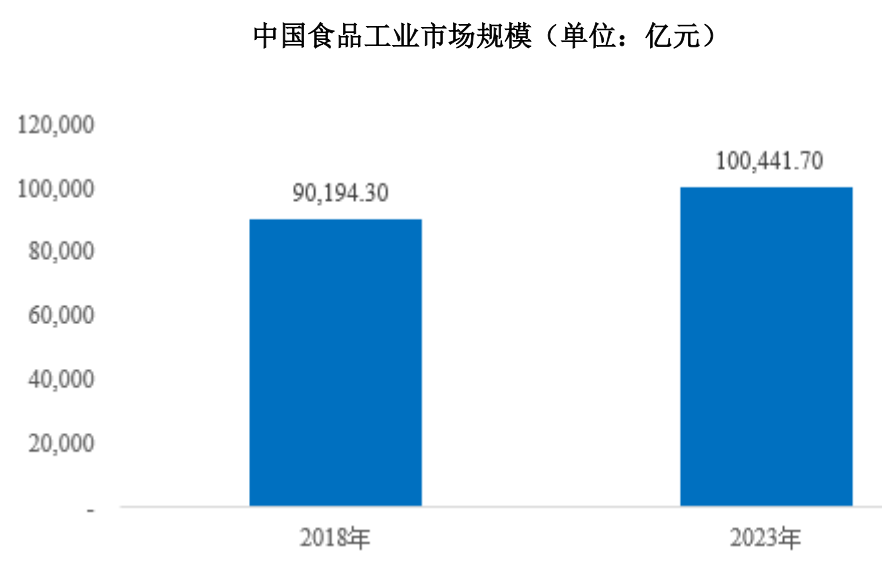

The food industry refers to the category of industry that manufactures food by processing agricultural and sideline products through physical methods or using yeast fermentation. It is closely related to the country's economic development level and the quality of people's lives and is also an important pillar industry for the development of China's national economy. In recent years, China's food industry market has developed steadily. According to data from the National Bureau of Statistics, the market size of China's food industry in 2023 is approximately 10.04 trillion yuan.

At the same time, the increasingly diverse needs of consumers are driving the continuous enrichment of the product matrix in China's food industry, with a deeper degree of product segmentation. The food industry is an important application field for food container products, such as beverage processing and dairy processing.

02 Food Delivery

The most important application scenario and field for food containers is food delivery.

Takeout initially referred to the sale of food that customers could take away from the store in packaged form. In recent years, with the proliferation of telephones, mobile phones, and the internet, people's lifestyles have undergone significant changes. Online food delivery platforms, driven by big data and carried by smartphones, have gradually become part of people's lives, injecting strong momentum into the development of the food delivery industry.

