Moment of Catastrophe! Mitsui Chemicals Plunges 71.9%

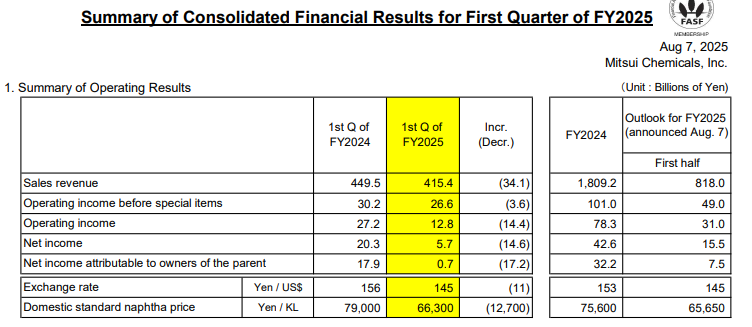

Revenue and profit both declined: In Q1, sales revenue was 415.4 billion yen, a decrease of 34.1 billion yen (down 7.6%) compared to 449.5 billion yen in the same period of fiscal year 2024. Operating profit (before special items) was 26.6 billion yen, down 3.6 billion yen (a decrease of 12.0%) year-on-year. Net profit shrank even more significantly, plunging from 20.3 billion yen to 5.7 billion yen, nearly “halved,” representing a year-on-year drop of approximately 71.92% compared to the first quarter of fiscal year 2024.

External Environmental Impact: The exchange rate of the Japanese yen against the US dollar depreciated from 156 to 145, and the domestic naphtha price decreased from 79,000 yen/KL to 66,300 yen/KL. The dual pressure of raw material costs and exchange rate fluctuations squeezes profit margins.

From a business segment perspective, related sectors such as transportation and automobiles have become "hardest hit areas": sales revenue declined from 140.3 billion yen to 130.2 billion yen, a drop of over 7%, with both volume and price falling (sales volume down 0.7%, price down 10.8%), possibly related to fluctuations in demand within the automotive industry chain and intensified industry competition.

The specialty chemicals domain also faced pressure, with revenue of 255.5 billion yen, a year-on-year decrease of 9.7 billion yen. Prices declined by 14.4%, and although a 4.7% increase in sales volume provided some support, clear signs of a cooling high-end chemicals market were evident.

Only a few sectors, such as Life & Healthcare Solutions, showed slight growth, while the overall business experienced more declines than gains, indicating a serious lack of growth momentum.

Factory Accident Adds Insult to Injury, TDI Supply Pattern Changes

Misfortunes never come singly! On July 27, a sudden chlorine gas leak occurred at Mitsui Chemicals’ Omuta plant, causing the facility to shut down emergency operations. This plant is Mitsui Chemicals’ sole TDI production base. Prior to the accident, it had just completed maintenance, and its capacity had been adjusted from 120,000 tons per year to 50,000 tons per year.

Previously, Japan's TDI capacity had significantly contracted due to the shutdown of TOSOH's facility. After the suspension of Mitsui Chemicals' sole remaining plant, Japan's TDI production has effectively reached "zero capacity," and the country will rely 100% on imports to meet demand in the future. This will not only impact Japan's domestic downstream TDI industries (such as coatings and polyurethane products) but may also trigger a supply-demand rebalance in the Asia-Pacific TDI market—sources from China, South Korea, and others are likely to increase exports to Japan, reshaping global trade flows.

On one hand, there are the "reds and greens" of the performance report, indicating sluggish growth in core business; on the other hand, there is the supply chain disruption caused by a factory accident, leading the TDI business to a standstill. Mitsui Chemicals needs to address in the short term:

Accident Aftermath and Resumption of Production: How to quickly repair the Omuta plant, restore TDI supply, and minimize the impact on downstream customers is key to securing orders and maintaining reputation.

Cost and market competition: To cope with naphtha price fluctuations and exchange rate risks, while regaining growth in specialty chemicals and mobility businesses, it is necessary to recalibrate product strategies and explore emerging markets.

In the long run, the "safety + sustainability" transformation of the chemical industry is imperative. Mitsui Chemicals needs to learn lessons from accidents, strengthen plant safety management, and accelerate the deployment in areas such as green materials and bio-based chemicals in order to find new support points in performance recovery and industrial transformation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track