New HEC's Billion-Yuan Nylon Project Launched! 8 Million Tons of Production Capacity Set to Enter? Nylon 66 Ushers in an Era of Fierce Competition

Recently, in the Tianjin Nangang Industrial Zone, a billion-level nylon new materials project officially broke ground. This project is invested and constructed by Zhejiang Xinhengcheng Co., Ltd., the parent company of Tianjin Xinhengcheng Material Technology Co., Ltd., a leading private enterprise, covering a total area of approximately 380,000 square meters.

Source: Binhai Release

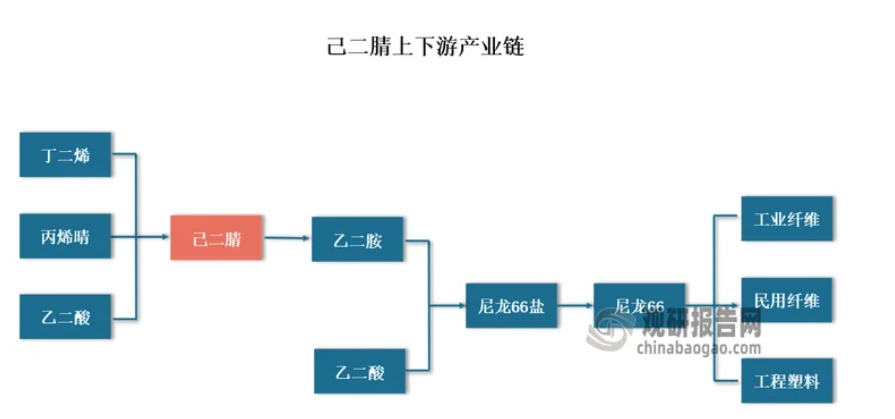

The project will build production facilities for adiponitrile, hexamethylenediamine, and nylon, along with supporting auxiliary production facilities, using New Hope's proprietary patented technology to fully develop them. AdiponitrileHexamethylenediamineNylon 66Key intermediates and high-end nylon new materials industry chainXu Lihua, the deputy commander of the first phase of the New Material Industry Chain Project of Tianjin Xinhecheng Materials Technology Co., Ltd., stated, "Currently, in this product field, our country still relies mainly on imports. After the completion of the first phase of construction, we will use Xinhecheng's patented technology to solve the technical bottleneck issues."

The project site in Nangang Industrial Zone has strategic considerations: it can utilize the 1.2 million tons of ethylene produced by the upstream large ethylene project to supply butadiene, forming a separation wall supply.Break the long-standing monopoly of Invista on adiponitrile and the industrial chain of high-performance fibers in Tianjin.

The localization process of adiponitrile in China is accelerating.

Friends who pay attention to the nylon industry are very familiar with adiponitrile. As the core raw material for the production of nylon 66, adiponitrile has long been a "bottleneck" in China's nylon industry. In the past, the global production technology of adiponitrile has been mainly monopolized by four international giants: Invista, Ascend, BASF, and DuPont, with China needing to import a large amount every year.

Source: Guanyan Report Network

As of the end of 2023, there are mainly six companies globally with adiponitrile production capacity, with a total capacity of approximately 2.36 million tons per year. Among them, Invista is the world's largest adiponitrile producer, with an equity capacity of 1.07 million tons per year. BASF and Invista each hold a 50% stake in the Butachimie plant in France, corresponding to an equity capacity of 300,000 tons per year. Ascend produces adiponitrile using the acrylonitrile method, with a capacity of 545,000 tons per year. The combined capacity of these three giants accounts for over 80% of the global total.