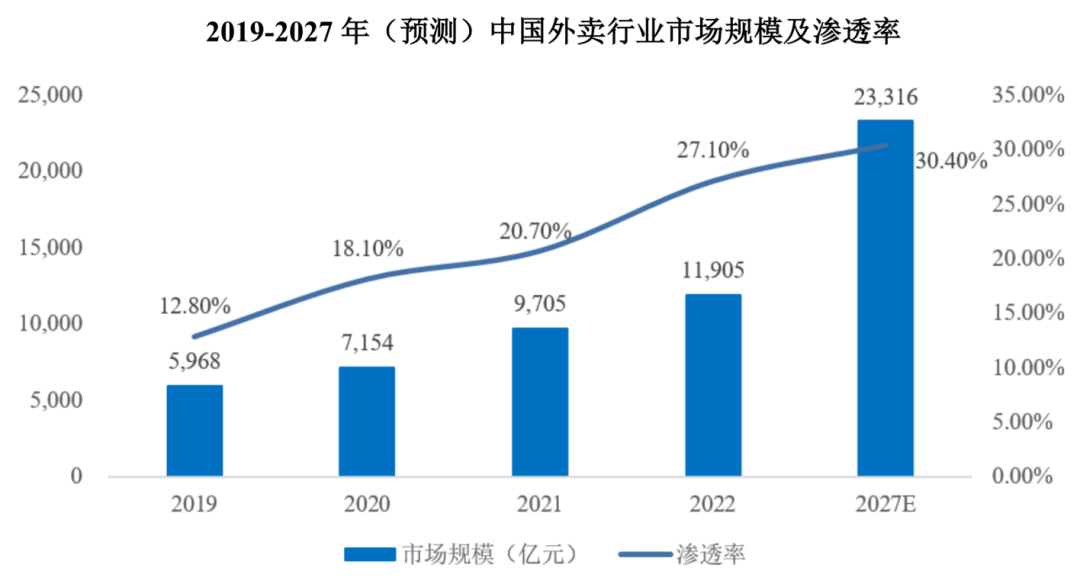

At the same time, with the increasingly fast pace of people's lives, the penetration rate of the food delivery industry in China has been rising year by year, and the market size has been expanding rapidly. According to data from Frost & Sullivan, the size of China's food delivery industry grew from 596.8 billion yuan in 2019 to 1,190.5 billion yuan in 2022, with the penetration rate increasing from 12.80% to 27.10%. It is expected that by 2027, the size of China's food delivery industry will reach 2,331.6 billion yuan, with a penetration rate of 30.40%. The continuous expansion of the downstream food delivery market has laid a solid foundation for the sustained development of the company's business.

03 Street Beverage Industry

Since the 1980s, when milk tea and coffee-related products were introduced on a large scale to mainland China from the West and the Hong Kong and Taiwan regions, the Chinese street beverage industry has gone through 40 years of significant development.

From an external perspective, with the continuous development of China's macroeconomy, the continuous improvement of consumer spending levels, and the increasing purchasing power, residents' demand for diversification, personalization, and quality in consumer products and services is also constantly rising. Street beverages, as one of the representatives, are developing rapidly.

From an internal perspective, the products within the street beverage industry are continuously being updated and iterated. They have evolved from the initial offerings that merely met basic needs such as quenching thirst, cooling down, and relieving stress with instant milk tea and coffee, to today's diverse street beverage categories. These now feature exquisite product packaging, high-quality ingredients, and uniquely designed store decorations, catering to the increasingly sophisticated aesthetic, health, and social needs of consumers, thus establishing a solid user base.

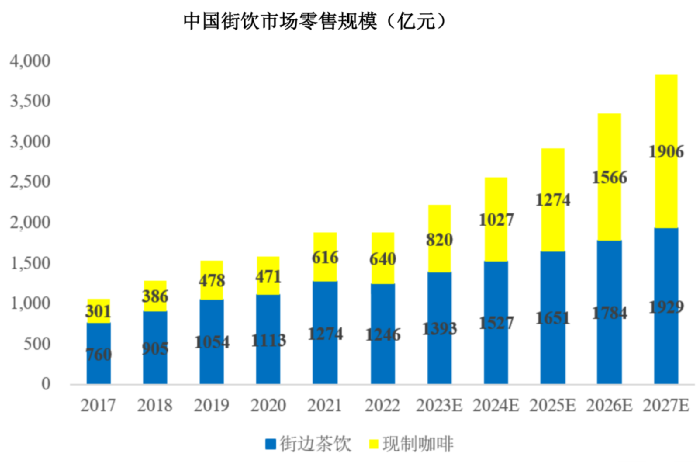

According to the "2021-2023 Asia Trend Report" released by Euromonitor International in conjunction with Nestlé, the street beverage industry in China is showing a steady growth trend. The total retail scale of street beverages increased from 106.1 billion yuan in 2017 to 188.6 billion yuan in 2022, with a compound growth rate of 12.19%. It is predicted that the street beverage industry will maintain its growth trend, with the market size expected to reach 383.5 billion yuan by 2027.

Industry Technology Level and Characteristics

Industry technical level

01 Molding Process

The molding processes for plastic food containers mainly include injection molding and thermoforming. The technology is relatively mature and stable. Companies in the industry comprehensively consider factors such as product appearance, functionality, cost, and delivery time when choosing between these processes.

Injection molding is a process where granular raw materials are liquefied at high temperatures and then injected into molds to set, characterized by high raw material utilization and being more suitable for producing complex-shaped, irregular products.

