New Phase Micro Plans to Acquire AiXieSheng! The Deal is Expected to Constitute a Significant Asset Restructuring

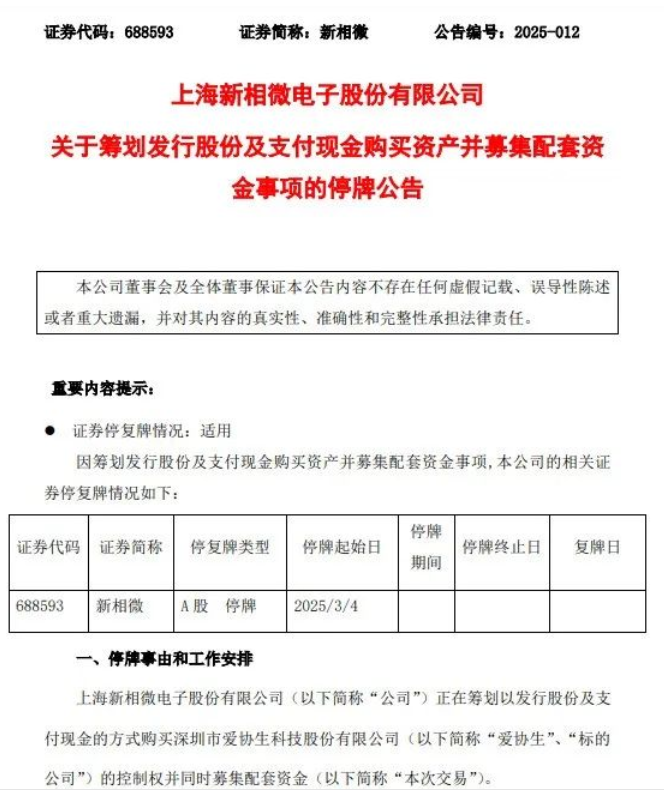

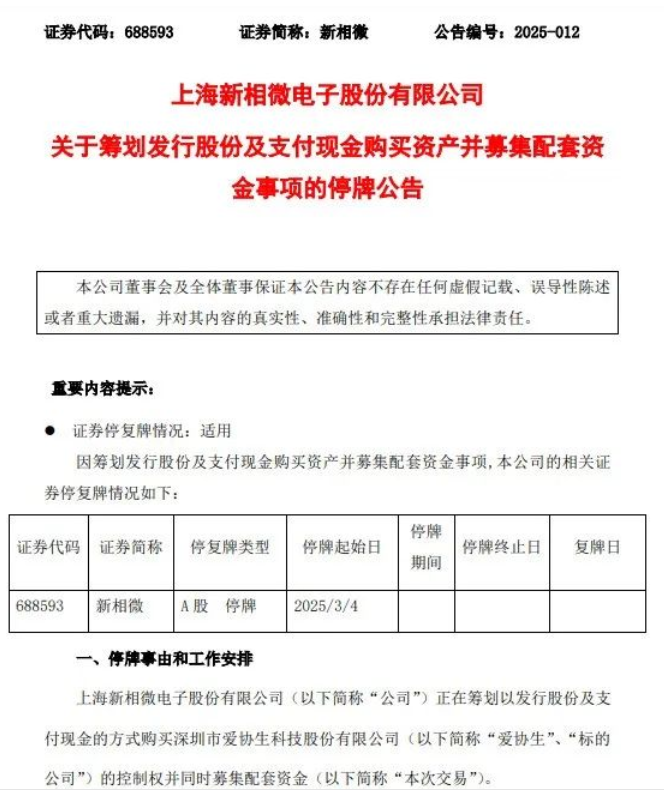

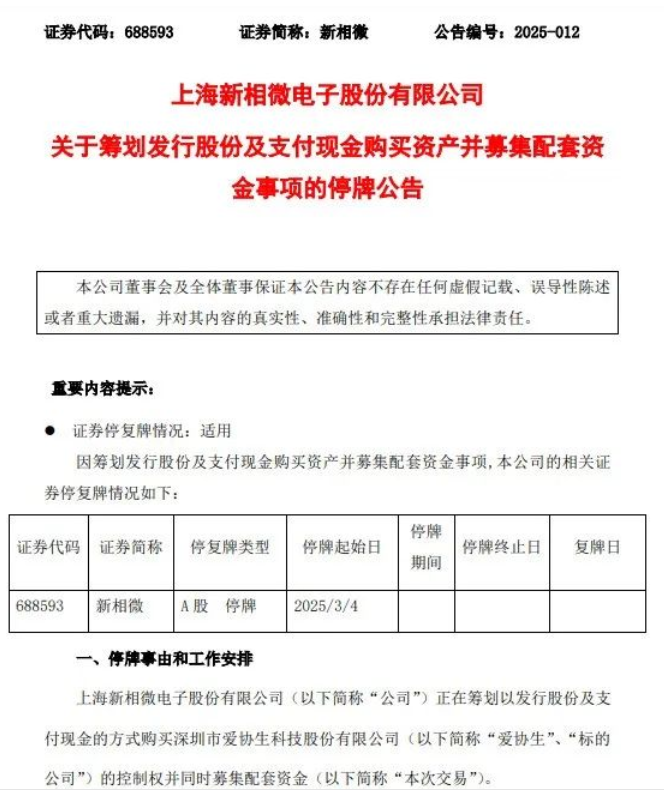

XinXiangwei stated that this transaction is initially expected to constitute a significant asset reorganization. Prior to this transaction, there was no affiliation between the company and the counterparties, and the transaction will not result in a change of the company's actual controller, thus not constituting a backdoor listing.

On March 2, XinXiangwei signed an "Equity Acquisition Intention Agreement" with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) regarding the acquisition of Aixiesheng's equity, agreeing to acquire the controlling stake of Aixiesheng through the issuance of shares and payment of cash.

Given the uncertainty of this transaction, to ensure fair information disclosure, protect investors' interests, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon the company's application, the trading of its stock (Stock Code: XinXiangwei, Stock Symbol: 688593) has been suspended from the opening of the market on March 3 and will continue to be suspended, with the estimated suspension (cumulative) period not exceeding 5 trading days.

Aixiesheng Had Previously Considered Going Public

Public information shows that Aixiesheng, established in 2011, is a chip design and solution provider focused on human-computer interaction, recognized as a national high-tech enterprise and a national specialized, refined, unique, and new "little giant" enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT.

Previously, Aixiesheng had considered planning for an A-share listing. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd."

Xinxiangwei stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to this transaction, the company had no related party relationship with the counterparty, and this transaction will not lead to a change in the actual controller of the company, thus not constituting a reorganization for listing. On March 2nd, Xinxiangwei signed an "Equity Acquisition Intention Agreement" with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) regarding the acquisition of Aixiesheng's equity, agreeing that the company intends to acquire the controlling stake of Aixiesheng through the issuance of shares and payment in cash. Due to the uncertainties still present in this transaction, in order to ensure fair information disclosure, protect the interests of investors, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon the company's application, the trading of the company's stock (stock abbreviation: Xinxiangwei, stock code: 688593) has been suspended since the opening of the market on March 3rd and will continue to be suspended, with the expected cumulative suspension period not exceeding five trading days. Aixiesheng Previously Intended to Plan for Listing Public information shows that Aixiesheng was established in 2011 and is a chip design and solution provider focusing on the human-computer interaction field, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative 'little giant' enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had intended to plan for an A-share listing. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng

