More than one automaker returns to "reality"

"NIO is promising again for the future," should be the more intuitive feeling in the industry recently.

The reason for renewed optimism about its future largely stems from the strategic shift of "Li Bin letting go of his obsession, and NIO returning to reality." To put it more bluntly, from the LeDao L90 to the recently released third-generation ES8, NIO is confronting the current intense "price war" with a more pragmatic attitude.

This is not a compromise, but a rational choice made in the face of a brutal "survival battle."

In the entire automotive industry, NIO is not the only company returning to reality and adjusting its strategy. In today's world, where "price wars" and "involution" have almost become the norm, "survival first" has become the primary goal for many car companies. This actually reflects the survival wisdom of Chinese car companies to "adapt flexibly" in adversity.

Image source: NIO Inc.

"Price reduction and feature increase" has an obvious effect.

The first step in returning to reality is to effectively use the "price" as a sharp tool. Starting with the Le Tao L90, NIO's new product pricing has become more proactive.

Launched at the end of July, the LeDao L90 has a starting price of 265,800 RMB, while the BaaS battery leasing option starts at just 179,800 RMB. With a price of less than 300,000 RMB, it features "four-wheel drive performance + zero-gravity seats + a complete air suspension system." Due to the car's pricing exceeding market expectations, the industry is optimistic about it.

CMB International's analysis suggests that, considering the pricing strategy and channel feedback, the monthly sales of the Letao L90 are expected to exceed the market expectation of 5,000 units. This will pave the way for the subsequent release of the L80 model and help NIO achieve a turnaround in sales.

Image Source: NIO Cars

On September 20, the third-generation ES8, launched at NIO Day 2025, saw its price further reduced by 10,000 yuan from the pre-sale price to start at 406,800 yuan, a decrease of over 100,000 yuan compared to the current model. If the BaaS (Battery as a Service) battery leasing option is used, the purchasing threshold is further lowered to under 300,000 yuan. This pricing strategy is almost equivalent to a "table-flipping" adjustment.

An industry insider attending the event said that the all-new ES8 is "worth every penny," and "I think I should place an order right away."

The reason behind this is that the all-new ES8 has significantly improved its product strength after a "price reduction and feature enhancement." The new vehicle is built on the NT3.0 platform, with overall dimensions increased to 5280/2010/1800mm (length/width/height) and a wheelbase of 3130mm. It is equipped with a 102 kWh long-range battery, a 900V high-voltage platform, dual-chamber air suspension with CDC damping, a 230L front trunk, and more. The interior features are more luxurious, including a 15.6-inch horizontal center console screen, an ET9-style panoramic sky screen, and a column shifter design. The all-new ES8 has enhanced its intelligence, comfort, and power performance.

Some analysis suggests that compared to competitors like the AITO M9 and Li Auto L9, the new ES8 maintains its luxury attributes while offering more flexible pricing and appealing to a broader audience.

The effect of the "price reduction and configuration enhancement" was quickly evident. On the night of the new car's release, NIO's app booking page crashed due to excessive traffic. A Deutsche Bank analysis report stated that the new ES8 had received about 100,000 small orders. Although NIO did not disclose the exact order data, founder William Li admitted that the order locking situation was "better than expected," which undoubtedly brings greater potential for sales in the fourth quarter.

What is more noteworthy is the supportive attitude shown by NIO's long-time user community. One of the first ES8 owners has already ordered two new cars this year, one of which is the all-new ES8. He told Gasgoo Auto, "Let the betrayals come more fiercely," demonstrating his understanding and strong support for the NIO brand.

Despite the potential depreciation of old models due to new car price reductions, some car owners still choose to side with the survival and development of the company. This "big-picture perspective" not only reflects the emotional connection between the brand and its users but also serves as a moat for NIO in this tough battle. For car owners, "choosing NIO is not just choosing a car, but choosing a set of values and a sense of community belonging."

