New Materials | 2025 Polyvinyl Chloride (PVC) Industry Development Analysis: Engine Stalls

Material Properties and Industrial Foundation

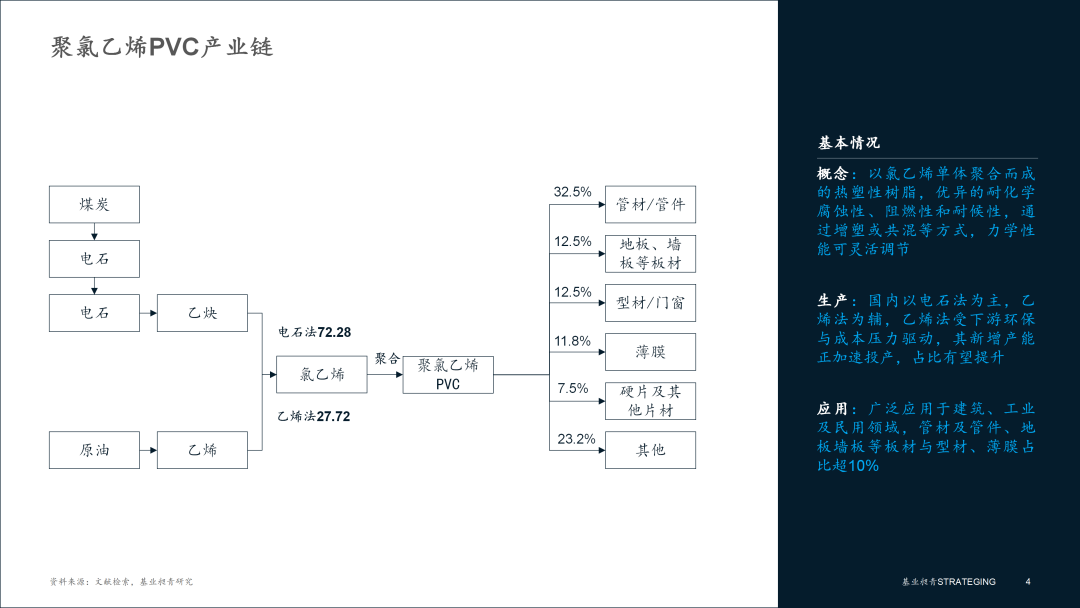

Polyvinyl chloride (PVC) is a thermoplastic resin polymerized from vinyl chloride monomers. With a chlorine content as high as 56.7%, it exhibits excellent chemical resistance, flame retardancy, and weatherability. Additionally, through plasticization or blending, the mechanical properties of PVC can be flexibly adjusted, enabling a transformation from high rigidity to high flexibility.

In the production process, China's PVC industry is primarily dominated by the calcium carbide method (coal → calcium carbide → vinyl chloride route), which contributes 72.28% of the vinyl chloride monomer supply. This process relies on the country's abundant coal resources and a well-established coal chemical industry system, effectively ensuring the stability of raw material supply and cost competitiveness. The synthetic route using petrochemical ethylene as the raw material accounts for 27.72%. As an important supplementary route, driven by downstream environmental and cost pressures, its new production capacity is accelerating, and its proportion is expected to increase.

In downstream applications, PVC demonstrates a highly diversified demand pattern. PVC pipes and fittings account for the highest proportion at 32.5%. Flooring, wall panels, profiles, and windows and doors each account for 12.5%. Films are close to 12% (11.8%), rigid and other sheets account for 7.5%, materials for wires and cables account for 6.7%, soft products and others account for 6.5%, rigid products account for 4%, and shoe and shoe sole materials and artificial leather each account for 3%. This wide range of applications highlights PVC's status as a key fundamental material in the construction, industrial, and civil fields.

Supply-demand pattern and market operation

On the demand side, the real estate sector is a significant drag, leaving exports as the only source of growth, though their scale is limited.

