Mixed Fortunes in July New Energy Vehicle Sales

Even during the traditional off-season for automobile consumption, the new energy passenger vehicle market remains vibrant. Highly attractive policy subsidies, coupled with a stable supply environment, have boosted the consumption of new energy vehicles, resulting in a "not-so-slow" market in July. Some car manufacturers have achieved record-high wholesale sales of new energy vehicles.

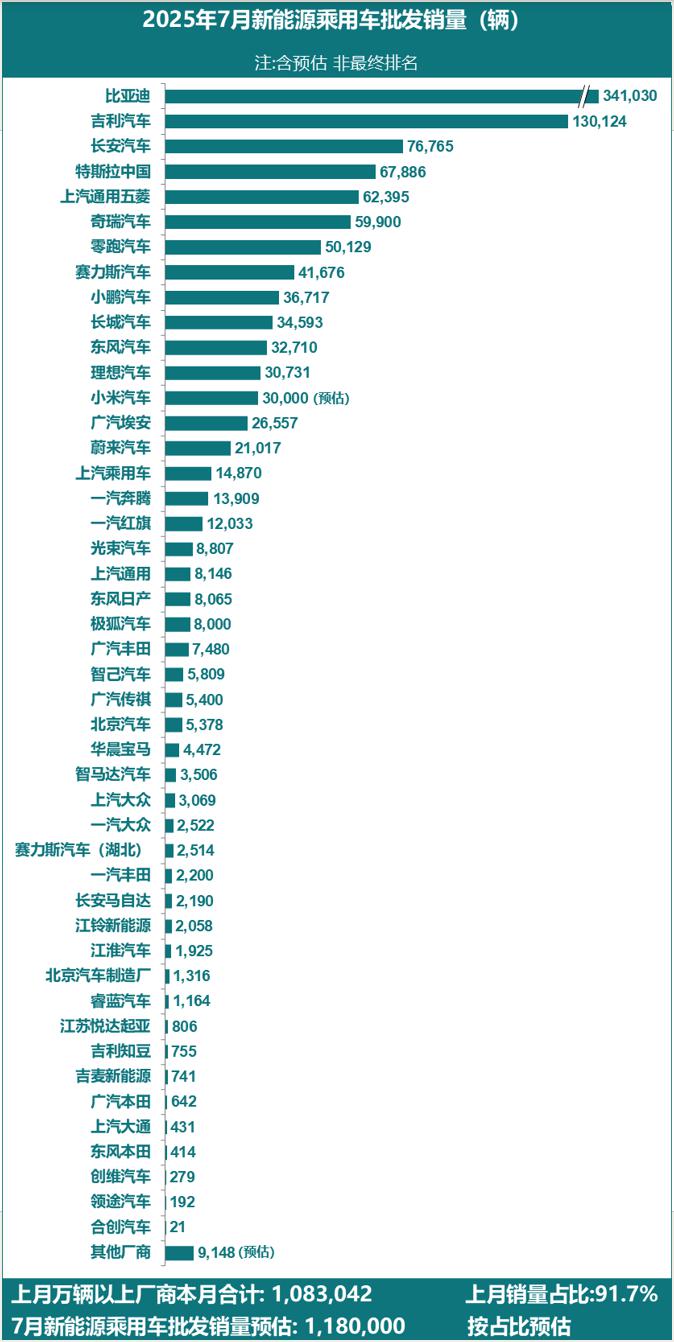

According to the China Passenger Car Association's forecast, the wholesale sales of new energy passenger vehicles nationwide in July reached 1.18 million units, representing a year-on-year increase of 25% and a month-on-month decline of 4%. From January to July this year, the cumulative wholesale volume was 7.63 million units, marking a year-on-year growth of 35%.

Analyzing the wholesale sales statistics of new energy passenger vehicle manufacturers for July released by the China Passenger Car Association, the lively market reflects numerous changes, revealing the fierce competition in the new energy passenger vehicle market.

The new 2+1 structure in the new energy vehicle market is becoming stable. BYD and Geely Automobile maintain the top two positions in new energy vehicle sales, with sales reaching 341,000 and 130,100 units respectively in July. Changan Automobile, SAIC-GM-Wuling, and Tesla are competing for the third position.

