Explosion at a Chemical Plant! Mitsui Chemicals Plunges 71.9%! Boeing Supports Thermoplastic Composites

International News Guide:

Raw Materials News - Affected by Multiple Instabilities, Ethylene Industry Development May Stall in Europe

Aerospace News - Boeing Emphasizes at U.S. Senate Hearing That Thermoplastic Composites Simplify Aircraft Production

Exhibition News - Over 300 Exhibitors Gather! 2025 AMI Plastics World Expo Scheduled for November, Unlocking New Industry Trends

Macro News - Japanese Trade Representative: Confirmed with U.S. That 15% Tariff "Is Not Cumulative Imposition"

Price Information - CFR Northeast Asia $820/ton; CFR Southeast Asia $830/ton

International News Details:

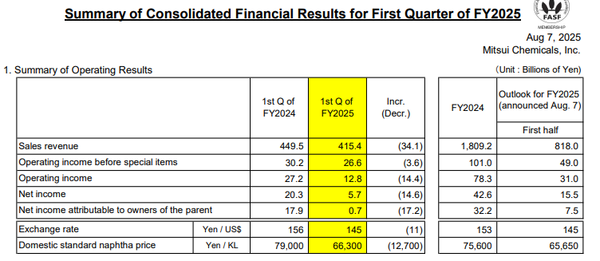

On August 7, Mitsui Chemicals released its consolidated financial results for the first quarter of the 2025 fiscal year, with multiple core financial indicators declining and the chemical business facing multiple challenges:

Both revenue and profit fell: Q1 sales revenue was 415.4 billion yen, a decrease of 34.1 billion yen (7.6% drop) compared with 449.5 billion yen in the same period of the 2024 fiscal year; operating profit (before special items) was 26.6 billion yen, a year-on-year decrease of 3.6 billion yen (12.0% drop); net profit shrank sharply from 20.3 billion yen to 5.7 billion yen, nearly "halved", a plunge of about 71.92% compared with the net profit in the first quarter of the 2024 fiscal year.

3. DIC to Build New Epoxy Resin Production Facility in Japan

DIC Corporation announced plans to build a new epoxy resin production facility at its Chiba Plant in Japan, which is expected to start operation in July 2029. This investment will increase the annual production capacity of epoxy resins specifically used in the semiconductor industry by 59%.

The investment plan for the new facility has been approved by Japan's Ministry of Economy, Trade and Industry under the "Stable Supply Assurance Program", which is the background for DIC's decision to advance the project. As part of the program, DIC will receive a subsidy of up to 3 billion yen (approximately $20.3 million), highlighting the Japanese government's determination to safeguard national security through strengthened economic measures.

Currently, the existing epoxy resin production facilities at the Chiba Plant can no longer meet the expected surge in demand for these key materials. By building a new plant near the existing facilities, DIC aims to ensure additional epoxy resin production capacity from a medium- to long-term perspective.

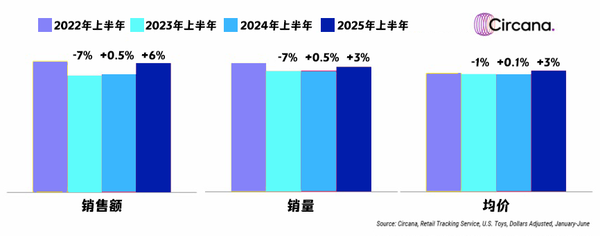

4. Under the Shadow of Tariffs, U.S. Toy Market Grew Against the Trend in the First Half of the Year

According to the latest data from international consulting firm Circana, compared with January-April, the U.S. toy market still maintained an upward momentum in the first half of the year, with sales and sales volume rising by 6% and 3% respectively. This data is consistent with that of January-April, but the average price of products increased by 3% year-on-year in the first half of this year, 1 percentage point higher than that in January-April, which is the first significant increase in toy average prices in recent years.

Data source: Circana

5. Breaking! 1 Dead, 1 Injured! Explosion at a Chemical Plant!

At around 4:30 a.m. on August 7, the Kanto Denka Kogyo Shibukawa Plant in Shibukawa City, Gunma Prefecture, Japan, received a 119 call saying that "some buildings in the plant exploded". According to the prefectural police and the plant, a male employee (28 years old) was taken to the hospital but was confirmed dead, and another person was injured.

7. Boeing Emphasizes at U.S. Senate Hearing That Thermoplastic Composites Simplify Aircraft Production

Recently, Boeing Company CEO Kelly Ortberg emphasized the need to invest in thermoplastic composite (TPC) technology at a U.S. Senate hearing. TPC offers "significant advantages" and will "simplify aircraft production".

8. Over 300 Exhibitors Gather! 2025 AMI Plastics World Expo Scheduled for November, Unlocking New Industry Trends

The 2025 AMI Plastics World Expo will be held at the Huntington Convention Center in Cleveland, Ohio, U.S., from November 12 to 13, 2025, with over 300 exhibitors confirmed to participate.

Image source: Applied Market Information Ltd.

Overseas Macro Market:

[Japanese Trade Representative: Confirmed with the U.S. that the 15% tariff is "not cumulative"]

According to reports, Japan's chief trade negotiator, Ryoichi Akazawa, stated that U.S. officials have apologized for applying cumulative rules to Japan despite having an oral agreement and said that Washington will refund the excess taxes paid. Ryoichi Akazawa also confirmed that the U.S. has pledged to issue another order to reduce tariffs on automobiles and auto parts when revising the universal tariff executive order.

[Japanese Finance Minister: US Tariff Reduction Will Reduce Impact on Japan's GDP by 0.2 Percentage Points]

Japanese Finance Minister Shunichi Kato stated that the reduction of US tariffs on automobiles and other related products from 25% to 15% will reduce the impact on Japan's real GDP growth rate by 0.2 percentage points. Even if the US lowers tariff rates, Japan's real GDP per fiscal year may still decline by 0.3% to 0.4%. The government will continue to analyze how tariff developments and other international developments will impact domestic industries and employment in Japan, and will take necessary measures.

[Turkey Initiates Anti-Dumping Sunset Review Investigation on Chinese-Related Plastic Pacifiers]

On August 7, the Turkish Ministry of Trade issued Announcement No. 2025/27 stating that, upon the request of Turkish manufacturers, an anti-dumping first sunset review investigation has been initiated on plastic pacifiers, plastic feeding bottles, breast pumps, and other breastfeeding and care products originating from China and Thailand. During the investigation period, the current anti-dumping duties will remain in effect. The announcement is effective from the date of publication.

Price Information:

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track