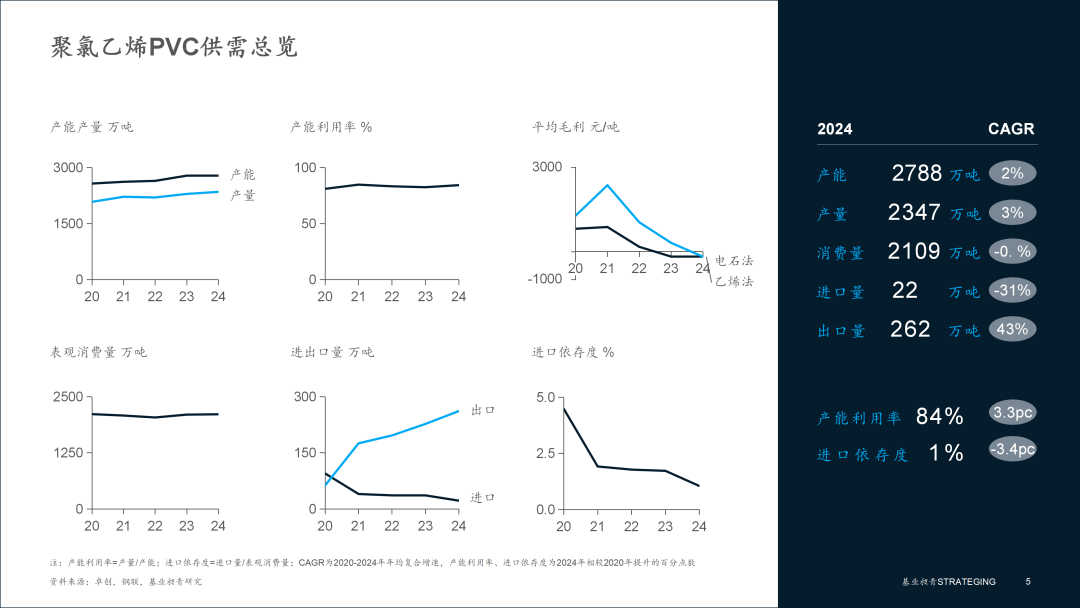

▪ Domestic demand has fallen into a zero-growth trap: the apparent consumption volume in 2024 is 21.09 million tons, exactly the same as in 2020 (CAGR -0.05%), marking a ten-year low. The core issue lies in the contraction of the real estate sector, which accounts for 65% of downstream PVC demand. In recent years, the area of new housing starts and construction has continuously declined significantly (with a year-on-year drop exceeding 20% in 2024), directly leading to a shrinkage in demand for core rigid products such as pipes and profiles.

▪ Explosive growth in exports fails to conceal structural shortcomings: In the short term, exports have become the core channel for capacity absorption. In 2024, export volumes surged to 2.617 million tons (with a CAGR of 42.8%), accounting for 11.1% of production, absorbing 74% of the new capacity (2.69 million tons) added in the past five years. However, the absolute volume of exports only accounts for 11.1% of domestic production, which cannot fully offset the pressure of stagnant domestic demand.

On the supply side, there is a rigid expansion of capacity, and the increase in utilization rates hides potential concerns. Capacity continues to grow, and production increases but is more of a passive boost. From 2020 to 2024, capacity increased from 25.7 million tons to 27.88 million tons (CAGR of 2.1%), and production rose from 20.8 million tons to 23.49 million tons (CAGR of 3.1%), driving capacity utilization up from 81% to 84.24%. The main reason for the increase in utilization is the bundling of chlor-alkali profits to maintain high operating rates. The calcium carbide-based PVC incurs a loss of about 200-300 yuan per ton, but caustic soda prices remain high. Integrated chlor-alkali enterprises forcibly maintain production through the "alkali compensating chlorine" model, leading to inflated production figures. Amidst stagnant domestic demand, companies intensify low-price competition to spread fixed costs, while rigid raw material costs (such as firm ethylene-based raw material prices) further compress profit margins. Currently, the calcium carbide process is listed in the "High Pollution Process Elimination Directory," and regions like Inner Mongolia and Shandong have halted new project approvals, explicitly requiring the elimination of 50% capacity by 2027. The industry's new capacity is shifting towards the low-energy consumption ethylene process, which will force small and medium-sized enterprises to exit.

