【Morning Alert for the Plastics Market】Oil prices are rising! PE and PP are experiencing fluctuating adjustments, while PS, ABS, and PVC are running weakly.

Summary: On March 27, the general plastic market briefing indicates that U.S. crude oil and refined oil inventories have decreased, coupled with unstable geopolitical situations, leading to an increase in international oil prices. Downstream sentiment remains cautious, with the PE market experiencing price fluctuations; factories are less accepting of high-priced sources, and the PP market shows a strong oscillation. Demand continues to be weak, with PVC transactions mainly seeking lower prices, while the PS market may operate on a weaker trend. The price in the South China market has declined, and ABS is experiencing a downward trend. Supported by strong photovoltaic demand, the EVA market is likely to maintain weak stability.

PP

On March 26, U.S. crude oil and refined oil inventories declined, coupled with geopolitical instability, leading to an increase in international oil prices. NYMEX crude oil futures for May rose by $0.65 to $69.65 per barrel, up 0.94% month-on-month; ICE Brent crude futures for May increased by $0.77 to $73.79 per barrel, up 1.05% month-on-month. The main contract for INE crude oil futures for May rose by 2.1 to 539.4 yuan per barrel, and increased by 3.5 to 542.9 yuan per barrel in the night session.

2. On March 26, acrylic FOB Korea remained steady at $800/ton, while CFR China rose by $10 to $830/ton.

3. On March 26: Haiwei Petrochemical (300,000 tons/year) PP unit restarted. Langgang Petrochemical (110,000 tons/year) PP unit shut down for maintenance.

On March 27, it was reported that the inventory of two types of oil polyolefins is 710,000 tons, a decrease of 15,000 tons compared to yesterday.

Core logic: Under high support from costs and maintenance, polypropylene prices remain strong.

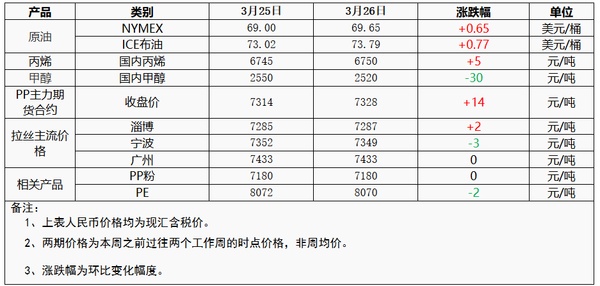

Price List

Market Outlook

Due to geopolitical events, international oil prices have risen, providing some support to the market. Recently, maintenance activities have concentrated, with the impact on daily production accounting for about 17.5%, resulting in low operating rates. In the short term, there is not much supply pressure. Downstream factories have shown average follow-up on new orders, and demand is difficult to sustain, coupled with factories' low willingness to accept high-priced materials, which may suppress the demand side's upward potential for market prices. It is expected that today the polypropylene market will experience a strong fluctuation, with the mainstream price for drawing in East China ranging from 7,300 to 7,430 yuan/ton.

PE

I. Focus Points

1Cost side:U.S. crude oil and refined oil inventories have decreased, coupled with unstable geopolitical situations, leading to an increase in international oil prices. NYMEX crude oil futures for May contract rose by $0.65 to $69.65 per barrel, a month-on-month increase of 0.94%; ICE Brent oil futures for May contract rose by $0.77 to $73.79 per barrel, a month-on-month increase of 1.05%.

2Current parking device:Currently, the parking facilities involve 23 sets of polyethylene units, with scheduled maintenance for the new units from Wanhua Chemical and Lanzhou Petrochemical.

3Market Review of Yesterday:On the previous day, the domestic polyethylene market mostly fell, with a decline of 4-10 yuan/ton. The market is not lacking in spot supply, and there are expectations for new production facilities to come online, leading to a bearish sentiment among industry players. Traders continue to offer discounts to sell their inventory, resulting in sluggish trading activity.

Core logic:The polyethylene spot market is operating with fluctuations.

