New Car Price-Cutting Wave Strangles Market, Used Cars Say Goodbye to Easy Profits Era

Frowning, pursing their lips, then breaking into a meaningful bitter smile. When discussing the current used car business environment, the two salespeople from different brands in Shanghai at the lively dining table simultaneously showed the exact same embarrassed expression.

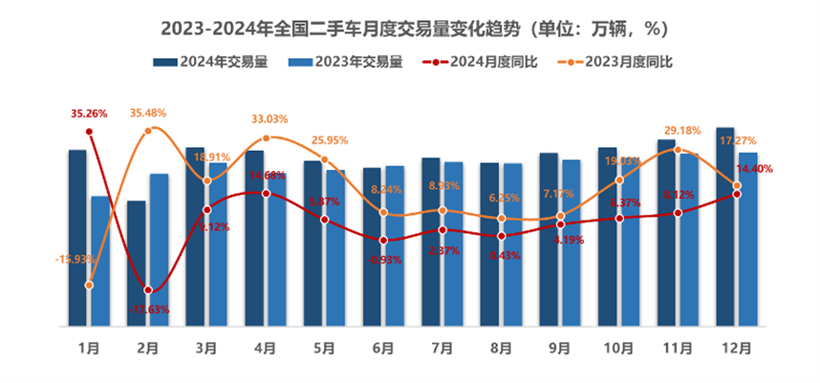

In 2024, driven by a series of favorable policies, China's used car market achieved a historic breakthrough. Data from the China Automobile Dealers Association shows that the cumulative transaction volume of used cars nationwide reached 19.6142 million units in 2024, a year-on-year increase of 6.52%. The total transaction amount exceeded 1.28 trillion yuan, with both core indicators setting new industry records.

However, behind the impressive market figures, industry professionals are struggling in dire circumstances: 90% of car dealers are operating at a loss, and both the average price and profit per vehicle continue to decline. This seemingly prosperous market feast has become a life-or-death test for most participants.

01In the past "picking up money", now losing money

"The price cannot be any lower."

Having been deeply involved in the used car industry for many years, "Liaoran Fuping," who transitioned from automotive editor to used car and aftermarket business, has a particularly profound insight into the current market. He cites the example of the F35 BMW 3 Series, stating, "Two years ago, the average price was 123,000 yuan, and now it is basically 78,000 yuan."

As Liao Ran Fu Ping mentioned, 2024 became an important watershed for the used car industry. Before this, the industry was booming, making money effortlessly; however, after this, the used car industry bid farewell to its era of excessive profits and was suddenly plunged into an ongoing price war.

"In the past, this industry was really like picking up money." Speaking of the past, Liao Ran Fuping couldn't hide the excitement in their tone, "Especially in 2022, car dealers made a lot of money. The pandemic in 2022 caused severe chip shortages for many manufacturers, and there were no cars on the market. Nearly new second-hand cars from brands like BBA were bought back at the invoice price and then sold at a markup. As long as you had cars in hand, you were making money, because the sales of new energy vehicles hadn't picked up at all, and there were no fuel cars due to chip shortages, so the prices of second-hand cars skyrocketed, and car dealers were having a great time."

However, the changes brought about by industry transformation have put an end to the days when many traditional used car dealers could easily make money without effort. The model that once relied on "information gaps" and "supply-demand gaps" to generate easy profits has become completely ineffective amid dramatic shifts in the market environment. At the heart of this upheaval is the wave of price cuts that started in the new car market and has since spread.

Regarding the root cause of the price war, Liao Lian Fu Ping believes it is closely related to the price drop in the new car market. "The high prices for trade-in vehicles, combined with the continuous price reductions of new cars, have squeezed the space for used cars. Additionally, buyers' purchasing psychology has changed; they now prefer to buy new cars rather than paying high prices for used ones."

Statistics from the Gasgoo Auto Research Institute support this view. In 2024, more than 70 automotive brands and over 330 models experienced price reductions. For new energy vehicles, the average price drop per model reached 18,000 yuan, with a discount rate of 9.2%. For conventional fuel vehicles, the average price drop per model was 13,000 yuan, with a discount rate of 6.8%.

Under the trend of new car price cuts, the price advantage of used cars is quietly disappearing, while inherent issues such as non-transparent vehicle conditions and false advertising are becoming more prominent. For consumers, the cost-effectiveness of used cars has significantly diminished, naturally shifting their preference towards new cars.

The transmission effect of new car price reductions has also directly triggered a price collapse in the used car market. Previously, used gasoline cars with relatively stable retention rates were the first to be impacted. A relevant person in charge at the used car platform Tiantian Paiche previously revealed that in 2023, the average retention rate for gasoline cars with a three-year age was 56.8%. However, by 2024, their average retention rate had dropped to 51.8%.

Taking the Changan UNI-V as an example, at the beginning of 2024, the new car discount for this model was 15,000 yuan, with an on-road price of about 110,000 yuan. Now, with a discount of 30,000 yuan, the new car can be purchased for less than 100,000 yuan. This price reduction has directly broken through its used car price system: in just one and a half years, the second-hand price of the Changan UNI-V has dropped by more than 40%, down to around 60,000 yuan.

Compared to the well-developed fuel vehicles with high market share and better after-sales service, second-hand new energy vehicles generally have a lower retention rate due to rapid updates and frequent technological iterations. The price reduction of new cars is even more detrimental to them. According to data from Tiantian Paiche, the average retention rate of 3-year-old second-hand new energy vehicles is only 43%.