Supply Capacity Building and Industrial Upgrading

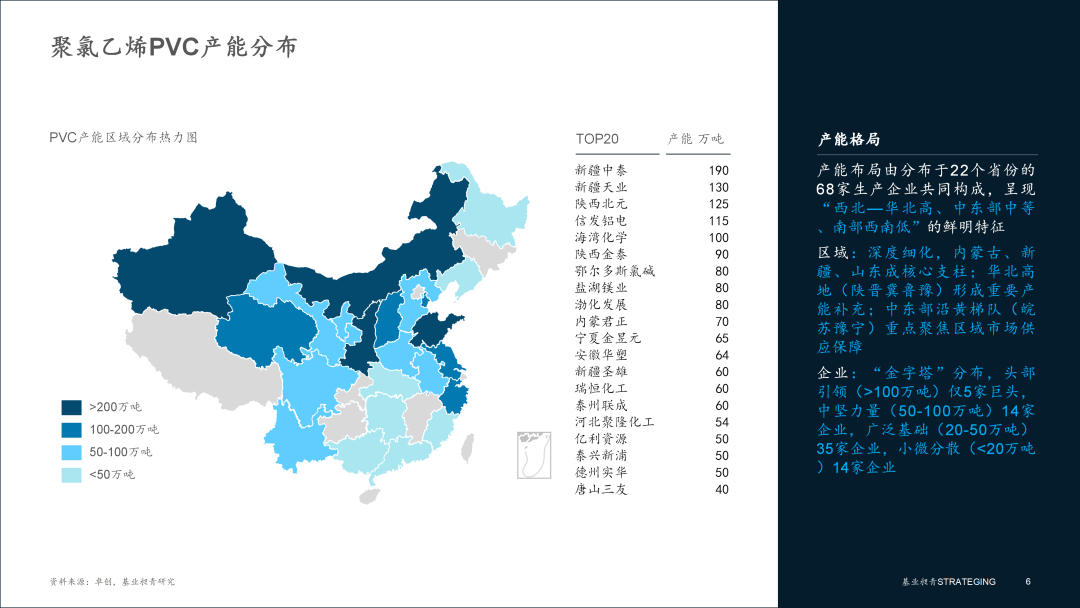

By the end of 2024, China's total PVC production capacity had risen to 27.88 million tons, comprising 68 production enterprises distributed across 22 provinces. The capacity layout deeply reflects the synergistic effects of China's resource endowment, industrial policies, and market demand, showing a distinct pattern of "high in the Northwest and North China, moderate in the central and eastern regions, and low in the southern and southwestern regions."

▪ Regional Deep Refinement: Inner Mongolia, Xinjiang, and Shandong (each about 4 million tons) form the core pillars. Inner Mongolia relies on its abundant coal and raw salt resources and its location along the Yellow River. Xinjiang leverages its unique cost advantage of coal-electricity integration (with Zhongtai's 1.9 million tons and Tianye's 1.3 million tons as leaders). Shandong relies on its strong chemical industry foundation, comprehensive port logistics, and vast downstream market, collectively forming the "iron triangle" of national PVC supply. Their capacity scale, cost competitiveness, and market influence are significant. In addition to the core province of Shandong, the North China Highlands (Shaanxi, Shanxi, Hebei, Shandong, Henan) form an important capacity supplement with Shaanxi (Beiyuan's 1.25 million tons) and Shanxi relying on resources and industrial bases. The central and eastern Yellow River corridor (Anhui, Jiangsu, Henan, Ningxia) is represented by Ordos Chlor-Alkali, Salt Lake Potash, and Bohai Development, with major installations typically in the 500,000-1,000,000-ton range, playing a crucial role in regional market supply assurance and industrial chain support. The southern and southwestern weak areas (Guangdong, Sichuan, Yunnan, etc.) are constrained by energy structure (higher electricity prices), stricter environmental constraints, and limited local market hinterlands, resulting in significantly lower total capacity, with regional supply-demand balance heavily reliant on external inputs.

▪ The industry exhibits a significant "pyramid" distribution: The leading giants (>1 million tons) include only five major companies (such as Xinjiang Zhongtai with 1.9 million tons, Beyuan with 1.25 million tons, Xinfeng with 1.15 million tons, and Haiwan with 1 million tons), accounting for just 7.3% in number. However, with their super-large scale, integrated cost advantages, and resource integration capabilities, they have a decisive impact on national market pricing and supply stability. The backbone (50-100 million tons) consists of 14 companies, forming the second tier (accounting for 20.6% in number), and they are an essential force in supporting regional markets and meeting differentiated demands. The broad base (20-50 million tons) includes 35 companies (accounting for 51.5% in number), constituting the main body of the industry and playing roles in flexible supply and niche markets. The small and micro enterprises (<20 million tons) consist of 14 companies (accounting for 20.6% in number), with the smallest capacity being only 20,000 tons. These companies generally face immense pressure from cost competition, environmental compliance, and technological upgrades, with their survival space constantly being squeezed. The trend of concentration and scale in the PVC industry is irreversible.