Image source: Le Dao Brand

With the launch and delivery of the ES8, NIO has set a production target of 40,000 units for the fourth quarter, and plans to achieve a monthly production capacity of 15,000 units by December. The newly launched Letao L90 also has a monthly target of 15,000 units by the end of the year. The strong sales of these two models will be crucial for NIO to fulfill its promise of "profitability in the fourth quarter."

This year, Li Bin has repeatedly pledged in public to achieve profitability in the fourth quarter. To achieve this, the monthly delivery target for the fourth quarter needs to reach 50,000 units, with the gross margin increasing to 16%-17%.

Clearly, NIO hopes to leverage the effects of production and sales scale to break the long-standing loss situation. Regarding whether the price adjustment of the all-new ES8 will affect profitability, Li Bin emphasized that the pricing benefits from technological improvements and efficient management, allowing the gross margin to maintain a reasonable level.

The buzz generated by price reductions is not only about the increase in orders, but perhaps also about the revival of confidence. As Li Bin said, "Currently, around 30%-40% of consumers are hesitant to buy NIO cars because they worry about the company going bankrupt. If we can achieve profitability in the fourth quarter, user confidence will be strengthened, and many problems will be easily resolved."

Automotive industry analyst Zhong Shi believes that "NIO's sales will definitely see a significant increase in the fourth quarter, but the issue of profitability is more complex and requires a comprehensive assessment of the cost structure." However, at least with the LeDao L90 and the new ES8 demonstrating price and product advantages, NIO is getting closer to its profitability target for the fourth quarter.

Many "NIOs" are returning to reality.

In fact, NIO had previously publicly expressed multiple times that it would "not reduce prices," but now it has proactively broken its promise. The reason is not complicated; the actual operational pressure is far more severe than imagined.

In recent years, NIO has consistently pursued a high-profile strategy, establishing a heavy asset system for battery swapping and charging, adhering to a direct sales model, and investing over 60 billion yuan in research and development. Although these strategies have created a unique brand moat, they have also subjected NIO to significant financial pressure when sales fall short of expectations.

