Model y to dominate the 150,000-350,000 market? tesla's first wave of counterattack arrives

In the first half of the year, the sales of Model 3 were consistently surpassed by Xiaomi SU7, and the year-on-year growth of Model Y continued to slow down. In the second half, Tesla plans to regain its competitive edge with new car models.

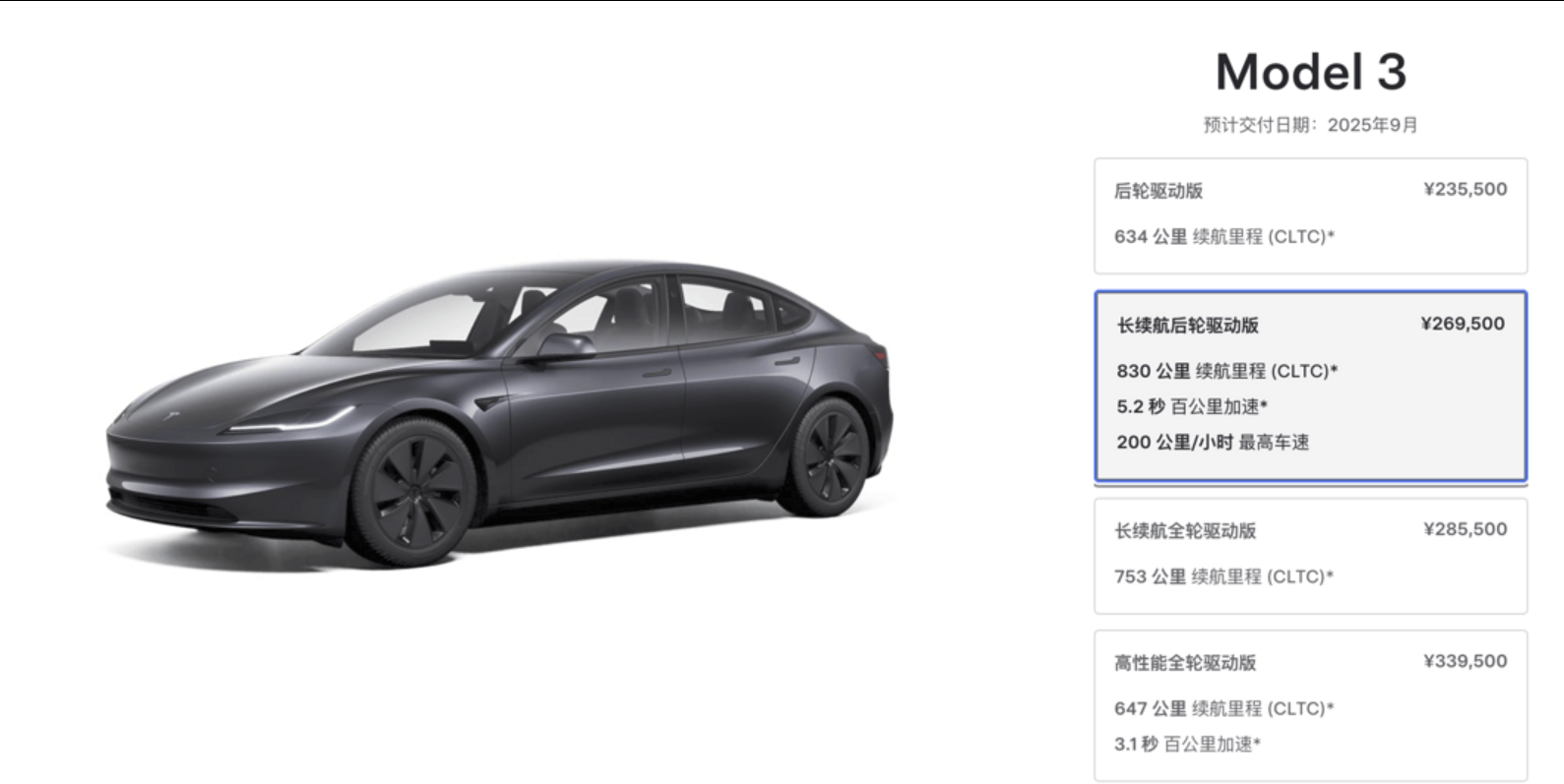

On August 12, the 2025 Model 3 Long Range Rear-Wheel Drive version went on sale on the official website, priced at 269,500 RMB, with deliveries expected in September. Simultaneously launched was the Model 3 Performance All-Wheel Drive version. As of now, all four available Model 3 models have been upgraded.