The core driving force behind the current and future expansion of PVC production capacity is not only quantitative growth but also profound quality transformation and technological iteration. "Large-scale, base-oriented, and integrated" is the dominant logic for capacity layout, while "greening, intelligence, and high-end development" are the core directions for technological upgrading. These are the only paths to break through homogeneous competition, enhance profitability, and achieve sustainable development. In the future, enterprises possessing resource endowments, scale strength, core technologies (especially high-end grade development capabilities), and strong financial power will stand out amid increasingly stringent environmental regulations and continuously upgrading downstream demands, leading China's PVC industry to truly advance toward a new stage of high-efficiency, green, intelligent, and high value-added high-quality development.

Demand Structure and Application Domain Dynamics

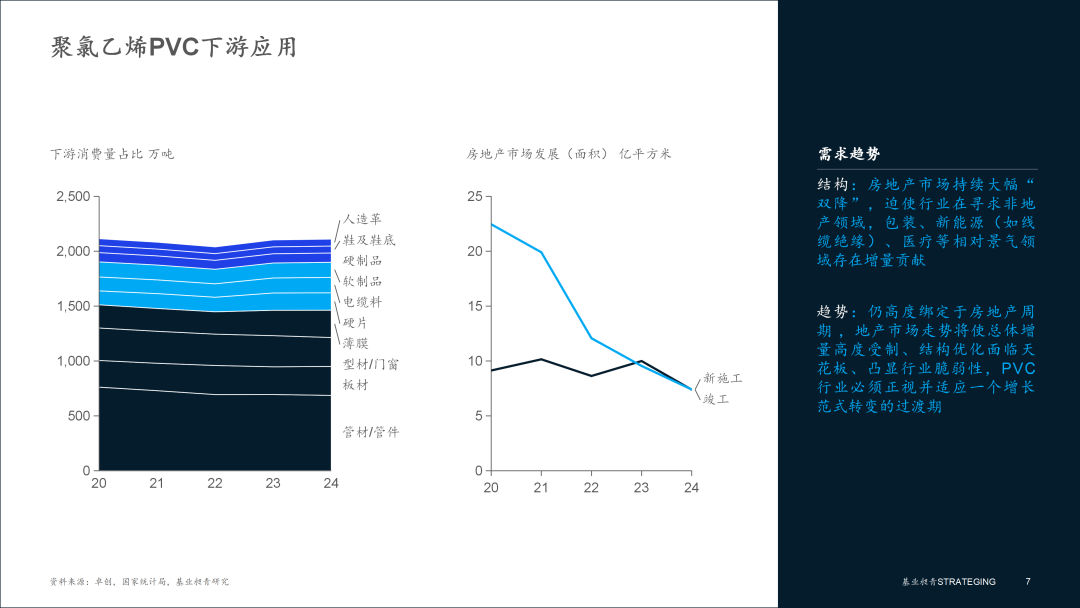

The downstream application pattern of PVC exhibits the dual characteristics of high concentration and gradual evolution. The three traditional pillar fields—pipes and fittings, profiles and windows, and flooring and wall panels—together account for 57.5% of the total demand, forming the industry's basic framework, but demand continues to decline. The proportion of film applications increased from 10% in 2020 to 12% in 2024, rigid sheets and other sheets rose from 6.5% to 7.5%, and cable materials also slightly increased from 6% to 6.7%, reflecting the incremental contributions from relatively prosperous fields such as packaging, new energy (e.g., cable insulation), and medical applications. Meanwhile, the shares of soft products and others, rigid products, shoe materials, and synthetic leather are relatively stable or have slight fluctuations.

Despite the increasingly diversified applications and structural adjustments, the primary growth engine and the greatest risk for overall PVC demand remain closely tied to the real estate cycle. As the most important end-use industry for PVC, a deep adjustment in the real estate market has become inevitable. Newly started construction area has plummeted from approximately 2.2 billion square meters in 2020 to less than 740 million square meters in 2024, while completed construction area has also dropped from 910 million square meters to around 740 million square meters. This “double decline” in end demand (both new starts and completions) stands in stark contrast to the gradual optimization of downstream structures. The profound impact resulting from this includes:

▪ Overall incremental growth is highly constrained: In the short term, the overall growth potential of PVC demand remains primarily limited by the pace of recovery in real estate investment and construction activities. Although emerging application fields demonstrate resilience in growth, their current scale is still insufficient to fully offset the significant gap caused by the downturn in the real estate sector.