The blister process first involves making the material into flat sheets, which are then heated and softened before being adsorbed onto a mold for cooling and shaping.

Generally speaking, thermoformed plastic products are characterized by "lightweight, high yield, and strong toughness." They are not easily broken during transportation and use, and they offer significant cost advantages and lightweight environmental benefits in mass production areas.

With the continuous improvement of people's living standards, a variety of foods have gradually entered the lives of consumers. As an important tool for food storage, food packaging containers' functionality and aesthetics have become one of the important factors for consumers to consider during their purchasing process.

Compared to conventional products that are directly formed from a single formulation of raw materials, food container products manufactured using multi-layer co-extrusion technology under the thermoforming process can organically combine the advantageous properties of various formulations. Their functionality and aesthetics are more prominent, with specific comparisons as follows:

02 Printing Process

In the production process of plastic food containers, color masterbatch is often added to the plastic particles to achieve coloring of the finished products. However, using the method of adding color masterbatch usually only results in products with a single color, making it difficult to directly meet customer demands. Therefore, the printing process becomes particularly important.

Food containers can be broadly divided into two categories based on the order of printing during the production process.

The first type is the traditional printing mode where the food container semi-finished products are printed after injection molding or vacuum forming.

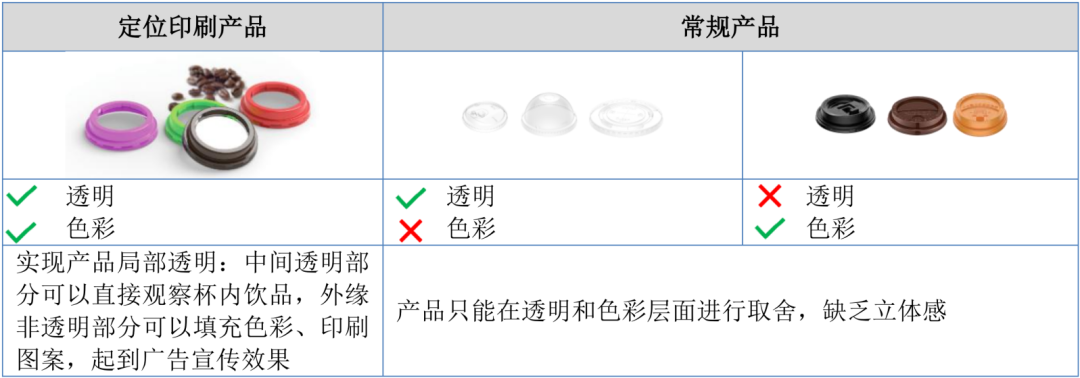

The second type involves integrated cover molding printing, which means first printing and coloring the predetermined position on the sheet material, and then precisely positioning it for thermoforming using a molding machine. In the vacuum forming field, this is commonly referred to as registration printing.

The positioning printing process makes the printed products more aesthetically pleasing and three-dimensional, achieving effects that are difficult to realize with traditional printing or color masterbatch dyeing methods. Meanwhile, the industry-leading positioning printing technology primarily uses water-based ink, ensuring it is safe, non-toxic, and has low VOC emissions, while also featuring colorfastness, making it more reassuring when used as food packaging containers.

Labeling and Sleeving Process

Food containers provide convenience for the storage and sale of food. For the sake of sales and ease of use, they need to be accompanied by labels carrying advertising and explanatory information to help consumers better understand the product. The process of attaching the aforementioned labels to food containers is referred to as labeling or sleeving. Depending on the position of the label, labeling can be divided into in-mold labeling and out-of-mold labeling, as detailed below:

Out-of-mold labeling involves using labeling machines and related equipment to place food container products on a conveyor belt moving at a constant speed. The machine's fixing device evenly separates the products at a fixed distance. The label strip is drawn from a reel beside the conveyor belt and firmly attached to the products passing by on the conveyor belt. Most labels used in out-of-mold labeling are made of BOPP material, characterized by bright colors and a good texture, which can highlight the product's individuality and a sense of "sophistication."