In addition, the already announced Model Y L six-seater version will officially go on sale this fall.

After this, there are two new budget-friendly cars, one is the low-cost version of the Model Y that has already been tested overseas, and the other is the Model Q, which has been delayed multiple times. Both of these cars are highly likely to debut in 2026.

Why did Tesla unusually launch multiple new car models? Why are they being released starting this year?

Review a set of data first.

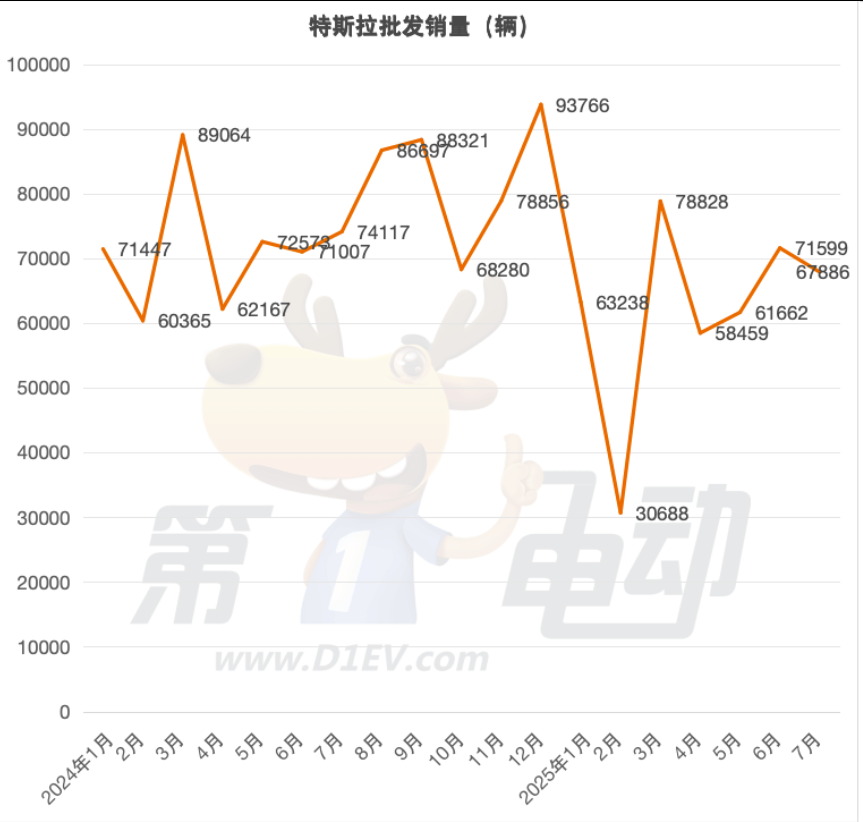

In 2025, Tesla experienced its most severe sales decline since 2015, with second-quarter revenue dropping 12% year-on-year, marking the highest single-quarter decline since 2012. A total of 384,100 new cars were delivered, a 14% decrease compared to the same period last year. Such performance is extremely rare for Tesla.

In the domestic market, sales in July this year decreased by 8.4 percentage points year-on-year and 5.2 percentage points month-on-month. This marks the eighth consecutive month of year-on-year decline for Tesla in China.

Taking another look at the bicycle data, as of July, Model 3 has experienced three months where sales did not exceed 10,000 units. Although Model Y is still at a high average of over 30,000 units per month, it has already experienced five year-on-year declines, and the same is true for month-on-month metrics. The latest result shows a drop of more than 30% compared to June's 44,800 units.

In simple terms, Tesla's sales growth in China has already slowed down. There are two reasons behind this:

1. There are more and more competitors, and the competitiveness of the Model 3/Y is no longer outstanding in aspects such as electric range, space dimensions, and chassis configuration.

The Chinese version of FSD is still "on the way." Currently, Huawei, Xpeng, and Li Auto have successively completed iterations of their assisted driving technology.