▪ Structural optimization faces a ceiling: the increase in share of non-real estate related sectors (such as films, sheets, and cable materials), while representing a positive direction of structural transformation, has its growth speed and potential limited by the overall sluggishness of the real estate market, thus slowing down the pace of the overall demand structure transformation.

▪ Highlighting industry vulnerability: This situation, where the application segments appear relatively balanced but incremental momentum heavily depends on a single and declining industry, profoundly exposes the demand-side vulnerability and transformation pressure of the PVC industry. Although minor adjustments in the downstream structure can provide some buffer, they cannot fundamentally reverse the pattern of demand growth predominantly driven by real estate.

It must be noted that the deep adjustment in the real estate market is systematically reshaping the demand pattern for PVC, forcing the industry to seek accelerated penetration and expansion in non-real estate fields (such as packaging, new energy infrastructure, healthcare, and consumer goods). At the same time, it must also face and adapt to a transitional period of a paradigm shift in growth.

Foreign Trade and Competitive Landscape

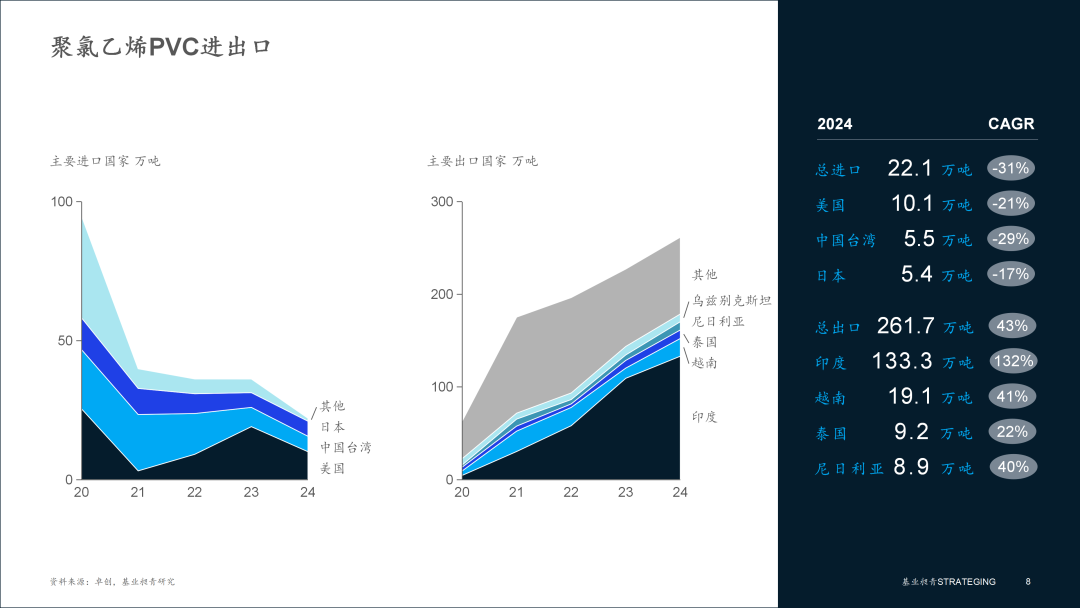

Between 2020 and 2024, China's PVC industry experienced a fundamental reversal in import and export patterns. The core logic behind this reversal lies in the dual effects of the release of domestic absolute capacity advantage (with slowing domestic demand growth forming an outward push) and the infrastructure dividend boom in emerging markets (creating export pull). Firstly, imports continued to be marginalized, with domestic substitution completed and cost barriers solidified. Import volumes shrank from an already low level of about 300,000 tons in 2020 (accounting for only about 1.5% of the domestic apparent consumption that year) to 221,000 tons in 2024 (CAGR of -30.5%). This continuous contraction marks the complete completion of the import substitution process in China's PVC industry. Traditional high-end sources such as the United States (101,000 tons, CAGR of -20.7%), Taiwan (55,000 tons, CAGR of -28.6%), and Japan (54,000 tons, CAGR of -17.0%) saw their shares rapidly decline, reflecting that domestic carbide-based capacity, leveraging resource endowments and economies of scale, has completely dismantled the cost-performance barriers of imported products, relegating imports to a very small-scale technical supplementary channel. Secondly, there was an explosive expansion in exports, driven by the infrastructure cycle in emerging markets and the global spillover of capacity. In stark contrast to the "slight shrinkage" of imports, exports experienced a quantum leap—from only tens of thousands of tons in 2020 to 2.617 million tons in 2024 (CAGR of 42.8%), accounting for more than 15% of domestic production. This drastic change is the inevitable result of the systematic spillover of Chinese capacity into global markets, particularly emerging economies. Specifically:

India: In 2024, imports of PVC from China will reach 1.333 million tons (CAGR of 132.4%), accounting for 50.9% of China's total exports. This explosive demand is driven by the country's "infrastructure + real estate" dual-engine period of material hunger, but the highly concentrated market structure poses significant trade risk concerns.