The working principle of in-mold labeling in injection molding is to place the pre-printed in-mold label into the injection mold cavity before injection. During molding, the high temperature and high pressure within the mold cause the special adhesive layer on the in-mold label to melt and integrate with the surface of the injection-molded part. Once the mold opens, the beautifully printed component is completed in one step. The commonly used label materials for in-mold labeling in injection molding are typically OPP, PP, and PE. Since the label is placed inside the injection-molded product and does not come into direct contact with the outside, it is resistant to scratches and its patterns and colors remain stable over time.

The sleeve labeling process involves turning printed roll film into sleeve labels, which are then applied to the bottle body. After passing through a heat shrink tunnel, the labels shrink and adhere to the bottle. Common materials used for sleeve labels include OPS, PET, and PVC, which have excellent shrinkage properties and print adaptability, making them suitable for irregularly shaped bottles or products that require a tight fit.

Industry Development Trends

01 Diversification of Application Scenarios

As social life becomes increasingly rich, the usage scenarios for food packaging containers are becoming more diverse. Downstream industries such as the food industry, street drinks, and meals are placing different demands on the physical and chemical properties required of containers.

"Safety" is the most important attribute of food. Clients in the food industry, based on the need to extend the shelf life of food, pay more attention to the barrier performance of food packaging containers to prevent direct contact between food and the external environment.

Street drink customers pay more attention to the stretching height, transparency, and printability of the cup body to enhance visual appeal and stimulate consumer purchasing behavior.

Food service customers have high requirements for the temperature resistance, oil resistance, sealing, and breathability of packaging products.

Moreover, in scenarios with high recyclability requirements, the rigidity and uniformity of single-material containers have become a primary concern for customers.

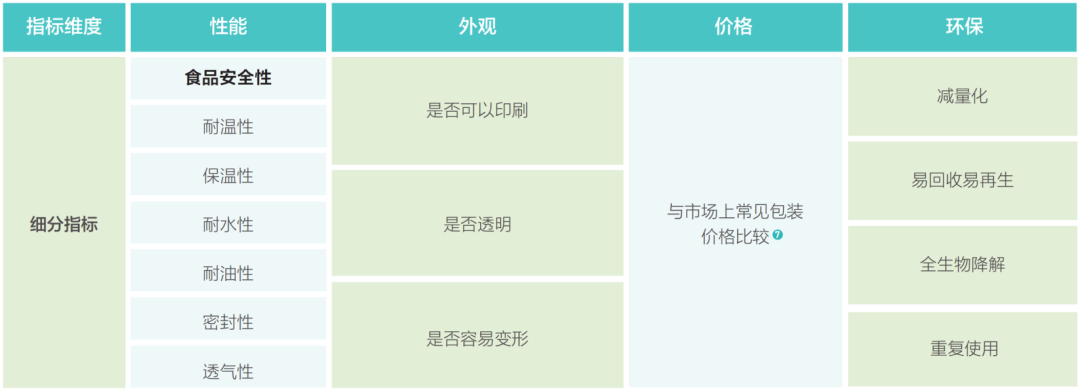

Therefore, under the trend of diversified development in various downstream fields, manufacturers of food packaging containers need to possess strong comprehensive capabilities. They must invest in multiple dimensions such as material formulation selection, molding design, and process optimization to create products that meet consumer demands. The factors considered by businesses when choosing packaging are as follows:

02 Branding and Customization

In August 2022, the National Development and Reform Commission and other departments issued the "Guiding Opinions on Promoting Brand Building in the New Era," stating that a brand is an important symbol of high-quality development and that strengthening brand building is an important way to meet the people's needs for a better life.

With the development of downstream consumer industries, consumer demand for low-end, inexpensive, standardized products tends to decrease, while the demand for quality, personalized, and diversified products continues to rise. This requires food packaging container manufacturers to integrate the customized needs of downstream clients and design container appearances and structures that align with the clients' brand culture. This approach can convey the brand cultural story and product cultural connotations to consumers, thereby enhancing the added value of the products.