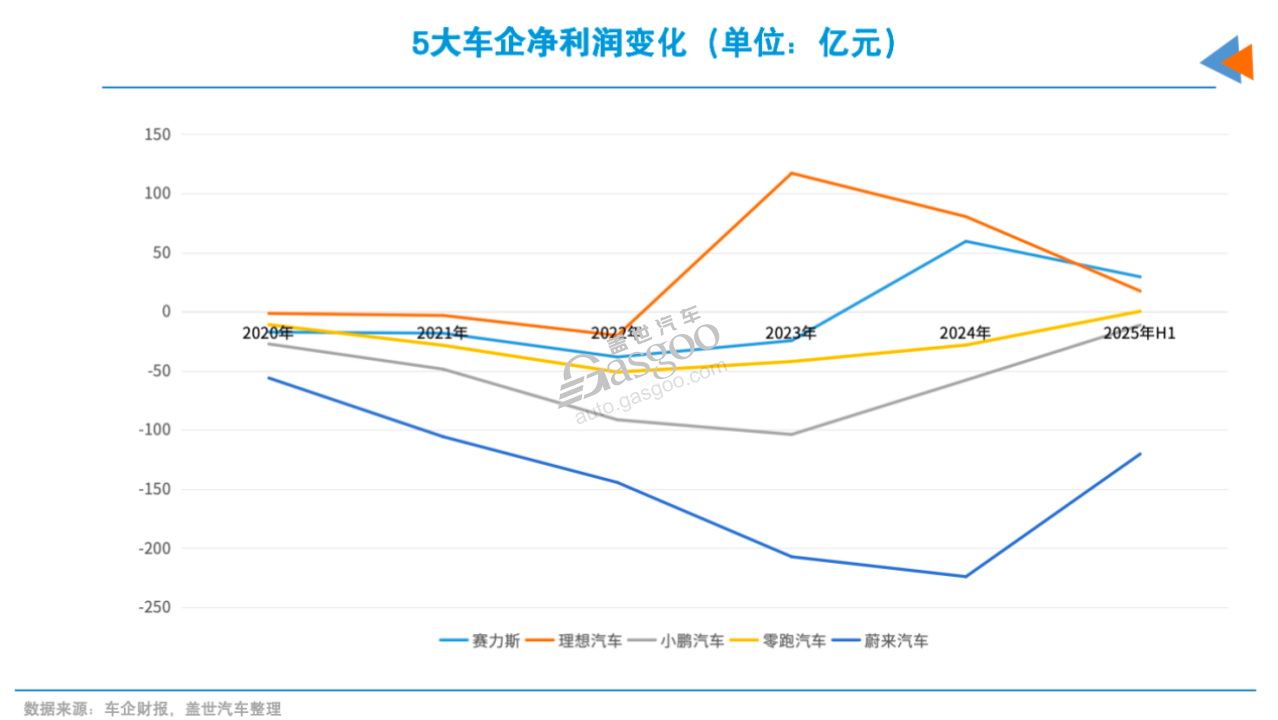

In the first half of 2025, NIO's net loss reached as high as 12 billion yuan, increasing by over 15% year-on-year. The gross margin fell to 9.1%, which is significantly lower than the over 20% gross margin of competitors such as Li Auto and Seres. Meanwhile, its cash reserves, although maintained at 27.7 billion yuan, are only slightly higher than its annual net loss. For a car manufacturer that has not yet achieved profitability, such a financial structure undoubtedly requires constant vigilance.

The root cause of the problem lies in the failure to effectively translate research and development and technology investments into market sales. Although NIO has expanded its product line through the "556677" series and a multi-brand strategy, the overall delivery scale remains low.