Starting this year, Tesla should fight back.

So, what is Tesla planning to do? Based on current analysis, Tesla's counterattack will come in three waves:

The first wave is the launch of new model versions (upgrading product capability), the second wave is adjusting the price (enhancing value for money), and the third wave is introducing the FSD under the new training system.

The first counterattack mainly optimizes space and endurance.

The first step in countering the slowdown in sales growth related to product strength is to focus on upgrading the space, range, and chassis, which have been repeatedly criticized by competitors.

In the space section, let's take Model Y L as an example.

The new car's length, width, and height are 4976/1920/1668mm, with a wheelbase of 3040mm; compared to the current 5-seater version, the car's length has increased by 179mm, the width remains unchanged, the height has increased by 44mm, and the wheelbase has increased by 150mm.

The increase in length and height naturally has a positive effect on the utilization of legroom and headroom in the second and third rows. However, there are still two points worth discussing regarding the third row: 1. The headroom in the third row might not be ample, 2. Comfort in the third row might be difficult to achieve.

Firstly, since the fastback structure of the Model Y L has not undergone any fundamental changes, the rear of the vehicle does not adopt the traditional box-shaped design of a large six-seater SUV. The extension of the Y-axis dimension allows for more flexible adjustment of the knee room for the second-row independent seats. The 44mm increase in the Z-axis is mainly reflected between the B and C pillars, which means that regardless of how the second-row seats are adjusted back and forth, the headroom in the third row will inevitably be affected by the fastback design.

Secondly, in order to achieve a stable and comfortable riding experience, the seat should never be placed directly above the longitudinal force of the suspension. Therefore, the hip point should either be positioned before or after this point. Considering the fastback trunk, placing the hip point behind the longitudinal force direction of the suspension is obviously not possible.

Most importantly, there are currently no indications that the Model Y L will upgrade its suspension system, such as adding CDC or air springs. The logic behind the chassis upgrade of the refreshed Model Y is merely the addition of a set of response valves specifically targeting high-frequency vibrations within the damping system. In terms of the upper limit of ride comfort for three-row seating provided by the damping suspension, it naturally does not match up to the combination of air springs and CDC.

Overseas six-seater Model Y

Based on the above two points of doubt, it can be roughly concluded that for the Model Y L to have three rows with ample space and a comfortable seating experience, it is likely necessary to sacrifice some of the seating posture in the second row.

Note that this is only a design-based inference, and the actual performance needs to be determined after practical testing and experience.

For the range section, we take the two new versions of the Model 3 as examples.

Long-range rear-wheel drive version, top speed of 200 km/h, 0-100 km/h in 5.2 seconds, 78.4 kWh LG ternary lithium battery pack, 18-inch wheels with a CLTC electric range of 830 km, 19-inch wheels with an electric range of 800 km, energy consumption of 11 kWh per 100 km.

Compared to the current rear-wheel-drive standard range version, the battery capacity has increased by 15.9 kWh, the pure electric range has increased by 200 km, the motor power has increased by 31 kW, the acceleration is 1 second faster, the energy consumption per 100 km has decreased by 0.2 kWh, and the price is 34,000 yuan higher.

Compared to the long-range all-wheel-drive version with the same battery capacity, it has one less front motor but offers 80km more range and is 16,000 yuan cheaper.

This version can be said to be the Model 3 with the highest all-electric range and lowest energy consumption in Tesla's history.

In addition, the price of the Model 3 Performance All-Wheel Drive version remains unchanged at 339,500 RMB compared to the 2024 model, but the CLTC range has increased by 24km and the energy consumption has decreased by 0.2kWh.

In the mainstream pure electric sedan market, the Model 3, with its pure electric range extended to over 800km, will be better positioned to compete with the Xiaomi SU7, the new Xiaopeng P7, and others. Of course, although it still utilizes the old 400V architecture, its fast-charging efficiency remains lacking. However, compared to its competitors, its two major advantages of low energy consumption and high range achievement rate will continue to lead the way.

However, no matter how Tesla improves its product power, the biggest shortcoming of the Model 3/Y compared to mainstream domestic electric vehicles will still be the excessively slow energy replenishment efficiency.

