Nio, turned around by it

Listed for 3 days, delivered 1,976 vehicles.

The LeDao L90 has delivered an impressive report card. This large three-row electric SUV ranked among the top three in the large SUV weekly sales chart right after its launch, second only to the Wenjie M8 and Wenjie M9.

As one of the few new models within the NIO system this year, and positioned for the home market, the L90 is undoubtedly NIO's most important product this year.

In particular, the Le Dao L60 failed to make a strong debut when it was launched last year, and the revamped "5566" also performed mediocrely after its release. The L90 must shoulder the responsibility of driving sales.

Although it is a model of the second brand, the LeDao L90 is almost entirely built according to "NIO standards," densely applying NIO's research and development achievements over the years. In terms of exterior and interior design and aesthetics, it aligns with NIO, laying a foundation for the "beyond expectations" pricing.

To ensure that this model, refined over three years, hits the mark in the market competition, Ledao has made thorough preparations this time.

NIO has adopted all the proven strategies from the market, whether it's product configuration and pricing strategy or the launch process and promotional rhythm. They focus on listening to advice and have effectively executed this combination.

The LeDao L90 is selling well, and NIO Chairman Li Bin couldn't hide his joy. He proactively quoted the weekly data on social media, stating, "The Hefei factory is already operating at full capacity, working overtime to produce and stock up," continuing to accelerate the production and delivery speed.

According to Yiou Auto, Shen Fei, who was newly appointed this year to be in charge of sales at Ledao, has made it clear internally that the delivery of this car must exceed 10,000 units in August.According to this guideline, the L90 is very likely to be NIO's highest-selling model in a single month in history.

In the "No Man's Land",Be the king of cost-effectiveness.

On the last day of July, the LeDao L90 was launched in Hangzhou.

When Li Bin announced its configuration and price, the media present and potential customers all cheered in unison.

For NIO, this is a long-awaited grand occasion.

In these years of rapid development of new energy vehicles, the products have become highly competitive, with prices dropping to astonishing levels. Competitors have successively launched blockbuster products in niche markets. NIO, which has always positioned itself as a high-end brand, has not had such a "show-stopping moment" for a long time.

The Le Tao, which meets the needs of a family car, played this role, and this time, NIO has finally played the "value for money" card.

The LeDao L90 is a large three-row family SUV, with starting prices of 265,800 yuan for the six-seater and 271,900 yuan for the seven-seater. If you rent the battery, the price can be reduced by an additional 86,000 yuan.

At this price, it almost breaks through the defenses of mainstream large three-row SUVs.

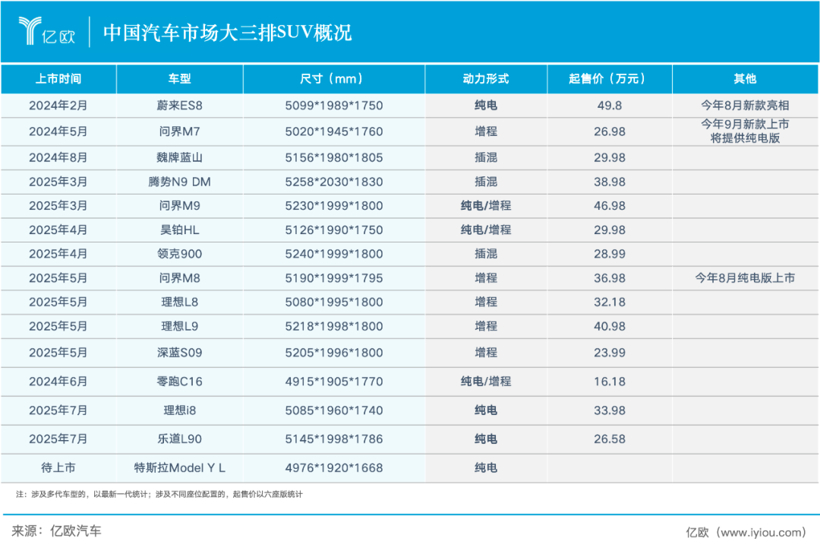

In comparison, the starting price of the popular Li Auto's 6-seater SUV L8 is 321,800 RMB, while the newly launched Lynk & Co 900 this year starts at 289,900 RMB.