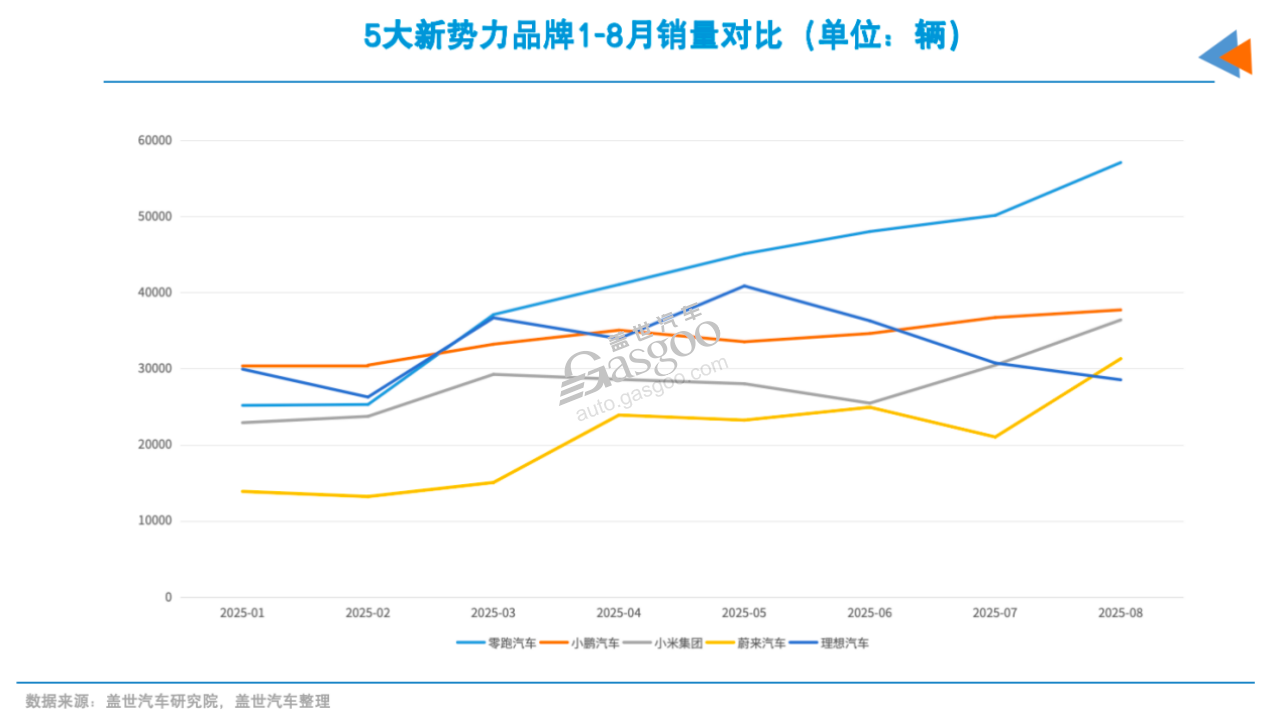

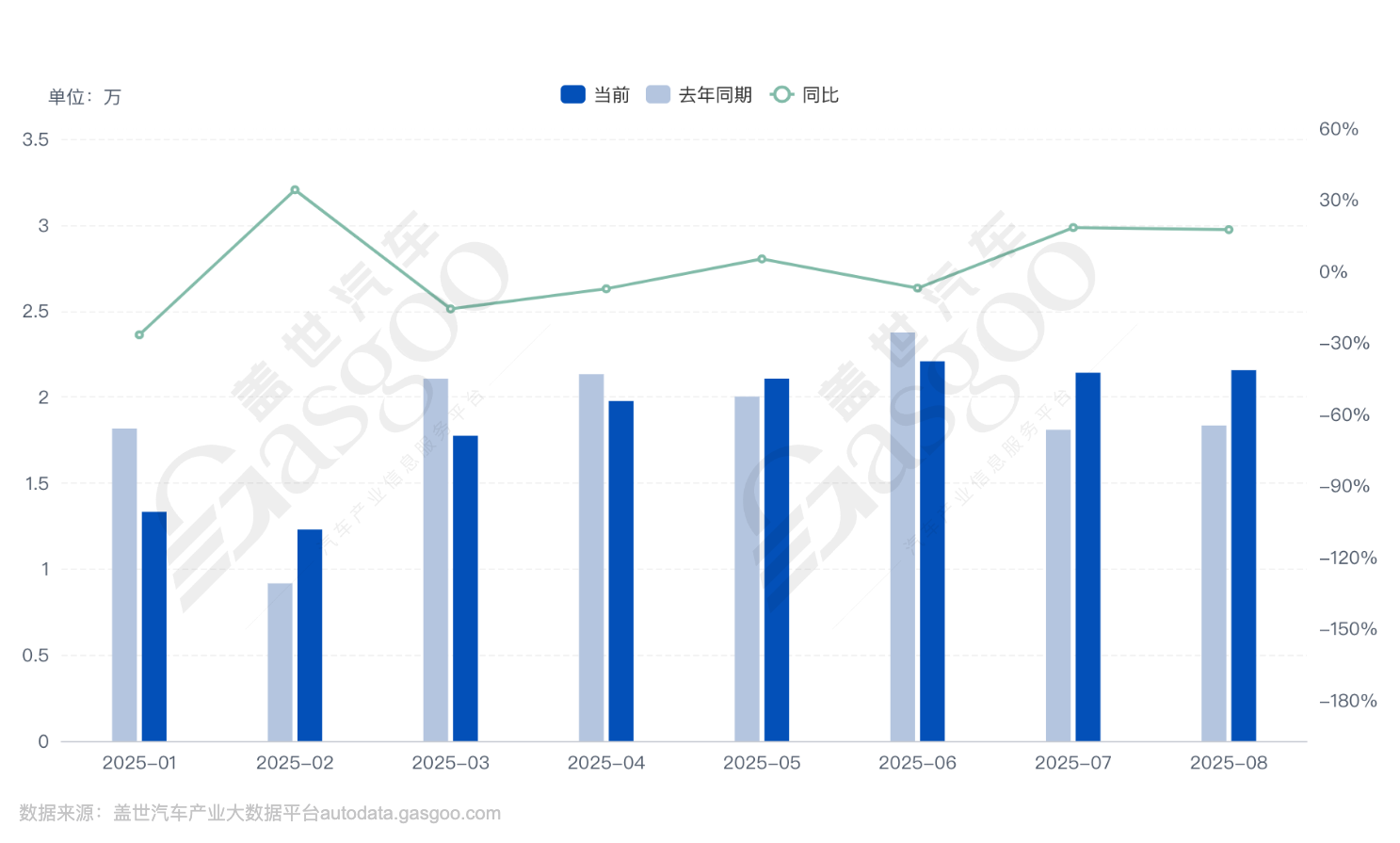

From January to August this year, although NIO maintained double-digit growth in delivery volume, its scale of 166,000 units still lags behind competitors like Li Auto (263,000 units) and AITO (240,000 units), indicating a need to accelerate its pace. The other two emerging forces, Leapmotor and XPeng, have achieved rapid expansion by introducing affordable models, with delivery volumes reaching around 300,000 units during the same period.

Xiaomi Motors also relies on the "Mi Fan" economy and precise user insights to achieve rapid breakthroughs in a short period of time. In the first eight months, Xiaomi Motors' cumulative sales reached 220,000 units, a year-on-year increase of 2.9 times.

Facing such a situation, Li Bin has repeatedly admitted that "the operational pressure is high" and reflected on NIO's lack of "speed and agility" in responding to external changes, as well as the inadequacy of its internal fundamentals. Particularly in its overseas expansion strategy, NIO once underestimated the difficulty and funding requirements of establishing its own service system abroad, which "costs more than building factories." Now, NIO is re-evaluating its product positioning and pricing strategy, showing its determination to shift from idealism to realism.

