Overcapacity Will End, Supply and Demand Already Rebalanced? Is the Good Era of Polycarbonate (PC) Coming?

Return to the starting point of anti-involution: business profitability → capacity expansion → market saturation → business losses → capacity reduction → business profitability again.

The reason for resisting involution is that the market is already saturated, with increasing additional capacity, and business losses have become a common phenomenon.

Market reactions are swift, with drastic changes occurring in just a few months or even days. However, increasing or reducing capacity is not something that can be done in a short period; it takes 1-2 years at the shortest, or 3-5 years at the longest. Therefore, the cycle for capacity expansion and contraction is quite long.

The impulse to chase highs unconsciously shortens the time of market profits, while hesitation when cutting losses prolongs the duration of business losses.

This has resulted in a near-saturated long business cycle of losses, with occasional profits.

Asymmetric profit and loss cycles are generated.

However, some capacities had already been saturated before the entire industry's anti-involution efforts, and the business had been losing money for several years, with actual capacity contraction already underway.

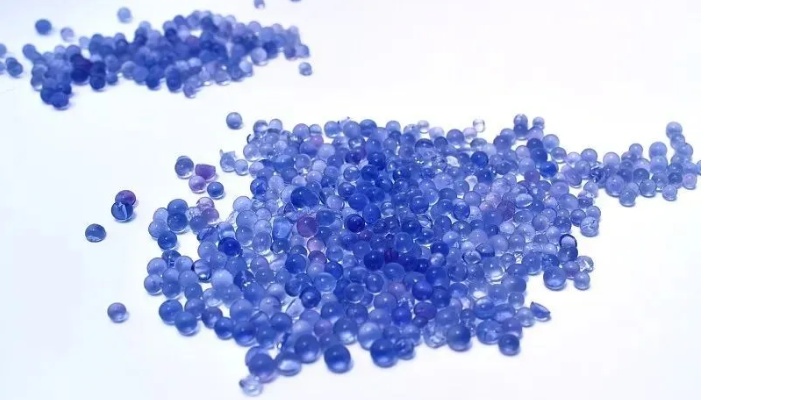

Taking the business introduced this time as an example, the production capacity of polycarbonate has surged rapidly over the past five years, and the industry as a whole has suffered losses for many years. This year may mark a critical turning point for the business.

1. Polycarbonate, long in the doldrums, now sees a turning point?

From 2019 to 2024, the expansion of polycarbonate (PC) production capacity in China has surged wave after wave.

According to data from authoritative institutions, domestic PC production capacity was only 1.66 million tons in 2019, but surged to 3.81 million tons in 2024, with a compound annual growth rate as high as 18%.

The uncontrolled production capacity led to the industry's operating rate lingering at a low level of 50%-60% from 2019 to 2022.

Overcapacity and intense competition have caused the prices of upstream raw materials for PC, bisphenol A and phenol, to be under long-term pressure. Starting from the second half of 2023, they have suddenly plummeted to historical lows, with no signs of recovery in sight.

At the darkest point for bisphenol A, the operating rate of the PC (polycarbonate) industry rose to 72.5% in 2023, increased to 75.8% in 2024, and further reached 81.08% in the first half of 2025.

The profitable moment for PCs has not yet arrived, but the shift in operating rates is no coincidence. Behind the scenes, the industry's supply and demand structure is quietly undergoing profound changes.

2. Capacity expansion has begun to "hit the brakes," and the supply landscape has already been reshaped.

The wave of capacity expansion in the domestic PC industry is rapidly receding.

According to the prediction of Longzhong Information, the only planned new PC production capacity in China for 2025-2026 is Chimei's 180,000 tons in Zhangzhou, Fujian, with no other new capacity entering the market.

This stands in stark contrast to the 2.15 million tons of new production capacity added over the past five years; the years of rapid capacity expansion are coming to an end.

The supply side has entered a "rigid" era, with nearly stagnant new capacity. The industry is focusing on how to efficiently utilize existing capacity.

From 2019 to 2022, the industry operating rate was only 50%-60%, with a large amount of capacity being idle.

Starting in 2023, it rose to 72.5%, reached 75.8% in 2024, and surpassed the 80% mark in the first half of 2025, with the industry average being 81.1%.

The growth rate of production capacity has stalled, and coupled with the continuous rise in operating rates, the era of disorderly expansion on the supply side has come to an end. Optimizing the existing stock has become the main theme.

3. Imports have been gradually replaced, and reverse exports have only just begun.

On the supply side, while the "pause button" is pressed, the demand side is witnessing an accelerated pace of import substitution due to the improvement in the quality of domestic products, and the export market is gradually expanding.

In 2019, China’s import volume of PC resin was 1.6 million tons, and its dependence on foreign sources remained relatively high.

In 2024, China's PC imports amounted to 887,000 tons, nearly halved compared to 2019.

This set of data also proves that domestic PCs have the quality and price competitiveness to compete with international giants.

At the same time, the export journey of domestic PCs is also quietly undergoing changes.

Between 2019 and 2022, the export volume of domestic PCs remained basically stable at 200,000 to 350,000 units.

In 2023, the export volume increased to 360,000 tons, and in 2024, it reached 490,000 tons, marking a 40% increase from the low point in 2019.

Domestic PCs have firmly established their position in the domestic market and are beginning to make a mark in the international market. The trend of reverse exports has already proven this.

The path for chemical products to go overseas is bound to be one of the choices for the future.

4. Supply and demand are rebalancing, and price recovery has begun.

The stagnation of supply expansion, coupled with the continuous strengthening of domestic and foreign demand, has led to a new balance in the supply and demand of the domestic PC industry.

The new production capacity for 2025-2026 has already been determined, and downstream consumption sectors such as electronics, automobiles, and sheet materials are expected to maintain stable growth.

If the export market can continue to expand, the supply and demand balance will inevitably begin to shift.

This is a fundamental shift in the pattern, with the core driver of market prices returning to the basics of supply and demand.

The industry operating rate, as a key indicator of supply and demand balance, has shown a clear upward trend.

It is expected that in the next two years, the industry operating rate is likely to rise to around 90%.

This is already the bottleneck where the overall capacity utilization rate of the industry is close to or even reaches the theoretical limit.

In this context, the prices of upstream raw materials such as bisphenol A and phenol are at historical lows, and the current supply-demand relationship cannot be reversed in the short term. The cost support for PC is very strong, and the prices of PC products have moved away from the bottom, fully meeting the conditions to enter a recovery and upward trajectory.

Although the current market price of PC resin remains pessimistic, the upward channel is still open, and opportunities may arise at any time.

5. The Springtime for Leading Enterprises is Coming Soon

As the industry shifts from "overcapacity" to "supply-demand rebalancing," the polycarbonate sector is entering a phase of definite upward momentum.

In this round of industry restructuring, leading companies with high operating rates, low costs, stable quality, and established overseas markets will become the biggest beneficiaries.

Their certainty in profit recovery and resilience in elasticity are both more prominent.

The commissioning of Fujian Zhangzhou Chimei's new 180,000-ton production capacity is the biggest variable on the supply side in the next two years. The impact of 180,000 tons on a 4 million-ton market is relatively small, and the overall supply-demand structure trend will not change.

Even if new players add production capacity, it won't have much influence within five years. For materials business like PC, where quality is paramount, starting up a project is just the beginning of the real challenge; quality is the true guarantee for the market.

A new era of the PC industry, shifting from disordered expansion to intensive cultivation and from relying on imports to both domestic and international advancement, has begun to knock on the door.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track