II. Price List

Market Outlook

Maintenance increases, and in the short term, upstream prices continue to be supported; demand for greenhouse films weakens, while the demand for agricultural films and packaging films remains stable. Downstream sentiment remains cautious. In the short term, supply and demand contradictions are not prominent, and the polyethylene market prices are fluctuating.

PVC

I. Focus Points

On March 26, U.S. crude oil and refined oil inventories decreased, coupled with unstable geopolitical situations, leading to a rise in international oil prices. NYMEX crude oil futures for the May contract rose by $0.65 to $69.65 per barrel, an increase of 0.94%. ICE Brent crude oil futures for the May contract rose by $0.77 to $73.79 per barrel, an increase of 1.05%. China's INE crude oil futures for the main contract 2505 increased by 2.1 to 539.4 yuan per barrel, and in the night session, it rose by 3.5 to 542.9 yuan per barrel.

2. Calcium Carbide: Yesterday, the domestic calcium carbide market operated steadily, with mainstream trade prices in the Wuhai region at 2,700 yuan/ton. Production enterprises had smooth shipments, and although there were unlimited impacts in the Inner Mongolia region yesterday, some enterprises still experienced unstable operations. Downstream deliveries improved somewhat, but overall unloading remained at a low level. Downstream purchasing enthusiasm remained strong. It is expected that the domestic calcium carbide market will continue to operate steadily today, with attention to changes in the supply side.

3. PVC: Yesterday, the domestic PVC market prices maintained a range-bound fluctuation. From the supply and demand fundamentals, there was no significant change. The supply side remained at a high level, while the demand side showed steady but lackluster performance, resulting in an overall dull market transaction atmosphere. Meanwhile, the sentiment in the bulk commodity market was poor, and investors were largely in a wait-and-see mode, with the market generally focused on seeking lower prices for transactions. As of March 26, in the East China region, the cash price for calcium carbide-based PVC was in the range of 4900-5050 yuan/ton, while the ethylene-based PVC was in the range of 5000-5200 yuan/ton.

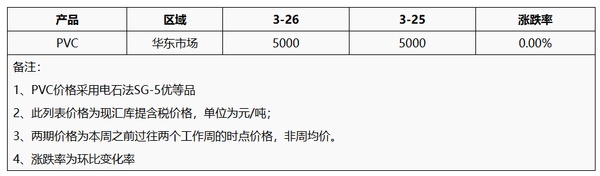

II. Price List

Market Outlook

The domestic PVC supply and demand fundamentals remain unsatisfactory. Recently, upstream PVC production enterprises have had limited maintenance efforts, with only a few companies like Tianyuan and Yanhai making changes to their production facilities. Meanwhile, there are expectations for recovery from ethylene-based enterprises in Huasu and Qinzhou, so the overall market supply has not experienced significant fluctuations. On the demand side, domestic demand remains relatively weak, primarily driven by just-in-time needs, making it difficult to create strong market momentum. It is expected that the cash price of calcium carbide method PVC in the East China market will be between 4850 and 5000 yuan/ton.

ABS

I. Focus Points

1、Crude oilOn March 26, U.S. crude oil and product inventories declined, coupled with geopolitical instability, leading to an increase in international oil prices. NYMEX crude oil futures for May contract rose by $0.65 to $69.65 per barrel, a change of +0.94%; ICE Brent crude futures for May contract rose by $0.77 to $73.79 per barrel, a change of +1.05%. China's INE crude oil futures main contract 2505 increased by 2.1 to 539.4 yuan per barrel, and in the night session, it rose by 3.5 to 542.9 yuan per barrel.

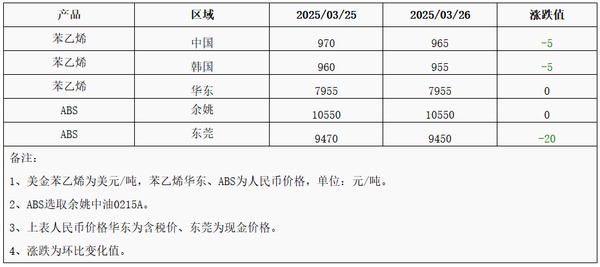

Price List:

III. Market Outlook

Yesterday, the prices in the South China market declined, and prices in the East China market struggled to rise. The overall market transaction volume is weak, and terminal demand is poor. It is expected that today's domestic ABS market prices will continue to maintain a downward trend.

