Ning wang paradox: Why Is CATL, Earning 200 Million Daily, Trapped in Growth Anxiety?

A company with continuous quarter-on-quarter growth in net profit, earning over 200 million yuan daily, has sparked doubts in the capital market. The shadow of market share and the slowdown in revenue growth are revealing the real challenges faced by the battery giant.

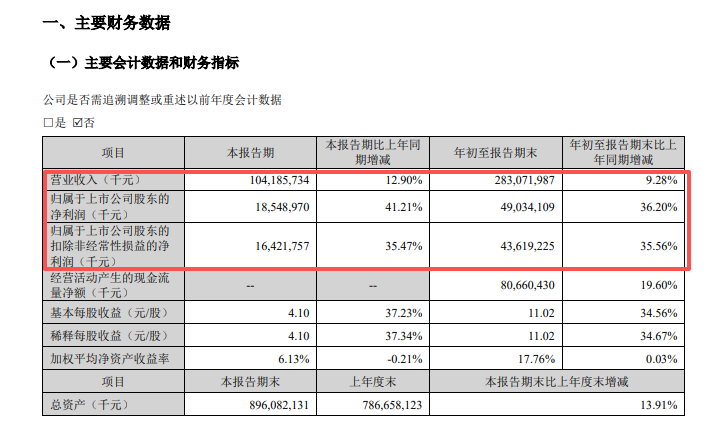

Recently, CATL released its financial results for the third quarter of 2025: the cumulative net profit for the first three quarters reached 49.034 billion yuan, a year-on-year increase of 36.20%. In the third quarter alone, it made a staggering profit of 18.549 billion yuan, a year-on-year increase of 41.21%.Net profit of 2.1 per day. 。

Source of the image: CATL

Behind this seemingly impressive financial report lies a puzzling phenomenon: a significant "scissors gap" between revenue growth and profit growth. In the third quarter, CATL's operating income was 104.186 billion yuan, an increase of only 12.90% year-on-year, which is much lower than the profit growth rate. For the first three quarters combined, revenue growth further slowed to 9.28%. While China's power battery industry is advancing at a rate of 42.5%, the industry leader CATL seems to be underperforming the market.

01The Multi-Engine Drive Behind the Profit Surge

CATL's third-quarter financial report appears to be a celebration of profits, but in essence, it signifies a subtle shift in its growth model. A detailed breakdown of the profit sources reveals three key drivers: improved gross margin, substantial interest income, and investment gains.

Image Source: CATL

The financial report shows that CATL's gross profit margin for the first three quarters of 2025 was 25.3%, an increase of 0.34 percentage points compared to the same period in 2024. In the context of fierce price wars in the industry, this slight increase reflects a significant upgrade in the company's product portfolio.The shipment proportion of high-end products such as Shenxing and Kirin batteries has risen to 60%.Bring higher brand premium.

What's even more striking is the astonishing figure under the financial expenses item: in the first three quarters, the financial expenses were "-7.016 billion yuan," meaning a net gain of over 7 billion yuan. This represents a 142% increase compared to -2.894 billion yuan in the same period in 2024. This mainly stems from the interest income generated by CATL's hefty cash reserves of 324.2 billion yuan. "CATL earned over 4 billion yuan just from interest income alone," a financial analyst pointed out, "which is equivalent to the total annual profit of many medium-sized enterprises."

In addition, investment income has become the third-largest profit engine: investment income for the first three quarters was 5.237 billion yuan, a year-on-year increase of 67.46%. This indicates that the companies in which CATL made early investments are beginning to enter the harvest period, contributing considerable investment returns to the company.

02 Market share hits a five-year low while energy storage climbs.

In stark contrast to high profit growth is the slowdown in revenue growth for CATL. Upon in-depth analysis, SPS Vision found that behind this phenomenon are the growth challenges of its two core businesses.

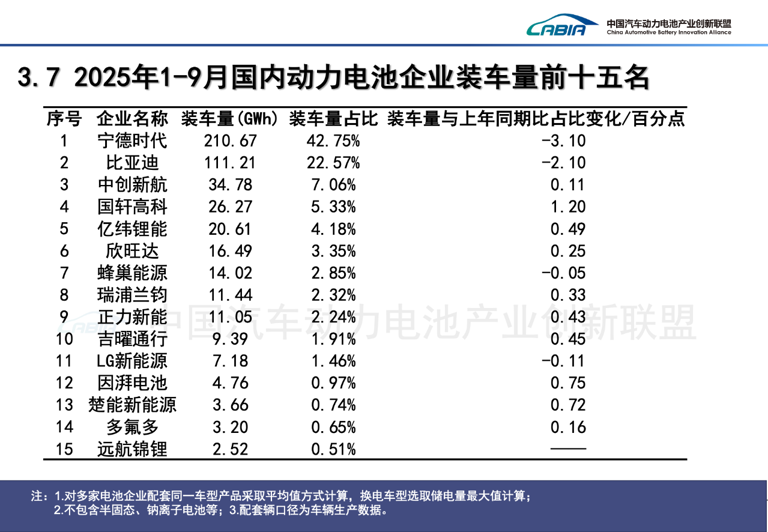

In terms of power batteries, CATL is facing pressure from a decline in market share. According to statistical data, in the third quarter of 2025,CATL's global EV battery market share has dropped to 41.7%.CATL's market share hit a nearly five-year low. In comparison, it held more than 50% of the market share between 2020 and 2021. Data from the China Automotive Battery Innovation Alliance further shows that in September 2025, CATL's installation volume share in the domestic market was 42.75%. Although it remains at the top, it has declined compared to the same period last year. The industry's installation volume increased by 42.5% year-on-year, while CATL's growth rate was significantly behind the industry average.

