French injection molder Groupe JBT has acquired D&M Plastics, an injection molding firm based in Burlington, IL, primarily serving the healthcare sector. The acquisition announced earlier this month will enable JBT to deliver reliable, localized services to its North American customer base, especially in terms of ISO Class 7 cleanroom production needs, the company said.

Evonik's Q2 Performance Declines! Apple's Earnings Surpass Expectations; Auto Industry Giant Faces Protests Over Pay Cuts and Layoffs

International News Guide:

Raw Materials - EVONIK Releases Q2 2025 Earnings Report: Declining Demand Impacts Performance

Automotive - ZF Announces Mass Layoffs and Pay Cuts! 12,000 Employees Protest on Streets

Packaging -BioLogiQ Receives $5 Mn Grant to Develop Innovative Packaging for Fresh Produce

Medical - French Medtech Molding Connection for D&M Plastics

Electronics - APPLE Releases Q3 2025 Fiscal Year Earnings Report: iPhone Sales Surpass 3 Billion Units, China Market Returns to Growth

Construction - ORIENTAL YUHONG Plans to Acquire Leading Chilean Building Materials Retailer for RMB 880 Million

Macro - JAPAN Insists on U.S. Fulfillment of Bilateral Agreement, Urges Immediate Tariff Reduction on Automobiles and Parts

Price - Ethylene Asia: CFR Northeast Asia $820/tonne; CFR Southeast Asia $830/tonne

International News Details:

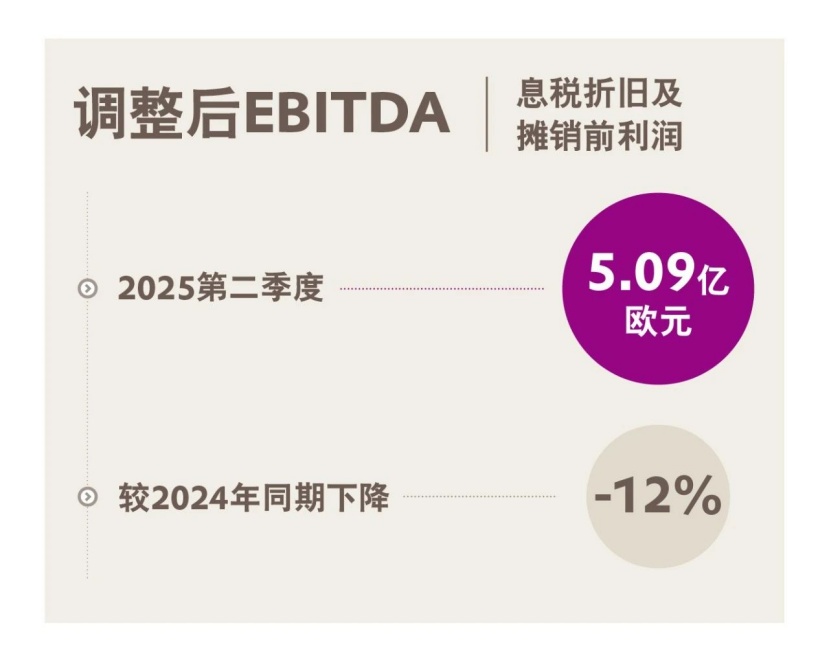

1. EVONIK Releases Q2 2025 Earnings Report: Declining Demand Impacts Performance

Against an increasingly challenging economic environment, EVONIK INDUSTRIES AG reported an adjusted EBITDA of €509 million for Q2 2025, a 12% decrease compared to the strong performance in the same period last year. Over half of the decline in Q2 sales was attributed to unfavorable exchange rate fluctuations and the divestiture of the superabsorbent business, which was still part of EVONIK in the same period last year. Sales volume dropped 4% year-on-year, while product prices remained generally stable.

2. U.S. Imposes Largest-Ever Sanctions on IRAN! Involving a Chinese Port Company

Recently, the U.S. TREASURY DEPARTMENT’S OFFICE OF FOREIGN ASSETS CONTROL (OFAC) announced sanctions on a shipping network controlled by Iranian businessman Mohammad Hossein Shamkhani, involving over 50 entities, individuals, and more than 50 oil tankers and container ships. This marks the largest-scale sanctions imposed by the U.S. government since its "maximum pressure" campaign against IRAN in 2018.

4. ORIENTAL YUHONG Plans to Acquire Leading Chilean Building Materials Retailer for RMB 880 Million

On the evening of July 31, ORIENTAL YUHONG announced that its wholly-owned subsidiaries ORIENTAL YUHONG Overseas Development Co., Ltd. and ORIENTAL YUHONG International Trade Co., Ltd. plan to jointly invest approximately $123 million (about RMB 880 million) with their own funds to acquire 100% equity of Construmart S.A. in Chile from the counterparty. After the transaction is completed, ORIENTAL YUHONG Overseas Development Co., Ltd. will hold 99% of Construmart’s equity, and ORIENTAL YUHONG International Trade Co., Ltd. will hold 1% of Construmart’s equity.

5. French Medtech Molding Connection for D&M Plastics

6. BioLogiQ Receives $5 Mn Grant to Develop Innovative Packaging for Fresh Produce

BioLogiQ has been awarded grant funding through the USDA Foreign Agricultural Service’s $5 million Sustainable Packaging Innovation Lab (SPIL) at Clemson University, launched through the Assisting Specialty Crop Exports (ASCE) Initiative.The BioLogiQ/Clemson partnership will develop and commercialize cutting-edge packaging solutions to help U.S. farmers meet evolving global packaging and trade standards. The project will focus on flexible film, pallet wrap, and protective packaging used for fruits, vegetables, nuts, and specialty greens.