Southeast Asia and Africa: The continuous high growth in markets such as Vietnam (191,000 tons, CAGR of 41.4%), Thailand (92,000 tons, CAGR of 22.4%), and Nigeria (89,000 tons, CAGR of 39.9%) reveals that regions with population dividends and accelerating urbanization are taking over as the main growth drivers of global PVC demand. Moreover, the local capacity gap is difficult to bridge in the short term.

▪ Central Asia: Primarily benefiting from the resilient demand supported by the "Belt and Road" initiative, Uzbekistan's stable import (83,000 tons, with a CAGR of 5.1%) reflects the rigid demand characteristics for basic chemicals driven by the region's industrialization process.

It should be noted that under the backdrop of overcapacity, enterprises have fallen into an internal competition of "increasing volume to compensate for price" in their struggle to capture export market share. In 2024, the average export price dropped by approximately 18% compared to 2020 (while raw material costs decreased by less than 5% during the same period). The phenomenon of "increased volume without increased revenue" is substantially squeezing the industry's profit foundation. At the same time, countries such as India and Vietnam have launched multiple rounds of anti-dumping investigations targeting Chinese PVC. The distorted structure of heavy reliance on a single market will sharply increase the vulnerability of the industry's exports.

Price Trends and Industry Profitability

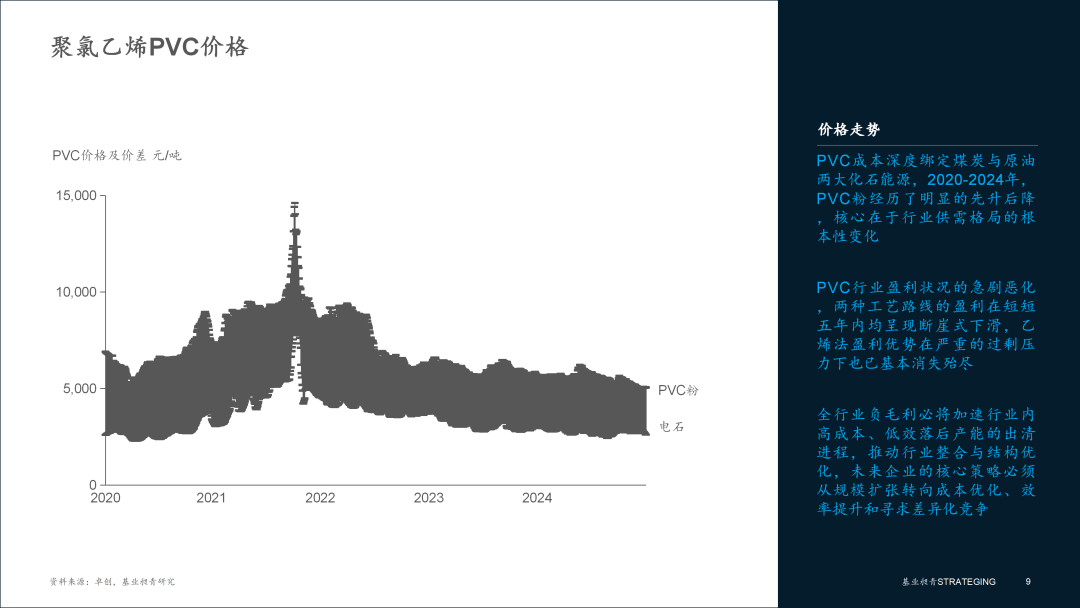

The cost structure of PVC is deeply tied to the two major fossil energies: coal and crude oil, and its price is significantly influenced by fluctuations in the global energy market. Currently, China's PVC production is still dominated by the carbide process, which makes the cost of carbide, mainly derived from coal, the most critical factor determining PVC prices. However, when international oil prices are relatively low, competitors using the ethylene method (oil route) may gain a cost advantage, putting pressure on the carbide process. Reviewing the period from 2020 to 2024, the PVC market price (PVC powder) has experienced a significant rise followed by a decline. The core driver behind this reversal is the fundamental change in the industry's supply and demand pattern, shifting from an early state of tight balance to a sustained situation of oversupply.