03 Intelligent Manufacturing Transformation

In December 2016, the Ministry of Industry and Information Technology issued the "Guiding Opinions on Accelerating the Transformation and Development of China's Packaging Industry," which pointed out: With the core of Internet and Internet of Things technologies, establish an open and shared mechanism for design, manufacturing, technology, and standards, promote the transformation of production methods towards flexibility, intelligence, and precision, vigorously promote advanced manufacturing modes that integrate collaborative manufacturing, virtual manufacturing, and networked manufacturing, and construct an intelligent packaging ecosystem.

Leading manufacturers in the industry are gradually building advanced automated production lines and introducing intelligent workshop management models to achieve smart scheduling, control material input, product shaping, and transfer of finished products. This approach minimizes human contact to reduce contamination and enhances quality control consistency while also reducing costs and increasing efficiency.

04 Industry Cyclicality

Food containers are part of everyday consumer goods, with low demand elasticity and strong sales stability, and do not exhibit obvious cyclical characteristics.

05 Industry Regionality

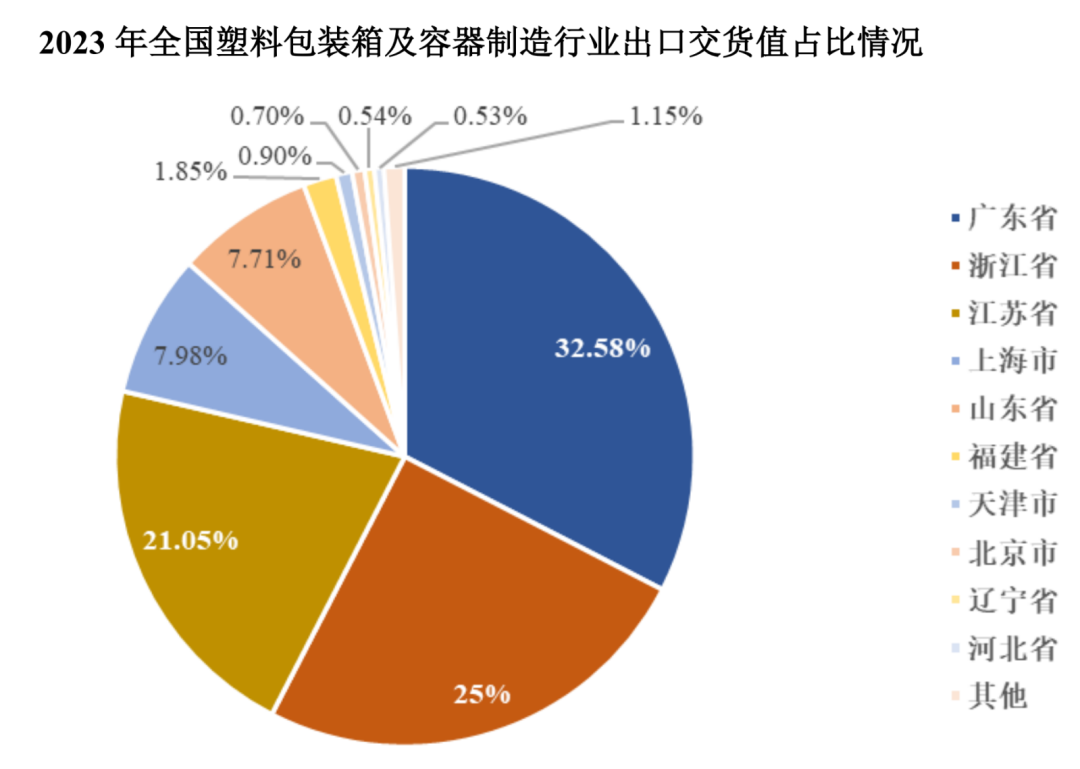

The production side of China's food packaging container industry exhibits a noticeable regionality. Thanks to a favorable political and business environment, comprehensive industry support, coastal location, and convenient transportation and logistics, the industry is primarily concentrated in the eastern coastal areas, showing significant industry clustering characteristics. According to data from the China Packaging Federation, Guangdong Province, Zhejiang Province, and Jiangsu Province rank as the top three in terms of export delivery value in China's plastic packaging box and container manufacturing industry, collectively accounting for 78.63%.