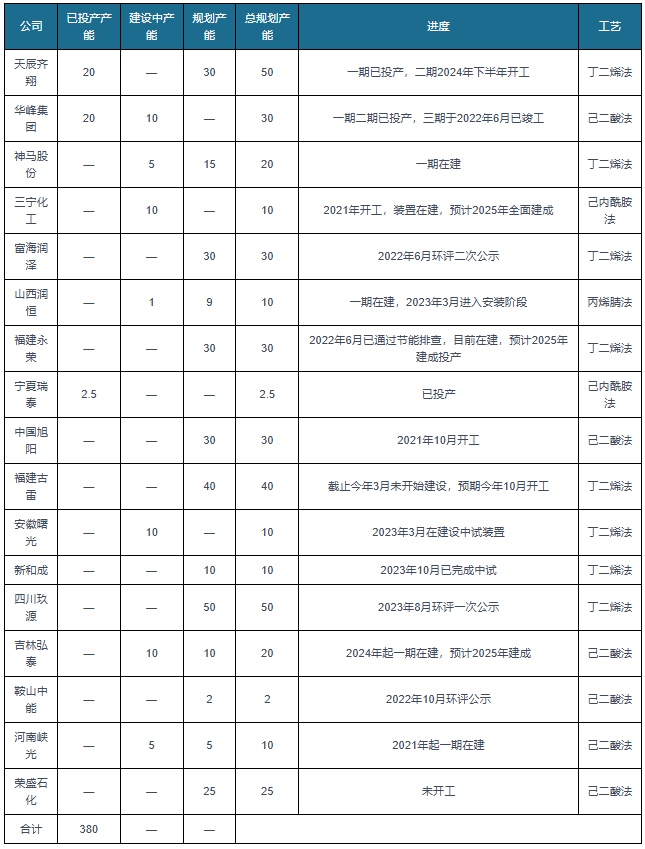

Table: Global Adiponitrile Production Capacity and Process in Operation (Source: Guanyan Tianxia Compilation)

This situation has undergone fundamental changes in recent years.

In 2019,Chongqing HuafengTo achieve the industrial production of hexamethylenediamine, however, the adipic acid method faces challenges such as high energy consumption and complex processes.

Source: Huafeng

2022Tianchen QixiangThe successful development and mass production of the butadiene method for preparing adiponitrile has become an important milestone in the development of China's adiponitrile industry. This domestically pioneering patented technology with independent intellectual property rights for the butadiene method not only can enhance the adiponitrile production capacity of enterprises but also holds the potential to further advance the overall development of the domestic adiponitrile industry through technology licensing and transfer in the future.

Currently, China's adiponitrile market has formed a diversified supply pattern: Invista Shanghai (400,000 tons/year), Chongqing Huafeng (200,000 tons/year), Tianchen Qixiang (300,000 tons/year), and other companies have achieved mass production. Additionally, many enterprises such as Shenda Co., Ltd. (200,000 tons/year under construction) and Yongrong Holdings (300,000 tons/year under construction) are actively making arrangements.

According to incomplete statistics,The planned domestic production capacity of adiponitrile has exceeded 300. completely bid farewell to the era of dependence on imports.

China's Adiponitrile Production Capacity Expansion Plan (Unit: 10,000 tons/year, Source: Organized by Guanyan World)

Currently, the industrial production of adiponitrile primarily employs three process routes: acrylonitrile electro-dimerization, direct hydrocyanation of butadiene, and catalytic ammoniation of adipic acid. Although the adipic acid method has a lower investment cost, its economic viability is currently weakened by the high price of raw material adipic acid. Additionally, this process has high energy consumption, produces many by-products, and involves a relatively complex procedure. The acrylonitrile method requires only a single reaction step, and product purification is simple. However, due to the strong toxicity and corrosiveness of acrylonitrile itself and its high raw material cost, the expansion of its production capacity is limited. In contrast, the butadiene method offers mild reaction conditions, low energy consumption, high yield, and excellent product quality. It has become the mainstream process, accounting for over 60% of applications and is currently the most optimal technological route in terms of comprehensive performance.

In addition to breakthroughs in the production of adiponitrile, domestic pathways that bypass adiponitrile to produce nylon 66 have also emerged.

June 2025China Pingmei Shenma GroupThe first domestic 100,000-ton/year AS installation has officially been put into operation, marking a significant breakthrough in overcoming the "bottleneck" situation of key raw materials for nylon 66. This technology innovatively synthesizes hexamethylenediamine directly from the ammoniation and dehydration of caprolactam, significantly reducing production costs and dependence on imported raw materials.

