Munich Auto Show, Second Wave of Technology Export from China Is on the Way!

Auto-FirstSamal

This world is too crazy. Who still remembers the past three years, when major multinational car manufacturers teamed up with emerging Chinese players to achieve the first wave of Chinese automotive technology export? Now, the second wave has arrived, with a broader scope, more brands involved, and including more traditional domestic automakers and multinational giants. It can be said that the second wave of Chinese technology export is on its way.

The story needs to be told from the beginning.

This topic first originated from a social media post. On September 8, veteran automotive blogger Wu Pei shared some recent industry secrets, stating: "The Italians are studying the three-electric system of a new Chinese EV startup; the Germans have purchased Changan’s electric drive system; a British supercar manufacturer is looking at Chinese V8 engines; the French are choosing between Dongfeng and Changan for rebranding; German and French engines are being developed in Hangzhou Bay; the Koreans have chosen a Chinese intelligent driving company..."

Yes, Germany, Italy, the UK, France, and South Korea are all eyeing Chinese technology.

Based on the above information, Chery, Changan, Great Wall, Dongfeng, Geely, Leapmotor, etc., are all potential technology exporters. For example, it is quite clear from the text mentioning "the Germans' and Frenchmen's engines being developed in Hangzhou Bay," which likely refers to the cooperation between Mercedes-Benz, Renault, and Geely.

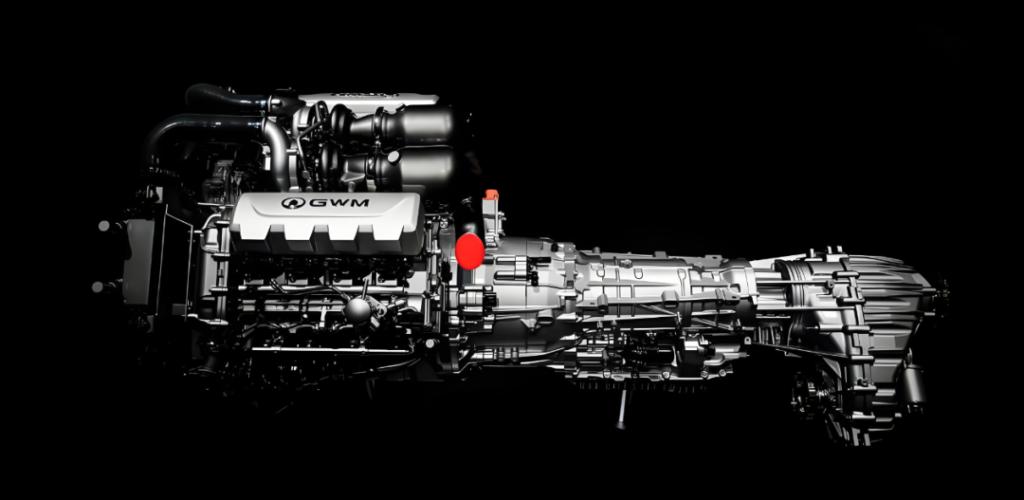

British supercar manufacturers are eyeing Chinese V8 engines, likely to develop the next generation of hybrid supercars. Major British supercar makers include McLaren, Aston Martin, and Lotus. Among them, Lotus has close ties with Geely, McLaren has already partnered with NIO, and Aston Martin is a more probable candidate. Currently, this V8 engine is exclusively available from Great Wall Motors.

In July this year, Wei Jianjun, the chairman of Great Wall Motors, released a new model covered with a black cloth on social media, which is suspected to be the rumored supercar. This car is expected to directly compete with the Ferrari SF90 and will feature a self-developed 4.0T V8 twin-turbo engine combined with an electric motor hybrid system.

It can be expected that a large number of Chinese automakers will continue to export technology to overseas car companies.

From the perspective of Qishe Auto-First, the intense competition and rapid iteration in China's smart three-electric (intelligent electric) sector, along with Chinese automakers' technological strength and cost control capabilities in intelligent driving, form the foundation for this kind of "technology feedback." It also signifies that the Chinese automotive industry has officially entered a new era of "technology export."

In addition, an increasing number of [technology monetization] methods have been realized.

NIO Chairman Li Bin recently confirmed for the first time the cooperation between NIO and the British supercar brand McLaren. Since the first quarter of this year, the two parties have had deep technical cooperation, with some revenue already accounted for, but it is currently unstable.

On the evening of September 2, NIO released its financial report for the second quarter of 2025, showing that other sales reached 2.8726 billion yuan, up 62.6% year-on-year and 37.1% quarter-on-quarter, mainly benefiting from increased revenue from technology research and development services.

XPeng Motors and Volkswagen collaborate to achieve "technology monetization."

XPeng Motors’ 2024 financial report shows that its “services and other income” became a new growth driver for the year, with revenue from this segment surging 89% to 5.04 billion yuan. The gross margin reached 57.2%, up 23.5 percentage points from the previous year.

Xpeng Motors stated that the increase in income was mainly due to the technical R&D services related to strategic cooperation with the Volkswagen Group on platform and software strategies as well as electronic and electrical architecture technology.

The collaboration between Leapmotor and Stellantis Group is also a model of technology export. In addition to Stellantis, the number of international automakers involved is expected to increase by one or two. Previously, in response to media inquiries, Leapmotor CEO Zhu Jiangming confirmed the company's plan to sign a Memorandum of Understanding (MoU) with foreign automakers, and revealed that two companies are currently in negotiations. One of them may adopt a cooperation model based on complete vehicle technology licensing, while the other may focus on licensing the underbody architecture.

At the ongoing Munich Motor Show, BBA is going all out by collectively launching electric vehicles in their home turf. The new-generation iX3, which will be produced in China next year, is adapted to more Chinese ecosystems and technologies. To achieve this, BMW has partnered with leading domestic suppliers including Alibaba, HarmonyOS ecosystem, Momenta, CATL, EVE Energy, and Envision Power.

During this year's Munich Motor Show, Horizon officially announced the establishment of its European headquarters in Munich, building localized operational capabilities aimed at the global market.

The recently launched FAW Audi A5L is the world’s first fuel vehicle equipped with Huawei’s Qiankun technology. The first product from the SAIC joint venture’s letter-branded AUDI, the E5 Sportback, collaborates with Momenta to build an end-to-end large model assisted driving solution.

Earlier, Geely and the world's third-largest automotive alliance, Renault, upgraded their collaboration by establishing a new powertrain company, with each party holding a 50% stake. They aim to develop next-generation efficient and energy-saving hybrid power system solutions to meet global market demands. Implicitly, in the future, Renault, as the world's third-largest automotive alliance, will carry Chinese automotive technology across the globe.

It can be said that there have been significant changes in the fields of chassis architecture and intelligent assisted driving. Chinese automakers are now exporting advanced technologies such as the three electrics, intelligent assisted driving, and hybrid systems, reversing the long-standing situation over the past decades where the market was exchanged for technology.

According to data from the China Passenger Car Association, the global market share of new energy passenger vehicles in China will reach 68.7% in July 2025. From January to July 2025, China's share of the global pure electric vehicle market was 64.3%, and during the same period, China's share of the global plug-in hybrid market reached an extremely high level of 74%.

This also means that in the new energy vehicle sector, Chinese technology is becoming increasingly valuable, and a second wave of Chinese technology export involving more brands and a broader range of both multinational and Chinese automakers is underway.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track