Source: Lithium Battery Frontier

The energy storage business, which is expected to be a promising second growth curve, is still in the "climbing and overcoming obstacles" stage. CATL's total shipments in the third quarter were approximately 180 GWh, with energy storage accounting for 20%. However, this business experienced negative revenue growth in the first half of both 2024 and 2025. The energy storage market is more competitive than the electric vehicle battery market, with more intense price wars. CATL's management also admitted, "Currently, energy storage shipments are constrained by delivery, and the capacity utilization rate has been too high this year."

03 Industry Status: The Ceiling of Suppliers and the Rebellion of Automakers

In the context of rapid industry growth, why is CATL facing a growth bottleneck?

The answer may not lie in the financial report itself, but in the inherent limitations of its industry position.The battery accounts for 30%-40% of the total vehicle cost.This figure has led car manufacturers to develop a complex dependency on CATL. As CATL's scale expands and pricing power strengthens, car companies are beginning to weaken this dependency through diversified procurement and in-house battery development.

NIO CEO William Li once publicly calculated an account: the battery accounts for nearly 40% of the total vehicle cost. With a profit margin of 20%, if NIO manufactures its own batteries, it could yield an additional profit margin of about 8 percentage points.

Other car manufacturers can also figure out this account. Tesla procures from CATL while also sourcing from LG Energy Solution and Panasonic, and is actively advancing the development of its own 4680 battery.

Volkswagen, in addition to purchasing products from CATL, has also invested in Gotion High-Tech and is building its own battery factory in Europe.

Li Auto, XPeng, NIO, and other domestic car manufacturers are actively introducing secondary and tertiary suppliers such as Sunwoda, CALB, and EVE Energy, and are even planning to develop their own batteries.

An industry observer pointed out: "While CATL's technology is advanced, it cannot dictate the pace of the supply chain. Even after the development of Kirin batteries and Shenxing supercharging technology, whether they can be installed in vehicles and how many vehicles they can be installed in still require the 'nod' from clients and coordination with car manufacturers' new model development and redesign cycles."

04 Strategic Breakthrough: The Dream of Battery Swapping and the Reality of Going Global

Facing the "supplier ceiling," CATL is attempting multiple paths to break through its original role, with battery swapping business and overseas expansion being the two most important steps.

The battery swapping business represents CATL's attempt to transition from a supplier to an ecosystem operator. In 2022, the battery swapping brand EVOGO was established and by the end of 2024, it was upgraded to the "Chocolate Battery Swap," launching standardized battery swap modules. In 2025, CATL adjusted its strategy from building independently to co-building through partnerships, collaborating with companies like NIO and Sinopec. However, the fundamental challenge of the battery swapping model is its acceptance by car manufacturers. They are concerned that adopting CATL's battery swap standards could make them dependent on CATL for core platform design and battery asset management. Without enough car manufacturers joining, scale effects cannot be achieved; and without enough battery swap stations, car manufacturers have no incentive to join.

In contrast,Overseas expansion, particularly in the European market, has become a more realistic growth path.CATL's market share in Europe increased from around 35% in 2024 to approximately 44% in the first four months of 2025. This data is in stark contrast to the decline in market share domestically. CATL has allocated 90% of its fundraising from its Hong Kong stock listing to the construction of the Hungarian factory, which is its largest overseas investment to date. The German production base began operations in 2024 and has been continuously profitable. The first phase of the Hungarian factory is expected to be completed by the end of 2025, and a joint venture company has already been established for the Spanish factory.

05 Future Challenges: The Transformation from Scale Growth to Value Growth

CATL is at a turning point: on one side is still strong profitability, and on the other is a fundamental transformation of its growth path.

CATL's capacity expansion is in full swing globally: the Jining base in Shandong plans to achieve over 100GWh of new energy storage capacity by 2026, and overseas projects in Hungary, Spain, Indonesia, etc., are progressing one after another. However, whether these investments can be transformed into sustainable growth momentum depends on CATL's ability to overcome two major bottlenecks: first, the ability to convert technological advantages into market influence, and second, the transition from a product supplier to an ecosystem builder.

In the second half for CATL, its real opponents are no longer competitors like BYD and LG, but rather its own insight into future technology trends, its ability to navigate the complexities of globalization, and its execution capability in achieving refined operations within a diversified business matrix.

When the next earnings season arrives, will CATL continue to rely on financial gains to maintain profit growth, or can it truly find the engine for revenue growth again? Let's pay attention!

Edited by: Lily

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track