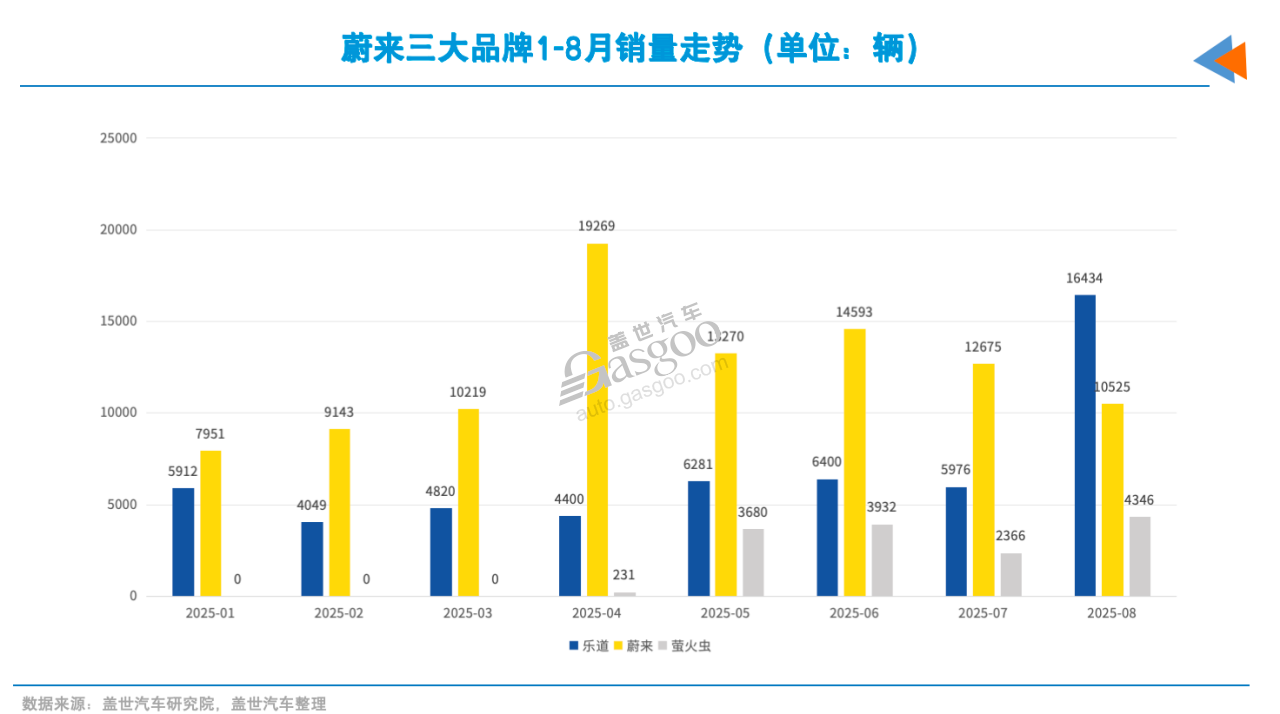

In August, NIO's market performance improved significantly, with sales reaching 31,000 units, a year-on-year increase of 55.2%, setting a new historical high. Among them, the NIO brand delivered over 10,000 new cars; the LeDao brand delivered 16,000 new cars, becoming the main driver of growth; and the Firefly brand delivered 4,346 new cars.

In fact, in the context of intense competition within the industry, NIO is far from the only car company that is actively or passively "returning to reality."

Previously emphasizing the need to grasp the "soul," SAIC Motor Corporation has proactively opened up cooperation in the field of intelligence and actively sought technical assistance after experiencing significant declines in sales and net profit to enhance product competitiveness. Currently, SAIC has collaborated with Huawei to establish the "Shangjie" brand and maintains cooperation with intelligent companies like Momenta. Similarly, GAC Group has partnered with Huawei in the field of intelligence to launch the "Qijing" brand.

In terms of new forces, after encountering obstacles in its push towards the high-end market, XPeng Motors quickly launched the MONA series aimed at the younger demographic, entering the 100,000 RMB market with the concept of "technology parity." Leveraging its technological expertise in assisted driving and smart cockpits, XPeng has achieved significant differentiation from competing models in the affordable vehicle segment.

The launch of the MONA series has significantly boosted overall sales and has accumulated cash flow and reputation for future product line expansion. XPeng Motors sold 270,000 units in the first eight months; losses narrowed to 1.14 billion yuan in the first half of the year, and there is hope for profitability in the fourth quarter.

Joint venture brands, facing a continuous decline in brand premium capabilities, have had to lower their stance. On one hand, they have been increasing current terminal discount rates, and on the other hand, the pricing of new cars is increasingly aligning with that of domestic brands.

For example, the starting price of the new SAIC Audi A5L Sportback has dropped to 259,900 yuan, and it is the first fuel model equipped with Huawei's Qian Kun intelligent driving system. Models like GAC Toyota Bozhi 3X have reduced their prices to the 100,000 yuan level, entering the market with more competitive pricing to maintain their share in the fiercely competitive market.

The common logic behind the "pragmatism" of the aforementioned car companies is the pressure from business performance, which forces them to make compromises. SAIC Motor's net profit in the first half of the year was only 6 billion yuan, less than one-third of its peak period, and it even experienced a loss in the fourth quarter of last year. Joint venture brands such as Dongfeng Nissan and FAW Audi have also seen continuous declines in sales, with year-on-year decreases of 16.8% and 9.5% respectively from January to July this year. Other car companies like GAC Group and Dongfeng Group are facing similar operational difficulties.

According to data from the China Passenger Car Association, in the first half of 2025, the market share of mainstream joint venture brands further declined, with the sales of some brands dropping by more than 20% year-on-year.

Meanwhile, the penetration rate of new energy vehicles continues to rise, with some brands expanding their leading advantages in electrification and intelligence, forcing traditional car companies to adopt more aggressive pricing strategies. In addition, consumer car purchasing behavior is becoming more rational, with reduced sensitivity to brand aura, and instead focusing more on product cost-effectiveness and actual user experience, which further accelerates the strategic adjustments of car companies.

From this perspective, the strategic adjustments of companies like "NIO" are an inevitable part of the industry's cycle. As the sales scale of new energy vehicles expands, the Matthew effect in the car market accelerates, concentrating resources and profits among leading players. Although "price cuts for volume" is a helpless yet direct strategy, lowering product prices can affect brand perception but allows for reaching a broader audience. After all, for companies that are still losing money, failing to quickly increase sales and market share could lead to elimination.

