Only 200 out of 10,000 repair shops can fix the three electric systems

The current situation in the field of electric vehicle maintenance can be outlined through multiple sets of data:

According to the prediction by Cinda Securities, the scale of the new energy vehicle after-sales maintenance market is expected to reach 300 billion yuan by 2025, with maintenance of the "three electric components" accounting for over 15%, corresponding to a market size of approximately 45 billion yuan.

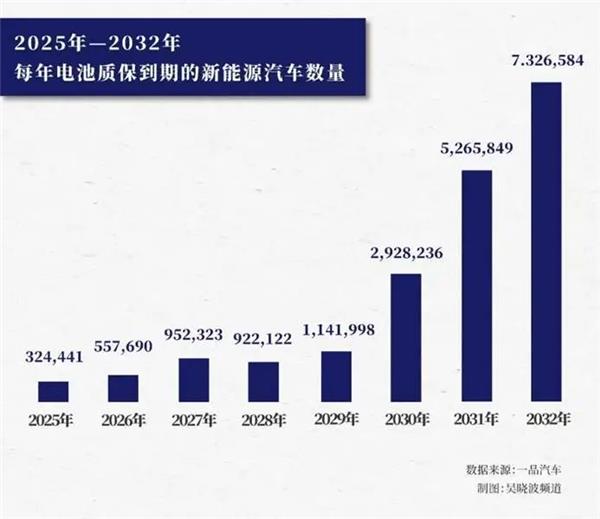

By 2025, 320,000 new energy vehicles will have reached the end of their warranty period for the "three-electric" system, increasing to 980,000 by 2028, and surpassing 7.2 million by 2032. Comprehensive estimates suggest that the total number of vehicles with expired power battery warranties will approach 20 million over the next eight years.

However, the contradiction between market expansion and insufficient supply of professional services is becoming increasingly prominent.

According to statistics from the China Automobile Maintenance Industry Association, there are currently about 400,000 enterprises related to the maintenance and repair of fuel vehicles in China, but only 20,000 to 30,000 enterprises for new energy vehicle maintenance.

The survey conducted by F6 Data Research Institute on 10,000 repair shops reveals a deeper issue: only 2%, or 200 shops, have the capability to repair electric drive systems.

A more severe issue is the talent gap. It is estimated that by 2025, the nationwide shortage of after-sales service personnel for new energy vehicles will reach 824,000 people, while currently there are fewer than 100,000 technicians qualified in the maintenance of the three-electric systems.

In this context, the landscape of the three-electric maintenance market is being reshaped, forming a diversified repair network with battery manufacturers, OEMs, insurance companies, 4S groups, and independent third parties as the main entities.

This article will analyze the layout and trends of these five major forces in the field of electric vehicle maintenance.

Battery Manufacturer-Led Three-Electric Maintenance Network

CATL, with its scale advantage of over 17 million electric vehicle battery installations, is extending its business from the B-end supply chain to C-end services by launching a repair chain brand called "Ningjia Service." (Further reading: Is another giant opening franchise opportunities to repair shops, heralding the arrival of the largest nationwide new energy vehicle repair chain?)

The network is divided into three tiers: the top level consists of Ningjia Direct Experience Centers, followed by Ningjia Authorized Service Stores (rated from 1 to 5 stars, with an estimated investment of about 1 million for a two-star authorized store), and newly established Ningjia Battery Repair Centers (requiring original authorized stores to invest and upgrade tools).

The repair center aims to address the issues of the high technical difficulty in CTP battery repairs and the insufficient capabilities of most service points, while also expanding profitable service projects for clients such as insurance companies.

As of February 2025, "Ningjia Service" has a total of 607 domestic networks, including 12 battery repair centers.

The Ningjia Service Mini Program, which has been launched, can provide car owners with battery testing, online consultation, roadside assistance, and product discounts, bringing C-end traffic to stores.

However, Ningde's heavy asset after-sales model also faces challenges in terms of input-output ratio and operational management.

At present, EVE Energy and REPT Battery have also initiated recruitment for after-sales service stations. Whether they will further launch C-end service chains remains to be seen.