7. APPLE Releases Q3 2025 Fiscal Year Earnings Report: iPhone Sales Surpass 3 Billion Units, China Market Returns to Growth

On August 1, APPLE released its Q3 2025 fiscal year earnings report for the period ending June 28, with quarterly revenue recording the largest increase since December 2021. The earnings report shows that APPLE’s total revenue in Q3 reached $94.04 billion, a year-on-year increase of 10%, and net profit reached $24.43 billion, a year-on-year increase of 9%.

8. ZF Announces Mass Layoffs and Pay Cuts! 12,000 Employees Protest on Streets

German leading automotive parts supplier ZF GROUP recently announced plans to cut approximately 11,000 to 14,000 jobs across GERMANY by the end of 2028. This marks the largest layoff plan in the company’s history, with most layoffs coming from production departments, including R&D staff.

In response to the austerity policies and layoff plans, more than 12,000 employees across GERMANY took to the streets to oppose the board’s plan to further cut thousands of jobs and continue to suppress wages. Achim Dietrich, Chairman of ZF’s General Workers’ Union, revealed that if all the management’s demands are implemented, employees will have to give up 25% to 30% of their annual compensation through measures such as shorter working hours, cancellation of one-time bonuses, and reduction of excessive benefits, with significant variations across regions and positions.

Overseas Macro Updates:

JAPANESE Government and Automotive Industry Exchange Views on U.S. Tariffs

According to NHK, on the same day, JAPANESE Prime Minister Shigeru Ishiba met with heads of several JAPANESE automotive industry groups to exchange views on the U.S.-JAPAN tariff agreement. JAPANESE automotive industry groups called on the JAPANESE government to provide support for the supply chain and formulate policies to stimulate domestic demand. Masanori Kataoka, Chairman of the JAPANESE AUTOMOBILE MANUFACTURERS ASSOCIATION and Chairman of ISUZU MOTORS LIMITED, stated that he hopes the JAPANESE government will continue dialogue with the U.S. to further reduce tariffs.

JAPAN Insists on U.S. Fulfillment of Bilateral Agreement, Urges Immediate Tariff Reduction on Automobiles and Parts

On August 1, Chief Cabinet Secretary Yoshimasa Hayashi stated at a press conference that JAPAN will continue to urge the U.S. to fulfill the reached bilateral agreement, including reducing tariffs on automobiles and parts. Hayashi emphasized: "U.S. President Trump has signed an executive order under the U.S.-JAPAN agreement to reduce bilateral tariffs to 15%... The JAPANESE government still insists that the U.S. should immediately take action to implement the agreement terms, especially the tariff reduction measures on automobiles and automotive parts."

EU Initiates Anti-Dumping Investigation into Chinese Polyamide Yarns

On July 29, the EUROPEAN COMMISSION issued a notice announcing the initiation of an anti-dumping investigation into polyamide yarns originating from China. The dumping investigation period for this case is from July 1, 2024, to June 30, 2025, and the injury investigation period is from January 1, 2022, to the end of the dumping investigation period. A preliminary ruling for this case is expected to be made within 7 months, with a maximum extension of 8 months.

JAPAN Plans to Raise Minimum Wage to a New Record High Again

A panel of the JAPANESE MINISTRY OF HEALTH, LABOR AND WELFARE plans to recommend a approximately 6% increase in the national average minimum wage for the current fiscal year, which would be the largest increase since 2002. The agency added that the proposed hourly increase of approximately 1118 yen ($7.43) would exceed last year’s 5% increase and be the largest since the current system was implemented, but did not cite sources. The government of JAPANESE Prime Minister Shigeru Ishiba set a target last year to increase the average minimum wage by 42% to 1,500 yen per hour by 2020.

Price Information:

USD/CNY Central Parity

7.1496, down 2 pips; previous trading day’s central parity 7.1494, previous trading day’s official closing price 7.1930, overnight closing price 7.1998.

Upstream Raw Materials USD Market Prices

Ethylene Asia: CFR Northeast Asia $820/tonne; CFR Southeast Asia $830/tonne.

Propylene Northeast Asia: FOB Korea average price $730/tonne; CFR China average price $770/tonne.

North Asia frozen cargo CIF price: propane $502-509/tonne; butane $472-479/tonne.

South China frozen cargo for second half of August CIF price: propane $540-550/tonne; butane $510-520/tonne.

Taiwan region frozen cargo CIF price: propane $502-509/tonne; butane $472-479/tonne.

LLDPE USD Market Prices

Film: $860-920/tonne (CFR Huangpu);

Injection molding: $940/tonne (CFR Dongguan).

HDPE USD Market Prices

Film: $910/tonne (CFR Huangpu);

Hollow: $855/tonne (CFR Huangpu);

Pipe: $1,030/tonne (CFR Huangpu).

LDPE USD Market Prices

Film: $1,070-1,095/tonne (CFR Huangpu);

Coating: $1,280/tonne (CFR Huangpu).

PP USD Market Prices

Homopolymer: $910-965/tonne (CFR Huangpu), up $10/tonne;

Copolymer: $920-975/tonne (CFR Nansha);

Transparent: $995-1,055/tonne (CFR Huangpu), down $5/tonne;

Pipe: $1,160/tonne (CFR Shanghai).

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track