Pragmatic as they are, they "live better."

Compared to those car manufacturers still struggling at the breakeven point or experiencing declining profits, some companies have proactively adapted to market trends and demonstrated strong survivability in this round of fierce competition, even achieving or nearing profitability. Certainly, they have not relied solely on low prices or sacrificing long-term value to succeed. Instead, they have achieved a high degree of pragmatism and adaptability by aligning product positioning, technological pathways, and user needs.

Seres is a typical example of this. A few years ago, when it announced its collaboration with Huawei to become the first traditional car company to partner in the "Smart Selection Car" model, there were endless voices of skepticism within the industry. The criticism was that handing over the "soul" to a technology company entailed too great a cost and posed significant risks.

However, the collaboration between Seres and Huawei has shown strong momentum. Leveraging Huawei's advantages in intelligence and channels, the AITO series of models created by both parties quickly opened up the market, driving sales to rise steadily.

Last year, Seres turned losses into profits, with net profit increasing 3.4 times year-on-year to 5.9 billion yuan, and the AITO M9 became the sales champion in the 500,000 yuan class SUV category. In the first half of this year, Seres' net profit grew by 81% year-on-year to 2.9 billion yuan, placing it among the top profit-earning domestic listed car companies.

Image Source: HarmonyOS Intelligent Travel

With the successful case of the AITO series, Huawei's HarmonyOS smart driving ecosystem has now attracted five car manufacturers to join, and it has also allowed Huawei to enter the auto parts cooperation market, with the number of cooperating car manufacturers exceeding 20. However, Seres, as the "first to take the plunge," remains the car manufacturer that benefits the most from the "Huawei" brand dividends.

Li Auto is similarly forging a path through controversy. While most brands are committed to the pure electric route, Li Auto has ventured into the extended-range path, addressing users' range anxiety while targeting family user scenarios.

Despite early doubts about being "technologically behind," the Li Auto ONE (now discontinued) and the L series have achieved continuous sales growth by accurately targeting large space, intelligence, and family scenarios, and were the first among new forces to achieve profitability. In 2023, Li Auto achieved its first-ever profit, with a net profit of 11.7 billion yuan, placing it among the top profit-making domestic listed car companies.

After achieving self-sufficiency, Li Auto not only continued to consolidate its market position but also led other car manufacturers to follow suit in the range-extended market. Due to the increase in competitors, Li Auto has been significantly impacted this year, but overall it remains highly profitable, with a gross margin stable at around 20%.

Leapmotor has entered the highly competitive 150,000 yuan mass market. Many people consider this choice to lack imagination and difficult to establish brand premium. However, Leapmotor has captured the market with the dual advantages of range-extending technology and high cost-performance. In the first half of this year, it even achieved positive profitability. In August, Leapmotor's sales reached 57,000 units, setting a new monthly record and firmly holding the top spot in the monthly sales rankings of new forces.

The success of Leapmotor proves that in an extremely competitive market, addressing the core needs of the majority of consumers is more meaningful in practice than pursuing so-called "technological disruption."

Xiaomi's entry into the automobile market demonstrates the effectiveness of precise user insights and ecosystem synergy. As a cross-industry car manufacturing company, Xiaomi, with its "smartphone + automobile + IoT" ecosystem strategy, integrates automotive products into smart living scenarios, creating unique competitiveness distinct from traditional car manufacturers. This provides strong support for its rapid breakthrough in the automotive market.

Xiaomi Motors has launched products with simple and advanced designs, excellent smart connectivity experiences, and highly competitive prices, centering around its existing "Mi Fan" ecosystem and user preferences. The launch of the SU7 and YU7 models has quickly gained market recognition, reflecting Xiaomi's precise grasp of consumer psychology and car usage scenarios. In the first eight months of this year, Xiaomi Motors' sales have exceeded 200,000 units, and production capacity is rapidly ramping up.

The current success of car companies like SERES reflects a reality—that in a highly competitive market, the most important thing is not to stick to a specific technological route, but to find a breakthrough for scale and cash flow as early as possible.