PS

I. Points of Focus

On March 26, U.S. crude oil and refined oil inventories decreased, coupled with unstable geopolitical situations, leading to a rise in international oil prices. NYMEX crude oil futures for May rose by $0.65 to $69.65 per barrel, an increase of 0.94%; ICE Brent crude futures for May rose by $0.77 to $73.79 per barrel, an increase of 1.05%. China's INE crude oil futures main contract for May rose by 2.1 to 539.4 yuan per barrel, and in the night session, it rose by 3.5 to 542.9 yuan per barrel.

Core logic:The downstream demand for PS is generally weak, and the industry supply is under considerable pressure, operating on the weaker side.

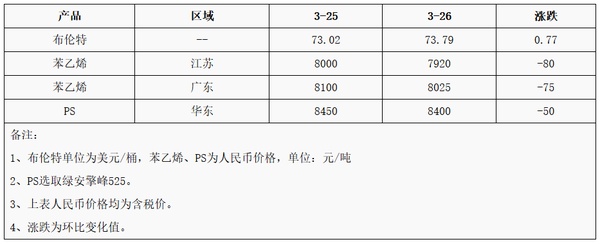

II. Price List

Market Outlook

Yesterday, raw material styrene was weakly sorted at low levels, with cost pressures being the main negative factor. Supply is high and there is pressure to sell, while demand is below expectations. It is anticipated that the PS market will operate weakly today. The expected price for toluene modified styrene in the East China market is between 8400-10300 yuan/ton.

EVA

1. Focus Points

1. On March 26, U.S. crude oil and refined oil inventories declined, coupled with geopolitical instability, leading to an increase in international oil prices. NYMEX crude oil futures for the May contract rose by $0.65 to $69.65 per barrel, up 0.94% month-on-month; ICE Brent crude futures for the May contract increased by $0.77 to $73.79 per barrel, up 1.05% month-on-month. In China, the INE crude oil futures main contract 2505 rose by 2.1 to 539.4 yuan per barrel, and in the night session, it increased by 3.5 to 542.9 yuan per barrel.

2. Ethylene: Production enterprises still have surplus for external sales, and downstream channels are rich in options. The bid prices are relatively low, and the market weakness is difficult to change. There is a possibility of narrow fluctuations in ethylene prices. The expected trading range is expected to remain between 7000-7200 yuan/ton; the USD market is expected to remain between 840-860 USD/ton.

Vinyl acetate: Production enterprises still have surplus for external sales, and downstream channels are rich in options. The negotiation prices are relatively low, and the market's weak trend is difficult to change. There is a possibility of slight fluctuations in ethylene prices. The expected transaction range is anticipated to maintain between 7000-7200 yuan/ton; the USD market is expected to remain between 840-860 USD/ton.

Core logic:The cost of ethylene and vinyl acetate is running weakly, with weakened support from the cost side. The EVA supply side is not pressuring the market, and the downstream foam demand is driven by necessity. Both supply and demand are weak, likely leading to a stable and consolidating market.

2. Price List

Market Outlook

In the short term, the supply and demand game for EVA in the domestic market continues. Supported by strong photovoltaic demand, EVA producers are maintaining prices without pressure. However, downstream orders in the foaming sector are average, and demand remains weak, which is unlikely to change. Industry players are adopting a cautious wait-and-see attitude, primarily focusing on liquidation operations. It is expected that the domestic EVA market will mainly stabilize at a weak level. Mainstream market prices are expected to fluctuate between 11,200-11,700 RMB/ton for hard material, 11,400-11,800 RMB/ton for soft material, and 11,500-11,900 RMB/ton for photovoltaic material.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track