Xinxiangwei stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to this transaction, there was no related party relationship between the company and the counterparty, and the transaction will not result in a change of the actual controller of the company, thus it does not constitute a backdoor listing. On March 2, Xinxiangwei signed an "Equity Acquisition Intention Agreement" with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) regarding the acquisition of Aixiesheng's equity, agreeing to acquire the controlling stake in Aixiesheng through the issuance of shares and payment of cash. Due to the uncertainty of this transaction, in order to ensure fair information disclosure, protect investor interests, and avoid a significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon the company's application, the trading of the company's stock (stock abbreviation: Xinxiangwei, stock code: 688593) has been suspended since the market opened on March 3, and the suspension will continue, with the total suspension period expected not to exceed five trading days. Aixiesheng Had Previously Planned for an IPO Public information shows that Aixiesheng, established in 2011, is a chip design and solution provider specializing in human-computer interaction, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative 'little giant' enterprise. The company supports its core technologies, including display touch interaction, sensing, and image processing, providing chips and solutions for various application scenarios such as mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had intended to plan for an A-share listing. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for listing tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi XinXiangWei stated that this transaction is initially expected to constitute a significant asset reorganization. Prior to this transaction, there was no related relationship between the company and the counterpart, and this transaction will not lead to a change in the actual controller of the company, nor does it constitute a restructuring for listing. On March 2nd, XinXiangWei, Liang Pishu, and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) signed an "Equity Acquisition Intention Agreement" regarding the acquisition of Aixiesheng's equity, agreeing that the company intends to acquire the control of Aixiesheng through the issuance of shares and payment of cash. Due to the uncertainties surrounding this transaction, in order to ensure fair information disclosure, protect the interests of investors, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon the company's application, the company's stock (stock abbreviation: XinXiangWei, stock code: 688593) has been suspended from trading since the opening of the market on March 3rd, and will continue to be suspended, with the expected total suspension time not exceeding 5 trading days. Aixiesheng Had Previously Planned for an IPO Public information shows that Aixiesheng, founded in 2011, is a chip design and solution provider focusing on human-computer interaction, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative "little giant" enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had planned to list on the A-share market. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for IPO tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Ventures, Detai Capital, and SMIC Xinxiangwei stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to this transaction, the company had no related party relationship with the counterparty, and this transaction will not result in a change of the actual controller of the company, nor does it constitute a reorganization for listing. On March 2, Xinxiangwei signed an "Intention Agreement for Equity Acquisition" with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) regarding the acquisition of Aixiesheng's equity, agreeing to acquire the controlling stake in Aixiesheng through the issuance of shares and payment in cash. Due to the uncertainty of this transaction, to ensure fair information disclosure, protect the interests of investors, and avoid a significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon the company's application, the company's stock (stock abbreviation: Xinxiangwei, stock code: 688593) has been suspended from trading since the opening of the market on March 3, and the suspension will continue, with the estimated cumulative suspension period not exceeding 5 trading days. Aixiesheng Had Previously Intended to Plan for an IPO Public information shows that Aixiesheng was established in 2011 and is a chip design and solution provider focusing on the human-computer interaction field. It is a national high-tech enterprise and a national-level specialized, refined, unique, and innovative "little giant" enterprise. The company, supported by core technologies such as display touch interaction, sensing, and image processing, provides chips and solutions to customers around various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had intended to plan for an A-share listing. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, and the company name was changed from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for pre-IPO tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Ventures, DTA Capital, SMIC Juyuan Investment, and Shenzhen Venture Capital, among others. Aixiesheng had previously stated, Xinxiangwei stated that this transaction is initially expected to constitute a significant asset reorganization. Prior to this transaction, there was no affiliation between the company and the counterparties, and the transaction will not result in a change of the company's actual controller, nor does it constitute a backdoor listing. On March 2, Xinxiangwei, Liang Pishu, and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) signed an "Intention Agreement for Equity Acquisition" regarding the acquisition of Aixiesheng's equity, agreeing that the company intends to acquire control of Aixiesheng through the issuance of shares and payment in cash. Given the uncertainty surrounding this transaction, to ensure fair disclosure of information, protect investor interests, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, the company applied for its stock (Security Abbreviation: Xinxiangwei, Security Code: 688593) to be suspended from trading starting March 3, and the suspension will continue, with the total suspension period not exceeding 5 trading days. Aixiesheng Had Previously Considered Planning for an IPO Public information shows that Aixiesheng, founded in 2011, is a chip design and solution provider focusing on the human-machine interaction field, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative 'Little Giant' enterprise. The company supports core technologies such as display-touch interaction, sensing, and image processing, providing chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had considered planning for an A-share IPO. