Nearly 30% price drop in one year! the spandex industry enters a tight competition! following xiaoxing, this chemical giant also begins to shrink its spandex production lines in china.

In recent years, as the domestic chemical industry enters a new round of capacity growth, the competition in the industry of various chemical fiber raw materials, including spandex, has become intense. Overseas chemical giants find it difficult to earn excess profits and are unwilling to engage in “close combat” with domestic companies, leading them to begin retreating.

South Korean chemical leader reduces production lines in China

According to reports, South Korea's Taekwang Group announced that it will suspend the operation of some spandex production lines at its Chinese subsidiary, Taekwang Chemical Fiber (Changshu) Co., Ltd., starting July 14, 2025, and will reassess its future strategy. This is the first time Taekwang Group has shut down production lines at a spandex factory in China. It is believed that this decision is due to the ongoing large-scale expansion of Chinese competitors and the slow recovery of market demand, leading to a deterioration in the profitability of the local factory.

Tai Kwang Fiber (Changshu) Co., Ltd. was established in 2003 and is the overseas spandex production base of the South Korean Tai Kwang Group, with an annual output of nearly 30,000 tons. Tai Kwang Fiber (Changshu) Co., Ltd. has suspended one production line for equipment inspection on July 14, 2025, and is considering shutting down another production line on July 21, with further adjustments possible based on evaluation results. According to a relevant person from the South Korean Tai Kwang Group, no specific decision has been made yet regarding whether to close or withdraw from the factory.

Previously, the South Korean Taekwang Group decided in May last year to suspend its investment in Taekwang Chemical Fiber (Ningxia) Co., Ltd.'s differentiated spandex project with an annual production capacity of 108,000 tons, and deemed the previous investment funds as losses, judging that they could not be recovered.

Tai Kwang Fiber (Changshu) Co., Ltd. was once regarded as a cash cow for the Korean Tai Kwang Group. However, the company has now incurred losses for three consecutive years and is currently in a state of complete capital impairment. Data shows that Tai Kwang Fiber (Changshu) Co., Ltd. has experienced a continuous decline in sales since 2021, resulting in consecutive losses. Considering that Chinese competitors are expanding their production capacity through large-scale investments, its future prospects look even bleaker.

Xiaoxing Spandex gradually shuts down old production lines.

Apart from Taekwang, another Korean giant, Hyosung, is also gradually shutting down its old production capacity.

The South Korean spandex company Xiaoxing Group is gradually advancing its capacity westward plan. Its old production capacity in the eastern coastal region is also being gradually shut down due to environmental and cost reasons. Xiaoxing Spandex (Jiaxing) Co., Ltd. has already shut down 8 production lines by the end of 2023, will shut down 2 more lines by July 2025, and plans to shut down another 2 lines by March 2026, with all shut down by the end of 2026.

According to China's "Carbon Peak Implementation Plan for the Chemical Fiber Industry," starting from 2025, a carbon tax of 200 yuan per ton will be levied on spandex that exceeds a carbon emission of 3.2 tons per ton. Some older facilities have emissions significantly above this standard, resulting in a loss of competitiveness in terms of pricing. The plan also mentions promoting lower energy-consuming "melt-spun spandex" technology. If the cost of upgrading the necessary equipment is high, this will accelerate the phase-out of older spandex facilities. Additionally, new capacity requires substantial funding, and with unclear profit prospects, foreign investment willingness in spandex production is currently low.

The spandex industry has fallen into "close combat."

As of the end of 2024, the global spandex production capacity has increased to 1.75 million tons, with domestic capacity accounting for over 75%. Compared to the same period last year, the year-on-year growth rate of global spandex capacity reached 7%, with the increase mainly coming from the mainland Chinese market, where the new spandex production capacity totaled 115,000 tons. Domestic spandex capacity reached 1.3545 million tons, a year-on-year increase of 9.3%. In terms of production, domestic spandex output reached 1.045 million tons, an increase of 11.3% year-on-year; regarding imports and exports, exports amounted to 69,600 tons, up 13.2% year-on-year, while imports were 47,900 tons, down 4.8% year-on-year. Domestic spandex apparent demand was 1.012 million tons, a year-on-year increase of 10.3%.

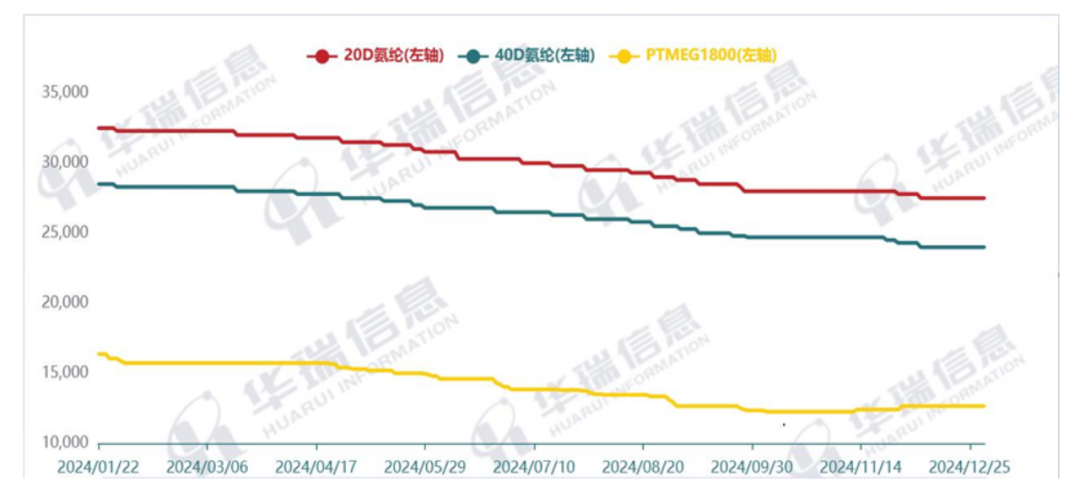

In recent years, the spandex industry has entered a downward cycle from the peak of prosperity in 2021. The prices of spandex fibers have been adjusting downward, the industry's profitability has decreased, and the market landscape is undergoing deep restructuring. In 2024, spandex prices will continue to trend downward, repeatedly hitting historical lows; the supply of spandex exceeds demand, and the prices of the main raw material PTMEG continue to decline, with the average annual price dropping by 29% compared to 2023. Lacking cost support, the situation of most companies in the industry incurring losses is still difficult to reverse.

Currently, apart from South Korea's Daewoo Group, which continues to actively build spandex production capacity in China, the market share of other foreign spandex manufacturers is being continuously squeezed, and they may completely withdraw from the Chinese market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track