In the NIO system, this large SUV, which is over 5 meters long, is 32,200 yuan cheaper than the currently least expensive model in the NIO brand—the mid-sized coupe ET5.

The unexpected price has brought extraordinary attention to the LeDao L90.

According to senior channel expert Sun Shaojun, after the car went on presale in mid-July, the number of first-line store visits surged by 3-4 times, and the presale orders were very high. "It's obvious that this time it has broken through," he said.

The reason is that the pre-sale price of Le Dao L90 is 15,000 to 20,000 yuan cheaper than the target users expected.

The Le Dao L60, which was launched last year, is also a well-refined product with a starting price 30,000 less than its benchmark, the Tesla Model Y. However, whether in terms of perceived value for money or market buzz generated, the L90 surpasses the L60.

One important reason is that the Ledo L90 has almost entered a "no man's land" in terms of product positioning—a large three-row pure electric SUV, with very few products on the market, and even fewer built on the latest native pure electric platforms.

In the past few years, "mid-to-large-sized cars are not fully electric" has almost become a market consensus.

Under the "leadership" of players like Li Auto and Huawei, the large three-row SUVs in the market are primarily driven by hybrid/extended-range systems. Even Zeekr, which has always adhered to a pure electric route, specifically developed a super electric hybrid solution for its flagship SUV, the Zeekr 9X.

Behind this is the fact that, due to technical limitations, pure electric solutions have not been able to effectively address the range issues of medium and large vehicles.

The conventional approach is to use a larger battery.

In actual vehicle engineering, larger batteries increase the weight of the car and energy consumption, so the balance between range and battery capacity is really a matter of trade-offs.

With technological advancements and the maturation of the industry chain, pure electric solutions can not only perfectly adapt to medium and large vehicles, addressing past product pain points, but also offer a highly competitive price.

Over the past decade, NIO, which has been focused on the pure electric route, seized this opportunity.

Based on NIO's third-generation pure electric technology platform, the basic product definition of the LeDao L90 was already completed in the second half of 2022.

With a 900V high-voltage electrical architecture, lightweight body, and highly integrated motor, this new electric vehicle achieves the expected performance level while also making a leap in overall vehicle curb weight. This fully optimizes battery efficiency, resulting in lower energy consumption and greater range.

In order to further reduce energy consumption, NIO has also developed an electronic fuse that enables independent control of electrical devices within the vehicle. Even when the vehicle remains in monitoring mode (Guard Mode), daily power consumption can be controlled to around 1 kWh, while comparable models consume about 4 kWh.

In the trend of component integration, NIO has also achieved better space levels in its large three-row SUV.

Plug-in hybrid/extended-range vehicles, which do not have range anxiety, face a challenge because the space occupied by both the electric drive and fuel systems often results in a slightly compromised space experience in these large three-row SUVs.

Based on the full-domain 900V high-voltage architecture, Ledao has achieved space upgrades through 36 integrated designs (including but not limited to highly integrated motors and thinner battery packs).

According to official data, the longitudinal effective space within the LeDao L90 cabin reaches 4195mm, and it offers a storage space of 670L (including the largest intelligent electric front trunk in the Chinese market at 240L), capable of accommodating 10 suitcases.

With its shortcomings addressed and strengths enhanced, the Le Dao L90 has taken the lead in the cost-effectiveness of large three-row SUVs, and to some extent, it has already become the benchmark in this market.

"Delivery upon launch" is a choice."Delivery equals scale" is capability.

In addition to refining the product, NIO has systematically adjusted its launch strategy by using a longer marketing cycle and a more compact delivery schedule, carefully planning the debut and delivery of the LeDao L90.

Since its debut at the Shanghai Auto Show in mid-April this year, the L90 has entered a rhythmic pre-heating stage. From the continuous release of product highlights such as the ultra-large front trunk and the standard 85kWh battery, to the technical groundwork laid at the pre-sale press conference in mid-July, and finally to its official launch at the end of July, each phase has been timed precisely and promoted steadily.

In the final stage of product launch, Ledao also fully integrated its channels and marketing resources, completing a powerful "100-meter sprint."