06 Industry Seasonality

The food container industry does not have obvious seasonal characteristics. Influenced by the stocking cycles of downstream industries and holiday breaks for industrial workers during New Year's Day and the Spring Festival, sales in the second half of the year are usually more robust than in the first half.

Main technical thresholds and barriers

System Certification and Product Quality Barriers

Food containers are products that are widely and frequently used in daily life, directly related to the dietary safety and health of the public. Relevant institutions both domestically and internationally have established clear certification standards for food container products, including ISO22000, ISO9001, BRC, etc., which impose strict constraints on all aspects of production processes and manufacturing procedures. Furthermore, downstream customers such as food industry enterprises and chain restaurant brands have rigorous supplier selection procedures, with high requirements for the suppliers' raw material sources, production process management, quality assurance systems, and after-sales maintenance services.

For new entrants to the industry, obtaining relevant certifications or meeting customers' factory inspection requirements presents significant difficulty and time costs, objectively forming an entry barrier for the industry. On the other hand, considering factors such as quality and supply chain stability, customers generally are not inclined to easily switch long-term cooperative suppliers who have already obtained relevant certifications and established a good cooperative relationship.

Technological and R&D Barriers

With the increase in per capita disposable income and the transformation of consumer concepts, residents' demands for food container products in terms of personalization, functionality, and environmental friendliness are gradually rising. Innovative designs, high-barrier functional products, and green packaging products are the focal points of the future market. For potential entrants, due to a lack of rich product design and development experience and insufficient accumulation of process technology, they cannot make timely adjustments according to market consumption demands, making it difficult to keep up with the rapidly changing industry trends. Therefore, the rapid upgrading and iteration of industry products establish high technical and R&D barriers for new entrants into the industry.

Comprehensive service capability barriers

Food container products are primarily targeted at food industry enterprises, catering, and street beverage brands. Customers often customize food packaging containers based on their market strategies and product positioning to attract customers' attention, enhance brand recognition, and increase the added value of food products.

The customization of products is an integrated solution that encompasses a series of processes such as design, production, printing, and labeling. It requires downstream companies to efficiently integrate and utilize R&D resources, formulate reasonable product implementation plans, and configure efficient production lines. Before a company reaches a certain scale and accumulates sufficient production experience, it is challenging to quickly streamline all the processes involved in implementing customized products, making it difficult to provide comprehensive solutions for food containers to well-known downstream clients.

Opportunities and Challenges Faced by the Industry

Opportunities Facing the Industry

Policy support creates a favorable development environment for the industry.

In recent years, relevant government departments and industry associations have successively introduced a series of policies to encourage and support the sustainable and healthy development of this industry.

In 2016, the Ministry of Industry and Information Technology and the Ministry of Commerce issued the "Guidance on Accelerating the Transformation and Development of China's Packaging Industry," which proposed the following goals to be achieved by 2020: Industry scale - the annual main business income of the packaging industry should reach 2.5 trillion yuan, forming more than 15 enterprises or groups with an annual output value exceeding 5 billion yuan, and significantly increasing the number of listed companies and high-tech enterprises. Actively cultivate new industrialization industry demonstration bases with distinctive characteristics in the packaging industry, forming a number of well-known brands with strong influence. The aim is to further enhance the core competitiveness of China's packaging industry and consolidate China's position as a strong packaging country.

In 2022, the China Packaging Federation released the "China Packaging Industry Development Plan (2021-2025)," clearly proposing to "deepen supply-side structural reforms, increase product categories, develop product varieties, and enhance the ability to provide diversified and varied products. It aims to guide packaging enterprises to proactively engage in product innovation, with leading products as the core, to strengthen the information-bearing, cultural communication, and value-enhancing functions of products. The plan vigorously promotes the development of high-end packaging products and collaborates with end customers to create and lead demand, capturing the high-end packaging market." This aims to deepen the supply-side structural reform of the packaging industry and enhance the leadership and competitiveness of domestic related enterprises.

These policies have created a favorable external market environment for manufacturing enterprises, laying a beneficial policy foundation for them to enhance their manufacturing capabilities and strengthen their competitive advantages.

