Off-Season Demand Weighs on PP Prices, Supply-Demand Imbalance Drives Volatile Trend; Plastics Weaken Today With POM Down Up to 300

Weak demand season suppresses PP prices; supply and demand contradictions dominate the volatile pattern.

Introduction: With the cooling down of macro policy speculation, the expansion project at CNOOC Daxie has been delayed until mid-August, easing supply pressure; on the demand side, weak demand persists, with downstream just-in-time purchasing during the off-season, and no improvement in demand currently, leading to cautious market sentiment.

1. Demand has eased, and expectations may improve.

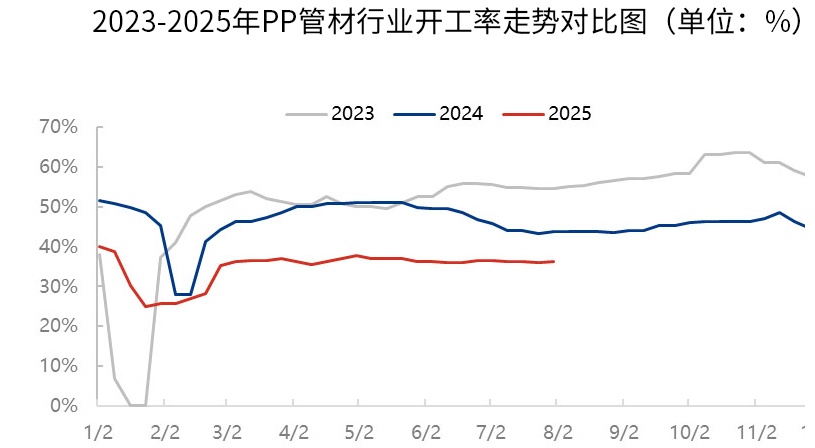

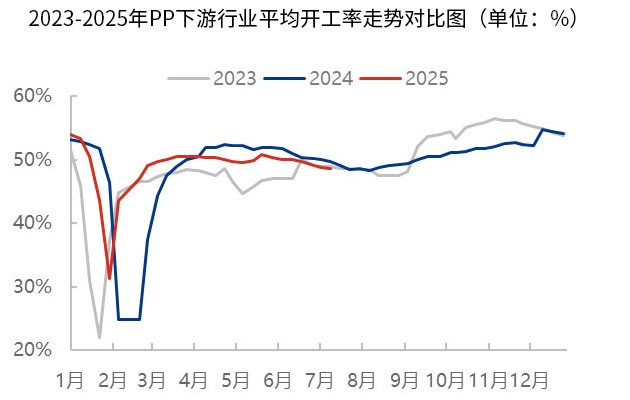

Driven by favorable macroeconomic policies, some downstream product manufacturers saw an improvement in orders last week. The average operating rate of China's polypropylene downstream industries—including woven bags, injection molding, BOPP, PP pipes, PP nonwoven fabric, CPP, PP transparent products, and modified PP (a total of eight downstream sectors)—rose by 0.03 percentage points to 48.40%. During the week, there was a clear divergence in the operating rates among various downstream sectors of polypropylene. Only the PP pipe, PP transparent products, and PP injection molding sectors showed an upward trend in operating rates. Among them, the PP pipe industry benefited from a slight increase in construction and infrastructure project initiations, leading to improved market demand and a rise in operating rates.

Overall, although there has been a slight recovery in demand from some downstream industries of polypropylene, the support on both supply and demand sides remains limited. However, as terminal demand gradually warms up in August, inventory replenishment is expected to steadily increase, and the operating rates across various industries may see a stable upward trend.

2. Macro guidance cools down, PP prices rise then fall back

The macroeconomic guidance on the market has weakened, and polypropylene has entered a demand pricing phase. On the fundamentals, the commissioning of Ningbo Daxie has been delayed, pushing back the expected supply pressure, and resources are being consumed positively during the commissioning window. In terms of demand, factory procurement pace has slowed down at the end of the month, with reduced enthusiasm, making it difficult to form upward momentum. Influenced by a strong policy cycle, market sentiment is becoming cautious, and spot price fluctuations are converging. As of July 31, 2025, the mainstream price for East China yarn is between 7080-7200 yuan/ton.

3. Medium- to long-term conflicts still lie in the fundamentals

At the macro level, the economic stabilization policies introduced by the Central Politburo Work Meeting and the expectation of RMB depreciation, which is beneficial for exports, will become important drivers guiding the market. The supply and demand sides are at a critical stage of variability, with intensive maintenance in August and new capacity expansion offsetting each other. The demand side is at a key period of seasonal transition, with potential for demand variables to improve from weakness. However, due to global trade barriers and tariffs, the demand side's valuation is lower than the same period last year. The support from the cost side is limited, with the expectation of OPEC+ production increase affecting international oil prices, leading to anticipated easing in oil-based costs. The supply-demand fundamentals of the polypropylene industry are difficult to change, with external policy becoming an important breakthrough to drive the market out of the stalemate. In a situation where external difficulties and internal challenges coexist, it is expected that the market's deadlock will persist, with intermittent surges driven by policy boosts. Close attention should be paid to changes in foreign trade export orders, fluctuations in the cost side, and the release of new capacity expansion.

Today's plastic prices

(The above content is compiled from Jinlianchuang and Dayi Yosu)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track