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for IPO tutoring. Among Aixiesheng's shareholders are a group of venture capital and industrial funds, including Junshi Ventures, DTA Capital, SMIC Juyuan Investment, and Shenzhen Venture Capital, among others. Aixiesheng previously stated that the company's turnover exceeded 800 million yuan in 2022, and the company will continue to strengthen its product layout in the future, in A Xinxiangwei stated that this transaction is initially expected to constitute a significant asset reorganization. Prior to this transaction, the company had no related party relationship with the counterparty, and this transaction will not result in a change of the company's actual controller, nor will it constitute a reorganization for listing purposes. On March 2, Xinxiangwei, along with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership), signed an "Equity Acquisition Intention Agreement" regarding the acquisition of Aixiesheng's equity, agreeing to acquire the controlling stake in Aixiesheng through the issuance of shares and payment in cash. Given the uncertainty of this transaction, to ensure fair information disclosure, protect investor interests, and avoid significant impact on the company's stock price, according to relevant regulations of the Shanghai Stock Exchange, the company applied for its stock (stock abbreviation: Xinxiangwei, stock code: 688593) to be suspended from trading starting from the market opening on March 3, and the suspension will continue, with the estimated total suspension period not exceeding 5 trading days. Aixiesheng Previously Considered Planning for an IPO Public information shows that Aixiesheng, established in 2011, is a chip design and solution provider focusing on the human-computer interaction field. It is a national high-tech enterprise and a national specialized, refined, unique, and innovative "little giant" enterprise. The company, supported by core technologies such as display touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had considered planning for an A-share IPO. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for IPO tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Ventures, Dat Capital, SMIC Juyuan Investment, and Shenzhen Innovation Investment, among others. Aixiesheng previously stated that the company's turnover exceeded 800 million yuan in 2022, and the company will continue to strengthen its product layout in AMOLED driver chips,Sure, please provide the content that needs to be translated. Xinxiangwei stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to this transaction, there was no related party relationship between the company and the counterparty, and the transaction will not result in a change of the company's actual controller, thus not constituting a reorganization for listing purposes. On March 2, Xinxiangwei, Liang Pishu, and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) signed an "Equity Acquisition Intention Agreement" regarding the acquisition of Aixiesheng's equity, stipulating that the company intends to acquire control of Aixiesheng through the issuance of shares and payment in cash. Due to the uncertainties surrounding this transaction, to ensure fair information disclosure, protect investor interests, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, the company applied for its stock (stock abbreviation: Xinxiangwei, stock code: 688593) to be suspended from trading starting from the opening of the market on March 3, and the suspension will continue, with the estimated cumulative suspension time not exceeding 5 trading days. Aixiesheng Had Previously Considered Planning for an IPO Public information shows that Aixiesheng, established in 2011, is a chip design and solution provider specializing in the human-computer interaction field, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative "little giant" enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had intended to plan for an A-share listing. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for pre-IPO tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Venture Capital, Dat Thai Capital, SMIC Juyuan Investment, and Shenzhen Capital Group, etc. Aixiesheng previously stated that the company's revenue exceeded 800 million yuan in 2022, and in the future, the company will continue to strengthen its product layout, focusing on AMOLED driver chips, wearable TDDI driver chips, intelligent display control SoCs, fingerprint recognition chips, and audio... Xinxiangwei stated that this transaction is initially expected to constitute a significant asset reorganization. Prior to this transaction, the company had no affiliation with the counterparty, and this transaction will not result in a change in the actual controller of the company, thus not constituring a backdoor listing. On March 2, Xinxiangwei, Liang Pishu, and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) signed an "Equity Acquisition Intention Agreement" regarding the acquisition of Aixiesheng's equity, stipulating that the company intends to acquire the controlling stake in Aixiesheng through the issuance of shares and payment of cash. Given the uncertainty of this transaction, to ensure fair information disclosure, protect investor interests, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, the company has applied for its stock (stock abbreviation: Xinxiangwei, stock code: 688593) to be suspended from trading starting from the market opening on March 3, and the suspension is expected to last (cumulatively) no more than five trading days. Aixiesheng Had Previously Planned to Go Public Public information shows that Aixiesheng, established in 2011, is a chip design and solution provider specializing in human-computer interaction, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative "little giant" enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had planned to go public on the A-share market. