Oil Prices Plunge Again, Closing at Lowest Since July; Plastic Futures Narrowly Weaken, PE Expected to Rise Slightly Today

1. Crude Oil Market Dynamics

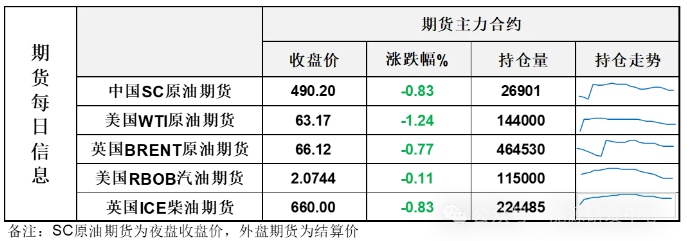

On August 12th, the market continued to focus on the meeting between the US and Russian leaders, with geopolitical tensions expected to ease further, leading to a drop in international oil prices. The NYMEX crude oil futures for the September contract fell by $0.79 to $63.17 per barrel, a decrease of 1.24% compared to the previous period; the ICE Brent crude futures for the October contract fell by $0.51 to $66.12 per barrel, a decrease of 0.77% compared to the previous period. China's INE crude oil futures for the 2510 contract rose by 2.5 to 492.6 yuan per barrel, and fell by 1.8 to 490.8 yuan per barrel in the night session.

Market Outlook

Oil prices plunged sharply again on Tuesday, with closing prices continuing to hit the lowest levels since July, repeatedly testing key support levels below. There was a wealth of supply and demand information overnight, with bearish factors dominating. In the early hours, the EIA released its Short-Term Energy Outlook, in which it downgraded its oil price forecasts, particularly adopting a more pessimistic view for 2026. The EIA revised upward both supply and demand estimates, with a larger increase in supply. Notably, the projected global oil inventory build for Q4 2025 and Q1 2026 will average over 2 million barrels per day, which is 0.8 million barrels per day higher than last month's forecast. This indicates that the pressure of oversupply in the crude oil market will intensify in the coming period.

On Tuesday, oil prices declined while the WTI crude oil monthly spread weakened significantly, indicating a cooling market sentiment. Although these days provide a rare breathing space before the US-Russia negotiations, increasing pressures on supply and demand have dominated oil price movements. The brief rebound failed to gain further momentum, and the upper boundary of the range formed in April and May is now at risk of being breached. Pay attention to timing and participate cautiously.

II. Macroeconomic Market Trends

The latest data from the U.S. Department of the Treasury shows thatThe total US debt has exceeded 37 trillion dollars for the first time.。

2In July, the US unadjusted CPI annual rate remained unchanged from the previous month, recording 2.7%; the unadjusted core CPI annual rate rose to a five-month high, recording 3.1%.After the data release, traders increased their bets on a Federal Reserve rate cut in September.

The White House: The Russia-U.S. summit will be bilateral and there will be no third parties.Trump may have plans to visit Russia in the future.。

Kim Kun-hee was detained.For the first time in South Korea's constitutional history, a former president and his spouse were arrested simultaneously.

5、OPEC raises its oil demand forecast for next year and lowers its supply growth estimate for non-OPEC+ oil-producing countries.The U.S. Energy Information Administration lowers oil price forecasts for this year and next year.

6. The Ministry of Finance, the People's Bank of China, and the Financial Regulatory Authority issued the "Implementation Plan for the Fiscal Interest Subsidy Policy on Personal Consumption Loans."The scope of interest subsidies includes individual consumption below 50,000 yuan, as well as key areas of consumption such as household automobiles, elderly care, and childbirth for amounts of 50,000 yuan or more.

3. Plastic Market Dynamics

On Tuesday, international crude oil prices declined, and plastic futures edged down.

The plastic September 2025 contract is quoted at 7,325 RMB/ton, down 0.04% from the previous trading day.

The PP2605 contract is quoted at 7,105 yuan/ton, down 0.17% compared to the previous trading day.

The PVC2509 contract is quoted at 5032 yuan/ton, down 0.06% compared to the previous trading day.

The styrene 2509 contract is quoted at 7,299 yuan/ton, down 0.21% from the previous trading day.

4. Market Forecast for Today

PE: In the short term, with downstream demand gradually increasing recently and support from favorable macroeconomic conditions, domestic polyethylene producers show a clear intention to maintain prices. As the peak demand season approaches, downstream demand is expected to continue rising, and polyethylene prices are anticipated to experience a slight increase today.

PP: Insufficient follow-up on demand is dragging down transaction progress, with downstream restocking intentions remaining mainly based on rigid demand. Market sentiment is cautious. In the future, as new production capacity continues to be released and the number of new maintenance units decreases, supply pressure will increase, affecting future market valuations. It is expected that polypropylene prices will mainly fluctuate and consolidate today, with mainstream raffia prices in East China at 7,000-7,150 yuan/ton.

PVC: The policy-driven sentiment in the black sector continues, with some rumors further disturbing the black and chlor-alkali sectors, leading to fluctuations and gains in PVC futures. However, the fundamental supply-demand imbalance in the spot market persists, with high supply and stable demand causing continued inventory accumulation in the industry. Market transaction activity remains subdued. In the short term, fundamental support is insufficient, followed by policy influences. Spot PVC prices are expected to remain stable, with the East China region's calcium carbide-based Type V cash warehouse price ranging between 4800-4900 RMB/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track