Against this backdrop, the industry's profitability has deteriorated sharply. The profit margin of the calcium carbide method plummeted from 815 yuan/ton in 2020 and 877 yuan/ton in 2021 to 170 yuan/ton in 2022, and it experienced deep losses for two consecutive years in 2023-2024 (-178, -175 yuan/ton). Similarly, the profit margin of the ethylene method also significantly declined from a high of 1,281 yuan/ton in 2020 and 2,366 yuan/ton in 2021 to 1,046 yuan/ton in 2022, 312 yuan/ton in 2023, and turned into a loss in 2024 (-183 yuan/ton). Within just five years, the profitability of both process routes has shown a precipitous decline from considerable positive profits (especially the extraordinarily high profitability of the ethylene method in 2021) to widespread industry losses in 2023-2024. This confirms that in an oversupply situation, intense market competition and price wars have severely squeezed the industry's profit margins. Even the ethylene method, which used to enjoy higher profits due to raw material cost advantages or technological premiums, has essentially lost its edge under severe oversupply pressure.

Two consecutive years of negative gross margins across the entire industry indicate that companies are generally operating below the cost line, facing immense cash flow pressures and severe survival challenges. This unsustainable loss-making situation will inevitably accelerate the elimination of high-cost, inefficient, and outdated production capacity within the industry, driving industry consolidation and structural optimization. The traditional development model that relies on low-level capacity expansion and homogeneous price competition has reached its end. In the future, companies must shift their core strategies from scale expansion to cost optimization, efficiency improvement, and the pursuit of differentiated competition. Substantial recovery of the industry will ultimately depend on the effective exit of backward capacity and the genuine rebound in demand from key downstream sectors such as real estate.

Development Challenges and Recommendations

The current PVC industry is facing severe structural imbalances in supply and demand as well as systemic challenges. Domestic demand remains stagnant, and the deep contraction of the real estate sector has caused a collapse in core applications of PVC such as pipes and profiles, which account for a significant portion of demand. From 2020 to 2024, apparent consumption has shown zero growth. Although exports have experienced explosive growth, they are highly dependent on the single Indian market and face dual risks of anti-dumping measures and profit squeeze due to compensating lower prices with higher volume. Overcapacity continues to worsen, with the industry relying on "alkali to compensate for chlorine" to maintain high operating rates, resulting in deep losses across the sector. Overall, the downstream industry is overly tied to the real estate cycle, and growth in emerging fields is insufficient to make up the shortfall.

In the context of stock competition, companies urgently need to break the deadlock and reconstruct their growth logic. In the short term, they need to focus on survival strategies by implementing extreme cost control measures (such as promoting coal-electricity integration through the calcium carbide method and securing long-term agreements for low-cost crude oil through the ethylene method) and reducing energy consumption via intelligent upgrades. They should proactively optimize their production capacity structure, trade quotas or switch to producing specialized grades like medical-grade high-transparency PVC for small and medium capacities, and simultaneously diversify export market risks by establishing localized production capacities in Southeast Asia and the Middle East while setting up anti-dumping warning mechanisms. In the medium term, it is essential to drive structural transformation, accelerate the replacement of high-pollution processes, and develop low-carbon ethylene production capacities such as ethane cracking and oxychlorination, supported by chlorine recycling technology. Collaborating with downstream partners to breakthrough high-end application scenarios is crucial, such as developing lead-free PVC for photovoltaic cables, recycled PVC interior materials for automobiles, and specialty materials that meet medical standards, while also entering infrastructure replacement fields like PVC-O high-pressure pipes and prefabricated building wall panels. In the long term, the industry ecosystem should be restructured, upgrading from a material supplier to a solution provider. Leading companies can integrate the industry chain through mergers and acquisitions of downstream pipe/profile processing enterprises, extending high-value-added products like CPVC high-temperature resistant pipes and PVC/ABS alloys based on the chlor-alkali platform. Simultaneously, they should establish a full lifecycle carbon footprint database and develop a green electricity hydrogen production-zero carbon PVC route to tackle international carbon barriers.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track