After all, compared to the 400V architecture, the ultra-high voltage architectures of 800V or even 1000V, the latter's core components' high-temperature and high-voltage resistance inherently determine its ability to achieve high-rate fast charging, reducing the fast charging time to within 15 minutes. Currently, among Tesla's mass-produced models, only the Cybertruck is equipped with an 800V high-voltage system.

It is important to note that this is only a local 800V system with four battery modules arranged longitudinally, each module having a voltage exceeding 220V. These four modules are then combined in series and parallel through a sealed bipolar switch. The technical difficulty is not considered complex, but current new cars have yet to embrace 800V.

The only explanation might be that Tesla's localized 800V and battery integration approach are not suitable for the two main selling models, Model 3 and Model Y.

Perhaps Musk's judgment is that the 400V system in Tesla's technological framework has not yet reached the point of being completely phased out, or maybe, out of consideration for extreme cost reduction, switching to an ultra-high voltage architecture is merely a matter of time.

Second wave of counterattack: adjust prices and compete on cost-effectiveness.

It is worth mentioning that the Model 3 Long Range Rear-Wheel Drive version is not being launched for the first time in China; it can be traced back to five years ago. The current price of 269,500 yuan, compared to the pricing strategy five years ago, cannot even buy the lowest-priced Standard Range Rear-Wheel Drive version. It must be said that Tesla, by reviving the Long Range Rear-Wheel Drive on the basis of five years of zero interest, aims to play the "cost-effectiveness" card once again.

From the pricing strategy of the entire Model 3 series, the difference between the standard range and long range of the rear-wheel-drive version lies only in motor power, electric range, power consumption per 100 kilometers, and 0-100 km/h acceleration, with a price difference of 34,000 yuan.

The rear-wheel-drive and all-wheel-drive versions are equipped with a 78.4kWh battery. The latter, in addition to having multiple front motors, offers greater overall horsepower and faster acceleration, and also includes 8 additional speakers and suede interior. With a range only 80km less, the price difference between the two is only 16,000 yuan. Clearly, the long-range all-wheel-drive version is more worthwhile.

With such a price configuration ratio, it's hard not to speculate that this leaves space for a price adjustment of 10,000 to 20,000 yuan later. This strategy of initially setting a high price and later offering subsidies and adjustments is not the first time Tesla has employed it.

Even excluding pricing strategies, this viewpoint holds from a technical perspective.

The core lies in the 3D6 motor used in the Model 3 Long Range Rear-Wheel Drive version. Its speed and torque reach 19,000 rpm and 440 N·m, respectively, which are significantly higher than the 3D7 motor used in the Model 3 Rear-Wheel Drive version. However, the 3D7 has been upgraded with raw materials slightly weaker in magnetic strength than neodymium-iron-boron magnets, enhancing high-temperature durability and reducing the overall weight of the machine. Essentially, while the 3D6 has more horsepower, the 3D7 offers improvements in energy consumption and cost. To put it more plainly, the new technology has a premium capability.

In addition to adjusting the price of the Model 3 to amplify its value-for-money advantage, Tesla's second value proposition is the straightforward and aggressive affordable version of the Model Y.

Based on the leaked spy photos, at least 10 areas of reduction in features can be identified in the new car.

For example, removing the panoramic sunroof, changing to fabric seats, eliminating physical levers for steering and gear shifting, canceling seat ventilation and heating, removing rear seat screens, shortening the body length (reducing the use of steel and aluminum materials to cut costs), taking away the coat hook next to the rear lighting, canceling the through front lights and diffused reflection tail lights, canceling the A-pillar tweeters, and so on.

As the major cost component of an electric vehicle, the battery capacity will shrink as the wheelbase becomes smaller, which means the battery cost will continue to decrease. Therefore, the product image of the cheaper Model Y can basically be imagined as a "large Robotaxi" with a steering wheel.

At this point, a Model Y will create a "one fish, three meals" situation in the domestic market.