Taking the collapsed Jiyue Auto as an example, it was previously reported by the media that a brand new Jiyue car, originally priced at 229,900 yuan, could be purchased for only 160,000 yuan at the terminal, which is equivalent to a 30% discount. In the used car market, even if dealers are willing to acquire such "thunderstorm models," the quotes are generally low. It is common for a new car to depreciate by over 100,000 yuan in just one year of purchase.

To make matters worse, although the subsidy policy has boosted the volume of used car transactions, it has left industry practitioners in a thankless predicament.

The performance data of the leading dealer Zhongsheng Holdings is highly representative. In the first half of this year, its used car sales increased by 9.6% year-on-year to 111,000 units, but revenue fell by 27% year-on-year to 6.02 billion yuan, with revenue per vehicle plummeting by 33.4%.

The structure of car sources is the core reason for the pressure on profitability. Under the trade-in program and local purchase subsidies, Zhongsheng Holdings acquired a large number of old cars with long age, with nearly 80% over six years old. Coupled with the price war of new cars, the comprehensive profit per used car is less than 3,000 yuan, with a total comprehensive profit of about 300 million yuan, a year-on-year decrease of 60.2%.

The situation for small dealers is even more difficult than that of major distributors. According to Liao Ran Fu Ping, 90% of car dealers in the current used car market are losing money. "We made a net profit of over 2 million yuan in 2023, 800,000 yuan last year, and we have lost 300,000 yuan so far this year."

02Crossing the customs, opportunities and challenges coexist.

As the price war in the domestic market remains intense, some car manufacturers and dealers have turned their attention overseas. Similar to new car exports, many overseas markets have a strong demand for used cars, and competition is not yet fully saturated. China's used car exports are being looked upon with high expectations to break the deadlock.

Since the launch of the used car export pilot program in 2019, this business has been advancing rapidly. According to data from the China Automobile Dealers Association, China's used car exports in 2020 amounted to only 4,300 vehicles, but by 2024, this number had exceeded 436,000 vehicles, covering over 160 countries and regions including Southeast Asia, the Middle East, Europe, and Latin America. It is expected that by 2025, the export volume will surpass 1 million vehicles.

The demand in the export market has even driven the price recovery of some domestically unsold car models. Taking the example of Neta Auto, which has been discontinued domestically, its second-hand car market has significantly improved due to increased export demand, despite the sharp drop in domestic second-hand car prices. Some car dealers have reported that the purchase price has increased by five to six thousand yuan compared to the same period last year.

However, despite the vast prospects for the export of used cars, there are still many practical limitations. The unique condition of each used car leads to high costs for inspection, certification, and communication. For example, vehicles for export must undergo multi-dimensional inspections such as body quality, battery health, driving modules, static data, and charging modules. This process is complex and time-consuming, significantly increasing export costs.

Moreover, the supporting after-sales and service system is not yet complete. Overseas consumers face difficulties in receiving timely responses for repair and maintenance needs after purchasing used cars, which also limits the long-term development of used car exports.

Policy changes in regional markets have made export business even more uncertain. Previously, Suifenhe City in Heilongjiang Province, due to its proximity to Russia, became a popular port for used car exports, with business once booming. The General Manager of Overseas Business at Cheboshi once said in a media interview, "If there are a thousand cars, we can sell a thousand cars. The Russian market has huge demand." There were even Russian internet celebrities who traveled there specifically to film videos selecting cars.

However, as Russia tightens its car import standards, China's automobile exports to Russia have significantly declined, and the prospects for used cars in the Russian market are no longer clear.

Liao Ran has also observed the used car export business: "(The export targets) are mainly Ukraine, Russia, and the third world, but now it's not profitable anymore because once the war stops, people don't need them."

In his view, the current export of used cars has not yet formed a stable long-term mechanism and is more inclined towards short-term supply, with a "very short window period of just over a year." However, the outlook for used car exports is not entirely pessimistic. He believes that in the future, African countries may become a vast new market, providing new possibilities for used car exports.

The essence of this round of deep adjustment in the used car market is an inevitable process of squeezing out the bubble.

For consumers who purchased cars at high prices in 2022, the current depreciation can be described as a "nightmare," and many inevitably regret the halving of their vehicle's value.

From an industry perspective, although individual businesses are under severe operating pressure, the overall trend is moving towards a healthier direction.

"This is a reshuffling process, inevitably filled with blood and tears. Improving service and quality is still the way to survive—it's exactly like real estate," Liao Ran Fuping further pointed out the industry's crux: "In fact, China's car market has never truly been 'normal.' Since the reform and opening up, it has always been on the rise." Perhaps it is only now that the used car market is experiencing its first real correction cycle, bidding farewell to rampant growth and returning to rational development.

This harsh winter also forces all participants to rethink their ways of survival. Price wars are unsustainable; only by shifting to value wars can there be a long-term solution. In the future, building a trust mechanism, improving service levels, and enhancing after-sales guarantees will be the core for the survival and development of used car companies. The industry must bid farewell to the rough model that relies on information asymmetry and move towards a transparent and standardized professional service track.

The industry must bid farewell to the extensive model reliant on information asymmetry and move towards a transparent and standardized professional service track. This period of growing pains may be inevitable, but after these pains, the Chinese used car market may truly mature. It will no longer be just a simple marketplace but an ecosystem where consumers can feel at ease, and practitioners can work with peace of mind. This is not only the rebirth of the industry but also an important step towards maturity for China's automotive market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track