Image source: Pingmei Shenma

Explosive growth in production capacity, China becomes the global leader in nylon 66.Largest producer

Nylon 66 (PA66), as the second largest nylon variety in the world, occupies a core position in automotive lightweighting, electrical and electronic applications, and industrial yarns due to its excellent performance. In recent years, with breakthroughs in the localization of adiponitrile (such as mass production by companies like Huafeng Group and Tianchen Qixiang), the raw material costs of PA66 have significantly decreased, and domestic production capacity has accelerated its expansion.

By the end of 2024, China's total nylon 66 production capacity will have reached 1.27 million tons.Accounts for 37% of global production capacity.China has become the world's largest producer. What's more noteworthy is that the planned domestic production capacity has already exceeded 8 million tons, with a total related investment of 170 billion yuan.

The ongoing promotion of Nylon 66 in China.The project is remarkable: Yulong Petrochemical.40,000-ton nylon 66 project 200,000-ton Nylon 66 New Material ProjectShandong Juhe Shun500,000-ton Nylon New Materials ProjectZhejiang PetrochemicalA number of major projects, including the annual production of 500,000 tons of Nylon 66, are under intense construction.

Here are some major Nylon 66Project Introduction:

Yulong Petrochemical 4010,000 tons of nylon 66

Shandong Yulong Petrochemical Co., Ltd. relies on the basic chemical raw materials produced by the first phase of the integrated refining and petrochemical project on Yulong Island, including ethylene, propylene, butadiene, xylene, benzene, toluene, ethylene oxide, styrene, ethylene glycol, and paraxylene, to carry out downstream petrochemical deep processing facilities and extend the industrial chain, producing a variety of high value-added products.New MaterialsNylon 66 has a capacity of 400,000 tons per year. In addition, the project will also construct a high-temperature nylon PA6T1 series with a capacity of 10,000 tons per year.

Xu Yang 20Ten thousand tons of nylon 66New Materials Project

On September 1st, the Ecological Environment Bureau of Heze City announced the acceptance of the environmental impact assessment for the annual production of 200,000 tons of nylon 66 new materials project by Yuncheng Xuyang New Materials Co., Ltd.

The proposed project involves an investment of 2,917.66 million yuan, with a total land area of 120 mu and a total construction area of 38,090 square meters. It mainly includes the construction of facilities for an annual production of 200,000 tons of Nylon 66, 100,000 tons of 1,6-hexanediamine, as well as waste gas and liquid incinerators, storage tanks, power distribution rooms, and other auxiliary production facilities. The Nylon 66 project will have two production lines using hexamethylenediamine and adipic acid polymerization processes, primarily equipped with crude salt reactors, polymerization kettles, and pre-polymerization kettles. The hexanediamine project will have two production lines utilizing caprolactam ammoniation and hydrogenation processes, primarily equipped with ammoniation reactors, hydrogenation reactors, and alcohol removal towers.

Shandong Juheshun 50Ten-thousand-ton nylon new material project

The total investment is 2.66 billion yuan, and the project is divided into two phases. The first phase has a production capacity of 200,000 tons per year, building one batch production line to produce 20,000 tons per year of high-temperature nylon (PA6T), and six continuous production lines to produce 180,000 tons per year of high-performance nylon (PA66). The second phase has a production capacity of 300,000 tons per year, building eight continuous production lines to produce 115,000 tons per year of high-performance nylon (PA66), 80,000 tons per year of high-temperature nylon (PA6T), and 105,000 tons per year of copolymer nylon (PA666). The first phase's 80,000-ton nylon 66 project is expected to be put into production in 2025.

Tianchen Qixiang plans to invest an additional 140 million yuan in its subsidiary.

On August 26, Juhe Shun announced that Tianchen Qixiang New Materials Co., Ltd. will invest 140 million yuan to increase its capital in Juhe Shun's wholly-owned subsidiary, Shandong Juhe Shun New Materials Co., Ltd. After the capital increase, Juhe Shun will still hold 65% of the shares in Shandong Juhe Shun, while Tianchen Qixiang will hold 35% and become a strategic shareholder. Juhe Shun stated that this cooperation will ensure the supply of key raw materials, adiponitrile, for its "80,000 tons per year nylon new materials (nylon 66) project" and promote the technological innovation and upgrading of nylon 66.