By offering the five-seater Model Y, the six-seater Model Y L, and the budget Model Y, the price range is covered from 150,000 to 350,000 RMB. This range is precisely the critical price market where both emerging domestic players and traditional car manufacturers transitioning to new energy vehicles are making sustained efforts. With brand strength, low energy consumption, safety, sporty handling, and the support of over 2,100 supercharging stations nationwide, the Model Y family is clearly set to once again become the catalyst stirring up the Chinese new energy market. However, this time, the focus is narrowed to the 150,000 to 350,000 RMB market.

The third wave of counterattack comes from the new training system of FSD.

Another question worth discussing is whether the significantly downgraded and cheaper Model Y, or even the potentially cheaper Model Q, would stand a chance against stronger competitors in the domestic market.

Actually, the only remaining advantages of the low-cost Tesla will be price, electric drive, energy consumption, and FSD.

Tesla's advantages in electric drive and energy consumption have been bypassed by most domestic electric vehicle brands, replaced by richer and more advanced configurations, more humanized value experiences, and lower prices. Even the brand appeal that was difficult to replicate in the past is now being systematically addressed by companies like Xiaomi, Li Auto, Xpeng, and Huawei.

The Ideal i8 has already been launched, with 5C supercharging and VLA as its trump cards to compete head-on with Tesla; the all-new AITO M7 is on its way, and it will engage in a battle with the Model Y in terms of passive safety and space comfort.

The brand new XPeng P7, with its concept car-like appearance and gull-wing doors, already surpasses the Model 3 in looks. With three Turing chips offering over 2000 TOPS of computing power, its intelligent cabin and driving capabilities will significantly outperform Tesla's current offerings.

Xiaomi YU7, which is clearly aimed at Model Y, achieved a staggering record of 289,000 orders within just one hour of its launch. This fact alone speaks volumes: Tesla is no longer the unrivaled leader in the 200,000 to 300,000 RMB market. Although Model Y's monthly sales remain around 30,000 units, the difference now is that it will no longer be the only model capable of achieving such figures.

Therefore, Tesla's third wave of counterattack comes from FSD.

On the 13th, a major piece of news about Tesla did not attract much attention or discussion domestically.

Tesla has decided to disband the Dojo supercomputing R&D department, retain the supercomputing center, and cease the development of supercomputing chips. Instead, they will focus their core computational resources on AI5 and AI6, two new generations of self-developed chips with both inference and training capabilities.

This means that Tesla's training system for FSD has undergone a fundamental change, shifting from relying on real-world data to being driven by synthetic data generated by a world model.

Why change the training system for FSD?

In the past, FSD training heavily relied on real road data collected by vehicles. While this ensured the authenticity and diversity of the roads, FSD still had significant shortcomings in extreme scenarios, long-tail scenarios, or situations where road data was lacking.

In February this year, during its debut in China, FSD V13.2.6 exhibited issues including but not limited to running red lights, not following designated road markings, speeding in urban areas, and even driving in the wrong direction. All these problems point to one issue: poor recognition and reasoning ability.

The decision to shift towards synthetic data generated by the world model is aimed at increasing the proportion of reasoning in FSD model training.

Under the new training system, Tesla's AI work will basically be divided into three stages:

1. Train a world model with a large number of parameters through a GPU cluster, serving as a synthetic data generation engine.

Run the world model through the AI5/AI6 inference cluster to generate synthetic data that covers a wide range of scenarios, including corner cases, in parallel computation.

Train a small-parameter FSD model for deployment on vehicles by mixing synthetic data with some real data.

In other words, what Tesla aims for is to reduce training costs and improve the inference capability of FSD.

After the implementation of the new training system, the future performance of FSD in China is promising and worthy of comparison.

Huawei has now released the QianKun Intelligent Driving ADS4, which is installed on vehicles running HarmonyOS Intelligent Driving as well as on models from brands like Voyah.

Li Auto is the first automaker to launch VLA, with the main difference from the previous VLM+E2E being the significant enhancement of inference logic. XPeng's VLA-OL large model has also been implemented in the brand-new G7, new P7, and other vehicles.

It can be said that after Tesla changed its training strategy, the minor issues with FSD have indeed improved. However, when compared with domestic technology, whether it is leading, on par, or lagging behind is still full of uncertainty.

Tesla's upcoming three-pronged counterattack seems aggressive at every step, but upon comparison, it seems challenging to replicate the once steep lead. Therefore, we leave the answer to time.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track