Align with the current survival rules of the car market.

As the new energy vehicle industry shifts from rapid expansion to a fully competitive deep-water zone, automakers are confronted with a relatively distorted market: compressed R&D cycles, severe product homogenization, and constant price and configuration wars, alongside increasingly intense technology and value battles. In this context, automakers are sometimes forced to sacrifice some long-term commitments to gain immediate survival space, which precisely constitutes the real "survival rules of the auto market."

Certainly, there are still a few car companies that refuse to directly join the "price war." Great Wall Motors is one such representative. Chairman Wei Jianjun emphasized that Great Wall Motors adheres to the concept of long-term development, does not participate in "bleeding" price wars, and focuses on "quality market share."

The semi-annual financial report shows that Great Wall Motor's revenue in 2025 increased by 1% year-on-year, while net profit decreased by 10.2% year-on-year. Compared to most car companies like GAC Group and JAC Motors, Great Wall Motor's profitability performance is relatively resilient, with the decline within a controllable range.

This is attributed to its focus on technological upgrades and breakthroughs in niche markets. The Tank brand under Great Wall Motors, as a pioneer of independent high-end off-road SUVs, has established a relatively stable consumer base, becoming one of the key factors in ensuring the group's profitability. At the same time, through core technologies such as Hi4 intelligent four-wheel drive, it has strengthened its differentiated competitiveness in high-performance new energy vehicles.

Tank brand sales from January to August 2025

This also indicates that in an extremely competitive market, there is not only the option of a price war. For car companies with specific technological accumulation and brand influence, adhering to their own advantages may be the key to enduring through cycles. However, such companies are indeed in the minority.

In the mainstream market ranging from 100,000 to 300,000 yuan, leading players such as BYD and Geely continue to lower prices and enhance configurations by leveraging their scale and supply chain advantages. If other car manufacturers wish to maintain their market share or achieve a greater breakthrough in the mass market, they must directly compete with early players like BYD and Geely, inevitably getting involved in price wars and configuration wars.

Joint venture brands are doing the same; to shorten the gap with domestic brands in the fields of electrification and intelligence, they actively choose to cooperate with local enterprises and adjust product pricing. In the luxury car market, traditional luxury brands such as BBA are also actively lowering prices and accelerating electrification and intelligent transformation to enhance their competitiveness with independent new energy high-end brands.

Balancing the fierce competition of price and scale with the long-term development of technology and brand building is a challenge faced by all car companies. Finding the equilibrium between short-term survival, medium-term development, and long-term vision is crucial. Excessive pursuit of sales may deplete brand value and R&D investment, but solely adhering to high investment and high pricing may lead to missing market opportunities.

More and more car companies are adopting a "both-and" strategy: in the short term, they are ensuring or capturing market share and maintaining cash flow as much as possible through flexible pricing strategies, integrating internal and external effective resources, and optimizing the supply chain. In the medium term, they rely on technological iterations and product upgrades to improve gross margins. In the long term, they continue to invest in research and development and ecosystem construction to create a moat for the next round of competition.

NIO's experience is a microcosm of the adjustments in short-term strategies by automotive companies. For many years, it adhered to high-end pricing and the construction of a heavy asset swap station network, hoping to leverage user experience and brand strength for future advantages. However, as the price war quickly spread and financial pressure intensified, this model had to be adjusted. While maintaining investment in swap technology and service systems, NIO gradually adjusted its pricing system, reduced costs, and managed energy efficiency to achieve production and sales scale and cash flow.

Some NIO users expressed understanding and support, saying, "I can be backstabbed, but Bin Ge must win." This is a result of the long-term trust and community culture that NIO has built with its users. It has also become the most differentiated "moat" for the company amidst fierce competition.

In the entire industry, there are many companies like "NIO" facing survival pressure, but car manufacturers with such a highly loyal user base are few and far between. This brutal elimination race tests not only the products, technology, and funds of car companies but also whether they can win the steadfast support of users. If NIO can "survive" this round of elimination, the future may indeed be promising. As for other "NIOs," it is still uncertain.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track