The macroeconomy of our country is stable and improving. Expanding domestic demand is the main theme of economic work, and economic development and transformation inject a "booster" into industry development.

After years of rapid development, China's national economy has achieved the goal of building a moderately prosperous society in all respects. In 2024, the Gross Domestic Product (GDP) reached 134.9 trillion yuan, with a growth rate of 5%, ranking among the top major economies in the world. China's contribution to global economic growth remains around 30%. During the process of high-quality economic development, the benefits have been extended to all citizens. The social security system has been continuously improved, the well-being of the people has been steadily enhanced, and the consumption capacity of residents has been continuously increased. According to the National Bureau of Statistics, the per capita disposable income of the national population increased from 18,311 yuan in 2013 to 41,314 yuan in 2024.

On the other hand, in December 2024, the Central Economic Work Conference was held in Beijing. The conference emphasized the implementation of a more proactive fiscal policy and made important arrangements for the economic work of 2025, outlining key tasks in nine major economic areas. Among them, "vigorously boosting consumption, increasing investment returns, and comprehensively expanding domestic demand" ranked first among the nine tasks.

The prosperity of consumer sales of food container products, as daily consumer goods, is closely related to residents' income and consumption levels. With the steady development of China's macroeconomy and the continuous release of domestic demand, the related benefits will also extend to downstream industries such as the food industry and food delivery services, thereby broadening the market for the industry and injecting a "booster."

The food industry has entered a high-quality development stage, driving the technological advancement and industry development of food packaging containers.

In the process of high-quality development in the food industry, high value-added differentiation competition strategies have gradually become the development goals of leading enterprises in the industry. A high-quality food packaging container can not only ensure the safety and health of food through functional designs such as moisture-proof, anti-oxidation, antibacterial, and high-temperature resistance, thereby enhancing the consumer experience; it can also capture consumers with exquisite packaging, ingenious design, and environmental concepts, enhancing brand image and thus increasing the product's added value.

Therefore, the current beverage, fresh produce, condiments, dairy products, and other food industry sectors have placed higher demands on the corresponding food container products, objectively driving technological advancements and industry development in food packaging containers.

Challenges faced by the industry

01 The market concentration needs to be improved.

The plastic food container industry currently has a low entry barrier, with many participants, resulting in a competitive landscape of "large industry, small enterprises." Apart from a few leading companies that have established highly automated production lines and comprehensive product quality management systems, most enterprises are relatively small in scale, including some that operate like family workshops.

Due to the relatively small scale of enterprises within the industry, insufficient funding, and weak research and development capabilities, they have to use relatively outdated production equipment to output homogeneous products. This leads to market share competition through pricing, which negatively impacts the overall profitability, quality, and innovation of the industry.

02 Raw Material Price Fluctuations

The raw materials for the plastic food container industry mainly include polypropylene (PP), polystyrene (PS), polyethylene terephthalate (PET), etc., all of which are products of petrochemicals. Oil is hailed as the lifeblood of industry, being one of the most important bulk commodities globally and also one of the most volatile in terms of price fluctuations.

Affected by fluctuations in oil prices, the prices of downstream plastic raw materials have also shown significant volatility, bringing considerable uncertainty to plastic product companies. If companies cannot dominate negotiations with downstream customers and adopt more flexible pricing methods, the uncertainty of their operations will also increase.

Industry Competitive Landscape

As of the end of 2023, China's food container industry is characterized by a competitive landscape of "large industry, small enterprises." There are only 2,109 enterprises in the plastic packaging box and container manufacturing sector with main business revenue exceeding 20 million yuan, with an average main business revenue of 76.5306 million yuan and an average operating profit of 3.8872 million yuan. Compared to the domestic market, which is worth tens of billions, the overall industry concentration is relatively low.

From the perspective of industry competition, based on factors such as production scale, industry reputation, and technical level, industry participants are mainly divided into first-tier leading enterprises and second-tier small and medium-sized enterprises.

