New Member Added to Domestic Polyethylene, Changing Regional Supply and Demand Pattern

Self2024Since the fourth quarter of the year, new domestic polyethylene plants have been launched intensively, leading to a significant increase in domestic polyethylene supply. Recently, with Inner Mongolia...3#The commissioning of the full density unit has further increased the domestic polyethylene production capacity to a new level.3621100 million tons, the domestic coal-to-capacity share increased to21%. With the continuous commissioning of new domestic installations, the supply landscape in various regions is undergoing changes.

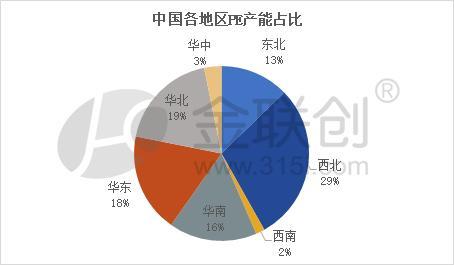

Data source: Jinlianchuan

From a regional perspective, with the commissioning of Inner Mongolia Baofeng's three full-density polyethylene units, the polyethylene production capacity in the Northwest region has exceeded 10 million tons, accounting for a significant share of the total capacity.29% , firmly ranking first in the country. Since2024Since the beginning of the year, with the successive commissioning of installations such as Sinopec-Shell, Yulong Petrochemical, Wanhua Chemical, and Shandong New Era, the production capacity in North China has increased most significantly, making it the second-largest supply region in the country. As of now, the production capacity in the North China region accounts for...19%After the Huajing Petrochemical in East China was put into production, its capacity accounted for the national total capacity.18%, ranked third. Sinochem Quanzhou High Pressure/EVAThe first conversion of the joint production facility to high pressure has resulted in a slight increase in capacity in the South China region.58910,000 tons, accounting for16%Ranked fourth. In recent years, there have been no new installations in the Northeast, Central China, and Southwest regions, with their respective production capacity shares at13%、3%、2%。

From the perspective of demand, East China and South China, with their superior geographical locations, have comparable polyethylene demand and are the two major regions for polyethylene consumption in China. Additionally, North China is also a significant consumer of polyethylene. There is a certain supply gap in these three major regions.

In recent years, changes in the domestic supply landscape have led to shifts in demand gaps across various regions. The Northwest and Northeast regions are traditional polyethylene production areas, with the Northwest being the largest production region. However, local demand and consumption are limited, accounting for only a small portion of the supply.20%, the demand in the northeastern region accounts for approximately40%The surplus supply from the two regions will mainly be allocated to North China and East China.2024As the polyethylene production capacity in North China rapidly increases, the local domestic supply grows quickly, significantly narrowing the supply gap and intensifying competition within the region. With the improvement of local resource self-sufficiency, there is a certain impact on external resources. The imported resources in East China and South China occupy a certain share, and after the ExxonMobil facility in South China begins operation, it will have a certain substitutive effect on imported resources.

In 2025, the domestic polyethylene industry will still be in a period of concentrated capacity expansion.818A 10,000-ton production capacity plan has been put into operation, further increasing the domestic self-sufficiency rate of polyethylene, while the domestic consumption growth rate is significantly lower than the supply growth rate.2025The domestic polyethylene market will present“Overcapacity, structural differentiation”Characteristics: competition in low-end general materials is intensifying, and import substitution for high-end materials still needs time. Enterprises need to keep up with policies and technological innovation, and seek growth points in niche markets.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track