02. Electric Vehicle Power System Maintenance System Led by OEMs

New energy vehicle manufacturers have significantly increased their involvement in the after-sales system of the "three electric" components, becoming a key force in market control. This includes direct-operated electrical and mechanical repair centers by companies like Tesla and Li Auto.

BYD has established a closed and independent three-electric maintenance system, relying on its self-developed battery technology and Fudi Battery (a wholly-owned subsidiary) to form a closed-loop ecosystem: it has built exclusive maintenance centers that only serve BYD models and are not open to the public.

After the vehicle owner submits a battery repair request through an authorized service center, complex faulty batteries are sent to the Fudi regional repair center for processing. During this period, a replacement battery is provided to ensure vehicle usage. The old battery is handed over to upstream precursor suppliers for collaborative handling, returning to the reproduction system.

The current model has already been piloted in the repair centers of six cities: Shanghai, Qingdao, Xiamen, Xi'an, Changsha, and Shenzhen. It achieves a full internal cycle of "repair-replace-recycle" for batteries, enhancing technical control and the after-sales service loop.

It is worth noting that Tesla and CATL have been actively involved in the formulation of group standards for battery remanufacturing, as the lack of relevant standards in China has restricted the application of remanufactured batteries (which are already widely used in the United States).

03. Insurer-led Electric Vehicle Repair Network

To effectively control claims costs, insurance companies are making the establishment or leadership of repair networks a key strategy.

A typical case is PICC's Bangbang Auto Service establishing the "Zhongbao Zhixiu" chain system, offering one-stop services such as electric vehicle repairs and accident repairs. The flagship store in Beijing has already started operations, and the first "new energy repair network" contracted store has been established in Ganzhou, Jiangxi.

At the same time, Bangbang Auto Service New Energy Business Department is collaborating with multiple local PICC Property and Casualty Insurance branches to explore a new model for PICC-branded new energy vehicle insurance services and accelerate the planning of the repair network.

The Xiamen branch of PICC has collaborated with the local 4S group, Xiamen Xindeco Automobile Group, to jointly build a new energy vehicle customer service center that integrates functions such as charging, three-electric maintenance, comprehensive sheet metal and painting center, and assessment center. Additionally, the PICC Property and Casualty division has also partnered with the automotive service chain Xinghengcheng to co-establish a new energy vehicle service center.

In 2024, data shows that the leading group consisting of PICC Property and Casualty, Ping An Property & Casualty, and China Pacific Property Insurance underwrote a total of 24.2 million vehicles, accounting for 77% of the national total.

This significant market concentration advantage may prompt the insurance company to adjust the repair structure in the underwriting sector of the three-electrics, directing accident vehicles towards its more cost-effective cooperative or self-built repair terminals.

The key lies in whether the concentration advantage of the auto insurance market can effectively influence or even challenge the long-term dominance of the OEMs in the field of electric vehicle component maintenance.

04. The electric vehicle repair network with a 4S group background

Taking Chengdu Electric Donkey Group as an example, there is no intersection with Zhongsheng Group at the equity level, but there is deep collaboration at the business level.

Electric Donkey's nationwide layout of "Flash Repair Centers" adopts a "store-in-store" model, directly entering the sheet metal and spray centers of Zhongsheng Group's 4S stores.

AC Auto has previously provided analysis that new energy vehicle repair chains backed by 4S dealership groups theoretically have more advantages.

At the resource integration level, 4S deeply integrates the sheet metal and painting business with the specialized repair business for the three electric systems. While the sheet metal and painting center undertakes the body repair of new energy vehicles, the internally set up Electric Donkey Quick Repair Center can simultaneously handle repairs of the three electric systems, maximizing the utilization of accident vehicle resources.

This model reduces the expansion costs for Diandong and leverages Zhongsheng's mature talent system to quickly replicate maintenance technicians.

Zhongsheng Group's luxury brand is accelerating its transition to electrification, with an increase in the number of new energy 4S stores. The scale of new energy customers and after-sales demand within the system will continue to grow. This expansion into new energy after-sales services will enhance their ability to service both fuel and electric vehicles.