Leading companies in the first tier have already equipped themselves with advanced production equipment and established highly automated production lines. They have a large production scale and high product quality, enjoying widespread industry recognition. They have established stable partnerships with downstream customers and possess strong research and development capabilities, enabling them to continuously enrich their product portfolio based on industry policies and market trends.

The second-tier companies in the industry are often small and medium-sized enterprises, among which there are entities that organize production activities in the form of family workshops. These enterprises typically have relatively outdated production equipment and processes and have not established effective quality control systems, relying mainly on price competition to secure orders.

The food container industry is currently at a critical stage of transformation towards automation, digitalization, and intelligence. The industrial structure will be further optimized and upgraded, shifting from labor-intensive to technology and equipment-intensive. In this process, leading enterprises with larger production scales, higher industry recognition, and advanced technological levels will have more pronounced competitive advantages, resulting in a more evident bipolar competition pattern in the industry.

The situation of enterprises with a certain scale and competitiveness in the food container industry is as follows:

Ningbo Jialian Technology Co., Ltd. (Stock Code: 301193.SZ)

Ningbo Jialian Technology Co., Ltd. (hereinafter referred to as "Jialian Technology") was established in 2009 with a registered capital of 192 million yuan. It was listed on the Growth Enterprise Market of the Shenzhen Stock Exchange in December 2021. Jialian Technology is a high-tech enterprise engaged in the research, development, production, and sales of high-end plastic products and fully biodegradable products. It is a leading company in the global plastic catering utensils manufacturing industry and a national single champion enterprise in bio-based fully biodegradable daily plastic products.

Jialian Technology's main products include plastic tableware, durable household products, and more, which are widely used in home, fast-moving consumer goods, catering, aviation, and other fields. The main customers include: Amazon, IKEA, Walmart, KFC, Starbucks, Pizza Hut, Costco, Woolworths, Sysco, US Foods, Safeway, Target, Loblaws, Tesco, Little Sheep, Yoshinoya, Mixue Bingcheng, RT-Mart, Metro, Auchan, and many other well-known domestic and international companies.

Fuling Technology Co., Ltd. (Stock Code: 001356.SZ)

Fuling Technology Co., Ltd. (hereinafter referred to as "Fuling Co.") was established in 1992 with a registered capital of 589.32 million yuan. It was listed on the NASDAQ in the United States in 2015 (stock code: FORK), privatized and delisted in 2020, and is scheduled to be listed on the main board of the Shenzhen Stock Exchange in January 2025. Fuling Co. is a high-tech enterprise mainly engaged in the research and development, production, and sales of plastic tableware and biodegradable material tableware. It is a leading plastic tableware manufacturing company in China, a national manufacturing individual champion demonstration enterprise, and an industrial product green design demonstration enterprise.

Fuling's main products are disposable tableware, including knives, forks, spoons, straws, cups, measuring cups, plates, cup lids, take-out boxes, and take-out bowls, which are mainly sold in the North American market.

Fuling Company has passed the product quality certification for major markets, with product sales covering multiple countries and regions including the United States, China, Canada, Central and South America. It possesses extensive and stable customer channel resources, with major direct or end customers including many well-known domestic and international companies such as McDonald's, Wendy's, KFC, Mixue Bingcheng, Chabaidao, and Bawang Chaji.

Hefei Hengxin Life Technology Co., Ltd. (Stock Code: 301501.SZ)

Hefei Hengxin Life Technology Co., Ltd. (hereinafter referred to as "Hengxin Life") was established in 1997 with a registered capital of 102 million yuan and will be listed on the ChiNext Market of the Shenzhen Stock Exchange in March 2025.

Hengxin Life mainly focuses on the research, production, and sales of paper and plastic tableware, using raw materials such as base paper, PLA pellets, and traditional plastic pellets. It has established production bases in multiple locations, including Hefei, Shanghai, and Hainan. The main products are sold to China, Oceania, North America, and other countries and regions. Its major clients include well-known domestic and international companies such as Luckin Coffee, Staples, Amazon, Heytea, Starbucks, Yihe Tang, McDonald's, Dicos, Mixue Bingcheng, Manner Coffee, Burger King, Coco Fresh Tea & Juice, Gu Ming, Dairy Queen (DQ), and others.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track