Zhejiang Petrochemical annual production of 50Ten thousand tons of nylon 66

The project includes a 250,000 tons/year adiponitrile unit and a 500,000 tons/year nylon 66 polymer chip unit, along with supporting facilities for nitric acid, cyclohexanol, adipic acid, hydrogen cyanide, and hexamethylenediamine. In August, it was reported that the "Zhejiang Petrochemical Company's High-end New Materials Project 250,000 tons/year adiponitrile unit engineering design kickoff meeting" was successfully held in Hangzhou, with Zhejiang Zhiying Petrochemical Technology Co., Ltd. licensing the process package and Shanghai Zhiying Chemical Technology Co., Ltd. undertaking the engineering design.

Liaoyang Petrochemical Company 10Ten thousand tons /Nylon 66

On June 30, the 100,000-ton/year Nylon 66 project of Liaoyang Petrochemical Company was successfully handed over as scheduled. With a total investment of 1.21 billion yuan, construction is set to begin on March 15, 2024. The main constructions include a 50,000-ton/year adiponitrile plant, a 50,000-ton/year hexamethylenediamine plant, a 120,000-ton/year salt formation plant, and a 100,000-ton/year Nylon 66 plant, ultimately forming a complete industrial chain of adipic acid-adiponitrile-hexamethylenediamine-Nylon 66.

Source: China Petroleum News

In addition, the nylon 66 projects in the planning stage in the country also include:Henan Heart to HeartThe chemical project with an annual production capacity of 200,000 tons of nylon 66.Shanxi Hengli New MaterialsThe project with an annual production of 120,000 tons of Nylon 66.Hualu HengshengAn annual production of 80,000 tons of nylon 66 project.Fujian Fuhua Gulei400,000-ton Nylon 66 projectJiangsu Weiming60,000 tons of Nylon 66 projectFujian YongrongAnnual production of 80,000 tons of Nylon 66 project.Sichuan JiuyuanAnnual production of 1.2 million tons of nylon 66 project.Longhua New MaterialsAnnual production of 1.08 million tons of Nylon 66 project, etc.

At the same time, international giants are also adjusting their strategies in China.

June 17, 2025, global Nylon 66 giantsAscendIt has been announced that the production facility for hexamethylenediamine located in Lianyungang, China, will be closed in an orderly manner, a decision that comes less than a year after the plant officially opened.

Image: Aosenda Lianyungang Production Factory (Source: Aosenda)

BASFIt announced the commissioning of its world-class hexamethylenediamine plant located in Chalonnes, France, with an annual production capacity increased to 260,000 tons.InvistaDeeply bind Chinese companies such as Pingmei Shenma and China Resources Yantai through technology licensing to exchange technology for market access.

Conclusion: The market prospects are promising, but the risk of overcapacity must be taken into account.

China is the core market for global nylon 66 consumption.

With the development trend of automotive lightweighting and high-performance electronic and electrical systems, the market prospects for nylon 66 are broad.

However, industry experts have repeatedly warned of the risk of overinvestment. By the end of 2024, the total domestic production capacity will be 1.27 million tons, but the apparent consumption will only be 524,000 tons.The capacity utilization rate is below 60%, and high-end products still rely on imports.

The Chinese nylon 66 industry is at a historical turning point: on one hand, there is a technological breakthrough and capacity expansion for the entire industry's independent control; on the other hand, there is an urgent need to address the competitiveness of high-end products and the risk of overcapacity.

In the next five years, the industry will enter a critical period of integration and upgrading. Companies with core technology, supply chain integration capabilities, and market application development advantages will stand out. New entrants like New Hope will inject new variables and vitality into this transformation.

Editor: Lily

Source of materials: High Performance Resins and Applications, Guanyan Report Network, Specialty Plastics World, Plastics Alliance, Binhai Release, Chemical Online, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track