As of now, Diandu has established 33 directly-operated repair centers and 1 repair base, with plans to increase to 200 centers and 10 bases by the end of 2025, and to reach 500 centers and 30 bases by the end of 2026, aiming to cover 90% of the cities nationwide.

If the model of the electric mule runs smoothly, other dealership groups are likely to follow suit, making it a significant force in the field of electric drivetrain maintenance.

05. Independent after-sales service brand for three-electric (battery, motor, and electric control) system maintenance

This is currently the most active force in the new energy after-sales sector, especially as some capable regional enterprises may prioritize establishing electric vehicle repair chains in regional markets due to the rapid expansion of Electric Donkey Flash Repair.

Mainly divided into four categories:

Firstly, taking Electric Workshop as a representative, it is positioned as an "after-sales service operation management platform for new energy vehicles (with a focus on the three-electric system)," similar to creating a "Meituan in the field of new energy vehicle maintenance."

Upstream, it undertakes the service needs of large clients in the industry, such as the three-electric component manufacturers, insurance companies, and operation platforms. Downstream, it establishes professional undertaking capabilities by empowering terminal repair shops with upgrades in "electrification services."

It is reported that the relationship between the electric workshop and the terminal stores is a "service operation management platform-service fulfillment store" cooperation model. It does not exclude the participation of other new energy peers, and currently focuses mainly on empowering traditional car repair shops.

Secondly, the focus is on creating a national new energy vehicle repair chain represented by Green Workshop, similar to the "Tuhu in the field of new energy vehicle maintenance."

Green Workshop focuses on second to fifth-tier cities and aids traditional repair shops in rapidly transitioning to the new energy sector through a franchise model. As of now, the number of franchise stores has exceeded 1,000.

In addition, the "HuaTech" Tesla specialized repair chain launched by Huasheng Group has been established in Suzhou, Xi'an, and other locations; Tesla specialized repair brands such as Xunwei, Fubon, and TBA are also accelerating the expansion of their store networks.

Through the self-developed electronic control circuit board repair system and diagnostic software system, Xunwei has surpassed 100 franchise stores nationwide.

The third is represented by Guangzhou Geyue New Energy Repair Chain, which focuses on the B2B field of repair enterprises, similar to the "global transmission specialist in the new energy repair field."

GeYue provides maintenance services for vehicles on ride-hailing platforms such as Didi, T3, and Ruqi, aiming for rapid scaling. It primarily focuses on accident vehicle repairs and introduces industry chain investors such as OEMs, insurance companies, or ride-hailing platforms to invest in shares.

As of June 2024, it has 15 directly-operated stores and 5 franchise stores. Its franchise models include a new energy specialty store with a total investment of approximately 1.2 million and an in-store shop model with a total investment of approximately 300,000. It is currently seeking new financing to expand out of Guangzhou and south of the Yangtze River.

Fourth, the three-electric maintenance represented by parts companies like Huichuan Electric has a relatively small share in the new energy maintenance business and is developing relatively slowly.

In Conclusion

According to industry statistics, the three most frequently damaged components of new energy vehicles are the battery, air conditioning compressor, and charging system. Currently, power batteries are reaching a peak period of "warranty expiration," which will undoubtedly become the focus of competition among multiple forces in the industry chain.

For car manufacturers, as battery repair technology becomes more widespread, there is no reason for the authorized after-sales system to exclude the repair services of the electric drive system. The two major systems of vehicle repair and battery repair are likely to become unified. This implies that a confrontation between battery manufacturers and the authorized after-sales systems of OEMs is inevitable in the future.

Insurance companies, from a cost-reduction perspective, are inclined to collaborate with 4S systems and independent aftermarket enterprises to build a joint repair network. By leveraging their concentration advantage in the new energy vehicle insurance sector, they aim to compete with the original equipment manufacturers (OEMs).

At the same time, as the number of new energy vehicle customers out of warranty surges, the competition for customer resources between the 4S system-dominated electric vehicle repair network and independent after-sales companies with cost advantages will become increasingly intense.

From this perspective, the field of power battery maintenance is forming a competitive and cooperative pattern among five major forces: vehicle manufacturers, battery manufacturers, insurance companies, 4S groups, and independent aftermarket enterprises.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track