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for IPO tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Ventures, DTA Capital, SMIC Juyuan Investment, and Shenzhen Innovation Investment, among others. Aixiesheng previously stated that the company's turnover exceeded 800 million yuan in 2022, and in the future, the company will continue to strengthen its product layout, continuously investing in AMOLED driver chips, wearable TDDI driver chips, intelligent display control SoCs, fingerprint recognition chips, audio and power management chips, and intelligent connected display control modules, aiming to become a leading domestic XinXiangwei stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to this transaction, there was no affiliated relationship between the company and the counterparty, and this transaction will not result in a change in the actual controller of the company, nor does it constitute a reorganization for listing. On March 2, XinXiangwei signed an "Equity Acquisition Intention Agreement" with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) regarding the acquisition of Aixiesheng's equity, stipulating that the company intends to acquire the controlling stake in Aixiesheng through the issuance of shares and payment in cash. Due to the uncertainties associated with this transaction, in order to ensure fair information disclosure, protect the interests of investors, and avoid significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon the company's application, the trading of the company's stocks (stock abbreviation: XinXiangwei, stock code: 688593) has been suspended from the market opening on March 3 and will continue to be suspended, with the estimated total suspension period not exceeding 5 trading days. Aixiesheng Previously Planned for IPO Public information shows that Aixiesheng, established in 2011, is a chip design and solution provider focused on human-computer interaction, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative 'little giant' enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various applications including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had intended to plan for an A-share IPO. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, changing its name from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for IPO tutoring. Among Aixiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Ventures, Detai Capital, SMIC Juyuan Investment, and Shenzhen Venture Capital. Aixiesheng previously stated that the company's turnover exceeded 800 million yuan in 2022, and in the future, the company will continue to strengthen its product layout, continuously investing in AMOLED driver chips, wearable TDDI driver chips, intelligent display control SoCs, fingerprint recognition chips, audio and power chips, and smart display control modules, aiming to become a leading domestic player in the field of human-computer interaction and smart interconnection. Xinxiangwei stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to the transaction, there was no affiliation between the company and the counterparty, and the transaction will not result in a change of the company's actual controller, thus it does not constitute a reorganization for listing purposes. On March 2, Xinxiangwei signed an "Equity Acquisition Intention Agreement" with Liang Pishu and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) regarding the acquisition of AiXiesheng equity, agreeing to acquire control of AiXiesheng through the issuance of shares and payment of cash. Given the uncertainties surrounding this transaction, to ensure fair information disclosure, protect investor interests, and prevent a significant impact on the company's stock price, according to relevant regulations of the Shanghai Stock Exchange, the company has applied for its stock (Stock Abbreviation: Xinxiangwei, Stock Code: 688593) to be suspended from trading starting from the opening of the market on March 3, and the suspension is expected to last (cumulatively) no more than 5 trading days. AiXiesheng Had Previously Considered Listing Public information shows that AiXiesheng, established in 2011, is a chip design and solution provider specializing in human-computer interaction, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative 'little giant' enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, AiXiesheng had considered planning for an A-share listing. According to the company's official website and Qichacha, AiXiesheng completed its corporate reform on July 1, 2022, changing its name from "Shenzhen AiXiesheng Technology Co., Ltd." to "Shenzhen AiXiesheng Technology Co., Ltd." On September 29, 2022, AiXiesheng filed for listing tutoring. Among AiXiesheng's shareholders are a number of venture capital and industrial funds, including Junshi Venture Capital, DTA Capital, SMIC Juyuan Investment, and Shenzhen Venture Capital. AiXiesheng previously stated that its turnover exceeded 800 million yuan in 2022, and the company will continue to strengthen its product layout, continuously investing in directions such as AMOLED driver chips, wearable TDDI driver chips, intelligent display control SoCs, fingerprint recognition chips, audio and power management chips, and smart interconnect display control modules, striving to become a leading domestic provider in human-computer interaction and smart interconnection. AiXiesheng Included