Hundreds of display vehicles arrived at the stores in advance, and test drives were opened while the pre-sale was still hot. The day after the official launch, large-scale deliveries were initiated nationwide.

Under this highly coordinated, full-chain operational system, the LeDao L90 achieved perfect conversion from reservation to delivery, setting a NIO example of "launching upon delivery, and scaling up upon delivery."

In the intense competition of recent years, "delivery upon launch" has become a prominent capability of new energy vehicle manufacturers. The rapid increase in data within a short period not only reflects the market acceptance of the new vehicle but also indicates the operational capability of the car manufacturer.

NIO has been affected by production ramp-up issues more than once. Both the old ET5 and the Ledo L60 failed to keep up with the top-tier delivery pace in the industry, delaying their optimal positioning period and experiencing a high start followed by a decline.

Li Bin once explained that "delivery upon launch" does not represent the strength or weakness of capability, but is a marketing strategy. This is because the ramp-up of production capacity in car manufacturing follows its own objective==== and is difficult to significantly improve in the short term. What the outside world sees as "delivery upon launch" is simply because the "production before release" approach was chosen.

NIO's past practice was based on the logic of "production based on sales," where they would first launch products and then start production after accumulating more orders. This benefits the lean production of the factory but objectively lengthens the vehicle delivery cycle.

This time, however, NIO learned from past experiences and lessons—the LeDao L90 was first put into production and then released, fighting a well-prepared battle.

Launching production before release not only allows L90 to maximize the momentum of publicity at each stage, but also enables LeDao to have more flexible response strategies in subsequent operations.

For example, Li Bin mentioned that 600 test drive vehicles had already been prepared, and on the night of the launch, the number of test drive vehicles was further increased to 1,000.

According to media reports, after the follow-up orders for the LeDao L60 were lost last year, Li Bin expressed a reconsideration of market rules in several internal company meetings, saying that he wanted to "let go of obsessions and align with a broader consensus."

Li Bin once again addressed this topic, still candidly stating that "listing and delivery simultaneously is a choice," but he also emphasized that "delivery and scaling up is a capability." Firstly, the demand must be sufficient, indicating a good product and accurate pricing. Secondly, the prediction must be accurate, which requires keeping up with demand understanding and supply chain management.

One significant change in the product aspect with the launch of the LeDao L90 is the substantial simplification of SKU numbers, offering only 6 core configurations (6-seater/7-seater ✖️ Pro/Max/Ultra). Core components, such as the power battery, come standard with 85kWh, with only a few options remaining like wheels, car color, and pedals.

This not only strengthens the "value for money" label by offering high configurations at lower levels, but also reduces consumer decision-making barriers and enhances delivery efficiency.

NIO President Qin Lihong also stated that "standard configuration across the entire lineup" greatly aids in immediate delivery volume because stocking cars requires inventory. Regardless of whether it's a few thousand or ten thousand units, if there are many optional configurations, it becomes very difficult to decide which features each car should include or exclude. However, now that everything is standard, it is much clearer for supply chain procurement and manufacturing.

The rapid ramp-up in production capacity also benefits from LeDao's platform strategy. For example, the 85kWh battery pack equipped in the LeDao L90 is the same model as that in the L60. When the L60 was launched last year, there were initial challenges in ramping up production, but for the later-released L90, the battery production line was better prepared.

The fast delivery pace is exactly the current user demand and also an intuitive reflection of a car company's systemic capabilities.

The operational capability and brand soft power of car companies translate into tangible emotional value for users, which is also a user demand.

NIO has been established for nearly 11 years, and its high-profile expansion has subjected this new star in the industry to ongoing debates about its commercial sustainability. This year, William Li set the core goal of achieving profitability in the fourth quarter.

Just a month ago, this seemed like an impossible task.

Now, a new car has the potential to turn the tide. Since the pre-sale of the LeDao L90, NIO's stock price has increased by about 30%.

According to Li Bin, the LeDao L90 has already achieved its initial victory.

If it can continue to maintain high production, high sales, and high delivery, it will not only be a success of a product but also a testament to NIO's organizational capabilities and systemic efficiency.

To boost morale internally and dispel doubts externally, the impact of the LeDao L90 on NIO will far exceed that of the car itself.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track