At the same time, the number of new energy passenger car manufacturers with monthly sales exceeding 10,000 vehicles has increased compared to last year. FAW Bestune and FAW Hongqi entered the 10,000-vehicles-per-month club with sales of 13,900 and 12,000 units respectively.

Many car manufacturers have achieved record-high sales in the new energy sector. Leapmotor, XPeng Motors, Xiaomi Auto, Dongfeng Nissan, and GAC Toyota have all reached historical highs in their wholesale sales of new energy vehicles. Notably, Leapmotor's monthly sales surpassed 50,000 units for the first time, leading the new wave of car manufacturing. Dongfeng Nissan and GAC Toyota, with their high "China content" models, have become pioneers in the transformation of joint-venture brands towards new energy. Geely Auto and Spotlight Automotive have also achieved their own record-high monthly sales performances.

In fact, behind the record-breaking sales and sustained high sales momentum is the creation of hit products that cater to market demand, such as the Leapmotor B10, Leapmotor C10, XPeng MONA M03, Xiaomi YU7, Dongfeng Nissan N7, and GAC Toyota Bozhi 3X. These models have driven the record-high sales of new energy vehicles for various brands.

The continuous boom in the pure electric small car market has driven the sales growth of new energy vehicles for automakers such as SAIC-GM-Wuling, Geely Automobile, and FAW Bestune. Especially SAIC-GM-Wuling, which experienced three consecutive years of declining sales, has leveraged the sustained popularity of the pure electric small car market. The sales of Wuling Hongguang MINI EV and the Wuling Bingo family have achieved rapid growth, enabling SAIC-GM-Wuling's new energy vehicle sales to maintain a high level and helping the company overcome the embarrassment of negative sales growth.

Joint venture brands' new energy vehicle sales diverge. In the wholesale sales statistics of new energy passenger vehicles in July, SAIC-GM, Dongfeng Nissan, and GAC Toyota achieved sales of 8,146 units, 8,065 units, and 7,480 units of new energy vehicles, respectively, thanks to their popular models with high "China content," making them leaders in the joint venture brand new energy transition. In contrast, new energy products from joint venture automakers such as FAW-Volkswagen, FAW Toyota, GAC Honda, and Changan Mazda are lukewarm, with monthly sales hovering between several thousand and even several hundred units.

In July, although the new energy vehicle market showed a strong performance during what is typically a slow season, external factors such as summer holidays and hot weather had some impact on the consumption of new energy vehicles. Among the 18 car companies with monthly sales exceeding 10,000 units, 12 companies, including BYD, Changan Automobile, Tesla, Chery Automobile, SAIC-GM-Wuling, Great Wall Motors, Li Auto, GAC Aion, NIO, etc., experienced a month-on-month decline in new energy vehicle sales.

Tesla, Li Auto, and GAC Aion all experienced both year-on-year and month-on-month declines. Among them, GAC Aion, which is in a deep adjustment period, saw its sales volume shrink to 26,600 units in July, representing a year-on-year decrease of 24.6% and a month-on-month decrease of 4.6%.

Tesla's sales in July were 67,900 units, a month-on-month decrease of 5.19% and a year-on-year decrease of 8.41%. The decline in Tesla's sales is partly due to two Xiaomi models diverting demand from the Model 3 and Model Y. Additionally, frequent price changes and the new Model Y L have led some consumers to hold off on purchasing.

Li Auto's sales in July hit a historic low, delivering 30,700 new vehicles, a year-on-year decrease of 39.74% and a month-on-month decline of 15.29%. The sales of Li Auto's L series products have shrunk amid fierce market competition. Meanwhile, the highly anticipated Li Auto i8 has faced setbacks in product configuration and marketing.

Fortunately, Li Auto promptly adjusted the configuration and pricing strategy of the Li Auto i8 by canceling the Pro and Ultra versions, making the Max version the standard configuration, and lowering the price from 349,800 yuan to 339,800 yuan, addressing consumer complaints about the complicated versions and the lack of support for optional high-end configurations.

Behind the rapidly growing new energy vehicle market, undercurrents are actually surging. Various automakers are fiercely competing in different market segments, and the competition is becoming increasingly intense. At the same time, new energy vehicles still present more opportunities than challenges. There are still structural blue oceans in niche markets, and creating best-selling models that meet market demand is the guarantee for sustained sales growth, as well as the key to changing the market landscape.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track