in M&A Plan Again It should be noted that this is not the first time AiXiesheng has been included in a listed company's M&A plan. On November 14, 2024, Yitoa announced that the company planned to purchase the controlling stake of AiXiesheng through the issuance of shares and payment of cash, along with raising supporting funds. However, on November 28, 2024, Yitoa announced the termination of this M&A, due to the transaction New Phase Micro stated that this transaction is preliminarily expected to constitute a significant asset reorganization. Prior to this transaction, there was no related party relationship between the company and the counterparty, and this transaction will not result in a change of the actual controller of the company, and does not constitute a reorganization for listing. On March 2nd, New Phase Micro, Liang Pishu, and Shenzhen Zhongrenhe Consulting Enterprise (Limited Partnership) signed an "Equity Acquisition Intention Agreement" regarding the acquisition of Aixinsheng's equity, agreeing that the company intends to acquire control of Aixinsheng through issuing shares and paying cash. Due to the uncertainties surrounding this transaction, in order to ensure fair information disclosure, protect the interests of investors, and avoid a significant impact on the company's stock price, according to the relevant regulations of the Shanghai Stock Exchange, upon application by the company, the company's stock (stock abbreviation: New Phase Micro, stock code: 688593) has been suspended from trading since the opening of the market on March 3rd, and will continue to be suspended, with the expected suspension (cumulative) period not exceeding 5 trading days. Aixinsheng Had Plans for an IPO Public information shows that Aixinsheng, established in 2011, is a chip design and solution provider focusing on the human-machine interaction field, recognized as a national high-tech enterprise and a national specialized, refined, unique, and innovative "little giant" enterprise. The company, supported by core technologies such as display-touch interaction, sensing, and image processing, provides chips and solutions for various application scenarios including mobile smart terminals, smart homes, and smart IoT. Previously, Aixiesheng had planned to go public on the A-share market. According to the company's official website and Qichacha, Aixiesheng completed its shareholding system reform on July 1, 2022, with the company name changing from "Shenzhen Aixiesheng Technology Co., Ltd." to "Shenzhen Aixiesheng Technology Co., Ltd." On September 29, 2022, Aixiesheng filed for listing tutoring. The shareholders of Aixiesheng include a number of venture capital and industrial funds, such as Junshi Ventures, DTA Capital, SMIC Juyuan Investment, and Shenzhen Innovation Investment (SIV), among others. Aixiesheng previously stated that the company's turnover exceeded 800 million yuan in 2022. In the future, the company will continue to strengthen its product layout, investing continuously in AMOLED driver chips, wearable TDDI driver chips, smart display control SoCs, fingerprint recognition chips, audio and power management chips, and intelligent connected display control modules, striving to become a leading domestic vendor in human-machine interaction and intelligent connectivity. Aixiesheng Included in Acquisition Plan Again It was noted that this is not the first time Aixiesheng has been included in an acquisition plan by a listed company. On November 14, 2024, Yitoa Intelligent Control announced that it intended to acquire control of Aixiesheng through issuing shares and paying cash, and to raise additional funds. However, on November 28, 2024, Yitoa Intelligent Control announced the termination of this acquisition, citing the failure of the relevant parties to reach a final agreement on the transaction plan and future product strategic development goals. Industry insiders pointed out that this acquisition plan, which failed within just half a month, may have exposed the company's management's haste and lack of rigor in making major decisions. The proposed acquisition target, Xinxiangwei, focuses its main business on the research, development, design, and sales of display chips, dedicated to providing comprehensive display chip system solutions. It is worth noting that Xinxiangwei has also co-invested with professional investment institutions to establish a new type of display industry M&A fund. On February 12, Xinxiangwei announced that its subsidiary, Shanghai Xinxian Technology Co., Ltd., plans to collaborate with Guoket Dongfang (Shanghai) Private Equity Fund Management Co., Ltd. (referred to as "Guoket Dongfang"), Chongqing Liangjiang New Area Junqi Yue Enterprise Management Co., Ltd., Shanghai Junquanxin Investment Co., Ltd., and Chongqing Liangjiang New Area High-Quality Development Industry Private Equity Investment Fund Partnership (Limited Partnership) to jointly establish a new type of display industry M&A fund, with Guoket Dongfang serving as the fund manager and a total scale of no less than 402 million yuan. Among them, Xinxian Technology intends to participate as a limited partner, contributing 120 million yuan, representing a contribution ratio of 29.8507%. According to the announcement, the main investment direction of the industrial fund established by XinXiangwei and professional institutions is the new display chip industry, focusing on the national strategy for integrated circuit development. The primary goal is to invest in the chip industry, targeting industrial mergers and acquisitions, investing in targets with innovation, growth potential, and platform value. This will help the company leverage the resource advantages and investment management experience of professional institutions, discover high-quality projects that are synergistic with the company's business direction, accelerate industrial resource integration, promote the company's industrial ecological layout and business development, and enhance the company's sustainable development capabilities.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track